Fluor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

What is included in the product

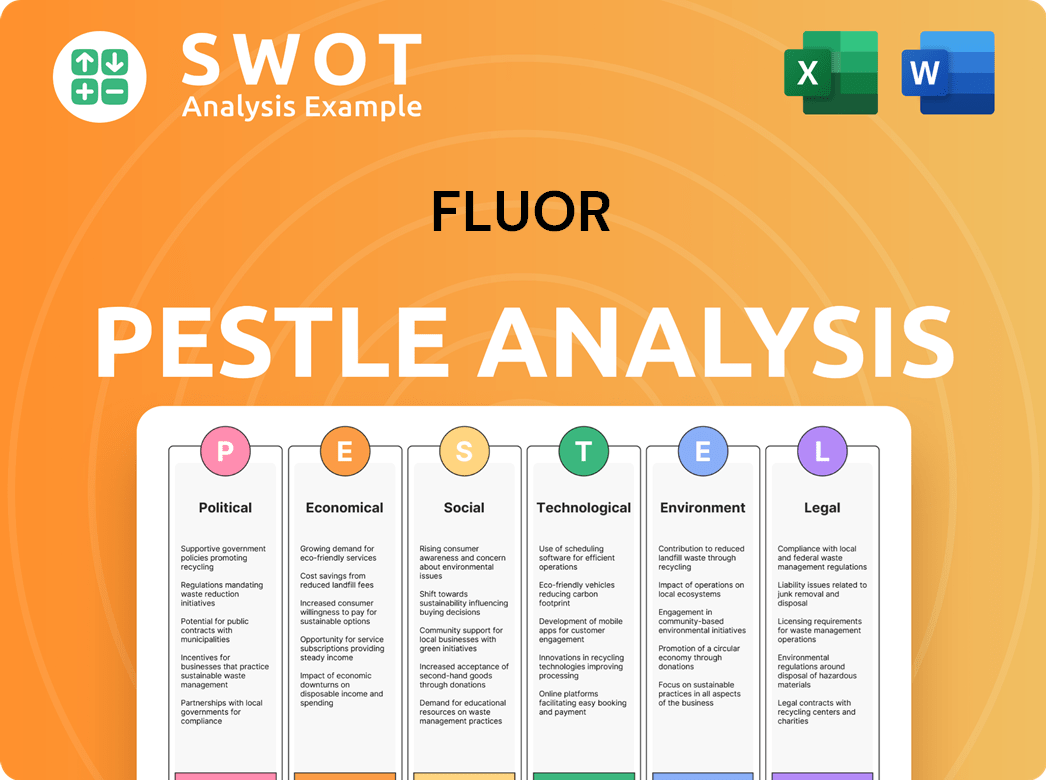

Examines external factors impacting Fluor through Political, Economic, etc., dimensions. Identifies threats and opportunities for strategic decision-making.

Helps uncover blind spots with strategic risk & opportunity identification for actionable insights.

Preview the Actual Deliverable

Fluor PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. The Fluor PESTLE analysis presented in this document explores Political, Economic, Social, Technological, Legal, and Environmental factors. The insights and data within are precisely what you'll download immediately. Ready to go!

PESTLE Analysis Template

Navigate Fluor's landscape with our detailed PESTLE Analysis. Uncover how political, economic, and social factors affect Fluor's strategy. Learn about crucial technological shifts and environmental concerns influencing the business. Enhance your understanding of legal challenges and opportunities. Download the full analysis today to gain actionable insights and make informed decisions.

Political factors

Fluor's fortunes are tied to government spending, especially in infrastructure and defense. For instance, in 2024, the U.S. government allocated billions to infrastructure projects, potentially benefiting Fluor. Policy shifts, like those related to renewable energy, also affect Fluor's project pipeline. Geopolitical instability in regions where Fluor operates can introduce financial risks, impacting project feasibility.

Fluor's global operations face risks from foreign political and economic instability. Trade barriers, tariffs, and security risks affect project costs and execution. For example, in 2024, changes in trade policies impacted material costs by 3%. Maintaining relationships across varied political environments is vital for Fluor’s success. The firm's international projects account for over 40% of its revenue, making it highly susceptible to geopolitical factors.

Political instability poses significant risks for Fluor, especially in regions with active projects. Changes in leadership or civil unrest can cause project delays or even cancellations. For instance, political turmoil in certain Middle Eastern countries has historically impacted project timelines. Fluor continuously assesses and mitigates these political risks, vital for its global operations. In 2024, Fluor reported $1.3 billion in revenue from projects in politically sensitive areas.

Federal Procurement Regulations

Fluor's operations are significantly influenced by federal procurement regulations, especially given its work with governmental bodies. These regulations dictate how Fluor bids for, secures, and manages government contracts. Strict adherence to rules concerning pricing, data security, and compliance is necessary for Fluor. In 2024, the U.S. government's procurement spending was approximately $700 billion, impacting companies like Fluor.

- Compliance costs can be substantial, impacting profitability.

- Changes in regulations can necessitate adjustments to business strategies.

- Failure to comply can lead to penalties or contract loss.

- Political shifts can alter procurement priorities.

Lobbying and Political Engagement

Fluor's political engagement, including lobbying, aims to influence policies favoring infrastructure, energy, and related sectors, vital for its operations. Lobbying expenditures are substantial; for instance, in 2023, Fluor spent over $1 million on lobbying efforts. These activities must comply with strict regulations, ensuring transparency and ethical conduct. Political factors, such as government spending on infrastructure, directly affect Fluor's project pipeline and financial performance.

- Fluor's lobbying spending in 2023 exceeded $1 million.

- Government infrastructure spending significantly impacts Fluor's project opportunities.

Fluor's business is heavily influenced by government policies and spending, especially in infrastructure and defense, creating significant dependencies. Political risks, including geopolitical instability and procurement regulations, present potential challenges for international projects. Lobbying and political engagement play crucial roles in shaping policies beneficial for Fluor, affecting the company's strategic priorities.

| Factor | Impact | 2024 Data |

|---|---|---|

| Government Spending | Direct influence on project pipeline. | U.S. infrastructure spending: $900B. |

| Political Instability | Risks project delays, cancellations. | Fluor's revenue from sensitive areas: $1.3B. |

| Lobbying | Influences favorable policies. | Fluor's lobbying spend: $1M+ in 2023. |

Economic factors

Fluor's success is closely linked to global economic health and demand for major projects. Economic growth, inflation, and interest rates significantly affect client investment. For example, in 2024, rising interest rates in the US influenced infrastructure spending. The company closely monitors these economic indicators.

Client investment levels heavily influence Fluor's project pipeline. Clients in energy, chemicals, and infrastructure drive Fluor's revenue. Economic instability can cause project delays or cancellations, impacting Fluor's backlog. For example, Fluor's Q1 2024 new awards were $2.8 billion, signaling ongoing client investment.

Fluor's global operations mean it faces currency risk. Exchange rate swings impact project costs, revenue, and profits. For example, a strong USD could reduce the value of foreign earnings. In 2024, currency fluctuations could significantly affect Fluor's financial results, especially in regions with high volatility.

Access to Capital and Financing

Fluor's financial health and project viability are heavily influenced by access to capital. The company's ability to secure financing, along with its clients' capacity to fund projects, is directly tied to prevailing credit conditions and interest rates. Rising interest rates can increase project costs, potentially curbing demand for Fluor's services, especially in capital-intensive sectors. Conversely, favorable financing environments can boost project investments and benefit Fluor. As of late 2024, the Federal Reserve maintained interest rates between 5.25% and 5.50%, impacting borrowing costs.

- Interest rates directly affect project costs and demand.

- Favorable conditions can boost investments.

- High rates can reduce demand for services.

- As of late 2024, rates were 5.25%-5.50%.

Commodity Price Volatility

Fluor's performance is significantly affected by commodity price fluctuations. Changes in oil, gas, and metal prices directly impact investment in the energy and mining sectors, critical for Fluor. High volatility can create uncertainty for Fluor and its clients, potentially delaying or canceling projects. For example, in early 2024, oil prices fluctuated between $70 and $85 per barrel, influencing investment decisions.

- Oil price volatility directly impacts Fluor's energy sector projects.

- Metal price swings affect mining project investments.

- Unstable prices can lead to project delays or cancellations.

- Fluor's financial planning must account for commodity price risks.

Economic factors significantly impact Fluor's financial performance. The company monitors global economic trends like GDP growth and inflation, as these affect project demand. Fluctuations in currency exchange rates pose a constant financial risk. Interest rate shifts, like the late 2024 rates between 5.25%-5.50%, influence both Fluor's and its clients' access to capital and project feasibility.

| Economic Factor | Impact on Fluor | Data (2024) |

|---|---|---|

| GDP Growth | Influences project demand | Global growth slowed to 3.1% |

| Inflation | Affects project costs, client investment | US inflation around 3.1% |

| Currency Exchange | Impacts project costs, revenue, and profits | USD Index fluctuated ~102-106 |

Sociological factors

Fluor heavily relies on skilled labor, encompassing engineers and project managers. Labor shortages in specific regions can significantly affect project schedules and expenses. For instance, the construction industry faces a projected shortage of 650,000 workers by 2025. This scarcity can lead to escalated labor costs and delays.

Fluor's projects influence communities, creating jobs and infrastructure while potentially causing disruption. Positive community relations are vital for project success. In 2024, Fluor invested $15M in community programs globally, reflecting its commitment. Engaging stakeholders and addressing concerns strengthens its social license to operate.

Fluor prioritizes health and safety, crucial in construction. A strong safety culture prevents accidents, injuries, and delays. In 2024, the construction industry faced a 7.7% injury and illness rate. Fluor's commitment helps avoid reputational damage. Safety investments boost project efficiency and worker well-being.

Diversity and Inclusion

Fluor prioritizes diversity and inclusion (D&I) to attract a skilled workforce and mirror its operational communities. This commitment fosters a positive workplace and enhances project success. D&I initiatives are crucial for Fluor's global presence. Fluor’s 2023 Sustainability Report highlights these efforts.

- In 2023, Fluor increased female representation in leadership roles by 2%.

- Fluor invested $1.5 million in D&I training programs.

Education and STEM Support

Fluor's commitment to education, especially in STEM fields, is a crucial sociological factor. By supporting STEM education, Fluor helps cultivate a skilled workforce. This also benefits the communities where Fluor operates. In 2024, Fluor invested $5 million in STEM education programs.

- Fluor's STEM initiatives aim to develop future industry talent.

- These programs often focus on underrepresented groups.

- Investing in education boosts community development.

- STEM support enhances Fluor's public image.

Sociological elements significantly affect Fluor's operations, primarily through workforce dynamics and community relations. Labor availability is a key concern, especially with predicted shortages in construction. Community engagement is essential for project success, underscored by investments like Fluor's $15M in community programs in 2024.

Fluor's commitment to safety, evident in its safety-focused culture, addresses the industry's average 7.7% injury/illness rate in 2024. Diversity and inclusion (D&I) are prioritized, shown by the rise in female leadership in 2023 and $1.5M investment in D&I training programs. STEM education is a key initiative for skill development.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Labor Shortages | Project delays, increased costs | Construction worker shortage: 650,000 by 2025. |

| Community Relations | Project success and license | Fluor's community programs investment: $15M. |

| Safety | Risk management | Industry injury rate: 7.7%. |

| D&I | Talent attraction | Leadership female representation +2% in 2023, D&I training programs cost: $1.5M |

| STEM Education | Skills improvement | $5M in STEM in 2024 |

Technological factors

Fluor is actively adopting digital technologies like BIM and data analytics to enhance project outcomes. In 2024, the global BIM market was valued at $7.8 billion, growing to $8.7 billion in 2025. These tools improve project efficiency and reduce risks. Data analytics helps Fluor make better predictions and decisions.

Fluor can leverage innovation in construction methods. Modular construction and 3D printing offer optimization opportunities. These methods can lower costs and facilitate work in difficult settings. The global modular construction market is projected to reach $175.6 billion by 2030.

The development of new materials, especially sustainable ones, is a key technological factor. Fluor can leverage these innovations to cut environmental impact. Incorporating sustainable materials helps align with client goals for eco-friendly projects. This shift can lead to cost savings and enhance Fluor's market position. The global green building materials market is projected to reach $439.8 billion by 2025.

Integration of Automation and Robotics

Fluor is increasingly integrating automation and robotics to enhance construction efficiency and safety. This includes using drones for site surveys and robotic arms for precise welding, reducing human error and project timelines. These technological advancements are critical for maintaining a competitive edge in the engineering and construction sector. For example, the global construction robotics market is projected to reach $3.7 billion by 2025.

- Robotics can reduce project completion times by up to 30%.

- Automation lowers labor costs by as much as 20%.

- Drones improve site safety by 40%.

- Fluor invested $150 million in automation technologies in 2024.

Cybersecurity Risks

As Fluor integrates more technology, cybersecurity risks escalate. Protecting data, intellectual property, and systems is crucial. The cost of cyberattacks rose in 2024, with average breaches costing $4.45 million globally. Fluor must invest in robust cybersecurity measures. The construction industry sees increasing cyber threats.

- Cybersecurity breaches cost an average of $4.45 million globally in 2024.

- The construction industry is a growing target for cyberattacks.

- Fluor must continually update its cybersecurity defenses.

Fluor's use of technology, like BIM and data analytics, enhances project success. Innovations such as modular construction offer cost and efficiency advantages. The global modular construction market will hit $175.6B by 2030, improving project efficiency. Meanwhile, Cybersecurity investments are crucial, as attacks cost an average of $4.45 million in 2024.

| Technology Area | Impact | Financial Data (2024/2025) |

|---|---|---|

| BIM Market Size | Enhances project efficiency, risk reduction. | $7.8B (2024) / $8.7B (2025) |

| Modular Construction | Lowers costs, suits difficult sites. | Projected to reach $175.6B by 2030. |

| Cybersecurity Costs | Protect data; crucial in increasing attacks. | Average breach cost: $4.45M |

Legal factors

Fluor faces a complex web of international laws. This includes regulations on quality, safety, and labor. For example, in 2024, Fluor was involved in projects across 40+ countries. Compliance costs can be significant, impacting profitability. These costs can include legal fees and operational adjustments to meet varying standards.

Fluor navigates intricate contractual obligations in global projects, a fundamental part of its operations. Legal risks, including those from disputes, are significant considerations. In 2024, Fluor's legal expenses totaled $125 million, reflecting ongoing dispute resolutions. Effective dispute resolution mechanisms are crucial for financial stability and project success.

Fluor must strictly follow environmental and safety rules set by agencies like the EPA and OSHA. Failure to comply leads to penalties and reputational harm. In 2024, the EPA issued over $100 million in fines for environmental violations. OSHA's penalties can reach over $15,000 per violation, impacting project costs.

Anti-corruption and Export Control Laws

Fluor's global operations necessitate strict adherence to anti-corruption laws like the Foreign Corrupt Practices Act (FCPA) and export control regulations. Non-compliance can lead to hefty fines and reputational damage. In 2024, FCPA enforcement actions resulted in over $2 billion in penalties. The company must maintain robust compliance programs to mitigate legal risks.

- FCPA enforcement actions: over $2 billion in penalties (2024).

- Export control violations: could lead to significant financial penalties.

Intellectual Property Protection

Fluor's ability to safeguard its intellectual property (IP) is crucial. This includes patents and other proprietary technologies. Strong IP protection helps Fluor maintain a competitive edge in the engineering and construction industry. Securing and defending these assets is vital for long-term profitability and market leadership.

- Patent filings: Fluor consistently files for patents to protect its innovations, with approximately 10-20 new patent applications per year.

- R&D spending: The company allocates around 1-2% of its revenue to research and development, focusing on new technologies and processes.

- Legal costs: Fluor spends roughly $5-10 million annually on legal fees related to IP protection and enforcement.

- IP portfolio: Fluor's IP portfolio includes over 500 active patents and trademarks globally.

Fluor operates within a complex global legal framework. It faces challenges from diverse regulations impacting costs and project execution. Legal expenses, including dispute resolutions, reached $125 million in 2024. Strict compliance with environmental and anti-corruption laws is essential for avoiding penalties and reputational damage.

| Legal Area | Risk | Financial Impact (2024) |

|---|---|---|

| Environmental | Non-Compliance | EPA fines exceeding $100M |

| FCPA | Non-Compliance | Industry penalties over $2B |

| IP | Infringement | Legal costs: $5-10M |

Environmental factors

Fluor faces both hurdles and prospects from climate change and the move to cleaner energy. Growing demand exists for renewable energy and carbon capture projects. In 2024, the global renewable energy market was valued at $881.1 billion. Fluor's expertise can be leveraged in these expanding sectors. The company can capitalize on the energy transition.

Fluor faces environmental regulations globally, impacting emissions, waste, and conservation. Stricter rules can alter project designs and timelines. For example, the EPA's 2024 regulations on emissions require significant compliance investments. Compliance costs may rise, affecting project profitability.

Fluor emphasizes sustainability in its supply chain, a key part of its environmental strategy. They assess logistics and material sourcing for environmental effects. This includes reducing carbon emissions related to transportation and procurement. For example, in 2024, Fluor aimed to reduce supply chain emissions by 10%.

Carbon Footprint Reduction

Fluor's commitment to reducing its carbon footprint is a key environmental factor. This includes efforts to lower emissions from its offices and vehicle fleet, aligning with broader sustainability objectives. These initiatives not only support environmental responsibility but also boost Fluor's public image. For instance, in 2024, Fluor aimed to decrease its carbon emissions by 15% compared to 2023 levels.

- Carbon emission reductions can lead to operational cost savings through energy efficiency.

- Fluor's sustainability efforts can attract environmentally conscious investors.

- Reduced carbon footprint helps meet regulatory requirements and avoid penalties.

Environmental Due Diligence in Projects

Environmental due diligence is crucial for Fluor's projects, aligning with global sustainability goals. This involves assessing environmental risks and impacts throughout project lifecycles. Fluor integrates environmental considerations into planning and execution to mitigate harm and promote sustainable construction. For example, in 2024, the global environmental services market was valued at $39.1 billion, expected to reach $50.8 billion by 2029.

- Compliance with environmental regulations is essential for project approval and operation.

- Fluor's initiatives include waste reduction, water conservation, and emissions control.

- Implementing these practices reduces environmental liabilities and operational costs.

- Strong environmental performance enhances Fluor's reputation and stakeholder trust.

Fluor must navigate environmental factors to meet sustainability demands. These include climate change effects and regulations. The firm must also manage carbon footprint, and ensure due diligence.

Fluor can seize chances in renewable energy, where the global market in 2024 hit $881.1 billion. Addressing regulations, like EPA emissions rules, is critical to avoid fines. In 2024, the environmental services market was worth $39.1 billion, growing to $50.8 billion by 2029.

| Factor | Impact | Data (2024) |

|---|---|---|

| Renewable Energy Market | Opportunities for project development | $881.1B global valuation |

| Environmental Services | Market for sustainability consulting | $39.1B market size (Growing to $50.8B by 2029) |

| Supply Chain Emissions Reduction Goal | Improve environmental performance | Target: 10% reduction |

| Corporate Carbon Emission Reduction | Enhance image, operational efficiency | Goal: 15% reduction vs. 2023 |

PESTLE Analysis Data Sources

Fluor's PESTLE relies on official reports, industry insights, and global databases, like the IMF and World Bank, to offer comprehensive coverage.