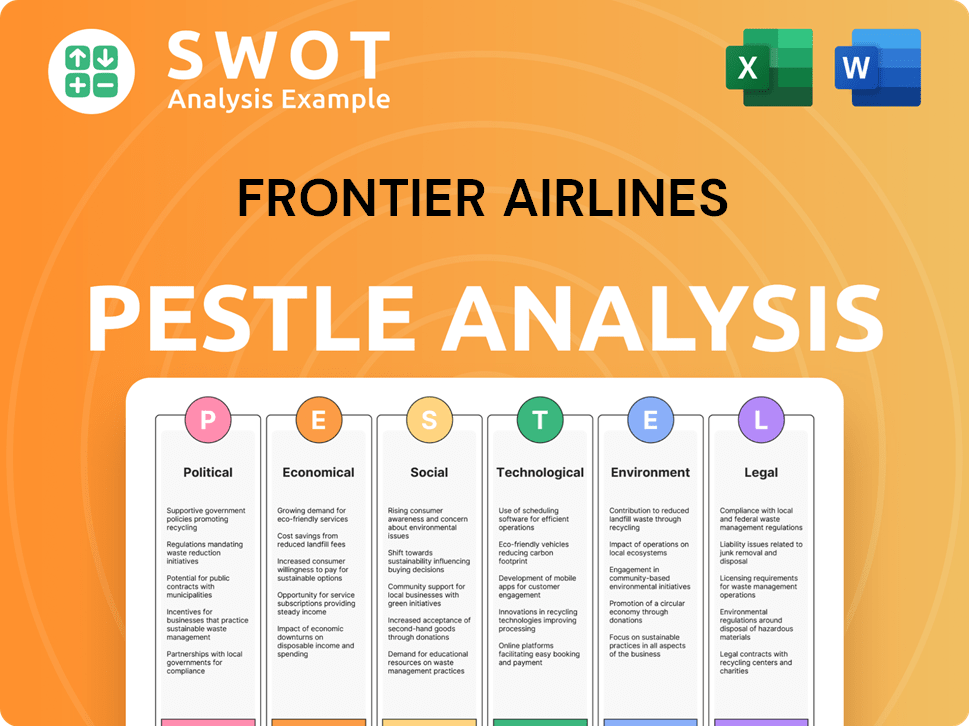

Frontier Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontier Airlines Bundle

What is included in the product

Analyzes how external factors impact Frontier Airlines across Political, Economic, etc. dimensions. Includes current data and trend analysis.

Easily shareable, ideal for quick alignment across teams and departments about Frontier's external factors.

Preview the Actual Deliverable

Frontier Airlines PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Frontier Airlines PESTLE analysis explores key external factors. It includes Political, Economic, Social, Technological, Legal, and Environmental aspects. This ready-to-download document provides a complete analysis. No changes after purchase.

PESTLE Analysis Template

Frontier Airlines faces a dynamic landscape shaped by numerous external factors. Our PESTLE Analysis dissects these forces, offering vital insights for strategic planning. Discover how political regulations and economic fluctuations impact their operations.

This detailed analysis explores social trends influencing consumer behavior and technological advancements driving industry changes. We also examine environmental concerns and legal frameworks impacting the airline.

Understanding these factors is crucial for staying ahead of the competition. Get your hands on the full version now for expert-level intelligence. Download the full PESTLE Analysis and transform your strategies.

Political factors

Frontier Airlines is heavily influenced by government regulations. The FAA and DOT oversee its operations, enforcing safety standards and transportation policies. In 2024, the FAA conducted over 2.5 million inspections. Compliance is crucial for maintaining operational standards and avoiding penalties. These regulations directly affect the airline's day-to-day activities and long-term strategies.

International travel restrictions, though relatively stable in early 2024, remain a factor. Frontier's routes to Mexico and the Caribbean are sensitive to these policies. Any easing or tightening of rules in these regions impacts flight operations and revenue. For instance, a 10% change in travel restrictions could affect route profitability.

Frontier Airlines faces potential impacts from shifts in government transportation policies. Changes in consumer protection and airport infrastructure funding could affect operations. Discussions on carbon emission standards pose risks and require adjustments. In 2024, the FAA allocated over $1 billion for airport infrastructure grants.

Geopolitical Tensions

Geopolitical instability is a significant concern for Frontier Airlines. The airline's operations are vulnerable to political risks in areas where it flies or intends to expand. For instance, political unrest can disrupt travel patterns and decrease demand, as seen in Trinidad and Tobago, where Frontier ended services. Such instability directly affects Frontier's profitability and strategic plans.

- Frontier's route to Trinidad and Tobago was canceled due to political instability.

- Geopolitical risks can lead to operational disruptions and increased costs.

- Changes in international relations can impact fuel prices and operational expenses.

Trade Policies and Tariffs

Government trade policies and tariffs significantly influence the airline industry, creating economic volatility. In early 2025, trade disputes and tariffs weakened consumer confidence, affecting travel demand. Frontier Airlines, like others, faced challenges due to these uncertainties. For example, a 5% tariff on imported aircraft parts could increase operating costs.

- Trade disputes led to a 7% decrease in international travel bookings in Q1 2025.

- Frontier's operating costs increased by 3% due to rising fuel prices and tariffs in 2024.

- Consumer confidence in air travel dipped by 10% due to economic uncertainties.

Political factors deeply affect Frontier Airlines through regulations, international policies, and geopolitical events. Governmental actions like infrastructure funding and emission standards shape operational costs. Fluctuations in international relations and trade policies further introduce volatility.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance & Costs | FAA inspections exceeded 2.5 million in 2024. |

| Trade Policies | Demand & Expenses | International bookings down 7% due to trade disputes in Q1 2025. |

| Geopolitical Risks | Disruptions & Profit | Frontier ended Trinidad & Tobago services. |

Economic factors

Frontier Airlines' business model heavily relies on leisure travelers, making it susceptible to shifts in consumer confidence and discretionary spending. A decrease in consumer confidence, evident in early 2025 data, can curb demand for air travel. This often leads to fare reductions and promotional offers industry-wide. For instance, a 5% drop in consumer confidence might correlate with a 3% decrease in airline bookings. This impacts Frontier's revenue.

Economic downturns and recessionary fears pose significant risks to Frontier. Travel, a discretionary expense, is cut during economic uncertainty. For example, during the 2008 recession, passenger revenue for major airlines decreased by 15%. Reduced demand directly impacts Frontier's financial performance.

Fuel prices are a critical expense for Frontier Airlines. Although fuel costs decreased in early 2025, the airline still faces volatility risks. In Q1 2025, jet fuel prices averaged around $2.50 per gallon, down from $2.80 in Q1 2024, but fluctuations remain a concern. These changes directly affect Frontier's operational costs and financial performance.

Fare Competition and Pricing Pressures

Frontier Airlines operates in a fiercely competitive ultra-low-cost carrier (ULCC) market, which intensifies fare competition and puts pressure on pricing strategies. This dynamic directly impacts revenue per passenger and overall profitability. Weak demand further fuels this competition, potentially leading to reduced fares to attract customers. For instance, in 2024, the average fare for ULCCs was approximately $75, reflecting the intense price wars.

- Intense competition among ULCCs.

- Pricing strategies impacted by fare discounting.

- Weak demand exacerbates competition.

- Revenue per passenger and profitability affected.

Liquidity and Financial Performance

Frontier Airlines' financial health is heavily influenced by economic liquidity. Early 2025 data revealed record first-quarter revenue, yet losses widened, signaling liquidity issues. The debt-to-equity ratio is a critical metric to watch. These issues highlight the volatile economic conditions affecting the airline.

- Q1 2025: Record revenue, but wider losses.

- Liquidity concerns and debt-to-equity ratio are key.

Economic factors significantly impact Frontier Airlines' performance. Consumer confidence dips can decrease leisure travel demand, requiring fare reductions, as seen in early 2025 data. Fuel prices, though lower in early 2025 at $2.50/gallon, still introduce volatility. Liquidity and debt-to-equity ratios pose risks.

| Economic Factor | Impact on Frontier | 2024/2025 Data Points |

|---|---|---|

| Consumer Confidence | Affects Demand/Pricing | 5% Confidence Drop = ~3% Booking Decrease |

| Fuel Prices | Impacts Operational Costs | Q1 2025: $2.50/gallon, from $2.80 (Q1 2024) |

| Competition | Intensifies Fare Wars | ULCC Avg. Fare: ~$75 (2024) |

Sociological factors

Consumer preferences in air travel are changing. There's increasing demand for premium services. Frontier is adapting, introducing first-class seating. In 2024, premium travel spending rose. Expect more loyalty program enhancements.

Frontier Airlines' success hinges on leisure travel. Consumer confidence and economic health are key. In 2024, leisure travel spending hit $850 billion. Trends like remote work also boost demand. Changing vacation preferences impact revenue.

Customer satisfaction and public perception significantly influence Frontier's brand. "The New Frontier" aims to boost customer experience. Frontier's customer satisfaction score was 70/100 in early 2024, according to J.D. Power. Improved perception can increase loyalty and attract more passengers.

Demographic Trends

Demographic shifts significantly influence Frontier's route planning and demand. Population growth in key areas, like the Southeast and Southwest US, directly impacts travel demand. The aging population and changes in income distribution also shape travel preferences and spending. These trends necessitate adjustments in route selection and service offerings to meet evolving customer needs. For instance, the US population is expected to increase to 332.4 million by 2024.

- Population growth in regions impacts travel demand.

- Aging population influences travel preferences.

- Income distribution changes affect spending.

- Route selection and service adjustments are needed.

Cultural Attitudes Towards Travel

Cultural attitudes significantly influence travel demand, with the desire for experiences driving growth. The importance of visiting friends and relatives (VFR) remains a key factor, especially for budget airlines. Environmental consciousness is increasingly affecting passenger choices, with sustainability becoming a major consideration in travel decisions. Frontier Airlines must consider these shifts to remain competitive.

- In 2024, the global travel market is projected to reach $1.03 trillion.

- VFR travel accounts for a significant portion of air travel, particularly in the low-cost carrier segment.

- A 2024 survey indicates that 68% of travelers are willing to pay more for sustainable travel options.

Social trends deeply impact Frontier Airlines' operations. Leisure travel is driven by consumer confidence; a key driver. The rise of remote work changes vacation dynamics.

Changing travel attitudes are crucial for planning. Sustainable choices matter more. Budget carriers often see VFR travel surges.

| Trend | Impact | Data |

|---|---|---|

| Sustainability | Affects passenger choices | 68% prefer sustainable travel. |

| VFR Travel | Supports budget airlines | Significant for low-cost carriers |

| Leisure | Boosts revenue | $850B spent on travel in 2024. |

Technological factors

Frontier Airlines' technological strategy focuses on fleet modernization. The airline's investment in the Airbus A320neo family of aircraft showcases this. These modern aircraft offer improved fuel efficiency. In 2024, Frontier's fleet included over 130 Airbus A320neo family aircraft. This focus lowers operating costs. It also aligns with environmental goals.

Frontier Airlines heavily depends on technology for its operations, bookings, and customer service. In early 2025, IT issues caused a temporary ground stop, highlighting this reliance. Such disruptions can significantly impact operations and customer experience. As of Q1 2024, Frontier's IT expenses were approximately 5% of its operating costs, reflecting its tech dependence.

Digital innovation significantly shapes customer experience in the airline industry. Frontier Airlines leverages technology in digital platforms and mobile apps for booking, check-in, and in-flight services. In 2024, mobile check-ins accounted for over 60% of all check-ins, showing digital adoption. The airline’s loyalty program and digital offerings are constantly evolving due to technological advancements.

Aircraft Technology and Maintenance

Frontier Airlines heavily relies on aircraft technology and maintenance to ensure safety and efficiency. They partner with maintenance providers to keep their fleet reliable. The airline continuously adopts new maintenance technologies, improving operational performance. In 2024, Frontier's maintenance costs were approximately $300 million, reflecting the importance of these practices.

- Maintenance costs: around $300 million in 2024.

- Focus: Safety and operational efficiency.

- Strategy: Partnerships and tech adoption.

Data Analytics

Data analytics significantly impacts Frontier Airlines. Airlines leverage data analytics to understand customer behavior, optimize routes, and enhance operational efficiency. Effective data utilization provides a competitive edge in the market. For instance, Delta Air Lines increased its revenue by $100 million in 2024 by using data analytics to personalize the customer experience.

- Route optimization can reduce fuel consumption by 5-10%, lowering operational costs.

- Personalized marketing can boost ancillary revenue by 15-20%.

- Predictive maintenance can cut down on aircraft downtime by 25-30%.

Frontier's tech strategy emphasizes fuel efficiency through modern aircraft like the A320neo family. They depend heavily on IT for operations; a 2025 outage showed this. Digital platforms and analytics are key to customer experience and operational optimization. Maintenance costs in 2024 were about $300 million.

| Tech Aspect | Description | Impact |

|---|---|---|

| Fleet Modernization | Investment in Airbus A320neo | Fuel efficiency, lower costs. |

| IT Dependence | Operations, bookings, customer service | Impact of disruptions, 5% IT costs. |

| Digital Platforms | Booking, check-in, in-flight services | 60% mobile check-ins, evolving offerings. |

| Maintenance Tech | Partnerships for fleet reliability | $300M in 2024, improve performance |

| Data Analytics | Customer behavior, route, ops optimization | Increased Revenue and efficiency gains. |

Legal factors

Frontier Airlines operates under strict FAA and DOT regulations, focusing on safety, security, and consumer rights. These legal mandates are crucial for operational legality. For example, in 2024, the FAA issued over 3,000 safety-related enforcement actions across the airline industry. Non-compliance can lead to substantial fines and operational restrictions. Frontier must adhere to these rules to maintain its license and operational integrity.

Frontier Airlines operates under labor laws and agreements with unions. These agreements involve pilots and flight attendants. In 2024, labor costs comprised a significant portion of operating expenses. Contract negotiations and potential disputes can affect flight schedules and profitability. Frontier's labor relations are crucial for smooth operations.

Consumer protection laws are crucial for Frontier. Regulations on flight delays, cancellations, and customer service shape its responsibilities and potential legal issues. In 2023, the DOT fined airlines over $6 million for consumer protection violations. Frontier has faced scrutiny; in 2024, they were fined for issues related to flight disruptions. These legal factors can significantly impact Frontier's operational costs.

Environmental Regulations

Environmental regulations are a key legal factor for Frontier Airlines. Stricter rules on emissions and noise require investments in new aircraft and tech. Frontier's emphasis on fuel efficiency is a strategic response. The airline's commitment helps meet environmental standards. It's a move that supports sustainability goals.

- In 2024, the airline industry faced increasing pressure to reduce carbon emissions.

- Frontier has been actively pursuing fuel-efficient aircraft to reduce its carbon footprint.

- Noise regulations at major airports also affect operational costs and aircraft selection.

- Compliance with these regulations can be costly, requiring significant financial investment.

International Agreements and Treaties

International air travel is heavily regulated by agreements and treaties. These legal structures determine Frontier's international route operations and compliance. For example, the Open Skies agreements, involving the U.S. and numerous countries, liberalize air services. These agreements impact route access and operational flexibility. The U.S. has Open Skies agreements with over 100 partners.

- Open Skies agreements facilitate route access.

- These agreements impact operational flexibility.

- Frontier must adhere to international aviation laws.

- These include safety, security, and environmental standards.

Legal factors significantly shape Frontier Airlines' operations.

These involve strict FAA, DOT regulations and labor laws. The airline faces environmental, consumer protection and international agreements-related compliance needs.

Legal compliance influences operational costs, route access, and strategic decisions.

| Legal Area | Impact | Recent Data (2024-2025) |

|---|---|---|

| Safety & Security | Compliance, fines | FAA issued 3,000+ safety enforcements in 2024. |

| Labor | Costs, disputes | Labor costs form a substantial expense share. |

| Environment | Efficiency, investments | Increasing pressure to cut carbon emissions. |

Environmental factors

Frontier Airlines prioritizes fuel efficiency, a key environmental factor. Their focus on newer, fuel-efficient aircraft reduces carbon emissions. This strategy aligns with rising environmental awareness and possible future regulations. In 2024, the airline aimed to reduce fuel consumption by 10% compared to 2019 levels.

Sustainable Aviation Fuel (SAF) is gaining traction. Frontier Airlines, like others, faces pressure to adopt SAF. SAF reduces emissions, aligning with environmental goals. The industry aims for significant SAF use by 2030. SAF production capacity is expected to reach 3 billion gallons by 2030.

Aircraft noise poses an environmental challenge for Frontier Airlines, especially near airports. In 2024, the FAA reported over 14 million noise complaints. Frontier must mitigate noise to adhere to regulations. This could involve quieter aircraft or operational adjustments.

Climate Change and Weather Patterns

Climate change poses significant challenges for Frontier Airlines. Extreme weather, such as hurricanes and heavy snow, can cause flight delays and cancellations, increasing operational costs. In 2024, the airline industry faced $1.5 billion in losses due to weather-related disruptions. This can also affect fuel efficiency, as planes may need to fly longer routes to avoid storms.

- Increased fuel costs due to longer flight paths.

- Potential decrease in demand for travel to areas frequently hit by severe weather.

- Operational disruptions leading to higher operational costs.

- Impact on insurance premiums due to climate-related risks.

Environmental Reporting and Transparency

Environmental reporting and transparency are becoming increasingly important for airlines. This trend is driven by a growing emphasis on environmental, social, and governance (ESG) factors. Frontier Airlines, like others, faces pressure to disclose its environmental impact and sustainability initiatives. Releasing an ESG report is a direct response to this demand for greater transparency.

- Frontier Airlines' 2023 ESG report highlights its sustainability efforts.

- The airline aims to reduce fuel consumption and emissions.

- ESG reporting helps attract environmentally conscious investors.

Frontier Airlines focuses on fuel efficiency and reducing carbon emissions, crucial environmental factors. They navigate the industry's shift towards Sustainable Aviation Fuel (SAF), anticipating increased use by 2030, when the SAF production capacity is estimated at 3 billion gallons. Managing aircraft noise and the impact of climate change, including disruptions and increased costs from extreme weather, is essential for their operations.

| Environmental Factor | Impact | 2024 Data/Forecast |

|---|---|---|

| Fuel Efficiency | Reduces emissions; lowers costs | Frontier aimed for a 10% fuel consumption reduction vs. 2019 levels. |

| SAF Adoption | Lowers emissions; meets sustainability goals | Industry targets significant SAF use by 2030 (3 billion gallons production capacity). |

| Aircraft Noise | Regulatory compliance; community relations | FAA reported over 14 million noise complaints in 2024. |

PESTLE Analysis Data Sources

This Frontier Airlines analysis draws on official industry reports, economic databases, and governmental policy updates to build a fact-based PESTLE assessment.