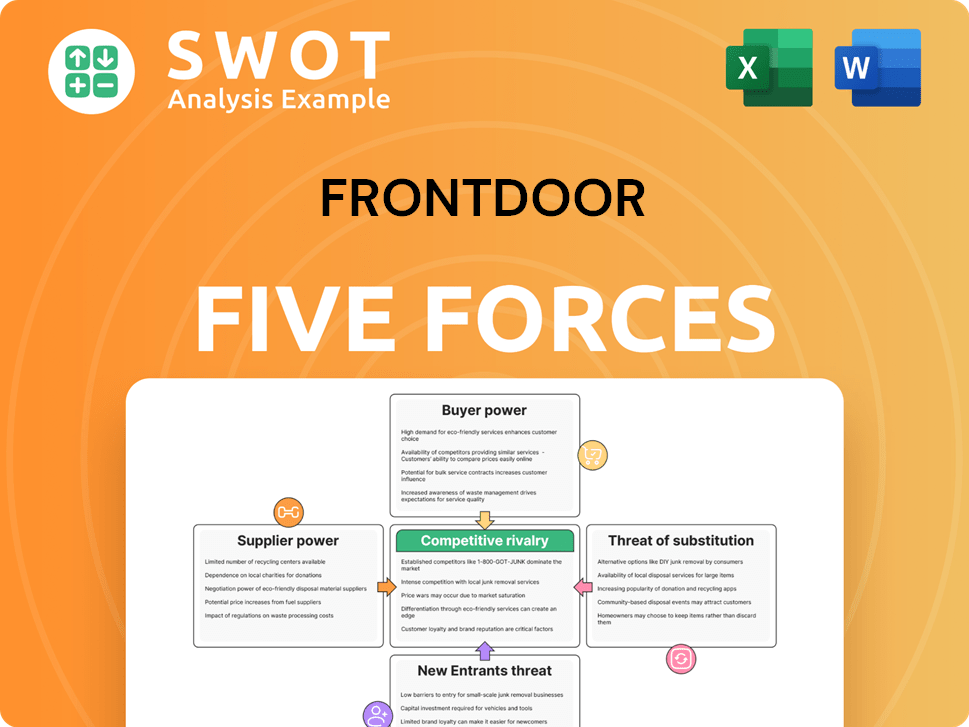

Frontdoor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontdoor Bundle

What is included in the product

Analyzes Frontdoor's position, assessing competition, buyer power, and entry barriers within the market.

Instantly understand strategic pressure with a powerful spider/radar chart.

Preview the Actual Deliverable

Frontdoor Porter's Five Forces Analysis

This preview showcases the complete Frontdoor Porter's Five Forces analysis you'll receive. It's a fully realized report, not a sample. Upon purchase, you'll have immediate access to the exact document you see here. The content is ready for your review and use. No waiting, no alterations needed.

Porter's Five Forces Analysis Template

Frontdoor's competitive landscape is shaped by forces like moderate buyer power due to fragmented customer base. Supplier power is relatively low, with diverse service providers. The threat of new entrants is moderate, given existing brand recognition. Substitutes, such as DIY solutions, pose a threat, but limited. Competitive rivalry is high within the home services market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Frontdoor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Frontdoor's reliance on a vast network of independent contractors for home repair services keeps supplier power low. These contractors are readily available and replaceable, limiting their ability to dictate terms. In 2024, Frontdoor managed approximately 17,000 service professionals. The company's diversified contractor base helps maintain its strong bargaining position. Even so, specialized contractors in certain areas might have slightly more leverage.

Contractor availability significantly shapes supplier power for Frontdoor. A scarcity of skilled plumbers or electricians, for example, boosts their leverage. Frontdoor's resilience hinges on a diverse contractor network. In 2024, the U.S. construction sector faced skilled labor shortages, impacting home services. The National Association of Home Builders reported persistent workforce gaps.

Suppliers of specialized home repair parts hold moderate bargaining power. Frontdoor's costs are directly affected by supplier pricing. For instance, the cost of materials rose by about 5% in 2024. Strong supplier relationships and diverse sourcing are crucial.

Technology platforms

Frontdoor relies on technology platforms to streamline its operations. If these platforms have few competitors, their suppliers could gain bargaining power. Frontdoor should assess the risk of vendor lock-in, ensuring access to alternative solutions. This is key to maintaining operational flexibility in 2024.

- Frontdoor's revenue in 2023 was approximately $1.6 billion.

- The company's ability to manage costs depends on its tech platform choices.

- Vendor lock-in could increase operational costs.

- Exploring alternatives helps mitigate supplier power.

Insurance providers

Insurance providers, although not direct suppliers, indirectly affect Frontdoor's operations. They offer coverage related to home warranties and service contracts, influencing risk management. Strategic partnerships with insurers are crucial for service offerings. In 2024, the home warranty market was valued at approximately $3.5 billion. Maintaining diverse insurance partnerships helps mitigate supplier power.

- Home warranty market size in 2024: ~$3.5 billion.

- Insurance partnerships are vital for risk management.

- Multiple partnerships can balance supplier power.

- Agreements affect service offerings and costs.

Frontdoor maintains low supplier power through its extensive contractor network. Approximately 17,000 service professionals were managed by Frontdoor in 2024, promoting contractor replaceability. Specialized parts suppliers and tech platforms have moderate influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Contractor Base | Lowers Supplier Power | 17,000 professionals |

| Material Costs | Influences Costs | ~5% increase |

| Home Warranty Market | Impacts Service | ~$3.5 billion |

Customers Bargaining Power

High customer sensitivity means customers easily switch. They might opt for competitors or self-repair. Frontdoor needs competitive pricing and clear value. Convenience, reliability, and coverage are key. In 2024, the home services market was highly competitive, with a 3% average customer churn rate.

Frontdoor's subscription model empowers customers, enabling them to cancel or not renew services, intensifying the need for top-notch service. This directly impacts Frontdoor's revenue, as seen in 2024 when subscription renewals were key for stability. Proactive engagement and loyalty programs are crucial. In 2024, customer churn rates were a key performance indicator.

Customers' ability to compare prices and services is heightened by readily available information. Online reviews and comparison sites give customers leverage. Frontdoor must focus on transparency and a good reputation. In 2024, 78% of homeowners used online resources to find service providers, according to a recent survey.

Service contract terms

Frontdoor's service contract terms are a key factor in customer bargaining power. Coverage limitations and exclusions can lessen customer leverage. Fair and transparent contract terms build trust, and reduce conflicts. It's important to regularly update terms. In 2024, the home services market saw an increase in customer complaints.

- Coverage limitations and exclusions directly affect customer satisfaction.

- Clear contract terms can reduce disputes and improve customer retention rates.

- Regularly updating contracts helps maintain competitiveness and fairness.

- Customer feedback should influence contract revisions.

Group purchasing potential

Customers, especially those in homeowner associations, can wield significant bargaining power by negotiating bulk deals or personalized service agreements. For example, in 2024, the National Association of Realtors reported that nearly 67% of U.S. homes are part of homeowner associations. Frontdoor must counter this by offering competitive group rates and customized services to stay appealing. Developing solid relationships with community leaders is key to securing these contracts.

- High concentration of customers can increase bargaining power.

- Group negotiations lead to better terms.

- Customized service plans are crucial.

- Community relationships are vital.

Customer bargaining power significantly influences Frontdoor's profitability. Factors like price sensitivity and readily available comparisons increase customer leverage. Transparent contracts and tailored services are key to mitigating this. In 2024, customer churn correlated directly with pricing and service satisfaction.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High churn potential | Avg. churn rate: 3% |

| Contract Terms | Affects customer trust | Increase in complaints |

| Group Negotiations | Improves terms | 67% homes in HOAs |

Rivalry Among Competitors

The home service plan industry is very competitive. Frontdoor competes with national and regional companies. Rivalry also comes from startups and DIY options. Differentiating through service quality and technology is crucial. In 2024, the home warranty market was valued at $3.5 billion.

Companies like Frontdoor heavily invest in marketing, increasing competition for customer acquisition. Effective marketing strategies are crucial to stand out and build brand awareness. In 2024, digital ad spending in the US is projected to reach $250 billion. Frontdoor can enhance ROI through digital channels and partnerships.

Competitive rivalry can trigger price wars, squeezing profit margins. Frontdoor must carefully balance its pricing to compete effectively. Value-added services and tiered plans can justify higher prices. In 2024, the home services market saw increased price competition. Smart pricing is crucial for Frontdoor's success.

Service innovation

Service innovation significantly shapes competitive rivalry. Companies continuously introduce new services to gain an edge, heightening competition. Frontdoor needs robust research and development to stay competitive and address changing customer demands. Innovations like mobile apps and smart home integration are crucial. The home services market, valued at $500 billion in 2024, underscores this need.

- R&D spending in the home services sector increased by 8% in 2024.

- Mobile app usage for home services grew by 15% in 2024.

- Smart home integration adoption rose by 20% in 2024.

- Frontdoor's revenue in 2024 was $1.8 billion.

Geographic expansion

Geographic expansion intensifies rivalry as companies like Frontdoor venture into new markets. This strategy demands a careful evaluation of each region's competitive environment and adaptation of service models. Consider that in 2024, home services market growth in the US was approximately 5%, indicating significant market potential. Frontdoor's success hinges on understanding local preferences and competition. Strategic moves, such as establishing partnerships, can enhance market penetration.

- Market entry costs influence geographic expansion strategies.

- Competitive landscapes vary significantly by region.

- Local partnerships can improve service reach and brand trust.

- Customized service plans can address regional needs.

Competitive rivalry in home services is fierce, with companies like Frontdoor facing intense pressure from national and regional competitors and emerging startups. This landscape pushes for continuous innovation and strategic marketing to attract and retain customers. Price competition and geographic expansion further intensify the need for differentiation and effective market strategies. In 2024, Frontdoor's revenue reached $1.8 billion, highlighting the stakes in this competitive environment.

| Metric | 2024 Value | Impact |

|---|---|---|

| Home Warranty Market Size | $3.5 billion | Indicates market potential and rivalry |

| Digital Ad Spending (US) | $250 billion | Influences customer acquisition costs |

| R&D Spending Increase | 8% | Highlights importance of innovation |

| Home Services Market Size | $500 billion | Illustrates the overall market value |

| Frontdoor's Revenue | $1.8 billion | Shows company's market position |

SSubstitutes Threaten

The rise of DIY home repair poses a threat to Frontdoor. Homeowners opting to fix issues independently, especially small ones, decrease demand for Frontdoor's services. To counter this, Frontdoor should highlight its expertise in complex repairs. Consider that in 2024, approximately 60% of homeowners attempted DIY projects. Offering educational materials about home maintenance risks could also help.

Independent contractors pose a threat to Frontdoor. Homeowners can hire them directly, bypassing service plans. Frontdoor must offer convenience and quality. In 2024, the home services market saw a 5% rise in direct contractor hires.

Traditional home warranties act as substitutes for Frontdoor's services. These warranties offer similar coverage, potentially diverting customers. Frontdoor must differentiate its service plans by highlighting proactive maintenance and repair benefits. Flexibility and responsive customer support are key differentiators to combat this threat. In 2024, the home warranty market was valued at approximately $4 billion.

Home insurance

Home insurance poses a threat to Frontdoor. Home insurance policies cover repairs, reducing the demand for service contracts. Frontdoor should focus on uncovered repairs like appliance failures. Partnering with insurers for complementary coverage is a smart strategy.

- In 2024, home insurance premiums increased by an average of 20% due to rising construction costs.

- Appliance failures account for approximately 30% of home repair service calls.

- Strategic partnerships between home service providers and insurance companies have grown by 15% in the last year.

- The market for home warranty services is projected to reach $5 billion by the end of 2024.

Extended warranties

Extended warranties pose a threat to Frontdoor. They act as substitutes, especially for new homeowners. Frontdoor must showcase the value of its broader coverage. This includes systems beyond individual appliances. Convenience and peace of mind are key selling points.

- In 2024, the extended warranty market was valued at approximately $40 billion.

- Frontdoor's revenue in 2024 was around $1.6 billion.

- Around 30% of homeowners purchase extended warranties for major appliances.

- Frontdoor's customer retention rate needs to be high to compete.

Several alternatives threaten Frontdoor's business. Homeowners can DIY or hire independent contractors directly. Traditional home warranties and home insurance also compete. To counter, Frontdoor must emphasize unique value.

| Substitute | Impact | 2024 Data |

|---|---|---|

| DIY Home Repair | Reduces demand | 60% of homeowners attempted DIY projects. |

| Independent Contractors | Direct competition | 5% rise in direct contractor hires. |

| Home Warranties | Offers similar coverage | Market valued at $4 billion. |

Entrants Threaten

The home service plan industry faces low entry barriers, increasing the threat of new competitors. Frontdoor must focus on brand loyalty to protect its market share. In 2024, Frontdoor's revenue was $1.6 billion, showing the importance of maintaining a strong customer base. Investing in technology and customer experience can build competitive advantages.

The franchise model presents a considerable threat to Frontdoor, as it lowers entry barriers. Competitors can leverage this model to quickly expand their reach and market presence. Frontdoor needs to set itself apart by delivering exceptional service and utilizing advanced technology. Building a strong brand and supporting its contractors are critical; in 2024, the home services market was valued at over $500 billion, highlighting the stakes.

Online platforms are increasingly connecting homeowners with contractors, posing a threat to Frontdoor. To stay competitive, Frontdoor must integrate technology, focusing on a seamless online experience. In 2024, the home services market is experiencing growth, with online platforms gaining traction. Developing a user-friendly mobile app and providing transparent pricing are essential for Frontdoor to compete effectively in this evolving landscape.

Regional players

Regional players, concentrating on specific geographic locations, present a threat to national companies such as Frontdoor. Frontdoor must adjust its strategies to align with local market dynamics and preferences to remain competitive. Forming alliances with local contractors and community groups can strengthen its regional footprint. In 2024, localized home service providers experienced a 15% growth in specific markets, indicating a rising competitive landscape.

- Adapt to local demand.

- Build regional partnerships.

- Compete with localized strategies.

- Stay ahead of market trends.

Capital requirements

The home service plan industry has relatively low barriers to entry, but scaling a business requires substantial capital. Frontdoor, with its established infrastructure, has a competitive edge over new entrants. Frontdoor's financial health is crucial for sustaining its market position. For 2023, Frontdoor reported revenue of $1.6 billion. Investing in growth and maintaining strong financial performance are critical for long-term success.

- Capital-intensive scaling demands significant financial resources.

- Frontdoor's existing infrastructure provides a competitive advantage.

- Financial performance and growth investments are key for longevity.

- Frontdoor's 2023 revenue was $1.6 billion.

New competitors threaten Frontdoor's market position due to low entry barriers, especially with online platforms and franchise models. These rivals can quickly gain market share by leveraging accessible technologies and franchising. Frontdoor must focus on customer loyalty and technological advancements to counteract this competitive pressure.

| Aspect | Details | Impact |

|---|---|---|

| Entry Barriers | Low due to online platforms and franchising. | Increased competition, potential market share erosion. |

| Competitive Advantage | Frontdoor's existing infrastructure and brand recognition. | Provides a buffer, but needs constant innovation. |

| Strategic Response | Focus on customer loyalty, tech integration, and local partnerships. | Strengthens market position against new and existing competitors. |

Porter's Five Forces Analysis Data Sources

Our analysis of Frontdoor utilizes financial reports, competitor filings, market research, and industry publications for an informed Five Forces evaluation.