Frontdoor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontdoor Bundle

What is included in the product

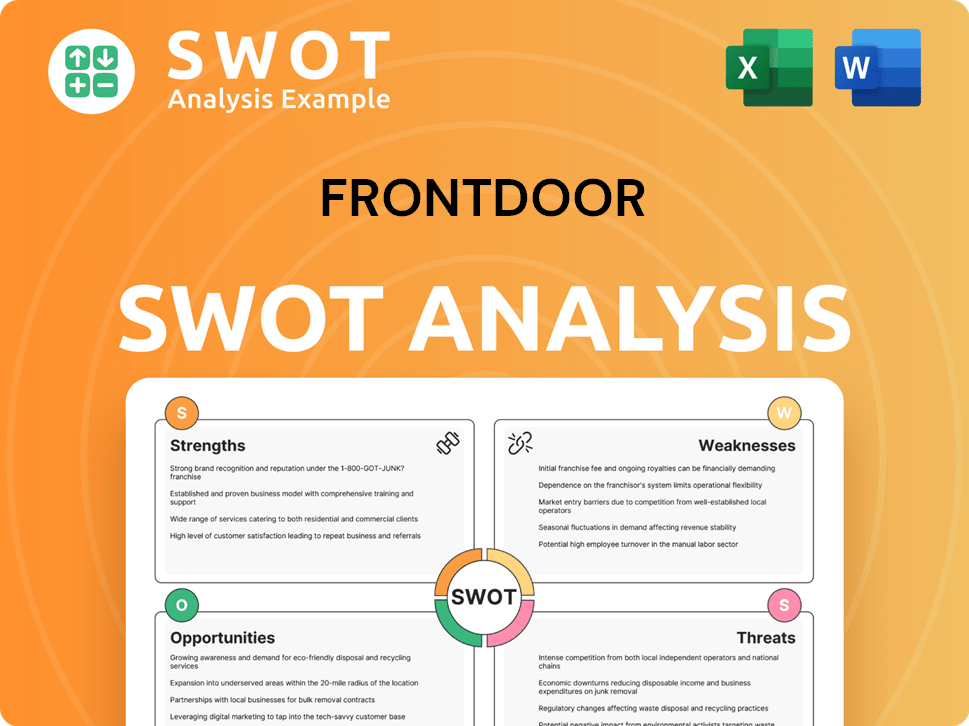

Analyzes Frontdoor’s competitive position through key internal and external factors.

Streamlines SWOT communication with visual, clean formatting.

What You See Is What You Get

Frontdoor SWOT Analysis

See a real piece of the Frontdoor SWOT analysis now. This is exactly what you'll receive upon purchasing the full document.

This comprehensive analysis you see is not a sample. You'll get the full, downloadable report right away.

This is the complete analysis—no extra content is added after your order, just the quality previewed here.

What you are seeing is the exact analysis you'll get access to once you finish checkout.

SWOT Analysis Template

The Frontdoor SWOT analysis unveils key insights into its strengths, weaknesses, opportunities, and threats. Our analysis helps you understand their market positioning and strategic options. Gain a deeper understanding of their competitive landscape with key differentiators. See actionable insights on growth potential and areas needing attention. Uncover their strategic imperatives with our full SWOT analysis.

Want the full story behind Frontdoor's potential and challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report.

Strengths

Frontdoor's market leadership is evident. It has a strong presence in the U.S. home warranty sector, supported by brands like American Home Shield. This brand recognition fosters customer loyalty and drives substantial revenue. In 2024, American Home Shield accounted for a significant portion of Frontdoor's revenue. The wide contractor network ensures service delivery.

Frontdoor's financial strength shines, with 2024 revenue at $1.84B and a net income of $235M. Their gross profit and adjusted EBITDA also saw improvements. This performance highlights the company's operational efficiency and profitability in the market.

Frontdoor's strategic acquisition of 2-10 Home Buyers Warranty in late 2024 significantly broadened its customer reach. This move also diversified its service offerings. The integration provides new home structural warranties. This creates strong opportunities for cross-selling and revenue growth. The company's revenue in 2024 was $6.7 billion.

Technological Innovation

Frontdoor's focus on technological innovation is a key strength. They are developing a new app and exploring AI to enhance customer experience. This could streamline service requests and boost operational efficiency. In Q1 2024, Frontdoor's app saw increased usage, reflecting their tech investments.

- App adoption is growing, suggesting positive impact.

- AI integration could lead to smarter service matching.

- Efficiency improvements can lower costs.

- Customer satisfaction may rise with tech enhancements.

Extensive Contractor Network

Frontdoor's vast network of contractors is a significant strength, enabling broad service coverage. This network, comprising roughly 17,000 professional contractor firms, supports a wide range of home repair and maintenance services across the U.S. This extensive reach allows Frontdoor to handle a high volume of service requests efficiently. The company's 2024 revenue was $1.4 billion, reflecting the effectiveness of its operational capabilities.

- Wide geographical service availability.

- Efficient handling of high service request volumes.

- Strong operational capacity.

Frontdoor benefits from strong brand recognition, especially with American Home Shield. Its financial health is highlighted by substantial 2024 revenues and net income. Technological advancements, like its new app, improve customer experience and operational efficiency.

| Strength | Details | Impact |

|---|---|---|

| Market Leadership | Dominance in U.S. home warranty sector with brands like American Home Shield. | Drives customer loyalty and revenue; 2024 revenue $1.84B. |

| Financial Performance | 2024 revenue $1.84B and net income of $235M; EBITDA improvement. | Demonstrates profitability and operational efficiency. |

| Strategic Acquisitions & Tech | Acquisition of 2-10 HBW, new app, and AI integration. | Expands customer reach, streamlines operations, and improves satisfaction; app usage up in Q1 2024. |

Weaknesses

Frontdoor's reliance on specific customer acquisition channels, like direct-to-consumer and real estate, poses a weakness. The company's customer growth could be significantly affected by any downturns or changes in these key channels. In 2024, approximately 60% of Frontdoor's revenue came through these channels. Any disruption here directly impacts revenue.

Frontdoor's performance is sensitive to economic shifts. Inflation and interest rate hikes can reduce consumer spending on home services. A decline in consumer confidence, like the dip observed in late 2023, could negatively affect demand for their plans. For example, in Q3 2023, Frontdoor's revenue decreased by 6% due to these factors.

Integrating acquired companies, like 2-10 Home Buyers Warranty, poses operational and financial hurdles. Frontdoor's acquisitions in 2023, including the $150 million purchase of 2-10 Home Buyers Warranty, required significant integration efforts. These challenges include aligning different company cultures, systems, and processes. A successful integration is crucial for achieving anticipated synergies and financial returns from the acquisition, such as enhanced market reach.

Competition in a Commoditized Market

Frontdoor faces intense competition in the home warranty market, often seen as commoditized. This makes it hard to stand out. Continuous innovation and superior service quality are crucial for Frontdoor. They must differentiate themselves to maintain market share. In 2024, the home warranty market was valued at approximately $4 billion, with Frontdoor holding a significant share.

- Market commoditization can lead to price wars, impacting profitability.

- Differentiation is tough due to similar service offerings among competitors.

- Frontdoor's ability to innovate dictates its competitive edge.

- Customer loyalty is crucial to withstand competitive pressures.

Sensitivity to Cost Inflation

Frontdoor's profitability faces risks from cost inflation. Rising service request costs, potentially including mid-single-digit inflation, could squeeze margins. Tariffs on materials also pose a threat. In Q1 2024, the company reported a gross profit margin of 30.2%, a slight decrease from 30.4% in the same period of 2023. This demonstrates the impact of cost pressures.

- Inflation's potential impact on service costs.

- Tariffs' influence on material expenses.

- Gross profit margin fluctuations.

Frontdoor’s heavy reliance on specific acquisition channels presents vulnerability, with roughly 60% of 2024 revenue tied to them. Economic downturns and consumer confidence shifts can negatively affect demand, impacting their financial performance. Competition, especially in the commoditized home warranty market, intensifies the need for differentiation to retain market share, which was about $4 billion in 2024.

| Weakness | Description | Impact |

|---|---|---|

| Channel Dependency | Reliance on specific customer acquisition channels. | Vulnerability to downturns. |

| Economic Sensitivity | Susceptible to economic shifts, impacting spending. | Potential revenue decline. |

| Competitive Pressures | Intense competition in a commoditized market. | Need for differentiation. |

Opportunities

The U.S. home services market is vast, with significant growth expected. Frontdoor can tap into underpenetrated markets to boost its share. In 2024, the home services sector saw $600 billion in revenue. Frontdoor's expansion could yield substantial returns.

Frontdoor can expand its non-warranty services. This includes on-demand repairs and specialized programs like HVAC. Such moves diversify revenue and boost profits.

Frontdoor can capitalize on tech advancements. Further tech development, including AI, boosts customer experience. This can make service delivery more efficient. New service offerings are possible. In Q1 2024, Frontdoor's revenue reached $684 million, showing potential.

Cross-Selling

Frontdoor's acquisition of 2-10 Home Buyers Warranty opens doors for cross-selling. This allows the company to offer both home warranties and new home structural warranties. This integration boosts revenue potential by bundling services. The strategy can increase customer lifetime value.

- 2-10 HBW acquisition enhances service offerings.

- Cross-selling can boost customer retention rates.

- Bundling services may increase average revenue per customer.

- Strategic partnerships may further enhance cross-selling.

Strategic Partnerships and Acquisitions

Frontdoor can boost growth via strategic partnerships and acquisitions. These moves can broaden service offerings and reach new customers. Consider how acquisitions have fueled growth in similar sectors. For instance, in 2024, the home services market saw $600 billion in revenue, with acquisitions playing a key role. This strategy could enable expansion, especially in fast-growing segments.

- Market Reach: Expanding geographic presence.

- Service Portfolio: Integrating new services.

- Customer Base: Accessing new customer segments.

- Revenue Growth: Increasing overall revenue.

Frontdoor's growth is fueled by its ability to capture opportunities in a large home services market. The firm's diversification via non-warranty services and technological integration allows for better customer experiences. The acquisition of 2-10 Home Buyers Warranty enhances service offerings and revenue streams.

| Opportunity | Strategic Action | Expected Impact |

|---|---|---|

| Market Expansion | Penetrate underutilized markets. | Increase market share |

| Service Diversification | Introduce on-demand services and HVAC programs. | Boost profits, diversify revenue |

| Technological Advancement | Implement AI, improve customer experience. | Increase efficiency, new service options |

| Strategic Acquisitions | Leverage 2-10 Home Buyers Warranty for bundling. | Enhance customer lifetime value and retention. |

Threats

Frontdoor confronts fierce competition from established home warranty providers and expanding home services firms. This includes companies like American Home Shield and newer tech-driven platforms. The competitive environment requires Frontdoor to consistently innovate its service offerings and enhance customer satisfaction to maintain market share. In 2024, the home warranty market was valued at approximately $4 billion, with expectations of continued growth, intensifying the need for differentiation.

Frontdoor faces regulatory hurdles, especially regarding home service standards and consumer protection. These regulations can lead to increased compliance costs. For instance, in 2024, the home services market saw a 5% increase in regulatory scrutiny. This can potentially limit operational flexibility and increase legal risks.

A tough real estate market poses a threat to Frontdoor. Customer acquisition, especially through home sales channels, suffers. In 2024, existing home sales declined, impacting related businesses. This downturn can reduce demand for Frontdoor's services, affecting revenue and growth. The National Association of Realtors reported a decrease in sales volume.

Increased Service Request Costs

Increased service request costs pose a significant threat to Frontdoor's profitability. Factors like inflation and labor shortages drive up expenses, impacting the bottom line. Supply chain disruptions further exacerbate these costs, creating financial uncertainty. For instance, in 2024, the home services sector faced a 5-7% increase in labor costs. These rising costs could squeeze profit margins.

- Inflation's impact on material costs.

- Labor shortages drive up wages.

- Supply chain issues increase delivery times.

- Potential for reduced profitability.

Economic Sensitivity of Consumers

Frontdoor faces threats from the economic sensitivity of consumers. Changes in consumer confidence and spending habits, driven by macroeconomic conditions, can impact demand for discretionary home service plans. During economic downturns, consumers may cut back on non-essential services, affecting Frontdoor's revenue. This sensitivity is particularly pronounced as the home services market is tied to disposable income.

- Consumer confidence levels have fluctuated significantly; for instance, the University of Michigan's Consumer Sentiment Index showed varying readings throughout 2024 and early 2025.

- Home services spending is discretionary; in economic downturns, it is often reduced.

- Frontdoor's revenue could decrease during economic recessions.

Frontdoor's threats include intense competition, regulatory pressures, and a challenging real estate market. Rising service request costs, driven by inflation and labor shortages, significantly threaten profitability. Economic sensitivity adds risk as consumer spending habits impact demand, particularly during downturns. Data from 2024 and early 2025 underscores these concerns, revealing potential revenue impacts.

| Threat Category | Specific Threat | Impact |

|---|---|---|

| Competition | Rivals and tech platforms | Market share pressure |

| Regulations | Home service standards | Compliance costs, limits |

| Real Estate | Home sales decline | Reduced demand, revenue |

SWOT Analysis Data Sources

Frontdoor's SWOT draws from financial filings, market research, and expert analysis, ensuring a data-backed assessment.