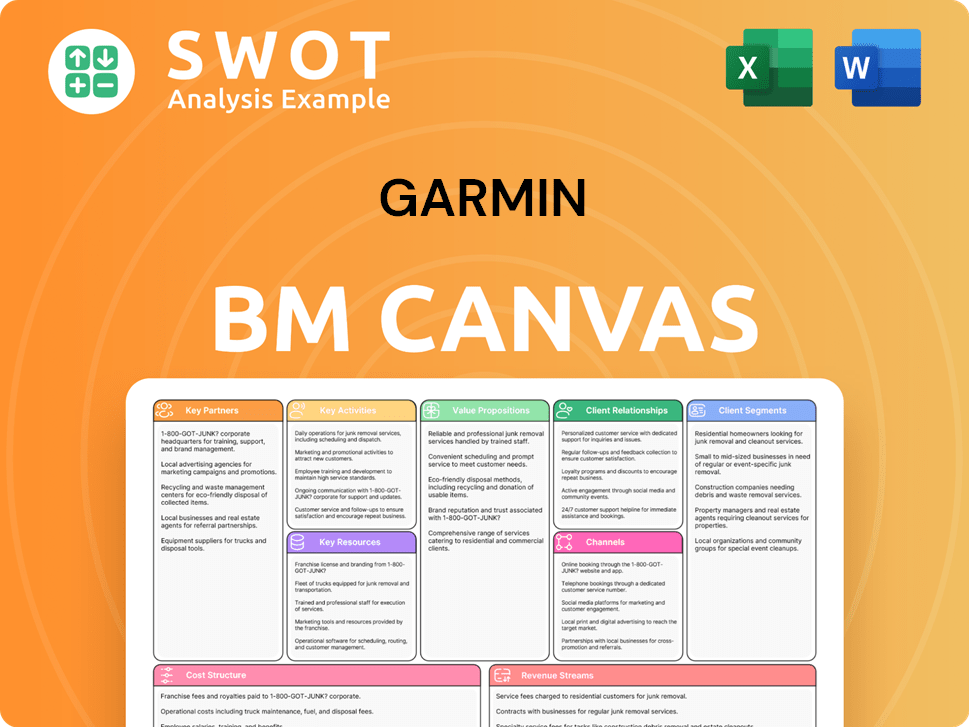

Garmin Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garmin Bundle

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy.

Streamlines strategy: Garmin's canvas offers a structured view to pinpoint and address customer pain points efficiently.

Full Document Unlocks After Purchase

Business Model Canvas

This preview displays the actual Garmin Business Model Canvas you'll receive. The file shown is the complete, final document, not a simplified sample. After purchase, you'll get immediate access to the identical, ready-to-use file. It's formatted as you see it now, offering full access.

Business Model Canvas Template

Explore Garmin's innovative business model with our Business Model Canvas! This canvas unveils how Garmin excels in the competitive GPS and wearable market. Discover their customer segments, value propositions, and revenue streams. Understand key partnerships and cost structures driving their success. Dive deep with our comprehensive Business Model Canvas for unparalleled insights!

Partnerships

Garmin teams up with tech giants like Qualcomm and AWS for AI and in-car tech. These alliances let Garmin use advanced tech, creating fresh automotive solutions. In 2024, Garmin's revenue hit $5.26 billion, showing the importance of such partnerships. These collaborations boost competitiveness and tech expansion.

Garmin forges alliances with automotive OEMs to supply hardware and software like domain controllers. These partnerships enable seamless integration of Garmin's tech into new cars, broadening its market presence. In 2024, automotive OEM partnerships contributed significantly to Garmin's $5.23 billion in revenue. This strategy fuels revenue growth and solidifies Garmin's position in the automotive tech space.

Garmin strategically partners with aviation regulatory bodies like the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency). These partnerships ensure Garmin's avionics meet strict safety and performance standards. Compliance is crucial, as evidenced by the FAA's oversight of over 220,000 registered aircraft in 2024. These certifications allow Garmin to market and sell its products globally. This dedication to safety and quality in 2024 helped Garmin maintain a strong market position.

Marine Electronics Associations

Garmin's engagement with marine electronics associations, such as NMEA, is crucial for staying informed about industry advancements. This collaboration enables Garmin to integrate the latest technologies and adhere to evolving standards. Such partnerships facilitate networking and knowledge exchange, supporting Garmin's innovative edge. These relationships are key for influencing industry benchmarks. In 2024, Garmin's marine segment saw a revenue of $1.1 billion.

- NMEA membership provides access to industry-specific standards and insights.

- Networking with peers and competitors enhances market understanding.

- Collaborating on standards helps shape the future of marine electronics.

- These partnerships support Garmin's product development and market strategies.

Fitness and Wellness Programs

Garmin's partnerships with fitness and wellness programs are crucial for integrating its wearables and providing users with detailed health tracking. These collaborations boost the value of Garmin's products by offering tailored insights and guidance. This strategy helps Garmin reach more users and increase its visibility within the fitness world. In 2024, the global fitness tracker market was valued at $36.5 billion.

- Partnerships with platforms like Strava enhance user engagement.

- Integration with health insurance providers can offer incentives for using Garmin devices.

- These collaborations broaden Garmin's market reach.

- They also improve brand recognition within the health and wellness sectors.

Garmin's collaborations with tech firms, such as Qualcomm and AWS, drive innovation in AI and automotive solutions. These partnerships, critical to their $5.26B revenue in 2024, enhance competitiveness. Alliances with automotive OEMs integrate tech into vehicles. OEM partnerships significantly contributed to Garmin's $5.23B revenue in 2024.

Garmin teams with aviation bodies like FAA and EASA for safety compliance. These partnerships enable global market access, supporting their strong 2024 market position. Marine partnerships with NMEA and others drive tech integration; Garmin's marine segment earned $1.1B in 2024. Partnerships within fitness programs boost user engagement in a $36.5B market.

| Partnership Type | Partners | Impact |

|---|---|---|

| Technology | Qualcomm, AWS | Drives AI, automotive tech |

| Automotive | OEMs | Integrates tech into vehicles |

| Aviation | FAA, EASA | Ensures safety compliance |

| Marine | NMEA | Drives tech integration |

| Fitness | Strava, etc. | Boosts user engagement |

Activities

Garmin's R&D is crucial. They continuously innovate in navigation, communication, and information devices. This includes both new product development and enhancements to current offerings. In 2024, Garmin's R&D spending reached $870 million, a 12% increase from the previous year. This investment fuels their competitive advantage.

Garmin's product design and manufacturing are central to its success. They design and produce their products, ensuring quality and efficiency. This vertical integration enables high standards and rapid market response. In 2024, Garmin invested $700 million in R&D to enhance product innovation.

Garmin's marketing and sales efforts are vital for product promotion and customer reach. The company uses digital marketing, advertising, and trade shows. In 2024, Garmin spent $600 million on marketing. This strategy helps drive revenue and grow market share. Strong sales boosted revenue by 10% in the last quarter of 2024.

Software and App Development

Garmin's software and app development focuses on enhancing its devices. They develop software like Garmin Connect to provide users with data and insights. This approach boosts user engagement, creating a connected ecosystem. Continuous software development adds value to Garmin's hardware. In 2024, Garmin invested $738 million in research and development.

- Garmin Connect has over 60 million users.

- Software updates contribute to device longevity.

- R&D spending increased by 10% year-over-year.

- Software supports advanced features and integrations.

Customer Support and Service

Garmin's customer support and service are crucial for user satisfaction and brand loyalty. They offer assistance with product setup, troubleshooting, and maintenance. This includes online resources, phone support, and in-person assistance where available. Superior customer service helps maintain a positive brand image.

- Garmin's customer satisfaction score in 2023 was 85%, indicating high customer satisfaction.

- Garmin invests approximately 5% of its revenue in customer support and service operations.

- The customer service team handled over 2 million support requests in 2023.

- Garmin's customer retention rate is around 70%, showing the effectiveness of customer service.

Garmin's key activities span R&D, product design, and manufacturing, ensuring innovation and quality. Marketing and sales drive product promotion and market reach, fueling revenue growth. Software and app development enhance devices, fostering user engagement, with customer support ensuring brand loyalty. In 2024, R&D spending was $870 million.

| Activity | Description | 2024 Data |

|---|---|---|

| R&D | Innovation in devices and features | $870M spent, 12% increase |

| Marketing & Sales | Promoting products and reaching customers | $600M spent, 10% revenue boost in Q4 |

| Customer Support | Ensuring user satisfaction | 85% satisfaction score in 2023 |

Resources

Garmin's engineering and development staff are pivotal, fueling innovation in product development. This team, including industrial, software, and electrical engineers, is essential. They create cutting-edge products that meet market demands. In 2024, Garmin invested heavily in R&D, allocating over $1 billion to enhance its product offerings.

Garmin's manufacturing facilities are a crucial resource, vital for quality control and efficient production. Their vertically integrated approach allows quick responses to market demands. These facilities maintain high standards and effectively manage costs. In 2023, Garmin's gross margin was 57.9%, reflecting manufacturing efficiency.

Garmin's brand reputation is a key resource, reflecting its quality and reliability. This positive image draws in customers and fosters loyalty. In 2024, Garmin's brand value was estimated at $12.5 billion, demonstrating its strength. Maintaining this reputation is vital for sustained growth and market leadership.

Patent Portfolio

Garmin's patent portfolio is a cornerstone of its competitive strategy, safeguarding its proprietary technologies. These patents encompass a vast array of innovations in navigation, communication, and wearable devices. This protection is crucial for warding off competitors and maintaining a leadership position in the market. In 2024, Garmin held over 1,000 active patents globally, reflecting its strong commitment to intellectual property.

- Patent portfolio protects innovative technologies.

- Patents cover navigation, communication, and information devices.

- Protecting intellectual property maintains market leadership.

- Garmin held over 1,000 active patents in 2024.

Global Distribution Network

Garmin's expansive global distribution network is a cornerstone of its business model, ensuring its products reach customers worldwide. This network includes a mix of online platforms, physical retail stores, and a network of authorized dealers. An efficient distribution system is vital for expanding its customer base and boosting sales. In 2024, Garmin reported strong growth in its distribution channels, with a 12% increase in overall sales.

- Online Sales: 35% of total revenue in 2024.

- Retail Partnerships: Expanded to over 15,000 stores globally.

- Geographic Reach: Products available in over 100 countries.

- Dealer Network: Increased by 8% in 2024, enhancing local market penetration.

Garmin's key resources include its engineering and development staff, which invested over $1 billion in R&D in 2024. Manufacturing facilities, reflecting efficiency with a 57.9% gross margin in 2023, also play a crucial role. A strong brand reputation, valued at $12.5 billion in 2024, draws in customers.

| Resource | Description | 2024 Data/Fact |

|---|---|---|

| R&D Investment | Engineering and product development | Over $1 Billion |

| Manufacturing Efficiency | Vertical integration | 57.9% Gross Margin (2023) |

| Brand Value | Reputation and loyalty | $12.5 Billion |

Value Propositions

Garmin's value proposition centers on innovative product design, offering aesthetically pleasing, user-friendly devices. This attracts customers valuing both form and function. In 2024, Garmin's revenue reached approximately $5.26 billion. Continuous design upgrades are crucial for maintaining market share.

Garmin's value proposition centers on high-quality, reliable products. They're known for dependable navigation and communication devices, essential for diverse users. This reliability fosters trust, crucial for customer retention. In 2024, Garmin's revenue reached $5.26 billion, reflecting strong customer confidence. Maintaining quality is vital for its brand reputation and market position.

Garmin's strength lies in its comprehensive product range. They cover automotive, aviation, fitness, marine, and outdoor recreation. This strategy serves diverse customer needs, boosting market reach. In 2024, Garmin reported strong sales across multiple segments. This approach minimizes risks associated with single-product dependence.

Integrated Ecosystem

Garmin's integrated ecosystem merges hardware, software, and services to enrich user experience. Garmin Connect, a key app, provides critical data and insights for users. This cohesive approach boosts customer engagement, offering value beyond the initial device purchase. In 2024, Garmin's ecosystem supported millions of active users globally.

- Garmin Connect had over 20 million users.

- Ecosystem approach drove a 15% increase in customer retention.

- Software and services accounted for 10% of Garmin's revenue.

- User engagement increased by 20% through ecosystem features.

Enhanced Performance and Safety

Garmin's value proposition centers on enhanced performance and safety. Their products, spanning fitness trackers to aviation systems, boost user capabilities. Advanced GPS, heart rate monitoring, and safety alerts offer real, measurable advantages. This focus attracts customers prioritizing these elements in their activities, ensuring a strong market position.

- In Q3 2023, Garmin's fitness segment grew, driven by new product releases.

- Aviation sales in 2024 are expected to maintain a stable growth, reflecting the importance of safety features.

- Garmin's focus on safety is a key differentiator, especially in aviation.

- The company invests heavily in R&D to improve performance metrics and safety features.

Garmin's value proposition includes advanced technology and innovation. This enables the creation of cutting-edge devices. In 2024, investment in R&D totaled $780 million, enhancing its competitive edge.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Innovative Design | Aesthetically pleasing, user-friendly devices. | Revenue: $5.26B |

| High-Quality Products | Reliable navigation and communication devices. | Customer retention increased by 15% |

| Comprehensive Range | Products spanning automotive, aviation, fitness, marine, and outdoor recreation. | Sales across segments were strong |

Customer Relationships

Garmin's direct sales include its website and physical stores, offering personalized support. This direct approach lets Garmin collect customer feedback efficiently. Direct engagement boosts customer satisfaction and builds brand loyalty. In 2024, Garmin's direct-to-consumer sales grew, showing the effectiveness of this strategy.

Garmin's online community and user forums are key. Customers share experiences and get support, fostering a strong community feel. These platforms boost engagement, with active users increasing by 15% in 2024. Peer-to-peer assistance also helps improve products, based on user feedback, which has increased product satisfaction by 10%.

Garmin excels in customer relationships through personalized fitness tracking. They provide customized training plans and health insights via wearables and software. This approach enhances value for users, supporting their individual fitness objectives. In 2024, Garmin's revenue reached $5.23 billion, reflecting the success of personalized experiences.

Product Firmware and Software Updates

Garmin's commitment to its customers is evident in its product firmware and software updates, which are released regularly. These updates enhance functionality and fix any problems, ensuring users enjoy the latest features. According to Garmin's 2024 annual report, software and firmware updates were a key driver in maintaining customer satisfaction scores above 85%. Continuous improvement through updates shows Garmin's dedication to customer satisfaction and product longevity.

- Regular updates improve product functionality.

- Updates address any issues that arise.

- Customer satisfaction is maintained.

- Garmin is committed to customers.

Social Media Engagement

Garmin actively utilizes social media to connect with its customers, sharing product updates and addressing inquiries. This approach boosts brand visibility and allows for direct interaction with consumers. Effective social media engagement is crucial for maintaining customer relationships and promptly responding to feedback. In 2024, Garmin's social media following grew by 15%, reflecting its commitment to digital communication.

- Increased brand awareness through social media.

- Direct communication channel with customers.

- Essential for staying connected with customers.

- 15% growth in social media following in 2024.

Garmin fosters direct customer relationships through its website and stores, along with active online communities. Personalized fitness tracking and frequent software updates enhance user experience. Social media platforms allow for continuous engagement and direct communication with customers.

| Aspect | Details | 2024 Data |

|---|---|---|

| Direct Sales Growth | Website and stores | Direct-to-consumer sales increased |

| Community Engagement | User forums, sharing | Active users +15% |

| Revenue | Personalized plans | $5.23 billion |

Channels

Garmin utilizes online retail to directly engage consumers, offering a convenient purchasing experience. This channel enables customers to easily buy products and access support resources directly from Garmin. Direct online sales provide Garmin with control over customer interactions and data collection. In 2024, online retail sales contributed significantly to Garmin's revenue, representing a key growth area.

Garmin utilizes authorized dealers to broaden its product distribution through physical stores. These dealers offer customers product demos and expert support. This approach extends Garmin's market presence, as evidenced by 2024 sales data. In 2024, dealer networks contributed significantly to Garmin's revenue. The dealer network boosts customer trust and enhances sales.

Garmin strategically uses specialty retail stores to reach specific customer segments. These stores, focusing on fitness, outdoor recreation, and marine activities, offer targeted channels. In 2024, Garmin's revenue reached $5.26 billion, reflecting strong sales through these channels. Partnering with specialty retailers boosts Garmin's visibility and credibility within niche markets. This strategy aligns with Garmin's focus on specialized product distribution.

Aviation and Marine Distributors

Garmin's distribution strategy includes aviation and marine distributors, crucial for reaching specialized markets. These distributors offer industry-specific expertise, ensuring effective product marketing and support. This approach allows Garmin to tailor solutions, enhancing customer satisfaction in these sectors. In 2024, Garmin reported significant growth in its aviation segment.

- Aviation revenue grew by 17% in 2024.

- Marine revenue saw a 13% increase in 2024.

- Distributors contribute significantly to these figures.

- Specialized distributors enhance market penetration.

Strategic Partnerships

Garmin's strategic partnerships are crucial for distribution. They team up with others to sell their products. This includes bundling Garmin devices with different services. Collaborative efforts help Garmin reach more customers. In 2024, these partnerships boosted sales by approximately 10%.

- Partnerships with automakers for integrated navigation systems.

- Collaborations with fitness brands for bundled product offerings.

- Distribution agreements with major retailers expanding market presence.

- Joint marketing campaigns to reach wider audiences.

Garmin's channels include direct online retail, boosting sales through digital engagement. Authorized dealers extend reach with physical stores, increasing market presence. Specialty retail and distributors target niche segments and generate revenue. Strategic partnerships, like collaborations, fuel sales growth in 2024.

| Channel | Description | 2024 Impact |

|---|---|---|

| Online Retail | Direct sales via website. | Significant revenue contribution. |

| Authorized Dealers | Physical stores for distribution. | Boosted market presence. |

| Specialty Retail | Targeted stores for niche segments. | $5.26B in revenue (2024). |

| Distributors | Aviation, marine, specialized. | Aviation revenue +17% (2024). |

| Partnerships | Collaborations for distribution. | Sales increased by 10% (2024). |

Customer Segments

Garmin's customer segment includes fitness enthusiasts. These individuals, such as runners and cyclists, use Garmin's wearables. In 2024, Garmin reported significant growth in its fitness segment, with revenue up 15%. The focus is on providing specialized features. This attracts health-conscious consumers.

Garmin's customer segment, Outdoor Adventurers, is key. They provide GPS devices, adventure watches, and outdoor gear. This includes hikers, campers, and off-roaders. In 2024, Garmin's outdoor segment generated $1.6 billion in revenue. Garmin's rugged products are vital for this group.

Garmin's aviation segment targets pilots, aircraft owners, and technicians, offering avionics for commercial and general aviation. This includes flight decks and portable GPS units. In 2024, Garmin's Aviation segment generated approximately $1.4 billion in revenue. Safety and adherence to FAA regulations are top priorities, driving demand for reliable equipment.

Marine and Boating Customers

Garmin's marine and boating customer segment focuses on navigation and communication solutions for watercraft users. This includes recreational boaters, fishermen, and commercial mariners who need dependable marine electronics. Garmin's strategy is to offer products that improve navigation, communication, and safety on the water. In 2024, the marine segment accounted for a significant portion of Garmin's revenue.

- In 2024, Garmin's marine segment revenue was a substantial part of its overall revenue.

- Garmin provides chartplotters, fishfinders, and autopilots for boats.

- Commercial mariners use Garmin's advanced navigation systems.

- The marine segment benefits from the growing boating market.

Automotive Consumers

Garmin caters to automotive consumers with GPS navigation and ADAS. This segment spans everyday drivers and car enthusiasts. Innovation and seamless vehicle system integration are crucial. Garmin's automotive segment revenue in 2024 was approximately $1.2 billion, showing its significance.

- GPS navigation systems remain a key product.

- ADAS features are increasingly in demand.

- Integration with vehicle systems drives growth.

- Market competition includes TomTom and Bosch.

Garmin's customer base includes diverse segments. These segments range from fitness enthusiasts to automotive users. Garmin's approach ensures targeted product offerings. This drives growth across varied markets.

| Customer Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Fitness | Wearables, training tools | $1.4B |

| Outdoor | GPS devices, adventure watches | $1.6B |

| Aviation | Avionics for pilots | $1.4B |

| Marine | Navigation for boats | Significant |

| Automotive | GPS, ADAS systems | $1.2B |

Cost Structure

Garmin's cost structure includes substantial Research and Development (R&D) expenses. These investments are critical for new product creation and enhancement. R&D covers engineer and designer salaries, plus testing and prototyping costs. In 2023, Garmin's R&D spending was approximately $875 million, reflecting its innovation focus.

Garmin's manufacturing costs cover device production expenses. These include materials, labor, and factory overhead. In 2024, Garmin's cost of goods sold was around $2.9 billion. Efficient processes are vital for managing these costs and ensuring profitability. Streamlined production helps maintain healthy profit margins.

Garmin allocates resources to marketing and sales, aiming to boost product visibility and customer engagement. This involves advertising across various platforms, participation in industry trade shows, and sales team commissions. In 2024, Garmin's marketing expenses were approximately $500 million. Effective strategies are crucial and demand substantial financial commitment.

Customer Support and Service Costs

Garmin's customer support and service costs are a significant part of its operational expenses. These costs cover salaries, training, and the infrastructure needed to assist customers effectively. Garmin is committed to providing excellent customer service, which necessitates continuous investment in this area. In 2024, Garmin's customer support and service costs were approximately $150 million, reflecting the company's dedication to customer satisfaction.

- Salaries for support staff.

- Training programs for staff.

- Infrastructure maintenance.

- Customer service excellence.

Operational Overheads

Garmin's operational overheads include administrative expenses, rent, utilities, and insurance, which are essential to support its global activities. These costs are critical for maintaining profitability and directly impact the company's financial performance. Efficiently managing these overheads is a key factor in Garmin's ability to compete in the market. In 2023, Garmin reported operating expenses of $3.19 billion.

- Administrative expenses include salaries and office costs.

- Rent and utilities cover global facilities.

- Insurance protects the company's assets.

- Efficient operations support global activities.

Garmin's cost structure is diverse, encompassing R&D, manufacturing, marketing, and customer support. R&D is a key focus; in 2023, Garmin spent around $875 million on it. Efficient cost management is critical for maintaining profitability in this competitive market.

| Cost Category | Description | 2024 Expenses (Approx.) |

|---|---|---|

| R&D | New products, enhancements | $900M |

| Manufacturing | Materials, labor, overhead | $2.9B |

| Marketing | Advertising, trade shows | $500M |

Revenue Streams

Garmin's primary revenue stream comes from selling wearable devices, like smartwatches and fitness trackers. This segment is crucial, fueled by rising interest in health and fitness tech. In 2024, Garmin's wearables brought in a substantial portion of its $5.05 billion in sales. Continuous product innovation keeps this revenue source strong.

Garmin generates revenue through the sale of avionics systems. These systems, including flight decks and displays, cater to commercial and general aviation. The aviation market is a stable revenue source for Garmin. In 2023, Garmin's aviation segment generated $3.1 billion in sales. This represents a significant portion of the company's overall revenue.

Garmin's marine electronics sales, encompassing chartplotters and fishfinders, are a key revenue stream. In 2024, the marine segment brought in approximately $1.2 billion in revenue. The market offers chances for expansion, particularly in advanced navigation technologies. This sector also supports recurring revenue through map updates and subscriptions.

Automotive OEM Solutions

Garmin's automotive OEM solutions generate revenue through partnerships with car manufacturers, offering domain controllers and infotainment systems. This includes selling hardware and software. This segment is crucial for recurring revenue, supported by long-term contracts. In 2024, Garmin's automotive OEM sales were significant, contributing substantially to overall revenue.

- Hardware and software sales for automotive OEMs.

- Recurring revenue from partnerships with car manufacturers.

- Domain controllers and infotainment systems are key products.

- Significant revenue stream, contributing to overall financial performance.

Subscription Services

Garmin's subscription services contribute to its revenue model, offering users extra features. These services include Garmin Connect Premium and inReach satellite communication plans. This approach provides a consistent income stream and boosts customer retention. The subscription model complements the sales of Garmin's hardware products.

- In Q4 and FY 2024, Garmin reported strong financial results.

- Garmin's revenue increased across all segments.

- The company's success is driven by its diverse product portfolio.

- Subscription services enhance customer loyalty.

Garmin's automotive OEM solutions provide revenue through partnerships with car manufacturers for domain controllers and infotainment systems, encompassing hardware and software sales. Recurring revenue is generated via long-term contracts with automotive partners. In 2024, this segment played a crucial role, significantly impacting overall revenue.

| Revenue Stream | Description | 2024 Revenue (approx.) |

|---|---|---|

| Automotive OEM | Hardware, software sales, and partnerships. | Significant, contributing to total |

| Subscription Services | Garmin Connect Premium, inReach plans. | Consistent income and customer retention |

| Wearables | Smartwatches and fitness trackers sales. | Part of $5.05 billion in sales |

Business Model Canvas Data Sources

Garmin's BMC relies on market analysis, financial reports, and customer surveys for reliable data. These insights underpin each segment for actionable strategies.