General Mills Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Mills Bundle

What is included in the product

Analysis of General Mills' products within the BCG Matrix to guide investment, holding, or divestment decisions.

One-page overview placing each General Mills product in a quadrant to reveal opportunities.

Preview = Final Product

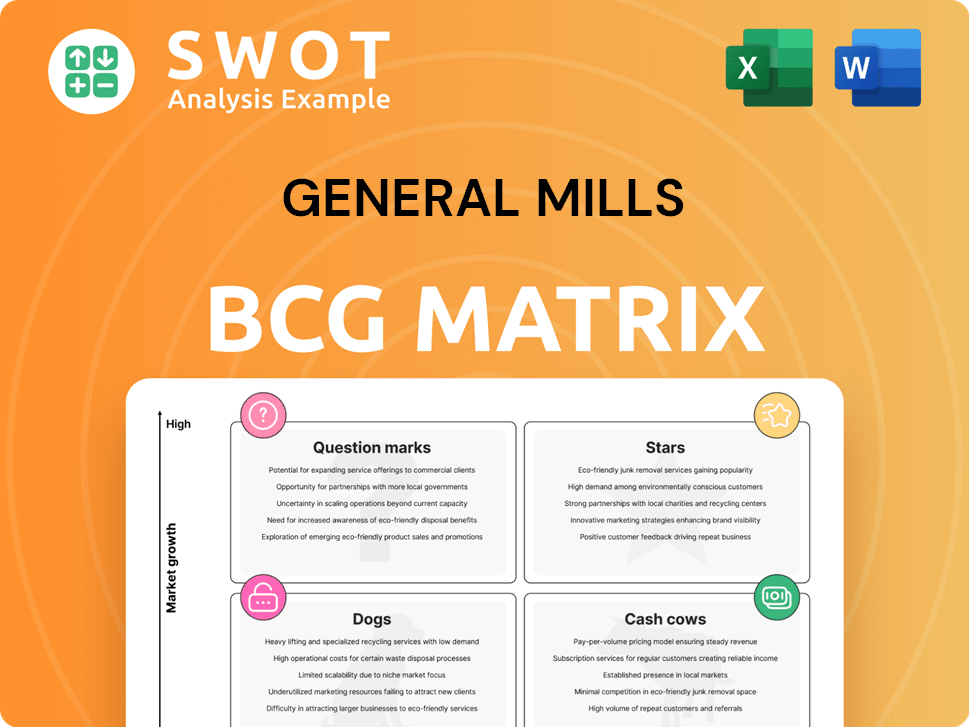

General Mills BCG Matrix

The General Mills BCG Matrix preview displays the complete document you'll receive after purchase. This is the actual, ready-to-use report, with all data included. Download instantly for your strategic analysis.

BCG Matrix Template

General Mills' diverse product portfolio is a complex landscape, ideal for BCG analysis. This framework maps products into Stars, Cash Cows, Dogs, and Question Marks. Knowing these positions guides resource allocation and strategic decisions. Understanding this is crucial for competitive advantage. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Blue Buffalo, a part of General Mills, is considered a Star in the BCG Matrix. It holds a significant market share in the booming pet food sector, especially in the premium category. General Mills' pet food segment, primarily Blue Buffalo, generated approximately $2.8 billion in net sales in fiscal year 2024.

Häagen-Dazs, a General Mills brand, is a Star within the BCG Matrix. It commands a strong presence in the super-premium ice cream market. The brand capitalizes on robust brand recognition and high-quality ingredients. In 2023, General Mills reported net sales of $20.1 billion, with Häagen-Dazs contributing significantly to the snacks segment.

Old El Paso, a General Mills product, is a Star in the BCG Matrix. It benefits from the growing interest in Mexican food and home cooking. This drives both high growth and a significant market share for the brand. In 2024, General Mills saw a 3% increase in net sales for its North America Retail segment, which includes Old El Paso.

Nature Valley

Nature Valley, a General Mills brand, is a Star in the BCG matrix. Its granola bars are popular among health-conscious consumers, driving high demand. In 2024, the global snack bar market was valued at approximately $27 billion. Nature Valley consistently captures a significant market share, with sales figures reflecting its strong brand recognition and consumer preference. The brand continues to innovate, maintaining its position in a competitive market.

- Market Value: The global snack bar market was worth about $27 billion in 2024.

- Brand Recognition: Nature Valley enjoys strong consumer preference.

- Sales: The brand shows solid sales figures.

- Innovation: Nature Valley continually adapts to stay competitive.

Select New Cereal Launches

General Mills is strategically expanding its cereal offerings. They plan to launch nine new cereals in 2025, with the Cheerios Protein line expected to be a strong performer. This expansion targets increased market share within the breakfast category. General Mills' net sales for fiscal year 2024 were $20.1 billion.

- Nine new cereals are planned for launch in 2025.

- The Cheerios Protein line is a key focus.

- The goal is to capture more breakfast market share.

- General Mills' net sales in 2024 were $20.1 billion.

Lucky Charms, a General Mills brand, is a Star within the BCG Matrix. It enjoys a significant market share in the highly competitive breakfast cereal market. The brand benefits from consistent consumer demand and strong brand recognition. In 2024, General Mills' cereal segment showed steady performance, with Lucky Charms playing a key role.

| Brand | Market Position | Key Feature |

|---|---|---|

| Lucky Charms | Star | Strong brand recognition, consistent demand. |

| Häagen-Dazs | Star | Strong presence in the super-premium ice cream market. |

| Old El Paso | Star | Benefits from growing interest in Mexican food. |

Cash Cows

Cheerios, a classic cereal, is a cash cow for General Mills. It holds a significant market share, benefiting from strong brand recognition. This translates to steady sales with minimal marketing spend. In 2024, General Mills reported solid sales, showing Cheerios' continued financial contribution.

Pillsbury, a General Mills brand, is a cash cow. It holds a strong market share in the established baking sector. Pillsbury enjoys brand loyalty and steady consumer demand. General Mills reported net sales of $5.09 billion in Q2 2024.

Betty Crocker, a key brand for General Mills, is a cash cow. It holds a dominant position in the baking category, ensuring steady revenue. In 2024, General Mills reported significant sales from its baking products. The brand requires little investment, leveraging its strong market presence.

Yoplait (potentially divesting)

Yoplait, a notable brand within General Mills, once held a significant share in the yogurt market, positioning it as a cash cow. However, General Mills has signaled its intent to divest its North American yogurt business, including Yoplait. This strategic move indicates a shift in focus, aiming to concentrate resources on other growth areas. In 2023, General Mills reported net sales of $20.1 billion. The decision to sell Yoplait reflects a broader portfolio strategy.

- Market Position: Yoplait held a high market share in the yogurt sector.

- Divestiture: General Mills is selling its North American yogurt business.

- Strategic Focus: The sale allows General Mills to concentrate on other areas.

- Financial Data: General Mills' net sales were $20.1 billion in 2023.

Cinnamon Toast Crunch

Cinnamon Toast Crunch, a General Mills staple, exemplifies a Cash Cow in the BCG Matrix. It boasts a strong, loyal customer base, driving consistent sales. Marketing costs are relatively low, as the brand is well-established. In 2024, General Mills' net sales reached approximately $20.1 billion, with brands like Cinnamon Toast Crunch contributing significantly to this figure.

- Loyal Customer Base: Ensures steady demand.

- Low Marketing Costs: Brand recognition minimizes expenses.

- Consistent Sales: Predictable revenue stream.

- High Profitability: Due to established market position.

Cash cows like Cheerios and Cinnamon Toast Crunch generate substantial revenue with low investment. These brands have strong market shares and loyal customers. General Mills' consistent sales, around $20.1 billion in 2024, highlight cash cows' financial stability. They fuel investment in other areas.

| Brand | Market Position | Financial Contribution |

|---|---|---|

| Cheerios | High Market Share | Steady Sales |

| Cinnamon Toast Crunch | Loyal Customer Base | Consistent Revenue |

| Pillsbury | Strong Market Share | Significant Sales |

Dogs

Some of General Mills' older product lines, like some cereal brands, might be considered "Dogs" in the BCG Matrix. These products likely have low market share and growth. Despite possibly having brand recognition, they don't significantly boost overall profitability. In 2023, General Mills' net sales were around $20.1 billion; the "Dogs" contribute a small portion.

General Mills likely has some smaller brands struggling to gain market share. These "Dogs" may drain resources with low profit potential. For instance, underperforming brands could have seen sales decline by 5% in 2024. These might include brands with less than 1% of market share.

In 2024, General Mills divested its yogurt business, including Yoplait. While Yoplait was a cash cow, the overall North American yogurt segment underperformed. This strategic move suggests that some yogurt sub-brands were classified as dogs. The divestiture aimed to reallocate resources to more profitable areas, reflecting a shift in the portfolio.

Products Facing Competitive Pressure

In General Mills' BCG matrix, "Dogs" represent product lines struggling in low-growth markets with weak market share. These face competitive pressures, often from private-label brands. This can erode profitability. For example, in 2023, General Mills' U.S. yogurt sales decreased by about 3%. This indicates potential "Dog" status.

- Competitive pressures from private labels.

- Erosion of market share and profitability.

- Product lines in low-growth markets.

- Examples include certain yogurt or cereal products.

Discontinued Product Lines

Discontinued product lines, like those that underperform, are considered "dogs" in General Mills' BCG matrix. These products have been removed due to poor sales or shifting consumer tastes. They no longer contribute to revenue and can even lead to disposal expenses. For example, General Mills discontinued several smaller brands in 2024 to streamline its portfolio.

- These products often have negative cash flows.

- They require minimal investment.

- Disposal costs can impact profitability.

- They represent a drain on resources.

General Mills' "Dogs" in the BCG matrix include underperforming product lines with low market share in slow-growth markets. These products often face stiff competition, leading to diminished profitability and sales. Divestitures and discontinuations, like those seen in 2024 with certain yogurt brands, aim to reallocate resources. The strategic shift aims to focus on more profitable segments.

| Characteristic | Impact | Example (2024) |

|---|---|---|

| Low Market Share | Reduced Revenue | Cereal Brands |

| Slow-Growth Markets | Limited Growth Potential | U.S. Yogurt |

| Competitive Pressure | Profit Margin Erosion | Private Labels |

Question Marks

Edgard & Cooper, a General Mills acquisition, is in the "Question Mark" quadrant of the BCG Matrix. It operates in the rapidly growing premium pet food sector, indicating high growth potential. However, it needs substantial investment to gain market share against established competitors. General Mills' pet food segment, including brands like Blue Buffalo and Edgard & Cooper, saw a 7% net sales increase in fiscal year 2024.

General Mills is venturing into plant-based foods, tapping into a growing market. These products currently hold a small market share, positioning them as "Question Marks" in the BCG matrix. They require significant investment to boost market presence. In 2024, the plant-based food market is projected to reach $36.3 billion globally.

General Mills is launching new snack innovations, aiming for growth. These snacks, like new flavors, have high growth potential. They need marketing and distribution to succeed. General Mills' net sales in fiscal year 2024 were $20.1 billion.

Fiber One Brownies

Fiber One Brownies, a product of General Mills, fit within the "Question Mark" quadrant of the BCG Matrix. This is because they operate in the expanding healthy snacks market, yet their market share requires growth. To boost their position, substantial marketing investments are necessary to compete effectively. For instance, in 2024, the global healthy snacks market was valued at approximately $30 billion, indicating significant growth potential.

- Market Growth: The healthy snacks market is experiencing rapid expansion.

- Market Share: Fiber One Brownies need to increase their market share to become a star.

- Investment: Marketing is crucial for Fiber One Brownies to stay competitive.

- Financial Data: The global healthy snacks market was valued at $30 billion in 2024.

Expansion in Asia and other Emerging Markets

General Mills' expansion in Asia and other emerging markets is a question mark in its portfolio, representing high growth potential but also significant challenges. These markets demand substantial investment and adaptation to local tastes to gain market share. General Mills' Accelerate strategy focuses on innovation and geographic expansion, including emerging markets. Success hinges on effectively navigating diverse consumer preferences and competitive landscapes.

- General Mills' fiscal year 2024 net sales were $20.1 billion.

- The company is focusing on emerging markets for growth.

- Adaptation to local tastes is crucial for success.

- The Accelerate strategy supports expansion efforts.

Question Marks represent high-growth opportunities requiring significant investment. Edgard & Cooper's pet food and plant-based ventures are examples. Fiber One Brownies also fall in this category, competing in a growing market.

| Category | Example | Key Factor |

|---|---|---|

| Market | Premium Pet Food, Plant-Based | High Growth |

| Challenge | Low Market Share | Needs Investment |

| Strategy | Marketing, Expansion | Adaptation |

BCG Matrix Data Sources

This BCG Matrix uses General Mills' financials, market data, and competitive analysis. It includes industry reports and growth forecasts.