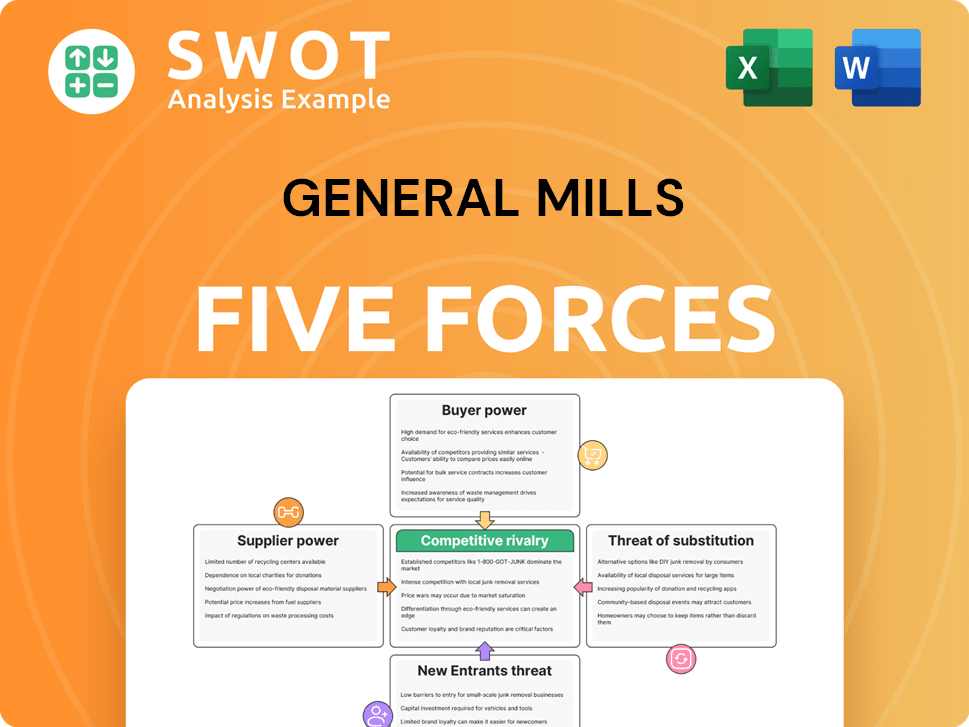

General Mills Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Mills Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Dynamic, color-coded threat levels to instantly show the impact of each market force.

Preview the Actual Deliverable

General Mills Porter's Five Forces Analysis

This preview offers the complete Porter's Five Forces analysis of General Mills. You're seeing the actual, professionally written document. Upon purchase, you'll receive this fully formatted analysis instantly. It's ready for download and immediate use. No alterations or further work needed.

Porter's Five Forces Analysis Template

General Mills faces a complex competitive landscape. Its bargaining power of suppliers is moderate, affected by commodity price volatility. Buyer power is significant due to retail consolidation and private label competition. The threat of new entrants is moderate due to high capital requirements and established brands. Substitute products, especially in the health food sector, pose a considerable threat. Rivalry among existing competitors remains intense.

The full analysis reveals the strength and intensity of each market force affecting General Mills, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

General Mills sources ingredients like wheat and corn, making it vulnerable to supplier power. The limited number of major suppliers for these commodities gives them leverage. This can pressure General Mills' margins, especially with global demand fluctuations. For example, in 2024, wheat prices saw volatility, impacting food producers.

The bargaining power of commodity suppliers, especially in agriculture, is a key factor for General Mills. A concentrated supplier base means fewer entities control a large supply, increasing their negotiation power. For example, in 2024, the top four global wheat exporters accounted for over 60% of the market. Any supply disruptions, like those from climate change, can severely impact General Mills' costs.

Switching ingredient suppliers poses challenges for General Mills, especially due to reformulation needs. Changing ingredients demands rigorous testing and potential manufacturing adjustments, raising costs. This reluctance to switch boosts supplier power, even with moderate price hikes. General Mills' focus on product consistency limits its flexibility; for example, in 2024, raw material costs significantly impacted its gross margin.

Impact of packaging suppliers

Packaging significantly impacts General Mills, influencing supplier bargaining power. A concentrated packaging market, or the need for specialized materials, gives suppliers leverage over pricing and delivery. Demands for sustainable packaging could amplify their influence. General Mills spent $1.1 billion on packaging in 2023.

- Packaging costs represent a substantial portion of General Mills' expenses.

- Supplier concentration can raise costs and reduce flexibility.

- Sustainable packaging trends may increase supplier power.

- In 2024, General Mills aimed to increase sustainable packaging.

Forward integration potential

Suppliers' bargaining power increases if they can integrate forward. This means they could start making food products themselves. Though less common in agriculture, big suppliers could enter branded food, pressuring General Mills. This threat impacts pricing and supply terms.

- 2023: General Mills' cost of goods sold was approximately $12.3 billion, reflecting supplier costs.

- Forward integration could disrupt this cost structure.

- Large agricultural companies have the resources for this.

- General Mills must maintain good supplier relationships to mitigate this.

General Mills faces supplier bargaining power, especially with key ingredients. Concentrated supply markets, such as agricultural commodities, enhance supplier leverage. In 2024, agricultural commodity costs significantly influenced General Mills' operational expenses, impacting profitability.

Switching suppliers is challenging due to reformulation needs and potential manufacturing adjustments. This reduces General Mills' flexibility, boosting supplier negotiation strength. Packaging, another major cost, also affects supplier power. For example, in 2023, General Mills' packaging spending was substantial, reflecting supplier influence.

Forward integration by suppliers, such as producing branded food, poses a threat. This can pressure General Mills' pricing and supply terms. To mitigate this, maintaining strong supplier relationships is crucial.

| Factor | Impact on General Mills | 2024 Data/Example |

|---|---|---|

| Commodity Supplier Concentration | Higher input costs; reduced margins | Wheat price volatility; impact on food producers |

| Switching Costs | Reduced flexibility; higher costs | Ingredient reformulation challenges |

| Packaging Costs | Significant expense; supplier leverage | $1.1B spent on packaging in 2023 |

Customers Bargaining Power

General Mills faces strong customer bargaining power. Major retailers like Walmart, Kroger, and Costco account for a large sales volume. These chains leverage their size to demand lower prices and better terms. This pressure impacts General Mills' profitability; for example, in 2024, Walmart's sales were up 3.5%.

Consumers' price sensitivity significantly impacts General Mills. In 2024, store brands captured a notable market share, showing consumer willingness to switch. General Mills must balance pricing with consumer demand to maintain sales volume. This limits their ability to fully offset rising input costs, affecting profit margins. For example, in Q3 2024, General Mills saw a slight volume decline due to price increases.

General Mills' brand loyalty fluctuates; it's not uniform across all products. In categories where brands are less distinct, like some cereals, customers are more sensitive to price changes or special offers. For example, in 2024, promotional spending accounted for a significant portion of their marketing budget to maintain market share. This means General Mills must continuously invest in branding and innovation to keep customers.

Availability of private label brands

The rise of private label brands intensifies consumer bargaining power, offering cheaper alternatives to products like General Mills' cereals. Retailers' focus on their own brands gives consumers leverage. In 2024, private label market share continued to grow. This shift forces companies to compete on price and value.

- Private label brands offer consumers alternatives.

- Retailers often promote their own brands aggressively.

- This increases the bargaining power of consumers.

- These brands frequently have lower prices.

Consumer access to information

Consumers today wield considerable power, thanks to readily available information. The internet and mobile devices offer instant access to product details, prices, and ingredients. This transparency enables informed choices and price comparisons, strengthening their bargaining position. Online reviews and social media further influence consumer preferences. For example, in 2024, about 93% of consumers read online reviews before buying a product.

- 93% of consumers read online reviews before purchasing in 2024.

- Mobile commerce sales reached $432 billion in the U.S. in 2024.

- Social media's influence continues to grow, with over 4.9 billion users globally.

- Price comparison websites saw a 20% increase in usage in 2024.

General Mills faces significant customer bargaining power, fueled by large retailers and price-sensitive consumers. Consumers can easily compare prices and switch to cheaper alternatives. The rise of private label brands and online information further empowers consumers.

| Factor | Impact | 2024 Data |

|---|---|---|

| Retailer Power | Demands lower prices | Walmart sales up 3.5% |

| Price Sensitivity | Switch to cheaper brands | Private label market share growth |

| Information Access | Informed choices | 93% read online reviews |

Rivalry Among Competitors

The food industry is fiercely competitive, with many companies fighting for consumer dollars. General Mills faces stiff competition from giants like Nestlé and PepsiCo. This rivalry leads to price wars and constant marketing efforts. In 2024, the global food market is valued at over $8 trillion, reflecting the scale of competition.

General Mills faces intense rivalry, with competitors constantly innovating. They introduce new products to differentiate themselves. To stay competitive, General Mills invests in R&D. In 2024, General Mills spent $650 million on R&D. This includes new flavors and healthier options.

Marketing and advertising are crucial in the food industry. General Mills invests significantly in these areas to boost brand visibility and sales. In 2024, General Mills' marketing spend was substantial, reflecting the need to compete with rivals like Kellogg's and Nestlé. This expenditure is essential for maintaining market share and influencing consumer choices, as the company needs to stay top-of-mind. The company allocated approximately $1.2 billion for advertising and marketing in 2024.

Consolidation trends

The food industry is experiencing significant consolidation. Mergers and acquisitions create larger competitors for General Mills. This intensifies competitive pressure. For example, in 2024, several major food companies engaged in M&A activity.

- 2024 saw over $50 billion in food industry M&A deals.

- General Mills' market share faces challenges from these larger entities.

- Consolidation often leads to increased marketing and innovation spending.

- Smaller players struggle to compete against these consolidated giants.

Price wars and promotions

Intense competition in the food industry can trigger price wars and boost promotional spending. General Mills faces this challenge, needing to balance competitive pricing with profitability. In 2024, the company's promotional expenses were significant, impacting margins. They must carefully manage discounts to stay competitive.

- Promotional spending eats into profits.

- Price wars decrease profitability.

- General Mills must balance pricing.

- Competition drives promotional offers.

Competitive rivalry in the food sector, like General Mills' sphere, is vigorous, necessitating continual innovation and marketing. General Mills contends with giants such as Nestlé and PepsiCo, fostering constant competition. This competition, highlighted by the $8 trillion global food market in 2024, pushes for strategic responses.

| Aspect | Impact | 2024 Data |

|---|---|---|

| R&D Spending | Product innovation & differentiation | $650M by General Mills |

| Marketing Spend | Brand visibility & sales | $1.2B by General Mills |

| M&A Activity | Creating larger competitors | Over $50B in food industry M&A deals |

SSubstitutes Threaten

Consumers today have many breakfast choices beyond cereal, like yogurt and oatmeal. This diversity pressures General Mills to innovate. In 2024, the global breakfast cereal market was valued at roughly $47.5 billion, indicating the need for General Mills to stay competitive. This threat forces the company to evolve to meet consumer needs.

General Mills battles numerous snack substitutes, like chips and fruit. Consumers readily swap General Mills' snacks. The company must provide unique, attractive options. In 2024, the global snack market reached $500 billion, showing intense competition.

Consumers increasingly prioritize health, which affects General Mills. Demand for healthier foods threatens traditional products. In 2024, the global health and wellness market reached ~$7 trillion, influencing food choices. General Mills adapts by offering healthier options and reformulating existing products. This shift is crucial for maintaining market share.

DIY and homemade options

Consumers are increasingly turning to DIY and homemade options, impacting packaged food demand. This shift, fueled by interest in fresh ingredients and home cooking, poses a threat to General Mills. To counter this, the company can adapt by offering convenient meal kits and baking mixes. This allows them to cater to home cooks while maintaining market presence.

- In 2024, the home meal replacement market was valued at approximately $25 billion.

- General Mills' net sales decreased by 2% in fiscal year 2024.

- The rise in home baking has been significant, with a 15% increase in baking ingredient sales in 2023.

- Meal kit services saw a revenue of $6.5 billion in 2023.

Restaurant and foodservice options

Consumers can choose restaurants and foodservice over General Mills' retail products. This substitution impacts sales and market share. General Mills must assess the competitive foodservice environment, including chains and independent outlets. This includes crafting products that appeal to both consumers and operators.

- In 2024, the US foodservice industry generated over $990 billion in sales.

- Quick-service restaurants (QSRs) account for a significant portion of foodservice revenue, around 45%.

- General Mills' strategy includes partnerships with foodservice operators to offer customized product solutions.

- Menu innovation and convenience are major drivers of consumer choice in the foodservice sector.

Consumers constantly switch to alternatives, creating pressure for General Mills. Competitors' offerings, from breakfast foods to snacks, require constant innovation. General Mills faces substantial competition, needing to stay agile.

| Substitute Type | Impact on General Mills | 2024 Market Data |

|---|---|---|

| Breakfast Alternatives | Consumers choose yogurt, oatmeal over cereal. | Cereal Market: $47.5B |

| Snack Substitutes | Consumers swap snacks for chips, fruit. | Snack Market: $500B |

| Healthier Options | Demand for healthier foods impacts sales. | Health & Wellness: ~$7T |

Entrants Threaten

High capital requirements pose a significant threat. Building food manufacturing and distribution needs substantial investment. New entrants face barriers like funding factories, supply chains, and marketing. Incumbents, such as General Mills, have advantages. In 2024, General Mills' capital expenditures were around $600 million, showcasing the scale needed.

Building brand recognition and customer loyalty is a lengthy and expensive process. General Mills, a well-established entity, benefits from a solid brand reputation and a dedicated customer base, which presents a significant hurdle for new competitors. For example, General Mills' marketing expenses were around $1.3 billion in fiscal year 2023. New entrants must make substantial investments in marketing and promotion to build brand awareness and compete effectively.

General Mills leverages economies of scale, giving them a cost advantage. They can produce, distribute, and market more efficiently. This allows for lower prices compared to new competitors. For instance, in 2024, General Mills' cost of goods sold was $11.8 billion. New entrants face challenges matching these efficiencies.

Access to distribution channels

Securing access to retail distribution channels presents a significant hurdle for new food product entrants, like those aiming to compete with General Mills. Retailers often prioritize established suppliers due to their broad product lines and consistent service. New entrants face the need to offer incentives, such as slotting fees, to secure shelf space and distribution agreements. This can be a costly barrier. The food and beverage industry's reliance on established distribution networks, where companies like General Mills have long-standing relationships, further complicates market entry.

- Slotting fees can range from $5,000 to $50,000 per product per store, which can be a significant cost for new entrants.

- General Mills' extensive distribution network, including relationships with major retailers, makes it harder for new competitors to gain similar reach.

- In 2024, the U.S. food retail market reached over $800 billion, with established players controlling the majority of shelf space.

- New brands often need to offer higher trade promotions or marketing spend to compete for consumer attention and shelf space.

Regulatory hurdles

General Mills faces regulatory hurdles that affect new entrants into the food industry. These regulations, covering food safety, labeling, and manufacturing, are costly and time-intensive for new companies to navigate. General Mills, with its established presence, has a significant advantage due to its experience in complying with these rules. This gives General Mills a competitive edge, making it harder for new businesses to enter the market successfully.

- General Mills reported a net revenue of $20.1 billion in fiscal year 2024.

- The company's Accelerate strategy focuses on innovation and growth.

- Compliance with food safety regulations can be a barrier to entry.

The threat of new entrants for General Mills is moderate. High capital needs and brand recognition hurdles act as barriers. Established distribution networks and regulations also limit new players. These factors impact the competitive landscape.

| Barrier | Impact | Example |

|---|---|---|

| Capital Requirements | High investment needs | General Mills CapEx: $600M (2024) |

| Brand Recognition | Difficult to build | General Mills Marketing: $1.3B (FY23) |

| Distribution | Challenging to secure | U.S. food retail: $800B+ (2024) |

Porter's Five Forces Analysis Data Sources

General Mills' analysis leverages annual reports, industry studies, and financial data to evaluate competition.