Getlink Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Getlink Bundle

What is included in the product

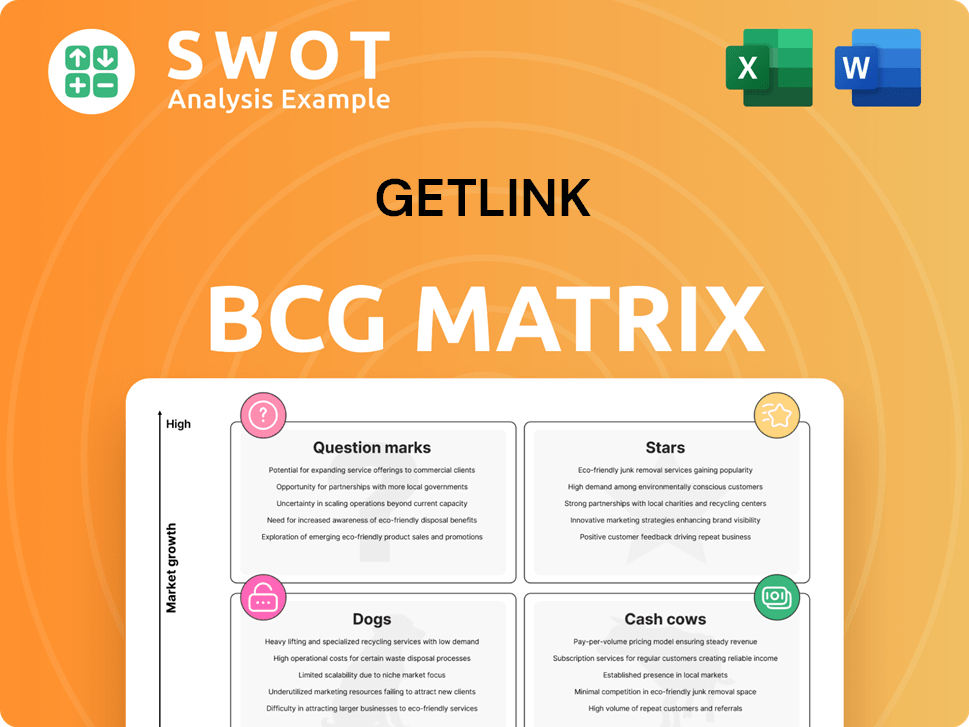

Getlink's BCG Matrix: strategic analysis of each business unit across quadrants.

Getlink's BCG Matrix offers a print-ready summary optimized for A4 and mobile PDFs.

Delivered as Shown

Getlink BCG Matrix

The Getlink BCG Matrix preview showcases the same comprehensive document you'll receive. Purchase the full version to access a ready-to-use report without hidden content or alterations. Dive straight into analysis—no modifications needed—for immediate application. This professional report is yours to download and leverage for strategic insights and impactful decisions.

BCG Matrix Template

Getlink's BCG Matrix unveils a snapshot of its market strategy. Identify key products across Stars, Cash Cows, Dogs, and Question Marks. This analysis provides a glimpse into their growth potential and resource allocation. See how they balance established performers and emerging opportunities. Uncover the strategic implications of their product portfolio. Dive deeper and pinpoint growth drivers and potential weaknesses. Purchase the full BCG Matrix for a detailed, actionable roadmap.

Stars

Eurotunnel's passenger shuttle service holds a strong market position. It boasts high market share on the Short Straits route, reflecting brand strength. In 2024, nearly 2.2 million passenger vehicles used the service, securing a 55.2% car market share. Further investment could enhance its already solid standing.

Eurotunnel Shuttle Service (Freight) transported nearly 1.2 million trucks in 2024, maintaining its market leadership. It held a 35.6% market share, demonstrating resilience. The freight service's success relies on its reliability and efficiency. These factors are crucial in a challenging economic climate.

Eurostar's traffic through the Channel Tunnel is thriving. Passenger numbers rose by 5% in 2024, exceeding 11.2 million travelers. This growth underscores the popularity of high-speed rail between London and Europe. Expanding routes and improving services will boost future growth.

Green Initiatives and Sustainability

Getlink's dedication to low-carbon services is a strong move as sustainability grows in importance. The company's green strategy has gained investor trust, as seen by the successful pricing of €600 million in green notes due in 2030. Focusing on environmental responsibility can boost Getlink's image and attract eco-minded customers.

- Getlink's CO2 emissions per passenger decreased by 26% between 2018 and 2023.

- In 2023, 80% of Getlink's energy came from renewable sources.

- The green notes issued in 2023 have a coupon rate of 5.5%.

- Getlink aims to reduce its carbon footprint by 50% by 2030.

Strategic Acquisitions

Getlink's strategic acquisitions have significantly bolstered its market position. The purchase of Associated Shipping Agencies (ASA) and Boulogne International Maritime Services (BIMS) complements its earlier acquisition of ChannelPorts Ltd. These moves enhance service offerings and create operational synergies, which is crucial. The effective integration of these acquisitions is vital for achieving their full potential, especially with increased cross-channel trade.

- 2024: Getlink's revenue reached €1.7 billion, reflecting growth from strategic acquisitions.

- The acquisitions are expected to contribute significantly to the company's long-term profitability.

- Getlink's focus on integration aims to streamline operations and improve efficiency.

- These acquisitions are a key part of Getlink's growth strategy.

Getlink's "Stars" include Eurotunnel passenger and freight shuttles, as well as Eurostar. These segments boast high market share and strong growth potential, reflected in robust 2024 figures. Eurostar saw passenger numbers exceed 11.2 million, while the freight shuttle transported nearly 1.2 million trucks.

| Service | 2024 Market Share | 2024 Passengers/Trucks |

|---|---|---|

| Passenger Shuttle | 55.2% (cars) | 2.2M (vehicles) |

| Freight Shuttle | 35.6% | 1.2M (trucks) |

| Eurostar | N/A | 11.2M (passengers) |

Cash Cows

Getlink's Channel Tunnel is a cash cow due to its long-term concession. As the concession holder until 2086, it ensures consistent revenue. In 2023, the tunnel carried 1.8 million trucks and 11.4 million passengers. Maximizing capacity is key to its value.

Getlink's railway network, used by Eurostar and freight services, is a cash cow. In the first half of 2024, it made €193 million, a 7% rise from 2023. This revenue stream is stable and predictable, offering a dependable income source for the company.

In 2024, Getlink SE saw its credit rating upgraded to BB+ from BB by S&P Global Ratings and Fitch Ratings. This upgrade, reflecting strong financial health, allows the company to secure capital at better rates. A solid credit rating is key, especially when Getlink's 2023 revenue was €1.6 billion.

Operational Efficiency

Getlink's operational efficiency in 2024 is a key characteristic of its "Cash Cow" status within the BCG matrix. The Group's operating expenses decreased by 9%, significantly influenced by changes in the ElecLink profit-sharing provision, mirroring revenue adjustments. This efficiency contributed to the Eurotunnel segment's impressive EBITDA of €642 million, exceeding expectations. This demonstrates robust cost management and productivity improvements, directly enhancing profitability and cash flow.

- Operating expenses fell 9% in 2024.

- Eurotunnel segment's EBITDA reached €642 million.

- Cost management directly boosts profitability.

Bond Issuance

Getlink's bond issuance strategy showcases proactive financial management. In 2024, Getlink issued a €600 million Green Bond maturing in April 2030, with a 4.125% annual coupon. This strategic move, along with existing cash, facilitated the early redemption of a €850 million Green Bond due in October 2025. This approach reinforces Getlink's financial stability.

- Green Bond Issue: €600 million, maturing April 2030.

- Coupon Rate: 4.125% annually.

- Early Redemption: €850 million Green Bond (October 2025).

- Objective: Strengthen Getlink's financial position.

Getlink's "Cash Cow" status is cemented by stable revenue streams and financial prowess. The company's railway network generated €193 million in the first half of 2024. A solid credit rating, upgraded to BB+, supports favorable financing. Efficient operations and strategic bond issuances further boost financial stability.

| Financial Metric | Details | Year |

|---|---|---|

| Railway Revenue (H1) | €193 million | 2024 |

| Credit Rating | BB+ | 2024 |

| Green Bond Issue | €600 million | 2024 |

Dogs

Cross-Channel rail freight faced a 13% decrease in 2024, signaling a loss of market share. This downturn could stem from stiffer competition or economic shifts. A detailed analysis is crucial to evaluate potential turnaround strategies. In 2023, Getlink reported 1.3 million trucks transported, a figure that could be indicative of the challenges rail freight faces.

ElecLink faced significant challenges. Revenue decreased by 69% in Q1 2025 due to a suspension lasting until February 5. The shutdown in early 2025 is estimated to cost €25 million. Despite resuming service, disruptions highlight its vulnerability.

Eurotunnel's coach traffic market share fell to 17.1% in H1 2024 from 25.9% in H1 2023. This decline signals reduced competitiveness in the coach travel sector. The decrease is a substantial drop, highlighting potential issues. Strategies are needed to understand and reverse this trend.

LeShuttle Car Traffic (March Decline)

Getlink's LeShuttle saw a 16% drop in car traffic during March, handling 122,419 passenger vehicles. This decrease is likely linked to the timing of Easter and UK bank holidays. Analyzing the cause of this decline is crucial for a suitable recovery plan. The Easter weekend was in March in 2024.

- March's car traffic: 122,419 vehicles.

- Traffic decrease: 16% compared to the previous year.

- Potential cause: Easter and UK bank holiday shifts.

- Focus: Assessing the decline's core reasons.

Truck Shuttle traffic (Sluggish Economy)

Truck Shuttle traffic, categorized as a "Dog" in Getlink's BCG Matrix, reflects a stable yet challenged performance. Despite the stable traffic in Q1, the sluggish economy continues to weigh on its growth potential. Getlink maintained its leading position on the Short Straits, with a market share of 36.4% in Q1 2025, an increase from 35.6% in Q1 2024. This limited growth indicates a constrained market environment.

- Market share increased from 35.6% (Q1 2024) to 36.4% (Q1 2025).

- Traffic remained stable in Q1.

- The sluggish economy penalizes growth.

- Leading position on the Short Straits.

Truck Shuttle, a "Dog," shows stable performance but faces economic headwinds. Market share rose from 35.6% (Q1 2024) to 36.4% (Q1 2025). Stable traffic indicates a constrained growth environment despite its leading position.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Market Share | 35.6% | 36.4% |

| Economic Impact | Sluggish; weighs on growth | |

| Traffic | Stable | |

Question Marks

Eurotunnel is targeting to cut the time to launch new rail services through the tunnel, from 10 years to 5. The goal is to double direct high-speed rail services via the Channel Tunnel by 2034. This is a high-growth area, but needs major investment. In 2023, Eurotunnel's revenue hit €1.7 billion.

Smart border technology is a question mark for Getlink. Since December 31, 2020, Eurotunnel has been developing this tech. It aims to maintain the Tunnel's efficiency. Regulatory approvals and implementation are key to its success. In 2024, Getlink saw a 13% rise in Shuttle revenue, showing potential.

Europorte is eyeing expansion in rail freight, focusing on combined transport and new markets. In 2023, Europorte's revenue grew by €10 million, with current EBITDA up €3 million. These moves, though promising, need strategic planning. The rail freight market is competitive, requiring smart execution for success.

ElecLink Capacity Sales (Future)

ElecLink's future is uncertain, fitting the "Question Mark" category in a BCG matrix. As of March 31, 2024, €200 million in revenue was secured for 2025, which is 83% of the annual capacity. However, €125 million was secured for 2026, representing only 35% of annual capacity. The interconnector's performance depends on market conditions and operations.

- Revenue secured for 2025: €200 million (83% of annual capacity).

- Revenue secured for 2026: €125 million (35% of annual capacity).

- Performance depends on market conditions and operational stability.

Digital Transformation Initiatives

Digital transformation can significantly boost rail's future. It aims to enhance safety and environmental responsibility while driving intermodal growth to regain market share. For the week ending November 23, 2024, rail traffic rose 25.6% year-over-year, showing growth. Digital initiatives can streamline operations and improve efficiency.

- Focus on safety and environmental sustainability.

- Aggressively pursue intermodal growth.

- Leverage digital tools for operational efficiency.

- Aim to regain lost market share.

Question Marks in the BCG matrix represent high-growth, low-share business units needing significant investment. ElecLink exemplifies this, with revenue secured for 2025 at €200 million and 2026 at €125 million, depending on market conditions. Smart border tech and Europorte's expansion also fit this category, each needing strategic focus.

| Project | Revenue 2025 | Revenue 2026 |

|---|---|---|

| ElecLink | €200M (83% capacity) | €125M (35% capacity) |

| Smart Border Tech | (Developing) | (Developing) |

| Europorte Expansion | (Growing) | (Growing) |

BCG Matrix Data Sources

Getlink's BCG Matrix is powered by market analysis, financial reports, and industry insights to assess the strategic landscape.