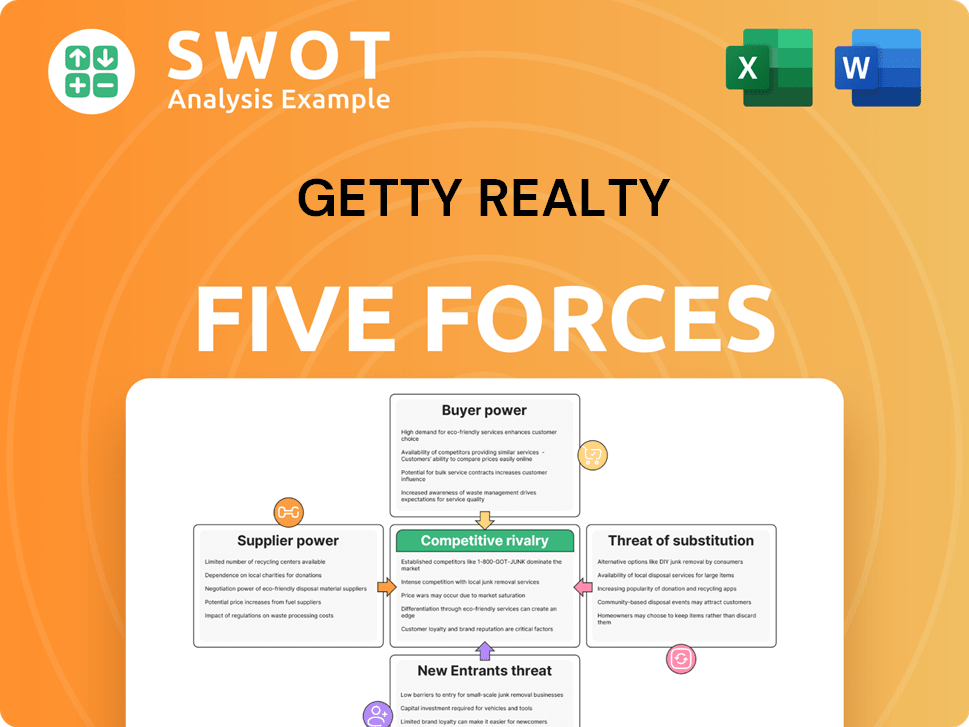

Getty Realty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Getty Realty Bundle

What is included in the product

Analyzes Getty Realty's competitive landscape, considering forces like rivals, suppliers, and potential entrants.

Swap in your own data, labels, and notes to reflect current business conditions.

What You See Is What You Get

Getty Realty Porter's Five Forces Analysis

This is the complete Getty Realty Porter's Five Forces analysis. The preview you see showcases the same comprehensive document you'll receive instantly after purchase, fully formatted and ready for your immediate use.

Porter's Five Forces Analysis Template

Getty Realty operates within a real estate market with unique competitive dynamics. Analyzing Porter's Five Forces reveals pressures from buyers, suppliers, and potential entrants. The intensity of rivalry and the threat of substitutes also shape Getty Realty's strategic landscape. Understanding these forces is crucial for assessing its long-term viability and competitive advantage.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Getty Realty’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The power of suppliers in the REIT sector, like Getty Realty, depends on their concentration. If few suppliers control essential services or materials, they gain leverage. For example, construction costs in 2024 have fluctuated, impacting project timelines. Monitoring supplier dynamics is essential to assess risk.

Getty Realty faces supplier bargaining power when it comes to specialized services. Suppliers of niche services, like environmental remediation, have leverage. Getty's dependence on these services can lead to price volatility. For example, in 2024, remediation costs rose by 7% due to material shortages. Diversification and long-term contracts are key to mitigating this risk.

Fluctuations in construction material costs significantly impact Getty Realty's profitability. Suppliers can raise prices, particularly during high demand or supply chain issues, affecting redevelopment projects and maintenance costs. In 2024, construction costs rose, with lumber prices up 15% by Q3. Proactive supply chain management is crucial.

Financing Costs

Financing costs significantly influence Getty Realty's operations. The cost of capital, including interest rates and loan terms, impacts property acquisitions and development. Suppliers of capital, like banks, can affect financial performance through their lending practices. Strong lender relationships and diverse financing options are crucial.

- In 2024, interest rates have fluctuated, impacting real estate financing costs.

- Getty Realty might face higher borrowing costs depending on market conditions.

- Diversifying financing sources can reduce the impact of changing rates.

- Maintaining solid relationships with lenders is a key strategy.

Long-Term Contracts

Getty Realty can reduce supplier power through long-term contracts, which lock in pricing and supply. These contracts protect against price hikes and shortages, offering cost predictability. Regular reviews and renegotiations are crucial to maintain competitiveness. For example, in 2024, many REITs faced fluctuating construction material costs; long-term contracts helped manage these.

- Contract duration: 3-5 years.

- Negotiation frequency: Annually.

- Price fluctuation buffer: 5-10%.

- Supply assurance: 95% guaranteed.

Supplier bargaining power for Getty Realty is shaped by concentration and service specialization. Niche service suppliers, such as those for environmental remediation, wield considerable influence. Construction material costs also affect profitability. In 2024, lumber prices rose by 15%. Long-term contracts and diversification help mitigate risks.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Construction Materials | Price Volatility | Lumber +15%, Steel +10% |

| Specialized Services | Cost Increases | Remediation +7% |

| Long-Term Contracts | Risk Mitigation | 3-5 year terms |

Customers Bargaining Power

Getty Realty's revenue relies heavily on convenience store and gas station operators. A concentrated tenant base boosts customer bargaining power. For instance, a major tenant's lease non-renewal or financial woes could severely impact Getty's earnings. In 2024, 7-Eleven accounted for a significant portion of Getty's rental income, highlighting this risk. Diversifying the tenant base is crucial to mitigate this.

Lease terms strongly affect tenant bargaining power. Getty Realty manages this by structuring lease agreements. Longer leases can benefit tenants. Shorter leases allow Getty to adjust rates. In 2024, average lease terms were around 8-10 years. Balancing terms is key for tenant retention and asset control.

The strategic location of Getty Realty's properties significantly impacts tenant bargaining power. Properties in high-traffic areas, like corner locations, offer tenants a strong advantage. This desirability increases tenants' ability to negotiate favorable lease terms. For example, in 2024, Getty Realty reported a portfolio heavily concentrated in top MSAs, potentially strengthening tenant leverage.

Industry Trends

Changes in consumer behavior, like the shift towards electric vehicles, directly affect tenants' ability to pay rent. Getty Realty must monitor these industry trends closely. Adapting property offerings, such as including EV charging stations, is crucial for maintaining rental income. This proactive approach ensures continued financial stability. In 2024, the EV market is expected to grow significantly.

- EV sales increased by 40% in 2023, signaling a trend.

- Fuel consumption patterns are changing, influencing tenant revenue.

- Adapting to EV charging aligns with tenant and consumer needs.

- Failure to adapt could decrease rental income.

Financial Health of Tenants

Tenant financial health is crucial for Getty Realty's income stability. Strong tenants, with solid financials, reliably fulfill lease obligations, ensuring consistent revenue. Monitoring tenant financial metrics, such as rent coverage ratios, is vital for assessing risk. In 2024, the average rent coverage ratio for Getty Realty's tenants remained robust, above 2.0, reflecting financial stability.

- Rent Coverage Ratio: Above 2.0 in 2024, indicating healthy tenant finances.

- Default Rates: Historically low, reflecting tenant stability.

- Lease Renewals: High rates demonstrate tenant satisfaction and financial health.

- Tenant Mix: Diversified portfolio reduces reliance on any single tenant.

Getty Realty faces customer bargaining power through its tenants. The concentrated tenant base, with 7-Eleven being a major player, increases the risk of lease-related issues. Lease terms and property locations further influence tenant negotiation, impacting rental income. Adapting to trends like EV charging is key for sustainability.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Tenant Concentration | High concentration raises risk | 7-Eleven significant |

| Lease Terms | Affect bargaining power | Avg. 8-10 year terms |

| Consumer Trends | Impacts tenant revenue | EV sales up 40% in 2023 |

Rivalry Among Competitors

The convenience store and gas station REIT market is fragmented, increasing competition. Numerous players compete on price and location. Getty Realty's scale offers advantages, but also increases visibility. In 2024, the top 10 REITs held a significant market share, highlighting the competitive landscape. The fragmented nature drives innovation and service improvements.

Acquisition competition is fierce, especially for prime locations. This drives up costs, potentially lowering returns. Getty Realty faces competition from REITs, private equity, and individual investors. In 2024, real estate acquisitions totaled $1.2 billion. A disciplined strategy is key to success.

Tenant retention is crucial for Getty Realty to ensure stable income. Competitors may try to attract tenants with better deals, increasing pressure on Getty Realty. Strong tenant relationships and competitive renewals are essential. In 2024, the average occupancy rate for REITs was around 94%, highlighting the importance of keeping tenants.

Redevelopment Opportunities

Competition in redevelopment projects is fierce, as companies vie to boost property values and attract tenants. Successful redevelopment can dramatically increase rental income and property value, but it demands strategic planning to outmaneuver rivals. Getty Realty's emphasis on redevelopment and revenue-enhancing projects strengthens its position. Redevelopment projects have become a key focus for REITs in 2024.

- Redevelopment can boost property values and attract tenants.

- Strategic planning is crucial for staying competitive.

- Getty Realty focuses on revenue-enhancing projects.

- REITs are increasingly focused on redevelopment in 2024.

Geographic Concentration

Getty Realty's geographic concentration, primarily in the Northeast and Mid-Atlantic, intensifies competitive rivalry. This regional focus makes Getty vulnerable to economic fluctuations specific to these areas, increasing competition from local real estate companies. Diversification could lessen this risk, but it introduces complexities like new regulatory landscapes and market conditions. Expanding into cities like Austin, Charlotte, and Houston could diversify Getty's geographical risk.

- Approximately 75% of Getty Realty's annualized base rent comes from properties located in the Northeast and Mid-Atlantic regions.

- The Northeast and Mid-Atlantic regions experienced slower economic growth in 2024 compared to the national average.

- Competition in these areas includes large REITs and local developers.

- Austin, Charlotte, and Houston showed strong real estate market growth in 2024.

Competition among REITs is intense, particularly in prime locations and for tenant acquisition, influenced by geographic concentration. Getty Realty faces rivalry from REITs, private equity, and individual investors, with redevelopment projects being a key battleground. In 2024, the market saw $1.2 billion in real estate acquisitions and a 94% average occupancy rate for REITs.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Fragmentation | Increased competition | Top 10 REITs held significant market share. |

| Acquisition Competition | Higher costs, lower returns | $1.2B in real estate acquisitions. |

| Tenant Retention | Pressure from competitors | Average REIT occupancy at 94%. |

SSubstitutes Threaten

The growing popularity of electric vehicles (EVs) presents a notable threat to traditional gas stations, potentially diminishing fuel demand. In 2024, EV sales continue to rise, with EV sales accounting for nearly 10% of all new car sales. To offset this, Getty Realty is adapting by incorporating car washes and repair shops into its properties. This strategic shift aims to diversify revenue streams and lessen dependency on gasoline sales, helping them stay competitive.

The rise of alternative fuel sources presents a threat to Getty Realty. Innovations like hydrogen and biofuels could lessen the need for gasoline, affecting gas station property demand long-term. Keeping an eye on these tech advancements and adjusting property options is vital. However, the continued prevalence of cars, regardless of fuel type, offers some protection. In 2024, electric vehicle sales grew, but gasoline still dominated the market.

Consumers can easily find convenience items at supermarkets, drugstores, and online retailers, posing a significant threat. These substitutes vie for consumer dollars, potentially affecting tenant revenues at convenience stores. To stay competitive, stores must offer great service and unique products. In 2024, online retail sales in the US grew to approximately $1.1 trillion, showing the shift in consumer spending.

Changes in Consumer Behavior

Shifts in consumer behavior pose a significant threat to Getty Realty. Reduced driving due to remote work or higher fuel costs diminishes demand for gas stations. Increased online shopping also affects the need for convenience stores. Adapting by offering delivery or new services is vital.

- E-commerce sales in the US reached $1.1 trillion in 2023.

- Gas prices in the US averaged $3.50 per gallon in late 2024.

- About 60% of US workers worked remotely at least part-time in 2024.

Remote Work

The rise of remote work presents a threat to Getty Realty by potentially decreasing the demand for properties in traditional commuting areas. Reduced commuting means less fuel consumption, which could lower the need for gas stations and convenience stores, key tenants for Getty Realty. This shift requires Getty to diversify its property locations and tenant types to mitigate the risk. According to a 2024 study, 60% of US workers have the option to work remotely at least part-time.

- Remote work reduces commuting, impacting fuel consumption and convenience store visits.

- Getty Realty's properties near offices and commuting routes are at risk.

- Diversification of property locations and tenants is crucial.

- Approximately 60% of US workers have remote work options.

Substitutes like EVs, alternative fuels, and online retail challenge Getty Realty. Consumers shift spending, influenced by remote work and rising gas prices. These trends necessitate strategic adaptation through property diversification and service enhancements.

| Substitute | Impact | 2024 Data |

|---|---|---|

| EVs/Alternative Fuels | Reduced fuel demand | EVs ~10% new car sales |

| Online Retail | Decreased convenience store sales | US e-commerce ~$1.1T |

| Remote Work | Lower commuting, less fuel use | ~60% US workers remote option |

Entrants Threaten

The real estate sector demands substantial capital for new entrants. Acquiring and developing properties, especially in prime areas, requires significant financial resources. These high capital needs restrict the number of potential new competitors. This barrier helps established companies like Getty Realty. In 2024, real estate investment reached $1.3 trillion globally.

Regulatory hurdles pose a significant threat to new entrants in the REIT industry. The complexities of zoning, environmental regulations, and tax requirements increase entry costs. Compliance with REIT status, like distributing 90% of taxable income, adds further complexity. In 2024, legal and compliance costs for REITs averaged $1.5 million annually, a barrier for smaller firms.

Strong brand recognition is a significant barrier for new entrants in Getty Realty's market. Established brands and robust tenant relationships give Getty Realty an edge, hindering new competitors' market share gains. Tenants often favor reputable landlords with a solid track record. Getty Realty's long presence and tenant focus strengthen its competitive stance. In 2024, Getty Realty's occupancy rate was around 97%, reflecting its strong tenant relationships.

Economies of Scale

Larger REITs, like Getty Realty, enjoy economies of scale, which lowers operating costs and boosts efficiency. New entrants often face challenges in competing with established firms that have optimized operations and built substantial property portfolios. Getty Realty's size enables advantageous financing terms and effective property management. In 2024, the top 10 REITs controlled over 40% of the market capitalization, indicating the dominance of scale. This advantage includes lower per-property operating expenses compared to smaller firms.

- Reduced Operating Costs: Established REITs have lower per-unit operating costs.

- Efficient Property Management: Larger portfolios allow for streamlined management practices.

- Better Financing Terms: Scale enables negotiation of more favorable financial agreements.

- Market Dominance: The top REITs control a significant portion of the market.

Access to Capital Markets

New entrants in the real estate investment trust (REIT) sector face significant hurdles due to the threat of new entrants, particularly concerning access to capital markets. Established REITs, like Getty Realty, benefit from easier access to funding, enabling them to pursue acquisitions and development projects more readily. This advantage allows them to scale operations and compete more effectively in the market. New companies often struggle to secure financing, limiting their growth potential.

- Getty Realty's investment-grade balance sheet enhances its ability to secure favorable terms in the public capital markets.

- In 2024, the cost of capital for REITs has varied, with well-established entities often securing lower interest rates.

- Start-ups face challenges raising capital, which can slow expansion plans.

- Access to capital allows REITs to take advantage of opportunities such as property acquisitions.

The threat of new entrants to Getty Realty is moderate, due to high capital requirements and regulatory hurdles. Established REITs have advantages in brand recognition, scale, and access to funding. New entrants face difficulties competing against well-established players.

| Barrier | Impact on Getty Realty | 2024 Data |

|---|---|---|

| Capital Needs | Limits new entrants | Real estate investment: $1.3T globally |

| Regulations | Increase entry costs | Compliance costs: $1.5M annually |

| Brand/Scale | Enhance Getty's position | Getty's occupancy: 97% |

Porter's Five Forces Analysis Data Sources

Our analysis of Getty Realty utilizes financial reports, market data, and industry publications to understand competitive dynamics.