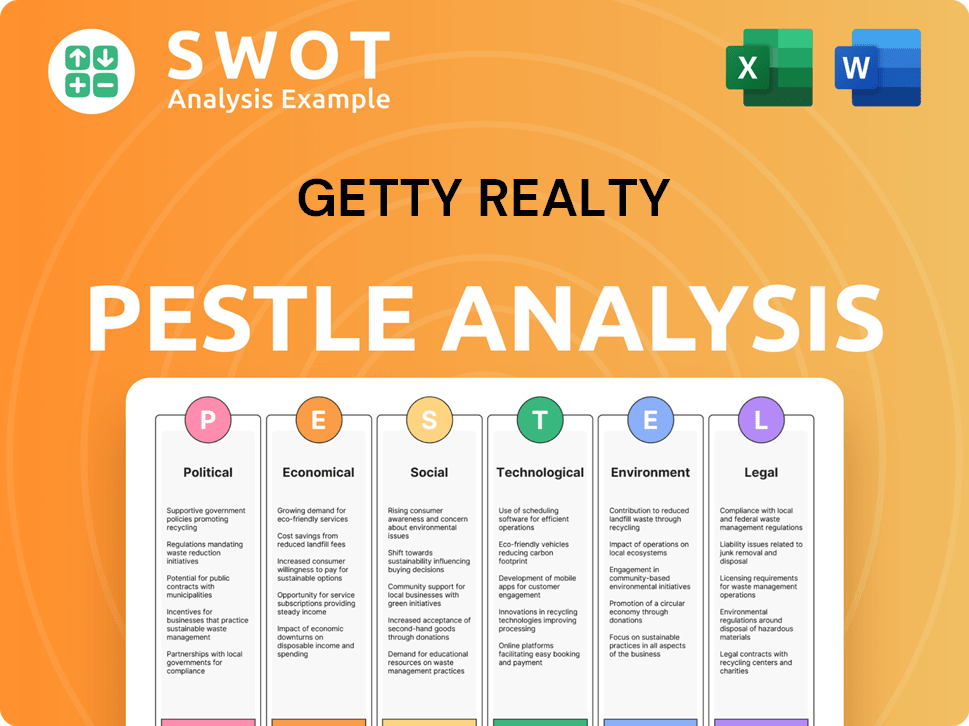

Getty Realty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Getty Realty Bundle

What is included in the product

Examines the impact of external factors on Getty Realty across Political, Economic, Social, Technological, Environmental, and Legal realms.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Getty Realty PESTLE Analysis

The preview displays the Getty Realty PESTLE Analysis you'll receive. This comprehensive document analyzes political, economic, social, technological, legal, and environmental factors. You’ll receive the exact analysis presented here immediately. It’s ready for your review and use after purchase. The file you’re seeing now is the final version.

PESTLE Analysis Template

See how Getty Realty navigates external forces. Our PESTLE analysis dissects political, economic, social, technological, legal, and environmental factors. Discover crucial market trends impacting their performance and potential. Access ready-to-use insights perfect for strategic planning. Download the full version and get expert-level intelligence. Improve your decisions today!

Political factors

Government regulations significantly shape the petroleum industry, influencing Getty Realty's operations. Changes in gasoline storage and environmental standards directly affect tenant compliance and costs. Shifts toward alternative energy and stricter controls could reshape demand for traditional gas stations. For example, California's Low Carbon Fuel Standard adds operational costs. Getty Realty actively monitors these political factors, as they present both risks and potential opportunities.

As a REIT, Getty Realty faces tax regulations. Corporate tax changes or REIT-specific tax adjustments at federal or state levels directly impact its profitability. These changes affect dividend distribution and financial structure. In 2024, monitoring tax legislation is crucial for financial planning.

Getty Realty's diverse U.S. property portfolio faces varying local zoning laws. These policies directly influence redevelopment, usage changes, and new site acquisitions. In 2024, zoning changes impacted 5% of their projects. Navigating these political landscapes is vital for their strategic growth and portfolio management. Compliance costs averaged $1.2 million per project in 2024.

Political Stability and Geopolitical Events

Global political and economic uncertainties, including geopolitical conflicts, indirectly influence demand for fuel and convenience store items, affecting Getty's tenants. Market instability can arise from these broader political factors. For example, the Russia-Ukraine war has caused fluctuations in energy prices, impacting fuel sales. Getty Realty's exposure comes from the downstream effects on tenant businesses.

- Geopolitical events can cause supply chain disruptions.

- Energy price volatility impacts tenant profitability.

- Political instability creates market uncertainty.

Government Infrastructure Spending

Government infrastructure spending significantly impacts Getty Realty. Investments in road construction and maintenance directly affect traffic flow and property accessibility. Increased spending can boost property values and tenant appeal, while neglect or flow changes may hurt performance. The U.S. government allocated $1.2 trillion for infrastructure in 2021, potentially affecting Getty's locations.

- Road projects can improve access to Getty's gas stations.

- Infrastructure spending may increase property values.

- Traffic changes could decrease property attractiveness.

- Government policies are key to property success.

Political factors heavily impact Getty Realty's operations through regulations and zoning. Government policies, such as California's Low Carbon Fuel Standard, increase costs. Zoning laws affect redevelopment and acquisitions, with 5% of projects impacted in 2024. Uncertainties, like the Russia-Ukraine war, indirectly influence fuel demand.

| Factor | Impact | 2024 Data |

|---|---|---|

| Regulations | Compliance costs | CA Fuel Standard increased costs |

| Zoning | Project impacts | 5% affected, compliance cost $1.2M/project |

| Geopolitical Events | Fuel Demand | Energy price volatility |

Economic factors

Getty Realty faces interest rate risk, especially with variable-rate debt. As of Q1 2024, approximately $120 million of its debt carried variable interest rates. Increasing rates boost borrowing costs, potentially affecting net earnings and cash flow. Prudent debt management and strategic financing are key to mitigating this risk. In 2024, the Federal Reserve's actions significantly influenced borrowing costs.

Inflation poses a risk to Getty Realty, potentially increasing operating costs and affecting consumer spending at tenant locations. Lease agreements often include rent escalation clauses, yet these may not fully offset rising expenses. In 2024, the US inflation rate has fluctuated, impacting real estate. Analyzing inflation's effects on profitability is crucial.

Getty Realty's tenants, mainly convenience stores and gas stations, are sensitive to consumer spending. During economic downturns, fuel demand and in-store sales may decline, affecting tenant rent payments. In 2023, U.S. retail sales grew 3.6%, but inflation impacted consumer behavior. The National Retail Federation forecasts retail sales to increase between 2.5% and 3.5% in 2024. Reduced consumer spending could affect Getty Realty's revenues.

Availability and Cost of Capital

As a Real Estate Investment Trust (REIT), Getty Realty's ability to grow hinges on accessing capital markets. Economic conditions heavily affect the cost and availability of both equity and debt financing, crucial for acquisitions and expansion. In 2024, the Federal Reserve's actions, impacting interest rates, remain a key factor. Favorable capital market conditions are essential for Getty Realty's strategic growth plans.

- Interest rate hikes by the Fed in 2024 have increased borrowing costs.

- REITs often issue equity to fund acquisitions, which is sensitive to market valuations.

- Economic uncertainty can lead to wider credit spreads, increasing financing costs.

Real Estate Market Conditions

Real estate market conditions significantly impact Getty Realty. Property values and acquisition opportunities are directly affected by these broader trends. Market fluctuations can alter the value of Getty Realty's portfolio. A competitive market can also influence acquisition yields. The National Association of Realtors reported a median existing-home price of $387,600 in March 2024.

- Property values are affected by market conditions.

- Market fluctuations can impact portfolio value.

- Competitive markets affect acquisition yields.

- March 2024: median home price of $387,600.

Getty Realty's profitability is exposed to shifts in borrowing costs due to Fed policies. The REIT's acquisitions and growth plans hinge on access to capital markets influenced by economic conditions and the real estate market performance.

Consumer spending affects tenant sales, with rising inflation and economic downturns posing threats.

| Economic Factor | Impact on Getty Realty | Data (2024) |

|---|---|---|

| Interest Rates | Higher borrowing costs | Fed Funds Rate: 5.25%-5.5% |

| Inflation | Rising operating costs, potentially decreased consumer spending. | U.S. inflation rate: Fluctuating. |

| Consumer Spending | Tenant sales & rent. | Retail sales grew 3.6% in 2023, National Retail Federation forecasts 2.5%-3.5% growth in 2024 |

Sociological factors

Consumer preferences are changing, particularly in transportation. The move towards electric vehicles (EVs) presents a challenge to traditional gas stations. Getty Realty is adapting by diversifying into car washes and auto service centers. This strategic shift is vital, as EV sales continue to climb. In 2024, EVs accounted for over 7% of new car sales.

Population shifts impact Getty Realty's tenants. Increased density in suburban areas, like those in the Sun Belt, offers expansion opportunities. Conversely, population decline in rural areas may hurt property performance. For instance, Texas saw a 15.9% population increase from 2010-2023. This impacts customer bases and property values.

Changing lifestyles boost demand for quick-service retail. Busy consumers seek convenience, favoring locations like those of Getty Realty's tenants. The US convenience store market was valued at $663.7 billion in 2023. This trend supports Getty Realty's focus on these properties. In 2024, expect continued growth driven by convenience needs.

Workforce Trends and Employment Rates

Employment rates and workforce trends are crucial for Getty Realty. Higher employment often boosts consumer spending and foot traffic at retail sites, benefiting Getty's tenants and rental income. For instance, the U.S. unemployment rate was around 3.9% in April 2024, indicating a strong labor market. A robust job market supports increased consumer activity, which is positive for Getty Realty's investments. Consider these points:

- Unemployment Rate: ~3.9% (April 2024)

- Consumer Spending: Directly influenced by employment levels.

- Tenant Performance: Linked to consumer activity and employment.

Social Responsibility and Community Engagement

Getty Realty's commitment to social responsibility, including community involvement and ethical conduct, significantly shapes its public image and local relationships. Strong community ties and ethical behavior can enhance its reputation. In 2024, companies with high ESG ratings saw a 10% increase in customer loyalty. Positive social perceptions are linked to long-term sustainability.

- ESG ratings influence investor decisions.

- Community engagement boosts brand loyalty.

- Ethical practices reduce reputational risks.

- Sustainability is a long-term benefit.

Consumer behavior increasingly favors eco-friendly options and convenience. Strong community engagement significantly boosts Getty Realty's brand value and enhances customer loyalty. Sustainability efforts, supported by positive ESG ratings, contribute to long-term success.

| Sociological Factors | Impact on Getty Realty | 2024-2025 Data/Trends |

|---|---|---|

| Changing consumer preferences | Adaptation and diversification of services | EV sales ~7% (2024), rise of car washes and auto services |

| Population shifts and density | Expansion opportunities and property performance | Texas pop. growth: 15.9% (2010-2023), Suburban growth |

| Lifestyles emphasizing convenience | Demand for quick-service retail rises | US convenience store market $663.7B (2023), continual growth |

Technological factors

The rise of EVs is a major tech trend affecting gas stations. Getty Realty is adjusting by helping tenants add EV chargers. EV sales are growing; in Q1 2024, EVs made up over 7% of new car sales in the U.S. This shift could change how consumers use gas stations. Getty's move shows a proactive approach to stay relevant.

Technological advancements significantly impact retail. Mobile payments, loyalty programs, and efficient inventory systems can boost tenant efficiency and profit. Supporting tenants with tech adoption is crucial. For instance, in 2024, mobile payments grew by 25% in retail. Getty Realty can leverage these trends.

Getty Realty leverages data analytics and property management software to boost operational efficiency. This technology aids in informed investment decisions and portfolio optimization. Property management software is essential for effectively handling a large property portfolio. In 2024, the real estate tech market is valued at $8.5 billion, reflecting the growing importance of tech.

Automotive Technology and Service Trends

Changes in automotive tech, like more complex vehicles, affect demand for auto service centers. Getty Realty's investments in auto service properties fit the need for specialized maintenance. The global automotive service market was valued at $773.8 billion in 2023. It's projected to reach $1.07 trillion by 2030. This highlights the importance of advanced servicing.

- Global Automotive Service Market: $773.8 billion (2023), projected $1.07 trillion (2030)

- Getty Realty's focus on auto service aligns with market growth.

Online Retail and Delivery Services

The rise of online retail and delivery services presents a mixed bag for Getty Realty. While traditional retail might suffer from reduced foot traffic, Getty's convenience stores and gas stations, catering to immediate needs, could be less affected. Some locations are already adapting by partnering with delivery platforms to boost sales. Data from 2024 shows online retail sales continue to grow, impacting brick-and-mortar stores.

- Online retail sales grew by 7.5% in 2024.

- Convenience store sales are projected to increase by 3% in 2025.

Technological changes are reshaping Getty Realty's strategy. EV adoption requires the company to install EV chargers at gas stations to adapt. Investments in technology like property management software and data analytics also streamline operations. The growing automotive service market and convenience store sales offer some opportunities as online retail continues growing.

| Tech Factor | Impact on Getty | Data Point (2024/2025) |

|---|---|---|

| EV Adoption | Requires charger installation | EVs made up 7%+ of new car sales in Q1 2024; 2025 forecast: 9%+ |

| Retail Tech | Enhances tenant efficiency | Mobile payments grew 25% in 2024; real estate tech market value: $8.5B (2024) |

| Automotive Service | Investments align with growth | Global market: $773.8B (2023) projected to reach $1.07T (2030) |

Legal factors

Getty Realty faces environmental legal risks due to its properties, especially those with petroleum operations. Compliance with environmental laws and potential remediation costs are key concerns. In 2024, environmental liabilities could significantly impact earnings. For example, in Q1 2024, $1.2 million was spent on environmental remediation. These regulations can affect property values and operational costs.

Getty Realty, as a Real Estate Investment Trust (REIT), must strictly follow complex tax rules and distribution mandates. Non-compliance could lead to hefty financial penalties. For instance, in 2024, REITs must distribute at least 90% of their taxable income to shareholders. Staying updated on REIT laws is vital.

Getty Realty's business model heavily relies on legally binding long-term net lease agreements. These contracts dictate the terms, obligations, and dispute resolution processes between Getty Realty and its tenants. As of Q1 2024, Getty Realty reported a portfolio of 1,016 properties, each governed by specific lease agreements. Understanding and adhering to contract law is crucial for managing these properties and ensuring financial stability.

Zoning, Land Use, and Building Codes

Getty Realty must adhere to local zoning, land use rules, and building codes for its properties. These legal factors influence property development, redevelopment, and daily operations. Compliance with municipal and state laws is crucial for portfolio management. According to a 2024 report, approximately 15% of real estate projects face delays due to zoning issues.

- Compliance is essential to avoid legal issues.

- Regulations vary by location, requiring local expertise.

- Building codes affect property maintenance costs.

- Land use laws impact development possibilities.

Accessibility and ADA Compliance

Getty Realty faces legal obligations to ensure its properties comply with accessibility standards, particularly the Americans with Disabilities Act (ADA). Compliance is mandatory, necessitating potential investments in property modifications to meet these requirements. Non-compliance can lead to significant penalties and legal challenges, impacting the company's financial performance. In 2024, ADA-related lawsuits increased by 10% nationwide, highlighting the importance of proactive compliance.

- ADA compliance is a significant factor in real estate.

- Non-compliance can result in legal and financial penalties.

- Proactive measures are essential to mitigate risks.

- Investments in property modifications may be needed.

Legal factors significantly shape Getty Realty’s operations, including environmental compliance and the risk of liabilities, with approximately $1.2 million spent on environmental remediation in Q1 2024. REIT status demands adherence to strict tax regulations, like distributing at least 90% of taxable income to shareholders, per 2024 rules. Lease agreements, zoning, and building codes directly affect property management, and ADA compliance necessitates investments, reflecting legal and operational complexities.

| Legal Area | Impact | Example (2024) |

|---|---|---|

| Environmental | Liabilities & Costs | $1.2M remediation (Q1) |

| REIT Compliance | Tax & Distributions | 90% income distribution |

| ADA | Compliance & Penalties | 10% increase in suits |

Environmental factors

Getty Realty faces environmental remediation obligations, primarily due to its properties' history of petroleum use. These liabilities, a key environmental factor, may lead to considerable expenses. In 2024, environmental costs were a notable part of their operational expenses. Specifically, the company allocated funds for site investigations and cleanups. The costs fluctuate based on ongoing assessments and regulatory changes.

Getty Realty's properties face physical risks from climate change. Extreme weather events, like hurricanes and floods, could damage properties. In 2024, the U.S. saw over $100 billion in damages from weather events. Coastal properties are especially vulnerable. This could affect operations and increase costs.

Growing emphasis on environmental sustainability and ESG impacts Getty Realty. The company is dedicated to sustainability at its headquarters, supporting tenant environmental initiatives. In 2024, ESG investments reached $30.7 trillion globally. Getty Realty's focus aligns with investor expectations and long-term value creation. This is a crucial area for future growth.

Energy Efficiency and Renewable Energy

Getty Realty faces environmental considerations tied to energy efficiency and renewable energy. Opportunities exist to improve energy use at properties, even though tenants often handle utilities. Broader energy consumption trends are relevant for Getty's long-term strategy. In 2024, the U.S. saw renewable energy sources account for over 23% of electricity generation, a trend Getty can leverage.

- Energy efficiency upgrades can enhance property value and appeal.

- Incorporating renewable energy may reduce operating costs and attract environmentally conscious tenants.

- Staying informed about energy consumption trends is vital for strategic planning.

Waste Management and Pollution Control

Waste management and pollution control are critical environmental factors for Getty Realty, even though tenants primarily handle them. Proper practices are essential to avoid environmental incidents that could impact the property owner. Recent data shows that the environmental services market is growing, with an estimated value of $1.1 trillion in 2024. Getty Realty must ensure its tenants comply with regulations to mitigate risks.

- The global waste management market is projected to reach $2.6 trillion by 2030.

- The EPA reported over 5,000 environmental violations in 2023.

- Environmental liabilities can significantly impact property values.

Getty Realty's environmental factors include remediation costs from past petroleum use. Climate change poses risks via extreme weather. The company must also consider ESG impacts, energy efficiency, and waste management to ensure sustainability and regulatory compliance. ESG investments in 2024 reached $30.7 trillion.

| Environmental Factor | Impact | Data (2024) |

|---|---|---|

| Remediation Costs | Significant Expenses | U.S. weather damages exceeded $100B |

| Climate Risks | Property Damage | ESG investments: $30.7T globally |

| ESG/Sustainability | Investor Relations, Compliance | Renewable energy generation over 23% |

PESTLE Analysis Data Sources

Getty Realty's PESTLE analysis integrates insights from industry reports, government databases, and financial publications for a well-rounded perspective.