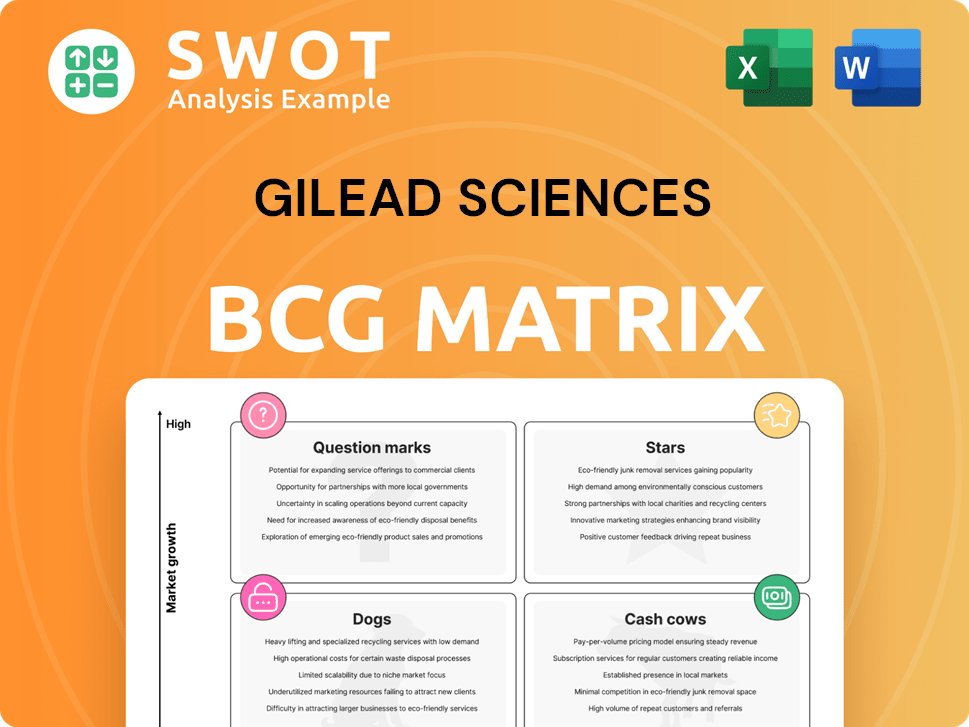

Gilead Sciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gilead Sciences Bundle

What is included in the product

Tailored analysis for Gilead's product portfolio, detailing strategic decisions for each quadrant.

Printable summary optimized for A4 and mobile PDFs of Gilead's BCG matrix, ensuring easy data accessibility.

Preview = Final Product

Gilead Sciences BCG Matrix

The BCG Matrix you see now is the complete file you'll receive after purchase. It's a fully editable report with Gilead Sciences data, no demo content or watermarks to hinder your use.

BCG Matrix Template

Gilead Sciences' BCG Matrix reveals its product portfolio's market positions, from blockbuster drugs to emerging therapies. We can briefly analyze its "Stars" like successful HIV treatments. The "Cash Cows," such as older antivirals, generate steady profits. "Question Marks" may be promising but require strategic investment. "Dogs" might be underperforming products needing reevaluation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Biktarvy, Gilead Sciences' leading HIV therapy, is a star in its BCG matrix. Sales of Biktarvy in 2024 surged by 13%, hitting $13.4 billion. This growth is fueled by robust demand. Biktarvy holds over 50% of the U.S. market share, making it a primary revenue source.

Lenacapavir, a long-acting HIV prevention option, is a rising star for Gilead Sciences. Its potential launch in Summer 2025 could broaden HIV prevention. Clinical trials reveal strong efficacy, potentially reshaping HIV strategies, and strengthening Gilead’s HIV dominance. In 2024, Gilead's HIV franchise generated $17.2 billion.

Trodelvy, a standout oncology drug, is experiencing robust sales growth, reflecting Gilead's strategic focus on its oncology portfolio. In Q4 2024, Trodelvy's sales surged by 19% to $355 million, showcasing its market expansion. This growth is fueled by rising demand across various regions, highlighting its increasing importance. Ongoing trials in lung cancer suggest further potential for Trodelvy.

Oncology Portfolio

Gilead's oncology portfolio is a star, showing significant growth and strategic importance. Oncology sales surged by 12% in Q4 2024, with Trodelvy leading the way. These successes highlight Gilead's commitment to innovation. Strategic moves, including partnerships, fortify its market position and sustain innovation.

- Q4 2024 oncology sales increased by 12%

- Trodelvy is a key driver of growth

- Strategic partnerships strengthen market position

- Focus on innovation drives sustained growth

Liver Disease Portfolio

Gilead Sciences' liver disease portfolio shines as a star in its BCG matrix, consistently driving revenue. Liver product sales saw a boost in 2024, fueled by the CymaBay acquisition. Strategic moves and regulatory approvals are key to Gilead's growth. This strengthens its position in the liver disease treatment market.

- 2024 liver disease product sales increased, driven by the CymaBay acquisition.

- Strategic acquisitions and regulatory decisions contribute to Gilead's growth.

- Gilead has a strong market share in liver disease treatments.

Gilead's stars include Biktarvy, with $13.4B sales in 2024, and Lenacapavir, poised for growth.

Trodelvy's 19% Q4 2024 sales increase underscores oncology's star status. Liver products boost sales through acquisitions.

These reflect innovation and strategic focus, driving revenue. Gilead's HIV and oncology franchises and liver portfolio are crucial.

| Product | 2024 Sales | Market Share |

|---|---|---|

| Biktarvy | $13.4B | Over 50% (U.S.) |

| Trodelvy (Q4) | $355M | Increasing |

| HIV Franchise | $17.2B | Dominant |

Cash Cows

Descovy, a key part of Gilead Sciences' portfolio, is a cash cow. It holds a strong position in HIV pre-exposure prophylaxis (PrEP). Descovy saw a 21% year-over-year growth. It continues to lead with over 40% of the U.S. PrEP market share. Despite generics, Descovy remains a significant revenue source.

Vemlidy is a cash cow for Gilead Sciences, consistently generating revenue from hepatitis B treatments. In 2024, Vemlidy continues to be a key product, contributing to Gilead's liver disease portfolio. This helps maintain a steady revenue stream. The product's established market position requires less promotional investment.

Gilead's HCV franchise, including Harvoni and Sovaldi, remains a cash cow. Despite market saturation and fewer new patients, these drugs still bring in significant revenue. In 2024, HCV product sales were approximately $600 million. Gilead's strong market position and brand recognition help sustain sales.

Yescarta and Tecartus

Yescarta and Tecartus, Gilead's cell therapies, are key cash cows. They consistently contribute to Gilead's oncology revenue. These therapies have treated over 65,000 patients globally. They provide a steady revenue stream in the growing oncology market.

- Yescarta generated $396 million in revenue in Q1 2024.

- Tecartus brought in $118 million in Q1 2024.

- Combined, these therapies represent a significant portion of Gilead's oncology revenue.

- The consistent performance makes them reliable assets in Gilead's portfolio.

HBV franchise

Gilead's HBV franchise is a cash cow, providing steady revenue. Hepsera, a key drug, continues to generate income. Long-term efficacy and safety data support its market presence. This focus leads to consistent patient adherence and revenue.

- Hepsera sales in 2023 were approximately $50 million.

- HBV drugs contribute to a stable revenue stream for Gilead.

- Patient adherence is key to sustained revenue.

Descovy, Vemlidy, and Gilead's HCV franchise are cash cows, consistently generating revenue. Yescarta and Tecartus, key cell therapies, also contribute significantly to oncology revenue. Gilead's HBV franchise, including Hepsera, provides a stable revenue stream.

| Product | 2024 Revenue (Approx.) | Market Position |

|---|---|---|

| Descovy | $3.7B+ (PrEP) | Dominant PrEP market share (40%+) |

| Vemlidy | Steady | Established in hepatitis B |

| HCV Franchise | $600M | Strong market presence |

Dogs

Veklury, a Gilead Sciences product, is facing declining sales due to fewer COVID-19 hospitalizations. The decrease in Veklury sales significantly impacted Gilead's total 2024 revenue, leading to a reduction in overall financial performance. As the pandemic's impact wanes, Veklury's revenue stream is diminishing. In 2024, Veklury sales decreased by approximately 30% compared to the previous year.

Zydelig, a Gilead Sciences product, faces market challenges. Competition and treatment changes limit its growth. Strategic evaluation is needed to reduce potential losses. Market dynamics significantly impact Zydelig's position. In 2024, Zydelig's sales were significantly lower due to these factors.

AmBisome, crucial for leishmaniasis, navigates pricing hurdles. Gilead Sciences increased prices by 40% in 2024, impacting accessibility. This move could affect market share. Sales in 2023 reached $400 million, showing its impact. Balancing profit and access is vital for sustained presence.

Truvada

Truvada, a key product for Gilead Sciences, is experiencing market erosion due to generic competition. As generics become more widely available, Truvada's market share is diminishing. This shift impacts the product's position within the BCG matrix. Strategic adjustments are essential to offset revenue declines and stay competitive in the market. In 2023, Truvada's sales were significantly affected by generic entries.

- Market erosion due to generics.

- Decline in market share.

- Need for strategic adjustments.

- Impact on revenue.

Complera/Eviplera/Stribild/Odefsey

Complera, Eviplera, Stribild, and Odefsey represent Gilead Sciences' older HIV treatments, now categorized as "Dogs" in the BCG Matrix. These regimens experienced declining market share as newer, more effective HIV therapies emerged. Gilead strategically shifted its focus to these newer treatments. This move aims to maintain its market leadership in HIV therapy.

- Declining sales due to newer treatments.

- Strategic shift to newer HIV therapies.

- Focus on maintaining market leadership.

Gilead's older HIV treatments (Complera, Eviplera, Stribild, Odefsey) are "Dogs" due to declining sales from newer therapies.

These treatments face shrinking market share, prompting Gilead to prioritize newer HIV drugs.

This strategic shift aims to preserve Gilead's HIV therapy market leadership.

| Product | Category | Reason |

|---|---|---|

| Complera/Eviplera/Stribild/Odefsey | Dogs | Declining sales, market share erosion |

| Newer HIV therapies | Stars | Strategic focus to maintain leadership |

| Market Dynamics | Overall | Shifting towards advanced treatments |

Question Marks

Seladelpar, marketed as Livdelzi, targets primary biliary cholangitis (PBC). FDA approval and EMA recommendation suggest market potential. However, its initial sales contribution might be modest. Gilead's 2024 revenue was $27.1 billion. Successful commercialization is key.

Sunlenca, Gilead Sciences' long-acting HIV treatment, is positioned as a question mark in the BCG matrix. Its potential for twice-yearly administration could transform HIV care. Phase I data is promising, but market adoption is crucial. Gilead's 2024 revenue was $27.05 billion. The product's success hinges on overcoming market challenges.

GS-2829 and GS-6779 represent Gilead's venture into hepatitis B virus (HBV) therapeutic vaccines. These candidates aim to offer a therapeutic intervention for chronic HBV. Clinical trials are ongoing, with their progress and regulatory approvals being pivotal. Success could significantly impact HBV treatment. In 2024, the global HBV therapeutics market was valued at approximately $2.8 billion.

GS-3107

GS-3107, Gilead's HIV capsid inhibitor, is a promising new approach. Its early-stage development targets improved efficacy in HIV treatment, potentially boosting market adoption. Clinical trial results and market demand will shape its success. Gilead's focus on innovation could lead to significant gains in the HIV therapy market.

- GS-3107 is in early clinical trials.

- HIV treatment market is valued at billions.

- Success depends on clinical outcomes.

- Gilead's market share is significant.

GS-9911

GS-9911, a DGKα inhibitor, is being explored in oncology, showing promise in cancer treatment. Its success hinges on ongoing clinical trials to assess its effectiveness and safety profiles. Positive results and strategic alliances could significantly boost its market presence. The drug's potential is substantial within Gilead Sciences' portfolio.

- DGKα inhibitors are designed to target and potentially disrupt cancer cell growth.

- Clinical trials are crucial for validating GS-9911's efficacy and safety.

- Successful trials could lead to significant revenue for Gilead.

- Strategic partnerships could accelerate GS-9911's market entry and adoption.

GS-3107, a new HIV capsid inhibitor, is in early trials. HIV treatment market is worth billions, but success depends on clinical outcomes. Gilead’s market share is significant, indicating potential if the trials succeed. Gilead's research and development spending in 2024 was about $5.4 billion.

| Product | Status | Market Potential |

|---|---|---|

| GS-3107 | Early Clinical Trials | High, if successful |

| HIV Market | Billions | Significant |

| Gilead's Share | Significant | Depends on Clinical Outcomes |

BCG Matrix Data Sources

Gilead's BCG Matrix is data-driven, incorporating financial results, market reports, competitor analyses, and expert projections for strategic positioning.