Gilead Sciences Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gilead Sciences Bundle

What is included in the product

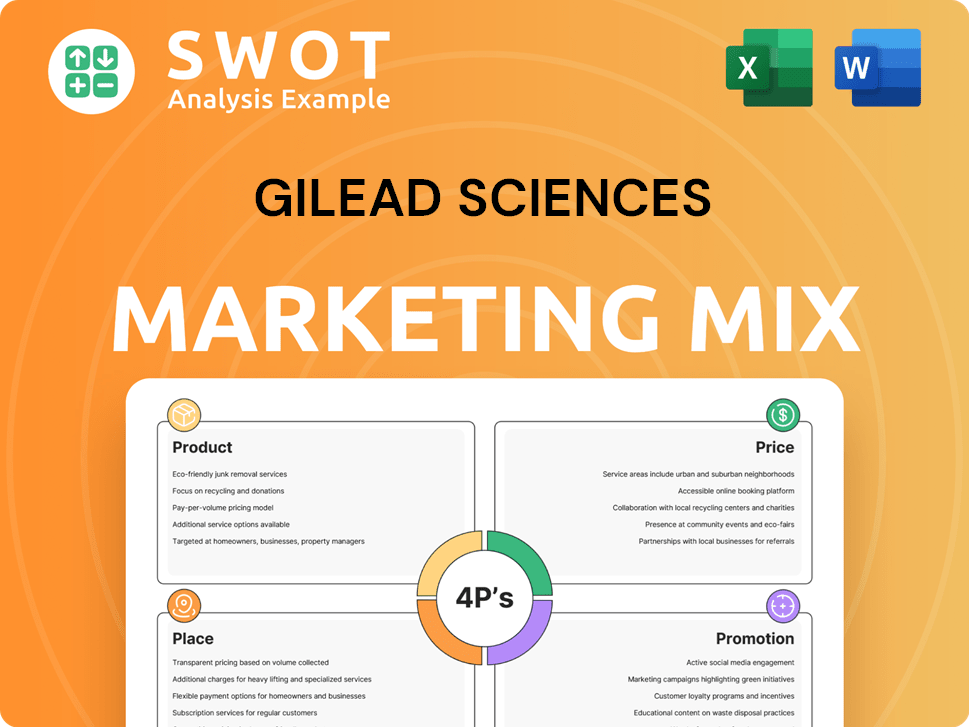

Provides a comprehensive Gilead Sciences marketing mix analysis across Product, Price, Place, and Promotion.

Provides a concise marketing overview to swiftly inform and align team members.

What You See Is What You Get

Gilead Sciences 4P's Marketing Mix Analysis

The preview presents Gilead Sciences' Marketing Mix Analysis in its entirety. This is the very document you'll receive after purchase. It’s fully detailed and ready to inform your strategic decisions. Purchase knowing you're getting the complete analysis immediately.

4P's Marketing Mix Analysis Template

Gilead Sciences strategically positions its antiviral medications, influencing patient outcomes. They balance premium pricing for innovative therapies with patient access initiatives. Their extensive distribution network ensures drug availability globally. Strategic partnerships, including with governments and healthcare providers, amplifies their reach. Comprehensive promotional strategies targeting physicians and patients generate awareness. This Marketing Mix analysis provides actionable insights, ideal for reports or strategic planning.

Product

Gilead Sciences strategically targets diverse therapeutic areas to address unmet medical needs. In 2024, its virology segment, including HIV and hepatitis treatments, generated $17.5 billion in product sales. Oncology, driven by cell therapies, showed strong growth, with sales reaching $3.1 billion. These areas showcase Gilead's commitment to innovation and patient care.

Gilead's HIV portfolio is a cornerstone of its product strategy. Biktarvy remains a top performer. Lenacapavir, a long-acting injectable, is a key pipeline asset. In Q1 2024, HIV product sales were $4.6 billion. Lenacapavir's market entry could significantly boost revenue.

Gilead Sciences is actively growing its oncology presence, a key element of its 4P's. This expansion includes cell therapies such as Yescarta and Tecartus, contributing significantly to revenue. In Q1 2024, cell therapy sales reached $538 million. Gilead's oncology pipeline is robust, aiming to solidify its position in the market.

Liver Disease Treatments

Gilead Sciences' product strategy strongly emphasizes its liver disease treatments. This includes established therapies for hepatitis B and C, generating significant revenue. Recently, the FDA approved Livdelzi for primary biliary cholangitis (PBC). This expansion into PBC broadens Gilead's market reach.

- HCV sales were $471 million in Q1 2024.

- Livdelzi approval happened in March 2024.

- Gilead's liver disease portfolio is worth billions.

Pipeline of Innovative Therapies

Gilead Sciences boasts a strong pipeline of innovative therapies. This pipeline focuses on areas like HIV, viral hepatitis, and oncology. In 2024, Gilead's R&D spending reached $5.6 billion. They have numerous clinical trials underway, including Phase 3 trials for several HIV treatments.

- HIV is a core focus, with several novel therapies in development.

- Significant investment is made in oncology research.

- Clinical trials are ongoing across multiple therapeutic areas.

Gilead's product strategy is anchored in virology and oncology, with HIV and cell therapies driving revenue. HIV products, like Biktarvy, are major contributors. The company is also expanding its oncology footprint. Their focus remains on high-impact treatments.

| Therapeutic Area | Key Products | Q1 2024 Sales |

|---|---|---|

| HIV | Biktarvy, Lenacapavir | $4.6B |

| Oncology | Yescarta, Tecartus | $538M |

| Liver Disease | HCV, Livdelzi | $471M (HCV Q1 2024) |

Place

Gilead Sciences maintains a significant global presence, with a strong sales footprint across various continents. In 2024, international sales accounted for approximately 30% of Gilead's total revenue. This global reach enables the company to access diverse markets and distribute its products, including HIV and hepatitis treatments. Gilead's strategy involves tailored approaches to address specific regional healthcare needs and regulatory landscapes. This international presence is key to Gilead's long-term growth.

In the U.S., Gilead relies heavily on wholesalers and distributors. Key players handle a large part of its sales, ensuring product reach. In 2024, around 80% of pharmaceutical sales were through distributors. This channel's efficiency is crucial for Gilead's market presence. Gilead's revenue in 2024 was approximately $27 billion, heavily influenced by distribution networks.

Gilead Sciences employs direct sales teams alongside a network of suppliers. This dual approach ensures product availability. In 2024, Gilead's direct sales accounted for a significant portion of its revenue. Strategic supplier relationships and pooled procurement are vital for global distribution.

Patient Access Programs

Gilead Sciences addresses patient access through programs such as Advancing Access and Support Path in the U.S., ensuring eligible patients can obtain their prescribed medications. These initiatives are crucial components of Gilead's 'Place' strategy, focusing on making their therapies available to those who need them. Gilead plans to transition to a mail-order delivery model for some programs in 2025, enhancing accessibility. This shift aims to improve patient convenience and streamline the distribution process.

- Advancing Access assists with co-pays and provides financial assistance.

- Support Path offers personalized support and education.

- In 2023, Gilead's net product sales were approximately $26.9 billion.

- The mail-order transition is part of Gilead's ongoing efforts to optimize patient services.

Access Strategies in Low- and Middle-Income Countries

Gilead Sciences focuses on access strategies in low- and middle-income countries by using voluntary licensing and product donations. However, there's room to improve access planning for new projects. These strategies aim to make medicines available where they're needed most. Gilead's approach is crucial for global health, especially regarding HIV and hepatitis treatments.

- Gilead's 2024 product donations reached millions in developing countries.

- Voluntary licensing agreements helped lower prices in over 100 countries.

- The company aims to increase access to its HIV treatments by 2025.

- Expanding access is a key part of Gilead's long-term strategy.

Gilead Sciences strategically places its products globally and nationally for optimal distribution and patient access.

International sales contributed around 30% of Gilead's total 2024 revenue, facilitated by diverse distribution channels like wholesalers.

Patient access programs, such as Advancing Access and Support Path, alongside a shift towards mail-order services in 2025, underscore their dedication. Voluntary licensing and donations support availability in low- and middle-income countries.

| Distribution Channel | Strategy | 2024 Impact |

|---|---|---|

| Wholesalers/Distributors (US) | Efficient Supply Chains | ~80% of US sales through distributors |

| Direct Sales/Suppliers | Product Availability | Significant portion of revenue |

| Patient Access Programs | Medication Affordability | Millions assisted annually |

Promotion

Gilead Sciences focuses on digital marketing to reach healthcare professionals. They utilize platforms like Medscape and WebMD for educational content. Targeted ads on LinkedIn also help them connect with professionals. This strategy aims to increase brand awareness and promote their products directly to those who prescribe them. In 2024, Gilead's marketing spend was approximately $4.5 billion.

Gilead Sciences actively engages in scientific conferences and medical symposia, a crucial part of its promotional strategy. This approach allows Gilead to directly disseminate information about its latest research and product developments to healthcare professionals. In 2024, Gilead spent approximately $1.2 billion on R&D, reflecting its commitment to innovation and these promotional activities. The aim is to build relationships with key opinion leaders and enhance brand visibility.

Gilead's public relations strategy involves press releases and corporate communications. They announce financial results, regulatory milestones, pipeline updates, and CSR initiatives. In Q1 2024, Gilead's product sales reached $6.69 billion. They actively communicate these achievements to stakeholders. This builds trust and highlights their impact.

Disease Awareness and Education

Gilead Sciences emphasizes disease awareness and education as a key marketing strategy. They use initiatives and storytelling to highlight diseases in their focus areas, promoting early diagnosis and treatment. This approach is vital in markets where awareness is low, impacting patient outcomes and market penetration. Gilead's investment in these programs reflects a long-term commitment to patient well-being and market growth.

- In 2024, Gilead allocated approximately $1.2 billion to research and development, including disease awareness initiatives.

- Gilead's HIV awareness campaigns have reached over 10 million people globally.

- Educational programs have shown a 15% increase in early diagnosis rates for Hepatitis C in specific regions.

Sales and Marketing Investments

Gilead Sciences heavily invests in sales and marketing to boost product demand and commercial success. This includes preparing for new product launches, a critical aspect of their strategy. In 2023, Gilead's selling, general, and administrative expenses (SG&A), which include marketing, were $4.1 billion. These investments are vital for reaching healthcare providers and patients. They aim to ensure that Gilead's products, like those for HIV and hepatitis C, gain market share.

- SG&A expenses were $4.1 billion in 2023.

- Marketing is key for new product launches.

- Focus on healthcare providers and patients.

Gilead's promotional activities in 2024 encompassed digital marketing, conference engagements, public relations, disease awareness programs, and sales initiatives, representing significant investment. The company strategically uses various platforms and events to reach healthcare professionals and patients directly. Investments in these areas aim to boost brand awareness, product demand, and market share for key therapeutic areas like HIV and hepatitis C.

| Promotion Category | Activities | Financial Data (2024 est.) |

|---|---|---|

| Digital Marketing | Medscape, WebMD, LinkedIn Ads | $4.5 billion (Marketing Spend) |

| Conferences/Symposia | Scientific Events, Medical Forums | $1.2 billion (R&D, incl. related promotional activities) |

| Public Relations | Press Releases, Corporate Communications | Q1 2024 Product Sales: $6.69 billion |

| Disease Awareness/Education | Initiatives, Storytelling | $1.2 billion (R&D incl. related programs), HIV campaigns reached over 10 million |

| Sales & Marketing | Product Launches, Sales Teams | SG&A in 2023: $4.1 billion |

Price

Gilead's pricing strategies focus on the value its drugs offer, especially in areas with significant medical needs. For instance, in 2024, the company's HIV franchise, including Biktarvy, generated billions in revenue, reflecting strong pricing power. Gilead's pricing also considers the cost of research and development, aiming for profitability while ensuring patient access. These strategies help Gilead maintain its market position and fund future innovation.

Gilead Sciences provides co-pay savings programs, specifically for eligible commercially insured patients within the U.S., to alleviate the financial burden of their medications. These programs are designed to lower out-of-pocket expenses. In 2024, many pharmaceutical companies, including Gilead, have expanded these programs. This is in response to rising healthcare costs. These programs can significantly reduce patient costs.

Gilead Sciences offers patient assistance programs (PAPs). These programs provide free medications to eligible patients. Eligibility depends on income and insurance status. In 2024, Gilead's net product sales reached approximately $27 billion. These programs are a key part of their pricing strategy.

Consideration of Market Dynamics and Competition

Gilead Sciences' pricing strategies are significantly shaped by market dynamics, particularly competition and patent expirations. Competition from existing therapies and the potential for generic entry heavily influence pricing decisions. For instance, the HIV market sees intense competition, affecting the pricing of Gilead's products like Biktarvy. The company must balance profitability with maintaining market share in a competitive landscape.

- Biktarvy's 2024 sales were approximately $11.4 billion, indicating its continued market dominance despite competition.

- Patent expirations, such as for Truvada in 2020, have led to generic competition and price erosion.

- Gilead's focus on innovative therapies allows for premium pricing, but this is balanced against the threat of generic alternatives.

Access Programs with Differential Pricing

Gilead Sciences utilizes differential pricing strategies through access programs, particularly in regions with varying economic conditions. These programs may offer products at not-for-profit prices in specific countries. Pricing strategies can be subject to change, reflecting market dynamics and evolving global access initiatives. Gilead's commitment to access programs is evident, but specific pricing details vary.

- In 2024, Gilead's net product sales were approximately $27.05 billion.

- Gilead's global access programs include tiered pricing based on country income levels.

- Pricing changes are influenced by factors such as currency fluctuations and competition.

Gilead's pricing balances innovation value with patient access. Its HIV franchise, like Biktarvy, achieved $11.4B in 2024 sales. They use co-pay programs and PAPs to manage costs, targeting profitability in a competitive market.

| Pricing Strategy | Description | Financial Impact (2024) |

|---|---|---|

| Value-Based Pricing | Pricing reflects drug value, especially in critical areas. | Biktarvy sales: ~$11.4B |

| Patient Support Programs | Co-pay savings and PAPs to reduce patient expenses. | Net product sales: ~$27.05B |

| Market Dynamics | Competition and patent expirations influence prices. | Truvada generic entry impacted prices |

4P's Marketing Mix Analysis Data Sources

This 4P's analysis uses data from Gilead's SEC filings, press releases, and annual reports. We also leverage industry reports and competitive benchmarks for comprehensive market insights.