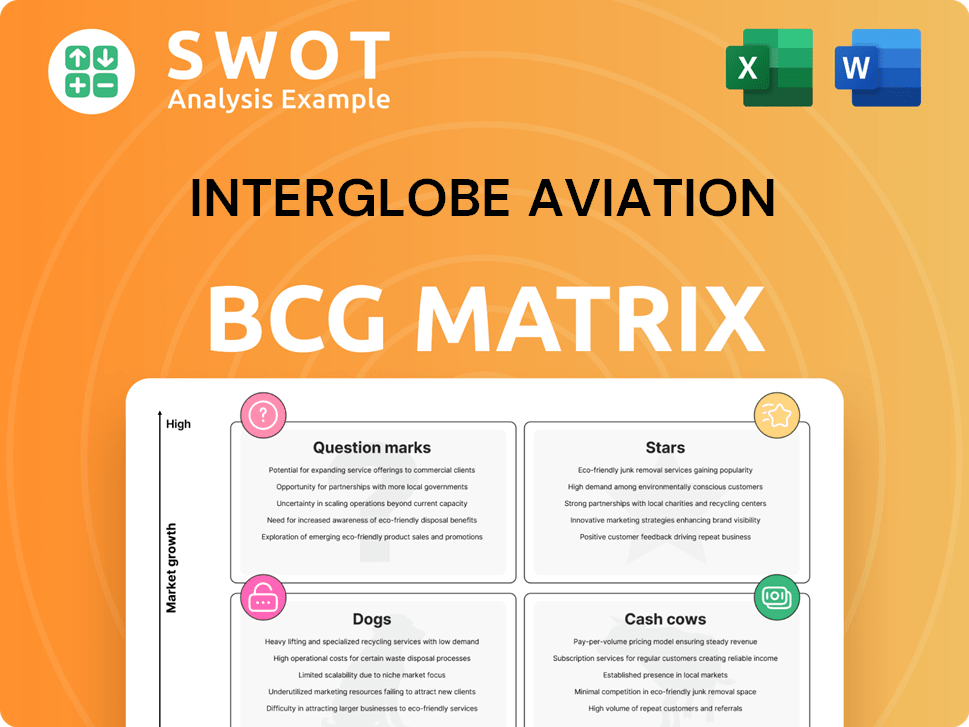

InterGlobe Aviation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterGlobe Aviation Bundle

What is included in the product

InterGlobe Aviation's BCG Matrix analysis reveals strategic investment, holding, or divestment opportunities across its portfolio.

Printable summary optimized for A4 and mobile PDFs, helping to easily share insights.

Delivered as Shown

InterGlobe Aviation BCG Matrix

The InterGlobe Aviation BCG Matrix you see here mirrors the purchased document. Upon buying, you'll receive this complete, strategic analysis report ready for use. It is fully formatted, editable, and immediately available for your needs. No hidden content or different version is waiting for you.

BCG Matrix Template

InterGlobe Aviation, the parent company of IndiGo, faces a dynamic market. Understanding its product portfolio through the BCG Matrix is crucial. Some products may be stars, while others struggle as dogs. Cash cows provide stable revenue, and question marks require strategic decisions. Analyzing these positions helps allocate resources wisely. This is just a glimpse of the analysis.

The full BCG Matrix report offers detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

IndiGo's domestic market share is a significant advantage. As of early 2024, it held over 60% of the Indian market. This dominance shows strong brand recognition and customer loyalty. Its operational strategies have been effective in maintaining this position. To stay ahead, IndiGo must keep innovating.

IndiGo excels in cost leadership, a core strength. They offer competitive fares, attracting budget-conscious travelers. This is due to high aircraft use and operational efficiency. In 2024, IndiGo's cost per available seat km (CASK) was notably low, around INR 3.50, showcasing this advantage.

InterGlobe Aviation, known as IndiGo, excels in operational efficiency. Its strong on-time performance and rapid turnaround times are key. This boosts customer satisfaction and maximizes asset use. IndiGo reported a load factor of 85.2% in 2024, showing effective resource utilization.

Fleet Expansion and Modernization

IndiGo's fleet expansion, fueled by orders for Airbus A321XLR and A350-900 aircraft, is a key growth strategy. This modernization improves fuel efficiency and allows access to new routes. Strategic aircraft deployment is vital for boosting profitability and market reach. IndiGo's financial strength supports this expansion, with ₹9,957.1 crore in cash and cash equivalents as of December 31, 2023.

- A321XLR and A350-900 orders reflect a commitment to growth.

- Fuel efficiency gains are crucial for cost management.

- New routes will enhance IndiGo's market presence.

- Financial health enables strategic investments.

Growing International Presence

IndiGo is significantly boosting its international presence, aiming to capture more global market share. This includes launching routes to Europe and Southeast Asia, which enhances revenue diversity. Successfully navigating the international market hinges on precise route planning, competitive pricing, and robust partnerships. In 2024, international passenger traffic is projected to grow, offering IndiGo substantial opportunities.

- New routes to Europe and Southeast Asia.

- Diversification of revenue streams.

- Careful route planning is crucial.

- Competitive pricing and effective partnerships.

IndiGo's dominance, cost leadership, and efficiency make it a Star. The fleet expansion and international growth strategies fuel its potential. IndiGo's strong financial position supports investments and market expansion.

| Strength | Details | 2024 Data |

|---|---|---|

| Market Share | Leading Domestic Share | Over 60% |

| Cost Efficiency | Low CASK | INR 3.50 |

| Operational Performance | High Load Factor | 85.2% |

Cash Cows

IndiGo's core domestic routes, like those connecting major cities, are its cash cows, providing consistent profits. These routes benefit from established demand, requiring minimal promotional spending. In 2024, IndiGo held over 60% of the domestic market share, highlighting its dominance. Efficient capacity management and smart pricing are key to sustaining high cash flow on these routes.

Ancillary revenue, like baggage fees and in-flight sales, is a key profit driver for IndiGo. These services need little extra investment but greatly increase earnings. In FY24, ancillary revenue per passenger for IndiGo was ₹1,676. Innovating these services can further boost income. IndiGo's focus on ancillaries is a smart move.

IndiGo's codeshare agreements, like those with KLM and Turkish Airlines, are a cash cow. These partnerships boost its network and customer base. In 2024, codeshares contributed significantly to IndiGo's revenue. Expanding these agreements is key for sustained cash flow.

BluChip Loyalty Program

IndiGo's BluChip loyalty program is a cash cow, driving consistent revenue through repeat business. The program fosters strong customer loyalty, crucial for maintaining a stable revenue stream. Enhancing BluChip's offerings can significantly boost customer retention and financial performance. This program ensures a reliable base, underpinning IndiGo's market strength.

- In 2024, IndiGo reported a passenger load factor of approximately 85%.

- BluChip members contribute significantly to the airline's overall revenue.

- Enhancements could include tiered benefits and exclusive deals.

- Customer loyalty programs generally increase customer lifetime value.

Cargo Services

IndiGo CarGo, a cash cow for InterGlobe Aviation, generates consistent revenue with minimal investment. It uses the established flight network and infrastructure, boosting efficiency and profits. This segment's growth is fueled by expanding services to new areas and sectors. IndiGo's cargo operations are key to its financial stability.

- In FY24, IndiGo's cargo revenue was a significant contributor to its overall earnings.

- The airline's extensive route network supports efficient cargo transport, reducing costs.

- Expansion into specialized cargo, like pharmaceuticals, can increase revenue.

IndiGo's core domestic routes are cash cows. They offer consistent profits due to strong demand and minimal promotional spending. In 2024, IndiGo held over 60% of the domestic market share, showing dominance. Efficient management and smart pricing are key to sustained high cash flow.

| Category | Details | Financial Impact |

|---|---|---|

| Market Share (2024) | Domestic market share | Over 60% |

| Ancillary Revenue (FY24) | Per passenger | ₹1,676 |

| Load Factor (2024) | Passenger load factor | Approximately 85% |

Dogs

Older aircraft in IndiGo's fleet, often less fuel-efficient, can be classified as dogs. These planes face higher operating costs, impacting profitability. In 2024, IndiGo aimed to retire older A320ceo aircraft, reducing operational expenses. Strategic fleet renewal, like introducing the A321neo, is vital.

Some international routes of InterGlobe Aviation, or IndiGo, might be categorized as "dogs" if they show low passenger numbers and high operational expenses. These routes consume resources without significantly boosting profitability. For instance, in 2024, some routes saw passenger load factors below 60%, indicating potential underperformance. To improve resource allocation, evaluating and possibly ceasing these routes is essential. This strategic move could enhance overall financial performance and operational efficiency.

Routes with fierce competition, like those to Dubai and Singapore, are considered dogs for IndiGo. These face strong rivals, leading to price wars and lower profits. Maintaining market share on these routes demands heavy spending on promotion and marketing. For instance, in 2024, routes with strong competition saw profit margins shrink by 10%.

Unsuccessful Ancillary Services

Unsuccessful ancillary services at InterGlobe Aviation (IndiGo) can be categorized as "dogs" within a BCG matrix. These services, failing to generate substantial revenue or facing high operational costs, become a drain on resources. In 2024, IndiGo reported a 15% increase in ancillary revenue, but not all services performed equally. Such services require careful evaluation and potential discontinuation to boost profitability.

- Ancillary revenue growth was not uniform across all services.

- High operational costs can offset revenue gains.

- Resource allocation needs optimization.

- Discontinuation of underperforming services is a strategy.

Legacy IT Systems

Legacy IT systems at InterGlobe Aviation can be classified as dogs, as they impede operational efficiency and customer service. These outdated systems lead to high maintenance expenses and restrict the airline's ability to innovate and compete effectively in the market. In 2024, IT maintenance costs accounted for 12% of the airline's operational expenditure. Modernizing IT infrastructure is crucial for enhancing efficiency and improving customer satisfaction.

- High maintenance costs: 12% of operational expenditure in 2024.

- Reduced innovation capabilities.

- Impact on customer service quality.

- Hindrance to competitive advantage.

Dogs in InterGlobe Aviation's BCG matrix include older aircraft, underperforming international routes, and services with low profits. Routes facing heavy competition, like those to Dubai, also fall into this category. Legacy IT systems also contribute to the "dog" status due to their operational inefficiencies.

| Category | Issue | 2024 Data |

|---|---|---|

| Aircraft | Older A320ceos | Fleet retirement aim |

| Routes | Low passenger load | Below 60% on some routes |

| Competition | Price wars | Profit margins down 10% |

| Ancillary | Inefficient services | Ancillary revenue grew 15% |

| IT Systems | Outdated tech | IT costs: 12% of operational exp |

Question Marks

IndiGo's foray into long-haul international routes is a "question mark." These plans demand considerable investment and pose significant risks. Success hinges on strategic route planning, competitive pricing, and effective marketing. Recent data shows international expansion is up; however, profitability margins remain under pressure. Partnerships are key to risk mitigation.

IndiGo's business class launch is a question mark, diverging from its low-cost roots. Success hinges on attracting premium travelers while maintaining cost efficiency. In 2024, IndiGo's market share was over 60%, but premium service viability needs strong demand. Careful marketing and research are crucial for this new service's potential.

Entering new international destinations for InterGlobe Aviation (IndiGo) fits the question mark category in a BCG matrix. These routes, like those launched to Nairobi in 2024, have limited brand recognition and uncertain demand. Significant investments in marketing and promotion are necessary, as seen with IndiGo's increased advertising spend in new markets. Thorough market research and strategic partnerships, such as code-sharing agreements, are crucial for success. IndiGo's international expansion saw a 25% capacity increase in Q3 2024, reflecting its aggressive growth strategy.

Sustainability Initiatives

Sustainability initiatives at InterGlobe Aviation, like reducing carbon emissions, are a question mark in the BCG matrix. The return on investments is uncertain, though they may improve the airline's reputation. These initiatives also involve extra costs, making balancing sustainability and financial performance key. In 2024, airlines globally are investing heavily in sustainable aviation fuel (SAF), which can cost up to five times more than conventional jet fuel.

- SAF adoption is projected to grow, but its high cost remains a challenge.

- InterGlobe Aviation's environmental investments aim to meet increasing regulatory demands.

- The financial impact of sustainability initiatives requires careful evaluation.

- Consumer preference for eco-friendly travel is a growing factor.

Regional Connectivity Expansion

Regional connectivity expansion, especially under the UDAN scheme, places InterGlobe Aviation in the question mark quadrant of the BCG matrix. These routes serve smaller cities, often with uncertain demand, making success challenging. The financial viability hinges on attracting enough passengers and effectively managing costs. In 2024, the UDAN scheme aimed to operationalize 400 routes and 77 airports, but actual performance may vary. Government subsidies and strategic alliances are critical to mitigate risks.

- UDAN Scheme: Aims to connect underserved regions.

- Demand Uncertainty: Smaller cities have variable passenger traffic.

- Cost Efficiency: Essential for profitability on these routes.

- Government Support: Subsidies and partnerships are crucial.

InterGlobe's "question mark" strategies involve high-risk, high-reward ventures. These include launching new international routes and premium services. Success depends on careful planning and market adaptation. As of Q3 2024, IndiGo increased international capacity by 25%

| Aspect | Details | Impact |

|---|---|---|

| New Routes | Nairobi launch | Limited Brand Recognition |

| Premium Services | Business Class | Cost Efficiency is Crucial |

| Sustainability | SAF adoption | High Costs |

BCG Matrix Data Sources

This InterGlobe Aviation BCG Matrix uses financial statements, market analysis, and industry insights to provide accurate strategic positioning.