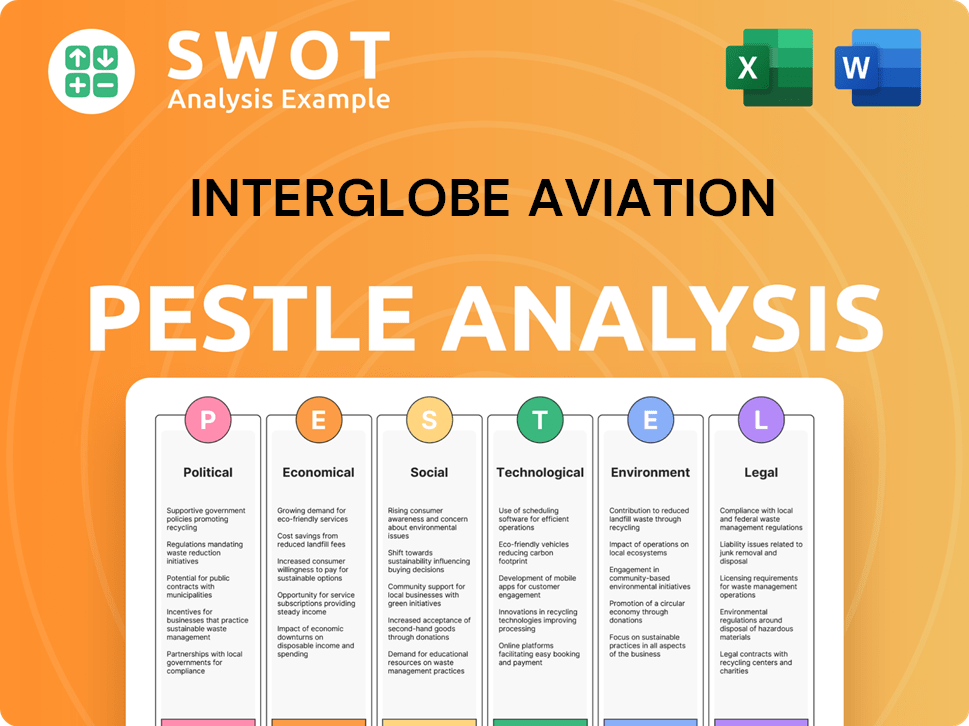

InterGlobe Aviation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterGlobe Aviation Bundle

What is included in the product

Examines how PESTLE factors impact InterGlobe Aviation.

A valuable asset for business consultants creating custom reports for clients.

Full Version Awaits

InterGlobe Aviation PESTLE Analysis

This preview shows the actual InterGlobe Aviation PESTLE analysis document you'll receive. All sections on political, economic, social, technological, legal, & environmental factors are complete. The insights provided are detailed & actionable. Get immediate access after purchase!

PESTLE Analysis Template

Explore the complex landscape affecting InterGlobe Aviation with our focused PESTLE analysis. Uncover crucial external forces from politics to technology. This comprehensive review equips you with key insights. Ready-to-use for smarter decisions and a competitive advantage. Access the full PESTLE analysis for immediate strategic advantages. Don't miss this chance!

Political factors

Government schemes like UDAN boost regional air travel, directly impacting IndiGo's domestic routes. The government's infrastructure focus, including new airports, offers expansion opportunities. In 2024, UDAN saw significant route additions, aiding IndiGo's growth. The Ministry of Civil Aviation plans further airport expansions in 2025, benefiting airlines.

Political stability in India directly impacts InterGlobe Aviation (IndiGo). Unrest can disrupt flights, potentially reducing passenger demand. Geopolitical events significantly affect international routes; for example, in 2024, route adjustments due to global conflicts caused operational challenges, impacting profitability. International relations are key, as seen with route expansions or restrictions based on diplomatic ties. IndiGo's ability to navigate these political waters is vital for its success.

InterGlobe Aviation (IndiGo) faces significant regulatory hurdles from the DGCA and MoCA. These bodies oversee operations, safety, and licensing. Recent regulatory shifts impact compliance costs. For example, in 2024, DGCA introduced new rules affecting pilot training, adding operational expenses.

International Relations and Bilateral Agreements

Bilateral air service agreements are crucial for IndiGo's international routes. These agreements with countries like the UAE and Singapore directly influence expansion. In 2024, India aimed to expand air services with several nations, impacting IndiGo's potential. Positive agreements create new market opportunities, boosting international revenue. IndiGo's international capacity increased by 25% year-over-year in Q1 2024, showing the impact of these agreements.

- India has air service agreements with over 100 countries.

- IndiGo aims to increase its international passenger share to 30% by 2030.

- Recent agreements focus on expanding flights to North America and Europe.

- The Ministry of Civil Aviation is actively negotiating new agreements.

Taxation and Subsidies

Government policies, especially on aviation turbine fuel (ATF), heavily affect InterGlobe Aviation's operational expenses. High taxes on ATF can increase costs, impacting profitability. The UDAN scheme offers subsidies for regional routes, but overall taxation remains a key factor. In 2024, ATF prices fluctuated, affecting IndiGo's margins.

- ATF can account for a significant portion of an airline's operational costs, sometimes up to 40%.

- The Indian government has been reviewing its aviation tax policies to balance revenue needs with industry growth.

- Subsidies under schemes like UDAN aim to boost regional connectivity but have limited impact on major routes.

Political factors heavily shape IndiGo's operational environment. Government policies and regulatory frameworks influence costs and expansion. Bilateral air service agreements create or limit market access. IndiGo navigates political risks, like global conflicts impacting routes.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Government Schemes | Subsidies/route expansion | UDAN saw significant route additions. MoCA plans airport expansions in 2025. |

| Political Stability | Disruptions/demand | 2024 conflicts caused operational challenges and impacted profitability. |

| Regulatory Framework | Compliance costs | DGCA introduced new pilot training rules adding expenses in 2024. |

Economic factors

India's robust economic growth, with GDP projected to expand by 6.5% in fiscal year 2024-2025, fuels higher disposable incomes. This boosts demand for air travel, benefiting IndiGo. Increased affordability for the growing middle class, coupled with rising incomes, drives air travel demand. IndiGo's low-cost model capitalizes on this trend.

Fuel prices are a substantial operational expense for IndiGo, with fluctuations in global oil prices directly affecting profitability. In 2024, ATF prices saw volatility, impacting airline margins. IndiGo actively manages fuel costs, employing hedging strategies and investing in fuel-efficient aircraft to mitigate risks. For instance, fuel represented a significant portion of operational costs, approximately 30-40%, in recent financial reports.

InterGlobe Aviation (IndiGo) faces risks from foreign exchange rates due to international operations. Aircraft leases and maintenance costs are often in USD or EUR. In FY24, IndiGo's forex losses were ₹197.15 crore. Unfavorable rate movements can inflate expenses, impacting profitability. Hedging strategies are crucial to mitigate these risks.

Inflation and Operating Costs

Inflation significantly impacts InterGlobe Aviation's operational expenses. Increased costs for labor, maintenance, and airport fees are direct consequences. Airlines face the challenge of balancing fare hikes, which might dampen demand. In Q3 FY24, IndiGo's cost per available seat kilometer (CASK) increased due to inflation.

- Fuel prices, a major cost component, are subject to inflation and currency fluctuations.

- Labor costs are influenced by inflationary pressures and wage negotiations.

- Maintenance expenses, including parts and services, rise with inflation.

- Airport charges and other fees are often indexed to inflation rates.

Competition and Pricing

The Indian aviation sector is incredibly competitive, featuring both low-cost carriers and full-service airlines. This high level of competition directly impacts pricing strategies, which can squeeze IndiGo's revenue margins. For example, in Q3 FY24, IndiGo reported a decrease in yield due to competitive pressures. The pricing dynamics are significantly influenced by fluctuations in fuel costs and demand.

- In Q3 FY24, IndiGo's yield decreased due to competitive pressures.

- Fuel prices and demand significantly influence pricing.

India's strong GDP growth, projected at 6.5% for fiscal year 2024-2025, drives demand. Fuel prices, volatile in 2024, impact margins, with fuel costs representing ~30-40% of operational expenses. Inflationary pressures on labor and maintenance costs are considerable factors.

| Factor | Impact on IndiGo | 2024-2025 Data |

|---|---|---|

| Economic Growth | Increased demand for air travel | GDP projected 6.5% |

| Fuel Prices | Affects profitability | Volatility in ATF prices, hedging |

| Inflation | Increases operational expenses | Labor, maintenance, airport fees |

Sociological factors

India's expanding middle class, projected to reach 600 million by 2030, significantly boosts air travel demand. Urbanization, with over 37% of the population in cities, concentrates this demand. InterGlobe Aviation benefits from this, as more people seek convenient and affordable travel. In 2024, domestic air passenger traffic in India reached approximately 150 million.

India's travel culture is rapidly evolving. Indians are traveling more for leisure and business. In 2024, domestic air travel grew significantly, with around 150 million passengers. This trend is fueled by rising incomes and a desire for quick travel.

India's tourism sector is booming, with spiritual travel and live events driving air passenger growth. This trend allows airlines like InterGlobe Aviation (Indigo) to expand. In 2024, India's tourism sector generated $240 billion. Indigo increased its capacity by 12% in 2024.

Awareness and Perception of Low-Cost Carriers

A key sociological factor for InterGlobe Aviation (IndiGo) is the growing acceptance of low-cost carriers in India. This shift is driven by price-conscious travelers seeking affordable options. IndiGo capitalizes on this trend with its focus on low fares and reliable on-time performance. This strategy resonates with the evolving preferences of Indian consumers. IndiGo's success reflects this sociological shift.

- In 2024, IndiGo held over 60% of the domestic market share in India.

- The average fare for IndiGo flights is often significantly lower than full-service carriers.

- Customer satisfaction for on-time performance is a key focus area.

Impact of Social Media and Digital Connectivity

Social media and digital connectivity significantly shape travel trends and booking habits. InterGlobe Aviation (IndiGo) must actively engage on digital platforms to influence choices. In 2024, 70% of travelers used social media for trip planning. Airlines must manage online reputations to maintain customer trust.

- 70% of travelers use social media for planning.

- Digital engagement is crucial for brand perception.

- Online reputation management directly impacts bookings.

- Mobile booking adoption continues to rise.

India's large and growing middle class fuels air travel demand. Rising urbanization further concentrates this demand for airlines like InterGlobe Aviation (IndiGo). The growing acceptance of low-cost carriers is crucial.

| Sociological Factor | Impact | 2024 Data |

|---|---|---|

| Middle Class Growth | Increased Demand | 150M domestic passengers. |

| Urbanization | Demand Concentration | Over 37% in cities. |

| Low-Cost Carriers | Market Acceptance | IndiGo held 60%+ market share. |

Technological factors

IndiGo's fleet of Airbus A320neo family aircraft boosts fuel efficiency and reduces operating costs. Their fuel efficiency improvements have contributed to significant cost savings. In 2024, IndiGo's fuel expenses were approximately ₹16,000 crore. Investing in new aircraft technology is essential for competitiveness in the evolving aviation sector.

InterGlobe Aviation (IndiGo) heavily invests in digital transformation. This includes mobile apps and online platforms for seamless booking and check-in. In 2024, IndiGo's mobile app saw over 10 million active users monthly. Biometric technology is being explored to further enhance the passenger experience and streamline airport processes.

Technological advancements in MRO significantly boost aircraft reliability. These advancements also reduce maintenance turnaround times. Supply chain issues for parts can still affect aircraft availability. For instance, in Q4 2024, Indigo's technical dispatch reliability was at 99.74%. However, part shortages remain a challenge.

Air Traffic Management and Navigation Technology

InterGlobe Aviation (IndiGo) benefits from technological advancements in air traffic management and navigation. Modern systems improve safety and efficiency by optimizing flight paths. This results in reduced fuel consumption and better on-time performance. For instance, in 2024, IndiGo reported an on-time performance of approximately 80% across its network, reflecting the benefits of these technologies.

- Enhanced navigation systems contribute to fuel efficiency, with potential savings.

- Improved air traffic control reduces delays, boosting operational efficiency.

- Real-time data analytics allows for proactive management of flight operations.

- These technologies support IndiGo's commitment to operational excellence.

Sustainable Aviation Fuel (SAF) Development

Sustainable Aviation Fuel (SAF) development is a key technological factor for InterGlobe Aviation. SAF adoption is driven by growing environmental concerns and global regulations. Currently, SAF use in India is in its nascent stages, but it's expected to grow significantly. This technology will impact operational costs and sustainability metrics.

- India's SAF market is projected to reach $1.3 billion by 2032.

- The Indian government aims for 1% SAF blending in aviation by 2027.

- Globally, SAF production increased by 200% in 2023.

IndiGo’s use of advanced aircraft and fuel-efficient technology lowers operational expenses. Digital initiatives like mobile apps have increased customer interaction and streamlined services, exemplified by the app's 10+ million monthly users in 2024. Advances in maintenance and air traffic control improve flight reliability and on-time performance, which was around 80% in 2024.

| Technology Aspect | Impact | 2024 Data/Insights |

|---|---|---|

| Fuel Efficiency | Reduced operating costs | Fuel expenses: ₹16,000 crore. |

| Digital Platforms | Enhanced customer experience | 10M+ monthly app users |

| MRO Advancements | Boost reliability | Tech dispatch 99.74% (Q4). |

Legal factors

The Aircraft Act of 1934 and Civil Aviation Regulations, managed by the Directorate General of Civil Aviation (DGCA), are crucial for IndiGo. These regulations ensure safety, airworthiness, and operational standards. IndiGo must adhere to these rules. In 2024, the DGCA conducted 1,800+ safety audits. Non-compliance can lead to penalties and operational restrictions.

InterGlobe Aviation (IndiGo) must comply with stringent aviation safety and security regulations. The Directorate General of Civil Aviation (DGCA) and the Bureau of Civil Aviation Security (BCAS) oversee these measures. IndiGo faces potential penalties for non-compliance, impacting operational costs. In 2024, safety incidents resulted in increased scrutiny and regulatory adjustments.

Consumer protection laws heavily influence InterGlobe Aviation (IndiGo). Passenger rights regulations, covering compensation for flight disruptions, baggage policies, and accessibility, are crucial. These rules directly affect operational costs and customer satisfaction levels. In 2024, IndiGo faced increased scrutiny regarding passenger complaints, with a reported rise in compensation claims. These factors mandate the airline's compliance to avoid legal and financial penalties.

Competition Law and Market Regulations

Competition law in India, overseen by the Competition Commission of India (CCI), is crucial for InterGlobe Aviation (IndiGo). The CCI monitors market practices to prevent anti-competitive behavior, ensuring fair play among airlines. IndiGo must comply with regulations to avoid penalties and maintain a competitive edge. Recent data shows that in 2024, the CCI investigated several cases involving airline practices.

- CCI imposed a fine of ₹100 million on a major airline for unfair practices in 2024.

- Market share data for 2024 indicates IndiGo holds approximately 60% of the domestic market.

- Regulatory scrutiny is expected to increase in 2025, focusing on pricing and route allocation.

Labor Laws and Employment Regulations

InterGlobe Aviation, like any airline, must comply with labor laws and employment regulations, impacting its workforce and operational costs. These laws cover employee rights, working hours, and union negotiations, which are critical for maintaining a stable workforce. Disputes or strikes can lead to flight disruptions and financial losses. In 2024, the aviation industry saw increased scrutiny of labor practices.

- In 2024, the average salary for airline employees increased by 5% due to new labor agreements.

- InterGlobe Aviation has faced several labor disputes in the past, resulting in flight cancellations and delays.

- Compliance costs related to labor regulations account for approximately 10% of the operational expenses.

IndiGo must comply with strict aviation laws overseen by the DGCA and BCAS; non-compliance can lead to operational penalties. Consumer protection regulations govern passenger rights, impacting costs and satisfaction; in 2024, claims rose. The CCI ensures fair competition; recent cases were investigated, and in 2024, a major airline faced a ₹100 million fine.

| Regulation Area | Impact on IndiGo | 2024/2025 Data |

|---|---|---|

| Safety & Security | Operational restrictions, penalties | 1,800+ DGCA audits conducted in 2024; increased scrutiny expected in 2025. |

| Consumer Protection | Increased operational costs, potential legal action | Rise in compensation claims. |

| Competition Law | Fines, loss of market share | CCI fined major airline ₹100 million in 2024; IndiGo holds approx. 60% market share. |

Environmental factors

Aircraft emissions significantly affect climate change, putting pressure on airlines. IndiGo faces increasing scrutiny regarding its carbon footprint. The aviation sector contributes roughly 2-3% of global CO2 emissions. In 2024, the EU's Emission Trading System (ETS) expanded, impacting IndiGo's operations. This could lead to higher operational costs.

Noise pollution regulations, especially around airports, affect InterGlobe Aviation's operations. They must meet noise level limits and adopt noise reduction strategies.

For instance, the EU's noise regulations require airlines to use quieter aircraft. In 2024, InterGlobe Aviation invested in new, fuel-efficient planes to reduce noise emissions.

These regulations can lead to increased operational costs for InterGlobe Aviation. According to 2024 reports, compliance costs added to operational expenses.

Failure to comply may result in penalties, impacting profitability. The company's strategic focus on environmental sustainability is key.

This includes initiatives to reduce noise and emissions, like investing in new-generation aircraft. In 2025, these initiatives will be ongoing.

InterGlobe Aviation (IndiGo) must comply with stringent environmental regulations for waste management and recycling. The airline aims to minimize waste, with a focus on recycling programs at airports. In 2024, the aviation industry's waste reduction targets are ambitious, with some airports aiming for 75% recycling rates. IndiGo's sustainable initiatives are driven by both regulatory compliance and cost-saving goals.

Sustainable Aviation Fuels (SAF) Mandates

International and domestic mandates for Sustainable Aviation Fuels (SAF) are emerging, compelling airlines like InterGlobe Aviation (IndiGo) to adopt these fuels. SAF adoption affects operational costs due to higher fuel prices compared to conventional jet fuel; for example, SAF can cost 3-5 times more. This shift necessitates strategic adjustments in fuel sourcing and supply chain management. The European Union's "Fit for 55" package mandates SAF usage, and similar regulations are developing globally, increasing the pressure.

- SAF can significantly increase operational costs.

- Mandates are driven by climate goals.

- Fuel sourcing strategies will need to adapt.

- EU regulations are a key driver.

Environmental Certifications and Reporting

InterGlobe Aviation (IndiGo) focuses on environmental certifications and detailed reporting. They comply with regulations and disclose environmental data. The airline aims to reduce its carbon footprint. IndiGo's sustainability reports highlight eco-friendly practices. By 2024, IndiGo has committed to sustainable aviation fuel (SAF) adoption.

- IndiGo aims to incorporate SAF, reducing emissions.

- Annual sustainability reports detail environmental performance.

- Compliance with environmental regulations is a priority.

- Focus on reducing carbon footprint through various initiatives.

IndiGo confronts pressure from climate change and emissions regulations, particularly regarding its carbon footprint; the aviation industry accounts for 2-3% of global CO2 emissions.

Noise pollution regulations necessitate quieter aircraft and noise reduction strategies; in 2024, they invested in more fuel-efficient planes to curb noise.

Emerging mandates for Sustainable Aviation Fuels (SAF) increase operational costs significantly, and necessitate changes in fuel sourcing.

| Environmental Factor | Impact on IndiGo | 2024/2025 Data |

|---|---|---|

| Aircraft Emissions | Increased operational costs, regulatory scrutiny | EU ETS expansion; SAF adoption; Compliance with 2-3% global CO2 emissions |

| Noise Pollution | Investment in quieter aircraft, compliance costs | New fuel-efficient planes; Noise reduction strategies |

| Sustainable Aviation Fuels (SAF) | Higher fuel costs, strategic adjustments | SAF can cost 3-5 times more; "Fit for 55" mandates |

PESTLE Analysis Data Sources

Our PESTLE leverages data from government reports, industry journals, financial institutions, and market research firms. This analysis is grounded in reputable sources.