GoodRx Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoodRx Bundle

What is included in the product

Tailored analysis for GoodRx's product portfolio across the BCG Matrix.

GoodRx's BCG Matrix offers a clear, printable summary, optimized for PDF and easy sharing.

Preview = Final Product

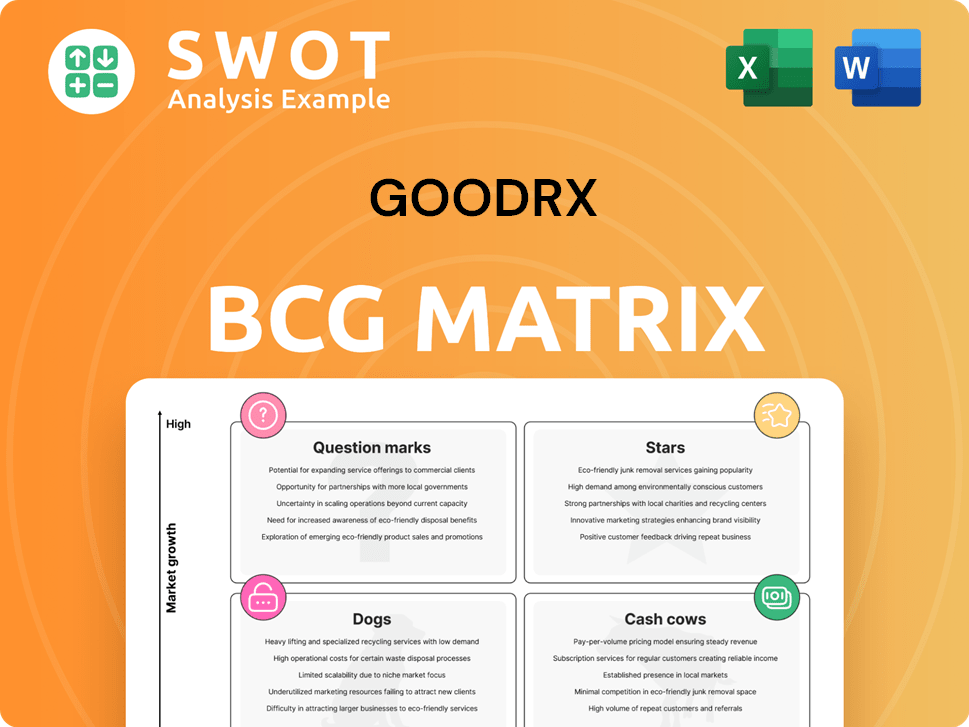

GoodRx BCG Matrix

The BCG Matrix you see is identical to the one you'll download. This complete, ready-to-use report offers immediate strategic insights, designed for professional presentations and business planning. There are no edits needed; it’s ready for immediate use. This version is suitable for various business needs.

BCG Matrix Template

GoodRx's BCG Matrix helps illuminate its product portfolio's strengths and weaknesses.

It categorizes offerings like prescription discounts into Stars, Cash Cows, Dogs, or Question Marks.

This framework reveals growth potential, resource needs, and areas to divest.

Understand market share and growth rates to make informed decisions.

The sneak peek hints at strategic insights; purchase the full BCG Matrix for a complete analysis and data-backed recommendations!

Stars

GoodRx's pharma manufacturer solutions are a "Star" in its BCG matrix. Revenue in this segment is expected to rise by 20% in 2025. They connect brands with patients through co-pay cards and cash prices. Brand partnerships grew from 150 in 2023 to over 200 in 2024.

The Integrated Savings Program (ISP) is a crucial growth engine for GoodRx. It tackles coverage gaps, providing savings on generic and specialty drugs. GoodRx is extending ISP to non-covered brands via its ISP wrap program. This benefits consumers, healthcare pros, PBMs, and pharma manufacturers. The ISP helps patients manage rising out-of-pocket medication costs. GoodRx reported over $1 billion in savings for consumers in 2023.

GoodRx's e-commerce platform, marked by online payment options and partnerships, is a growth area. This enhances the prescription process, offering inventory checks and digital payments. The e-commerce channel launch with Opill expands into the OTC market. In 2024, GoodRx's revenue reached $769.7 million. This platform is set to boost user engagement.

Prescription Discount Segment Leadership

GoodRx shines brightly as a leader in the prescription discount arena. They saw a 3% year-over-year growth in Q4 2024, solidifying their dominance. This growth boosts their market share, making them the top choice for medication savings. In 2024, nearly 30 million users saved around $17 billion using GoodRx.

- Market share growth in 2024 indicates strong consumer preference.

- 3% growth in Q4 2024 highlights ongoing success.

- Nearly $17 billion saved in 2024 showcases substantial impact.

- Almost 30 million users utilized GoodRx in 2024.

Strategic Partnerships

GoodRx's strategic partnerships shine as stars in its BCG matrix. Collaborations with Novo Nordisk and Boehringer Ingelheim provide discounts on medications like Ozempic and adalimumab-adbm, tackling affordability challenges. These alliances decrease the time patients wait to start treatment. Partnerships with pharmacies enhance their profitability, with a reported over 20% increase per script by January 2025 compared to the previous year.

- Partnerships with Novo Nordisk and Boehringer Ingelheim offer discounts.

- These partnerships tackle affordability issues.

- They also reduce time-to-therapy delays.

- Pharmacy partnerships boost profitability.

GoodRx's "Stars" demonstrate strong growth. Pharma manufacturer solutions are set for 20% revenue rise in 2025. Brand partnerships increased to over 200 in 2024.

| Metric | Data |

|---|---|

| 2024 Revenue | $769.7M |

| Users Saving in 2024 | Nearly 30M |

| Savings in 2024 | ~$17B |

Cash Cows

Prescription transactions are a cash cow for GoodRx. In 2024, they brought in $577.5 million, a 5% rise. This growth was fueled by a 7% increase in monthly active consumers. Price comparisons and discount coupons are the core revenue drivers.

GoodRx's strong website and mobile app traffic solidify its "Cash Cow" status. In Q3 2024, the platform saw 6.5 million average monthly visitors. This represents a 400,000 increase year-over-year, demonstrating sustained user engagement. The user-friendly design boosts repeat visits.

GoodRx's brand is well-recognized in the prescription savings sector. Since 2011, the platform has helped users save over $85 billion. Its strong reputation fosters customer loyalty and attracts new users. This contributes to its classification as a cash cow.

Data Analytics and Pricing Information

GoodRx's strength lies in data analytics, specifically its ability to gather and analyze extensive pricing data from pharmacies. This capability enables GoodRx to offer consumers accurate, current information for informed decisions. The platform's data aggregation is impressive, compiling over 320 billion price quotes daily, ensuring broad market coverage.

- Data-Driven Pricing: GoodRx uses data to negotiate prices.

- Real-time Updates: Pricing data is updated frequently.

- Market Coverage: It covers a vast number of pharmacies.

- Informative Decisions: Helps users make informed decisions.

Strong Liquidity Position

GoodRx's strong liquidity is a key strength in its BCG Matrix profile. Its current ratio of 5.48 showcases its ability to cover short-term debts. The company's balance sheet is solid, containing $448.3 million in cash and equivalents. This financial health supports investments and helps navigate market fluctuations.

- Current Ratio: 5.48 (demonstrates ability to meet short-term obligations)

- Cash and Cash Equivalents: $448.3 million (provides financial stability)

GoodRx's prescription transactions are cash cows, generating substantial revenue. In 2024, revenue reached $577.5 million, a 5% increase driven by a 7% rise in active consumers. The platform's robust user base and strong brand recognition solidify its position.

The company has a strong liquidity position. In Q3 2024, GoodRx's platform had 6.5 million average monthly visitors and a current ratio of 5.48. Its data-driven approach enables it to provide accurate, current pricing info.

| Metric | Value (2024) | Details |

|---|---|---|

| Revenue from Prescription Transactions | $577.5 million | 5% increase |

| Monthly Active Consumers | 7% increase | Yearly growth |

| Average Monthly Visitors (Q3) | 6.5 million | 400,000 increase YoY |

Dogs

GoodRx's subscription revenue faced a setback with the Kroger Savings Club partnership's end. This collaboration brought in $9.0 million in 2023, decreasing to $1.1 million in 2024 before its termination, impacting overall figures. The reliance on such partnerships for growth proved risky, as their loss directly affected subscription income. This situation underscores the need for diversified revenue streams.

GoodRx's legacy subscription revenue dipped by 8% in 2024, landing at $86.5 million, largely due to the Kroger Savings Club shutdown. This subscriber drop signals a crucial need for GoodRx to revamp its subscription offerings. The company must strategize to attract and retain users to bolster this income source. Focusing on innovation is key for future growth.

GoodRx's dependence on Pharmacy Benefit Managers (PBMs) is a key vulnerability. Revenue growth is affected by negotiations with PBMs about pharmacy reimbursements. Changes in reimbursement models could decrease the value of discount programs. In 2024, PBMs' influence continues to reshape drug pricing dynamics. This impacts GoodRx's competitive advantage.

Pharmacy Store Closures

Retail pharmacy closures, like Rite Aid's, significantly affect GoodRx's business. GoodRx expects a $5 million revenue hit due to these closures. This trend underscores the risk of depending on physical pharmacies for prescriptions. Closures reduce the number of locations where GoodRx discounts can be used, impacting transaction volume and revenue.

- Rite Aid's 2024 closures are a key factor.

- GoodRx's revenue is directly affected by pharmacy availability.

- The reliance on brick-and-mortar pharmacies poses a risk.

- Transaction volume is negatively impacted.

Market Saturation in Prescription Discounts

The prescription discount market is highly saturated, intensifying competition for GoodRx. Alternative discount cards and insurance options put pressure on GoodRx's market share. GoodRx needs to innovate to differentiate itself and retain its customer base. The company's ability to adapt to market changes is crucial for its long-term success.

- Competition from companies like SingleCare and Honey are rising.

- GoodRx's revenue growth slowed to 8% in 2023.

- Market saturation may decrease the overall profitability.

- Continuous innovation in pricing and services is essential.

GoodRx's "Dogs" face challenges in a competitive market. They experience low market share and growth. Strategies should focus on either shrinking or divesting "Dogs" to reallocate resources.

| Category | Description | Impact on GoodRx |

|---|---|---|

| Market Position | Low growth; low market share | Requires strategic attention |

| Strategies | Divest or shrink operations | Focus resources on better opportunities |

| Examples | Certain older subscription tiers | May drag on overall profitability |

Question Marks

GoodRx's telehealth services are positioned as a Question Mark in its BCG Matrix. The telehealth market saw a boom during the pandemic, but growth is now stabilizing. GoodRx must innovate to stand out in this competitive area. In 2024, the telehealth market is projected to reach $67.9 billion.

GoodRx sees growth in the over-the-counter (OTC) market. Their partnership with Opill is a starting point. To grow, they must bring in more manufacturers to sell products. More OTC listings could boost customer numbers and diversify income. In 2024, GoodRx's revenue was about $750 million.

Expanding the Integrated Savings Program (ISP) to non-covered brand medications presents a significant opportunity for GoodRx. This "ISP wrap" program aims to address coverage gaps, benefiting consumers, healthcare professionals, and pharma manufacturers. Success hinges on effective negotiations with pharma manufacturers and PBMs. In 2024, GoodRx's revenue was $750 million, demonstrating its market presence.

New E-commerce Initiatives

GoodRx's new e-commerce platform is a question mark in its BCG Matrix. Success hinges on broadening pharmacy and healthcare provider partnerships. The platform must prove it streamlines prescription purchases while boosting pharmacy profits.

- In 2024, GoodRx's revenue was $773.7 million.

- The company reported 5.9 million monthly active consumers.

- GoodRx's digital health market is valued at $1.2 billion.

- The platform's adoption rate will determine its future classification.

International Expansion

International expansion represents a significant opportunity for GoodRx to boost its growth. This strategy, however, involves navigating diverse regulatory landscapes and healthcare systems, which presents inherent complexities. The company must carefully evaluate the potential benefits and challenges before allocating substantial resources. GoodRx needs to conduct thorough market research and analysis to identify the most promising international markets and entry strategies.

- GoodRx's revenue in 2023 was $786.3 million, showing a 9% year-over-year growth.

- International expansion could tap into markets with potentially higher prescription drug costs.

- Regulatory hurdles, such as differing drug approval processes, pose significant challenges.

- Strategic partnerships with local pharmacies or healthcare providers could facilitate market entry.

GoodRx faces challenges with several "Question Mark" initiatives, like telehealth and the new e-commerce platform. These segments require substantial investment and strategic execution for growth. The success of these ventures will significantly impact GoodRx's overall performance.

| Initiative | Market Status | GoodRx Strategy |

|---|---|---|

| Telehealth | Growing, then stabilizing | Innovate to compete |

| E-commerce | New platform | Expand partnerships |

| OTC Market | Expanding | Add more manufacturers |

BCG Matrix Data Sources

GoodRx's BCG Matrix utilizes pricing data, prescription trends, market share info, & financial reports from public and proprietary sources.