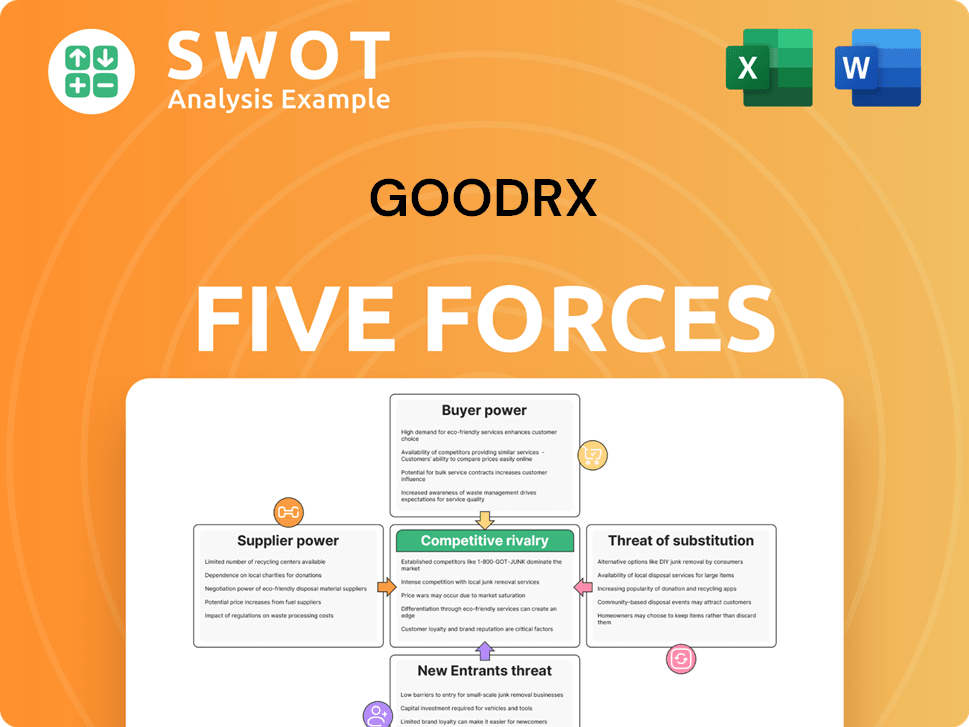

GoodRx Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoodRx Bundle

What is included in the product

Analyzes GoodRx's competitive landscape, including threats, substitutes, and market dynamics.

Identify and react quickly to shifting industry pressures with built-in "what-if" analysis.

What You See Is What You Get

GoodRx Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It's a full Porter's Five Forces analysis of GoodRx, covering its industry, competitive landscape, and potential challenges. The analysis examines bargaining power, threats, and rivalries. You'll gain valuable insights into GoodRx's strategic position. The document is ready for immediate use.

Porter's Five Forces Analysis Template

GoodRx operates in a dynamic market, constantly shaped by powerful forces. Analyzing these forces helps assess its long-term viability. Competition from established pharmacies and online platforms impacts pricing. Bargaining power of consumers and pharmacies is significant. Threat from potential new entrants remains a key concern.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore GoodRx’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Pharmacy Benefit Managers (PBMs) heavily influence drug pricing and formulary choices, affecting GoodRx's negotiation power. The top three PBMs control a major market share, creating a concentrated power structure. GoodRx depends on PBMs for pricing data and discounts, increasing its vulnerability. In 2024, PBMs managed over 70% of prescription claims, showcasing their dominance. This concentration limits GoodRx's ability to secure favorable terms.

Pharmaceutical manufacturers wield significant influence, especially concerning patented drugs and pricing strategies, which affects GoodRx's capacity to negotiate lower costs. Brand-name drug prices in the U.S. have been a subject of debate, often seeing increases. GoodRx's discounts depend on these manufacturers' participation in discount programs. In 2024, pharmaceutical companies' revenue reached approximately $600 billion, highlighting their financial strength. This financial dominance enables them to dictate pricing terms to entities like GoodRx.

The pharmaceutical supply chain is concentrated, with a few major distributors controlling a large share of the market, which strengthens supplier power. This concentration limits GoodRx's choices when sourcing medications, potentially increasing costs. In 2024, the top three drug distributors controlled over 90% of the market. GoodRx must negotiate effectively to manage these supplier dynamics. This is critical to maintain competitive discounts for consumers.

Regulatory Constraints

Regulatory constraints significantly impact supplier power within the pharmaceutical industry. The FDA's drug approval processes and CMS's Medicare drug pricing regulations influence the negotiation dynamics. GoodRx must navigate these complexities to comply and optimize its discount offerings. These regulations affect the entire supply chain, from manufacturers to pharmacies. Specifically, the FDA approved 49 new drugs in 2024.

- FDA approval processes set standards for drug availability.

- CMS regulations influence pricing and reimbursement.

- GoodRx must adapt to maintain competitive discounts.

- Compliance is crucial for operational integrity.

Data Dependency

GoodRx heavily depends on suppliers for pricing data, vital for its platform. Inaccurate or delayed data can decrease platform value and user trust. Reliable data feeds are crucial for GoodRx's function. In 2024, GoodRx's revenue was $793.9 million, showing the importance of reliable data. Securing this data is, therefore, very important.

- Data accuracy directly impacts GoodRx's user experience and financial performance.

- Supplier concentration could give suppliers leverage.

- Dependence on data is a key risk factor.

- GoodRx's ability to negotiate with suppliers is critical.

Suppliers, including manufacturers and distributors, impact GoodRx's ability to offer discounts. Their market concentration limits GoodRx's negotiation power. In 2024, key suppliers like drug manufacturers saw significant revenue. GoodRx must effectively manage supplier dynamics to ensure competitive pricing for consumers.

| Supplier Type | Market Influence | 2024 Data |

|---|---|---|

| Drug Manufacturers | High; Pricing Control | ~ $600B in revenue |

| Drug Distributors | High; Market Concentration | Top 3 controlled > 90% market |

| PBMs | High; Data & Discount | Managed > 70% claims |

Customers Bargaining Power

Customers are highly price-sensitive when buying prescription medications, always looking for ways to save. GoodRx directly addresses this, offering price comparisons and discount coupons. The availability of alternatives and potential high out-of-pocket costs boost buyer power. In 2024, GoodRx saw over 60 million monthly active users, showing this sensitivity.

Customers can easily switch between GoodRx and rivals. Low switching costs pressure GoodRx to excel. In 2024, GoodRx's revenue was around $770 million. The company must innovate to keep users. GoodRx's success depends on user retention.

Customers wield significant bargaining power due to readily available information on drug prices. Price transparency initiatives and online resources have amplified this trend. For example, in 2024, the GoodRx platform saw over 55 million monthly active users. This allows users to compare prices and find discounts, influencing GoodRx's pricing and service offerings. GoodRx must therefore compete effectively in this transparent market.

Alternative Options

Customers wield considerable power due to numerous alternatives to GoodRx. They can opt for pharmacy savings programs or manufacturer coupons, increasing their leverage. This competitive landscape demands GoodRx provide compelling discounts and value-added services. GoodRx's focus should be on differentiating its offerings to maintain customer loyalty.

- In 2024, pharmacy benefit managers (PBMs) controlled about 70% of prescription drug spending.

- Manufacturer coupons often offer significant discounts, especially for brand-name drugs.

- GoodRx's revenue in 2023 was approximately $760 million.

Group Purchasing Power

Large entities like employers and insurance providers wield considerable influence, potentially diminishing GoodRx's appeal. These groups often negotiate favorable prescription prices directly. GoodRx must prove its value proposition even to those already benefiting from existing insurance plans. This competition pressures GoodRx to maintain competitive pricing. In 2024, the pharmacy benefit managers (PBMs) controlled over 70% of the prescription drug market.

- Significant negotiating power of large employers and health plans.

- Potential for reduced reliance on GoodRx due to better prices elsewhere.

- Need for GoodRx to demonstrate value to those with existing benefits.

- Competition from PBMs, which controlled over 70% of the prescription drug market in 2024.

Customers have strong bargaining power due to price sensitivity and access to alternatives. GoodRx faces pressure from informed consumers seeking discounts. PBMs and manufacturer coupons further enhance customer leverage in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | 60M+ monthly active users |

| Alternatives | Numerous | PBMs control over 70% market share |

| Information | Transparency | GoodRx revenue ~$770M |

Rivalry Among Competitors

The prescription drug discount market is fiercely competitive, with companies like SingleCare and RxSaver aggressively pursuing market share. In 2024, GoodRx's revenue was approximately $750 million, facing pressure from these competitors. This intense rivalry necessitates constant innovation and differentiation for GoodRx. The crowded landscape demands strategic moves to retain and attract users.

Large Pharmacy Benefit Managers (PBMs) and retail pharmacies are launching prescription savings programs, intensifying competition for GoodRx. These established entities, like CVS Health and Express Scripts, leverage vast networks and influence. In 2024, CVS's Caremark and Express Scripts controlled a major share of the PBM market. GoodRx needs to innovate to stay ahead.

Competitive rivalry intensifies as rivals employ aggressive pricing to lure budget-conscious users, squeezing GoodRx's profit margins and hindering its revenue expansion. The emphasis on cost reduction can trigger price wars within the market. GoodRx must find a balance between competitive pricing and maintaining profitability. In 2024, GoodRx's gross margin was approximately 90%, emphasizing the importance of managing pricing strategies.

Innovation Imperative

GoodRx faces intense competition, making innovation crucial for survival. The digital healthcare market is dynamic, demanding continuous adaptation to maintain relevance. To stay ahead, GoodRx must invest heavily in research and development. Their ability to introduce new features directly impacts their market position. GoodRx's 2023 R&D expenses were $52.3 million.

- Market evolution necessitates constant adaptation.

- R&D investment is vital for competitive advantage.

- New features directly impact market position.

- 2023 R&D spend was $52.3 million.

Market Consolidation

The digital health market is seeing increased consolidation, with smaller solutions merging into larger platforms. This consolidation intensifies competition, as bigger players offer comprehensive services. GoodRx might need to explore acquisitions or partnerships to stay ahead. In 2024, the healthcare sector witnessed $14.4 billion in M&A deals. This strategic move could boost GoodRx's market position.

- Consolidation trends in digital health are escalating.

- GoodRx faces intensified competition from larger platforms.

- Strategic acquisitions and partnerships are vital for GoodRx.

- The healthcare M&A market reached $14.4 billion in 2024.

GoodRx faces intense rivalry in the prescription discount market, with competitors like SingleCare vying for market share. In 2024, the company's revenue reached approximately $750 million, highlighting the competitive landscape. This requires GoodRx to innovate and adapt constantly to maintain its position.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | GoodRx's revenue | $750 million (approx.) |

| Gross Margin | GoodRx's gross margin | ~90% |

| R&D Expenses (2023) | Research and Development Spend | $52.3 million |

SSubstitutes Threaten

Pharmacies' direct discounts pose a threat to GoodRx. These programs can entice customers directly. GoodRx must offer better deals to compete effectively. For instance, CVS's ExtraCare program and Walgreens' loyalty benefits offer price reductions. In 2024, these programs impacted GoodRx's market share.

Pharmaceutical manufacturers offer coupons and assistance programs, acting as direct substitutes for GoodRx's discounts. In 2024, these programs significantly reduced out-of-pocket costs for many patients. GoodRx incorporates these programs, yet faces the challenge of remaining competitive. The company must constantly negotiate better deals to offer superior savings. This dynamic requires GoodRx to innovate and provide added value.

Generic medications pose a significant threat to GoodRx. The availability of cheaper generics diminishes the demand for brand-name drugs, potentially lowering the need for GoodRx's discounts. This shift to generics directly impacts GoodRx's revenue model. However, GoodRx can adapt by offering value for both types of drugs. In 2024, generics accounted for approximately 90% of all prescriptions filled in the US, underscoring their dominance.

Insurance Coverage

The availability of comprehensive insurance coverage poses a threat to GoodRx. Patients with low co-pays have less incentive to use GoodRx for discounts. Changes in insurance policies, like those seen in 2024, can shift the market. GoodRx strategically targets those with high-deductible plans or limited coverage to maintain its user base. Its success hinges on providing value where insurance falls short.

- In 2024, approximately 50% of US adults were covered by employer-sponsored health insurance.

- High-deductible health plans (HDHPs) are growing, with about 30% of covered workers enrolled.

- GoodRx has over 60 million monthly active users.

- The average prescription cost is around $50, influenced by insurance coverage.

Alternative Therapies

Patients facing high prescription costs might turn to alternative therapies, impacting GoodRx. Lifestyle changes and alternative treatments can substitute prescription medications. This shift challenges GoodRx's core savings model. Expanding services to cover broader healthcare cost-saving strategies is crucial.

- In 2024, the global alternative medicine market was valued at approximately $118.4 billion.

- The U.S. alternative medicine market is projected to reach $45.2 billion by 2027.

- Around 40% of U.S. adults use some form of alternative medicine.

- GoodRx's revenue in Q1 2024 was $190.3 million.

Multiple substitutes challenge GoodRx. Direct discounts from pharmacies and manufacturer coupons compete for customer savings. Generics and comprehensive insurance further reduce the need for GoodRx's discounts.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Pharmacies/Coupons | Direct price competition. | CVS/Walgreens discounts affect market share. |

| Generics | Reduced demand for discounts. | ~90% prescriptions are generic. |

| Insurance | Decreased need for GoodRx. | ~50% US adults w/ employer insurance. |

Entrants Threaten

The digital healthcare space typically has a low barrier to entry, facilitating the emergence of new competitors. Telehealth and digital pharmacies further reduce entry thresholds. For example, in 2024, the telehealth market was valued at over $60 billion, indicating significant growth and opportunity. GoodRx must innovate to stay competitive. The company's 2023 revenue reached approximately $750 million, highlighting the need for continuous adaptation.

The threat of new entrants is high, particularly from tech giants. Amazon and Google, with vast resources, are entering healthcare. These companies can easily replicate GoodRx's services. GoodRx must leverage its brand to compete. In 2024, Amazon Pharmacy's revenue was estimated at $6 billion.

Specialized platforms pose a threat by targeting niche prescription markets. These entrants could erode GoodRx's market share. GoodRx's revenue in 2023 was $770.8 million. Expanding offerings to cover more niches could be a strategic response.

Pharmacy Partnerships

New entrants pose a threat by forming direct partnerships with pharmacies, potentially offering exclusive discounts and undermining GoodRx's broad platform reach. These partnerships could establish competitive advantages through specialized pricing and services. To counter this, GoodRx must fortify its relationships with pharmacies to maintain its market position. According to a 2024 report, pharmacy partnerships are becoming increasingly common, indicating a shift in the competitive landscape.

- Exclusive deals can attract customers.

- Bypassing GoodRx’s platform can reduce costs.

- Strong pharmacy ties are crucial for GoodRx.

- Partnerships offer new service opportunities.

Regulatory Changes

Regulatory changes pose a threat to GoodRx. Changes in drug pricing and transparency regulations could lower the barriers to entry for new competitors, increasing market competition. Simplified regulations can spur innovation, allowing new players to enter the market more easily. GoodRx needs to be prepared to adapt quickly to any regulatory shifts that may occur.

- The Inflation Reduction Act of 2022 introduced measures to lower drug costs, potentially impacting GoodRx's business model.

- Increased regulatory scrutiny on pharmacy benefit managers (PBMs) could affect GoodRx's relationships and revenue streams.

- In 2024, there is an increased focus on price transparency in healthcare, which can influence the market dynamics.

The threat from new entrants is high due to low barriers. Tech giants like Amazon, with $6B in 2024 pharmacy revenue, are a threat. Specialized platforms and pharmacy partnerships further intensify competition, potentially eroding market share. GoodRx needs to innovate to maintain its competitive edge.

| Factor | Impact | Data |

|---|---|---|

| Telehealth Growth | Increased Competition | $60B market in 2024 |

| Amazon Pharmacy Revenue (2024) | Direct Threat | $6 Billion |

| GoodRx Revenue (2023) | Need for Adaptation | $770.8 Million |

Porter's Five Forces Analysis Data Sources

GoodRx's Porter's Five Forces analysis relies on data from company filings, market research, and healthcare industry reports.