Great Panther Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great Panther Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

One-page overview highlighting portfolio's potential for executives.

What You’re Viewing Is Included

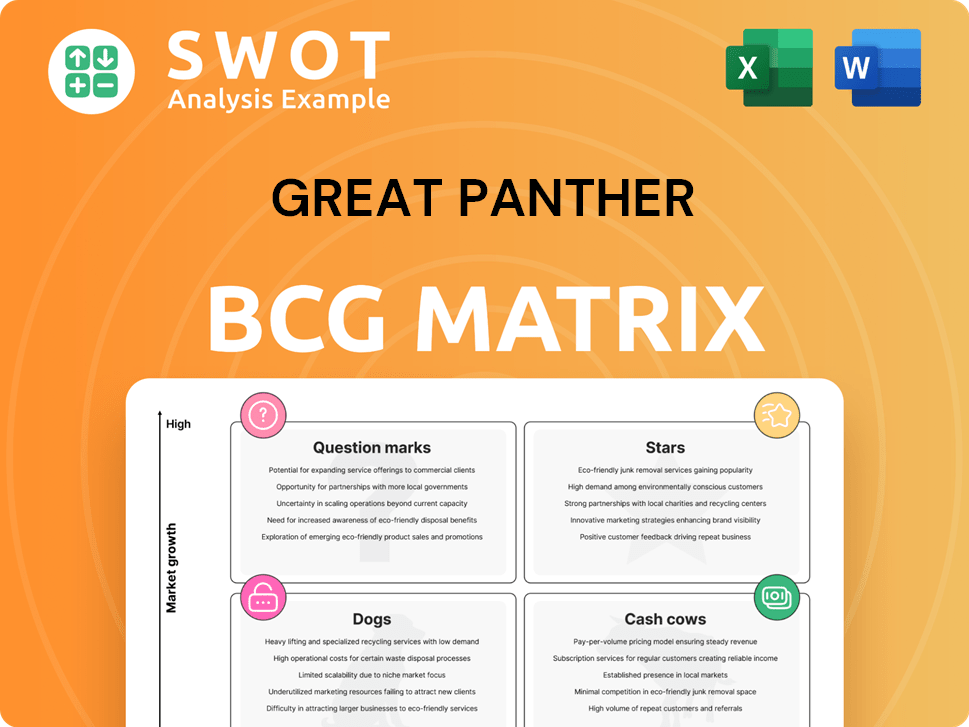

Great Panther BCG Matrix

The BCG Matrix preview you're currently viewing is the same, complete report you'll receive immediately upon purchase. It's a fully functional, ready-to-use document with all the necessary elements for strategic decision-making. You'll get the full, unedited file, enabling you to use it directly within your presentations or planning sessions.

BCG Matrix Template

Great Panther's BCG Matrix sheds light on its product portfolio, categorizing offerings as Stars, Cash Cows, Dogs, or Question Marks. Analyzing these quadrants reveals where Great Panther excels and where improvements are needed. Understanding market share and growth rates is crucial for strategic decisions. This overview helps you grasp the company's competitive landscape. Explore the full BCG Matrix for detailed insights and strategic recommendations.

Stars

If the Tucano Gold Mine restarts and hits its production goals, it could be a Star. With gold prices predicted to stay strong in 2025, it has big potential. Successful execution is key for Tucano Gold. In 2024, gold prices averaged around $2,000 per ounce, supporting this potential.

Exploration projects, if acquired, can be Stars. These projects require investment and successful exploration. A growing market and increased production could boost market share. In 2024, successful exploration is crucial for growth.

In August 2022, GSilver took over assets from Great Panther Mining, including the Topia, San Ignacio, and Valenciana mines in Mexico. These assets could be stars if they're growing fast and have a big market share. In 2024, if these mines boost production significantly, they may fit this category, although specific 2024 data is still emerging. A strong performance would suggest they're thriving within the BCG matrix.

Gold and Silver (Market Performance)

Gold and silver prices are surging due to global instability, acting as safe havens. Historically, gold prices have shown resilience during economic downturns. Experts predict continued strong performance for both metals in 2025. This is fueled by inflation concerns and potential interest rate adjustments.

- Gold prices hit an all-time high in March 2024, trading above $2,300 per ounce.

- Silver prices have also seen substantial gains, though not as dramatic as gold.

- Analysts forecast further appreciation, with some targeting $2,500+ for gold by year-end 2024.

- Geopolitical tensions and inflation are key drivers.

Sustainable Mining Practices

Mining companies leading in sustainable practices are stars, blending economic success with environmental responsibility. This includes structured approaches, responsible extraction methods, and long-term community benefits. For example, a 2024 study showed that companies with strong ESG (Environmental, Social, and Governance) scores in mining saw a 15% higher investor interest. These companies are well-positioned for future growth.

- ESG-focused mining companies attract more investment.

- Sustainable practices enhance long-term viability.

- Community benefits are key to star status.

- Responsible extraction is a priority.

Stars in the BCG matrix have high growth potential and market share. For example, a restarting Tucano Gold Mine could be a Star if it meets production goals. Exploration projects and acquired assets also can be Stars if successful. Companies with strong ESG scores are well-positioned for future growth. In 2024, gold hit an all-time high above $2,300 per ounce.

| Aspect | Details |

|---|---|

| Key Factor | High market share in a growing market |

| Examples | Tucano, exploration projects, ESG-focused mines |

| 2024 Metric | Gold prices > $2,300/oz. |

Cash Cows

Great Panther's bankruptcy in 2023 eliminates the possibility of cash cows. Cash cows need stable markets and high market share. A bankrupt company cannot fulfill these criteria. The bankruptcy filing occurred in early 2023. The company's assets were liquidated to pay creditors.

Historically, the Tucano Gold Mine, before being placed on care and maintenance, could have been considered a cash cow. In 2022, the mine produced 113,754 ounces of gold. However, its current state disqualifies it from this category. The mine's operational status changed significantly.

If any of Great Panther's past silver assets are still active and providing consistent revenue for their current owners, they could be classified as cash cows. This suggests a stable market with minimal reinvestment needs. For instance, a mine sold in 2023 might fit this, generating predictable cash flow. In 2024, silver prices have shown some volatility, impacting profitability.

Legacy Royalties (Speculative)

Legacy Royalties, if any, from Great Panther's past activities represent potential cash cows. These royalties' income hinges on the performance of assets now held by other entities. Assessing their value needs careful evaluation of ongoing operations and royalty terms. As of late 2024, specific figures are unavailable due to the company's restructuring.

- Royalty income depends on the assets' performance.

- Evaluation requires analyzing current operations.

- Specific financial data is hard to come by.

- Restructuring impacts data availability.

N/A

Given Great Panther's financial struggles, pinpointing cash cows is challenging. The company faced significant operational difficulties, impacting its ability to generate consistent revenue. Its portfolio lacked assets consistently producing high cash flow. The company's market capitalization in 2024 was severely impacted.

- Great Panther's market cap faced severe challenges in 2024.

- Operational issues significantly affected revenue generation.

- The portfolio didn't have reliable cash-generating assets.

- Identifying cash cows is difficult due to distress.

Identifying cash cows for Great Panther is difficult due to its bankruptcy in 2023 and operational issues. Any existing assets generating consistent revenue for new owners could be considered cash cows. However, the lack of specific financial data in 2024 hampers definitive identification. Legacy royalties represent potential cash cows, depending on asset performance.

| Category | Consideration | 2024 Status |

|---|---|---|

| Assets | Revenue Generation | Unknown - depends on new owners |

| Royalties | Performance of Assets | Data unavailable due to restructuring |

| Financial Data | Market Capitalization | Severely impacted; difficult to assess |

Dogs

Following Great Panther's bankruptcy in 2023, all former mining operations are now "Dogs" in the BCG Matrix. These assets, with low market share, struggle in low-growth markets. The company's market capitalization was just $15.6 million before delisting. This is a financial reality for these operations.

Unsold exploration projects from Great Panther before bankruptcy fall into the "Dogs" category of the BCG Matrix. These projects, having failed to attract buyers, indicate low growth potential and minimal returns. In 2024, such assets often represent significant liabilities, consuming resources without generating revenue. Specifically, these projects likely have a negative net present value (NPV).

Non-core assets for Great Panther before bankruptcy would be Dogs in a BCG matrix. These assets, with low market share and growth, likely underperformed. In 2023, Great Panther's financial struggles intensified. The company's valuation plummeted before its bankruptcy filing.

Outdated Technology

Outdated technology represents a significant drag on value, particularly for a company that has undergone bankruptcy. Any obsolete mining equipment or systems still held by Great Panther would be categorized as such. These assets are likely to be inefficient, costly to maintain, and offer minimal contribution to any potential recovery. Their presence would detract from the firm's overall financial standing and operational efficiency.

- Inefficient Equipment: Older machinery consumes more energy and produces less output.

- High Maintenance Costs: Outdated technology often requires specialized parts and frequent repairs.

- Low Market Value: Obsolete assets typically have little resale value.

- Reduced Productivity: Older systems limit operational capabilities and productivity.

N/A

Given Great Panther's financial state, its assets likely fall into the "Dogs" category of the BCG Matrix. This means these assets have low market share in a slow-growing market. The company faced significant challenges in 2024, including fluctuating gold prices and operational difficulties. For example, in Q3 2024, the company reported a net loss of $12.3 million.

- Low market share indicates weak competitive positioning.

- Slow market growth limits the potential for expansion.

- Financial struggles in 2024 reinforce the "Dogs" assessment.

- Divestiture or restructuring might be considered for these assets.

Dogs represent assets with low market share in slow-growth markets. Great Panther's operations, post-bankruptcy, fit this profile. Financial data from 2024, such as Q3 losses, confirms this.

| Category | Description | Impact |

|---|---|---|

| Market Share | Low | Weak competitive position |

| Market Growth | Slow | Limited expansion potential |

| Financial Health (2024) | Struggling | Reinforces "Dogs" assessment |

Question Marks

Early-stage exploration projects, like those Great Panther had before its bankruptcy, fit the "Question Marks" category in a BCG matrix. These projects, with high growth potential but low market share, demand substantial investment. For example, in 2024, junior mining companies often require millions in funding to advance exploration. Success hinges on converting resources into reserves.

The Tucano Gold Mine, now under Tucano Gold Inc., fits the Question Mark profile. It aims to restart operations, signaling high growth potential in the gold market. However, achieving this hinges on substantial investments to boost production and capture a larger market share. According to 2024 reports, gold prices have fluctuated, creating both opportunities and risks for such ventures.

Assets acquired by GSilver from Great Panther Mining, if possessing high growth potential yet low market share, fit the question mark category. Turning these assets into stars necessitates further investment and development. For instance, the GSilver's acquisition in 2024 involved significant capital outlay. The success hinges on strategic resource allocation and market penetration.

Silver Projects in Growing Market

Silver projects, positioned as question marks in the BCG matrix, are driven by the anticipation of silver outperforming gold. This expectation is fueled by rising industrial demand, particularly from solar photovoltaic technology. In 2024, the solar sector's silver consumption is projected to reach over 100 million ounces. The price of silver has fluctuated, with an average of $23 per ounce in the first half of 2024.

- Silver's price volatility impacts project viability.

- Industrial demand, especially from solar panels, is a key driver.

- Market expectations favor silver's outperformance over gold.

- Project success hinges on demand and price dynamics.

N/A

In the context of Great Panther's bankruptcy, the BCG Matrix classification becomes problematic. Due to the financial distress, it's challenging to definitively categorize any assets. Their future is uncertain, making traditional classifications less reliable. This uncertainty impacts strategic decision-making.

- Bankruptcy proceedings significantly cloud the classification of assets.

- The future performance of assets is highly unpredictable.

- Strategic planning becomes more complex due to the uncertainty.

- Traditional BCG Matrix analysis is less effective.

Question Marks represent high-growth, low-share market ventures, like early Great Panther projects. These require considerable investment to boost market share, with junior mining companies often seeking millions in funding in 2024. The success hinges on converting resources into proven reserves amid fluctuating gold and silver prices.

| Aspect | Details | 2024 Data |

|---|---|---|

| Silver Price | Average Price/Ounce | $23 |

| Solar Silver Demand | Projected Ounces Consumed | 100M+ |

| Junior Mining Funding | Typical Investment Needed | Millions |

BCG Matrix Data Sources

The Great Panther BCG Matrix leverages market analysis, company filings, financial statements, and expert forecasts for its strategic assessments.