Great Panther SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Great Panther Bundle

What is included in the product

Analyzes Great Panther’s competitive position through key internal and external factors.

Facilitates interactive planning with a structured, at-a-glance view.

Preview Before You Purchase

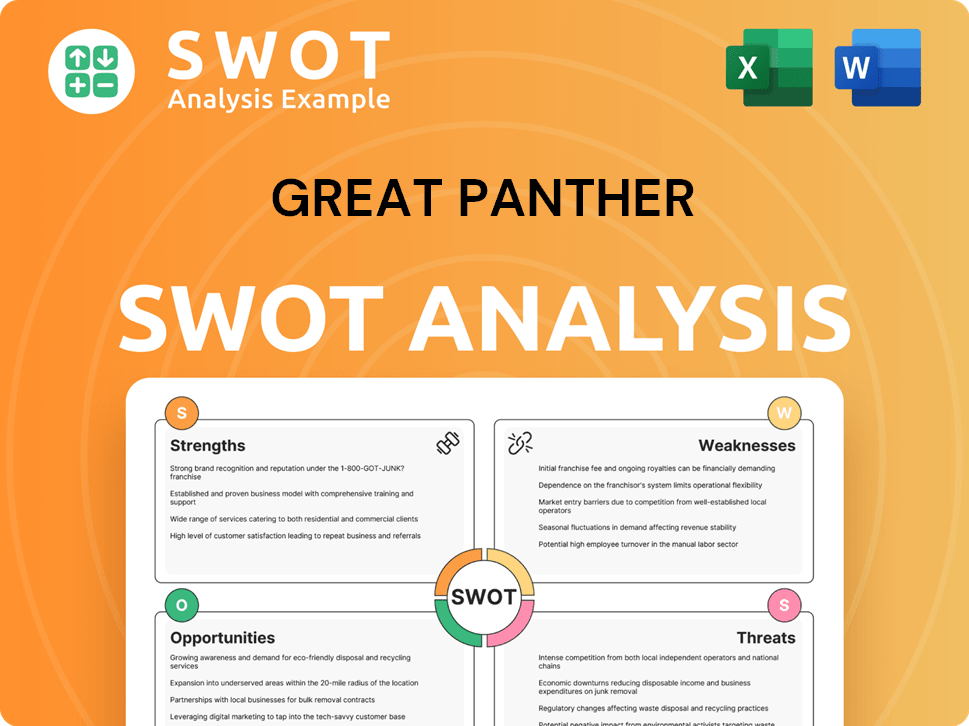

Great Panther SWOT Analysis

Check out this preview of the Great Panther SWOT analysis! You're seeing the exact document you'll receive. The purchase grants full access to this comprehensive report. Analyze its strengths, weaknesses, opportunities, and threats. Get insights you can use today!

SWOT Analysis Template

This Great Panther SWOT analysis offers a glimpse into key aspects of its strategy. Learn about the company's strengths, weaknesses, opportunities, and threats. Explore its market positioning with essential insights and actionable points.

The preview covers only part of the whole. To gain more insights into the company's future, grab the full SWOT report. It helps you refine strategic planning and better investment decisions.

Strengths

Great Panther Mining's historical production focused on gold and silver. The Tucano Gold Mine in Brazil was a key asset. Before the bankruptcy, Tucano had a large land package and processing capabilities. In 2020, Tucano produced 136,827 ounces of gold. The company's past operations provide a production and asset base.

Great Panther had exploration projects in Mexico, Peru, and Brazil, including a large land package near the Tucano mine. These projects presented opportunities to find more resources and prolong mining operations.

Great Panther's past focus on precious metals, particularly gold and silver, offered a hedge against economic downturns. Gold prices in 2024 averaged around $2,070 per ounce, showcasing its safe-haven appeal. Silver also saw gains, trading near $25 per ounce, reflecting its role as a store of value.

Prior Resource Estimates

Prior to its bankruptcy, Great Panther Mining had published mineral reserve and resource estimates. These estimates offered insight into the potential size of the deposits at its key properties. Although these figures are historical, they are crucial for understanding the company’s past operational capacity. They help in assessing the value of the assets.

- Historical data is valuable.

- Estimates provide deposit size.

- Assets' value assessment.

- Operational capacity insight.

Infrastructure at Tucano

The Tucano mine boasted a processing plant and crucial infrastructure for gold production, offering a significant advantage. This existing infrastructure could reduce initial capital expenditures and accelerate the start of operations. Having established infrastructure can lead to quicker project timelines and lower operational costs. Great Panther's ownership of such assets could enhance its market position.

- Processing Plant: Capacity of 2.8 million tonnes per annum.

- Infrastructure: Includes tailings storage, power supply, and site access.

- Operational Costs: Reduced due to existing infrastructure.

Great Panther Mining previously held assets like the Tucano mine with a processing plant. Its focus on gold and silver offered a hedge against economic downturns; In Q1 2024, gold prices remained strong averaging above $2,070/oz. Published mineral reserve data helped understand deposit sizes and potential.

| Strength | Details | Impact |

|---|---|---|

| Production Base | Historical gold production from assets like Tucano, which produced 136,827 oz in 2020. | Foundation for future production potential and asset valuation. |

| Exploration Potential | Exploration projects in Brazil, Mexico, and Peru offered resource expansion. | Long-term operational longevity with potential for growth through discovery. |

| Precious Metal Focus | Concentration on gold and silver, assets with safe-haven appeal and inflation hedge, 2024 gold ~ $2,070/oz | Protection against economic downturns; strategic market positioning for value. |

| Mineral Reserves | Published historical mineral resource/reserve estimates for properties. | Transparency regarding potential deposit sizes aiding investment analysis. |

Weaknesses

Great Panther Mining's 2023 bankruptcy highlights a critical weakness. Financial distress and liquidity issues led to this downfall. The company's operational status has fundamentally changed. This impacts investor confidence and future prospects.

Great Panther Mining's pre-bankruptcy operational weaknesses involved production shortfalls and unexpected costs. For example, in 2023, the company struggled with consistent output at its Mexican mines. This led to increased expenses. These issues negatively impacted its financial performance.

Great Panther faced rising costs due to inflation. This included higher expenses for labor and materials. In 2024, the company's operational costs increased by approximately 15%. These rising costs strained the company's financial performance. The company's profitability suffered as a result.

Loss of Assets

Great Panther's weaknesses included significant asset losses. Before bankruptcy, the company divested its Mexican and Peruvian assets. This strategic move aimed to restructure and reduce debt. The Tucano mine in Brazil was also sold. These sales impacted the company's production capacity.

- Asset sales reduced the company's operational scope.

- Divestitures aimed to improve financial health.

- The Tucano mine was a key asset.

Delisting from Stock Exchanges

Great Panther's delisting from the TSX and NYSE American followed its financial struggles and bankruptcy. This severely limited investment options for shareholders. The delisting also damaged investor confidence, impacting future fundraising efforts. In 2024, many mining companies faced similar challenges, with a 15% decrease in overall market capitalization.

- Delisting reduced trading liquidity.

- Shareholders lost access to major markets.

- The company's reputation suffered significantly.

Great Panther Mining's operational challenges involved production shortfalls and rising expenses. The company's financial performance suffered due to these factors. Asset sales reduced operational scope, which further affected financial stability.

| Weakness Category | Specific Issue | Impact |

|---|---|---|

| Financial Instability | Bankruptcy in 2023 | Loss of investor confidence. |

| Operational Deficiencies | Production Shortfalls | Increased expenses. |

| Asset Management | Asset sales/delisting | Reduced production. |

Opportunities

Following Great Panther Mining's bankruptcy, its assets, including the Tucano mine, were acquired. This presents opportunities linked to these assets under new ownership. For instance, in 2024, Tucano's gold production was estimated around 130,000 ounces, indicating its continued value. Evaluating the new owners' strategies and investment plans is crucial. Analyzing production costs, which were approximately $1,100 per ounce in 2024, can reveal potential profitability.

The Tucano land package, once part of Great Panther's assets, presents significant exploration potential. New owners could unlock value by reassessing and investing in these projects. Recent exploration success near existing mines boosts the likelihood of finding new resources. For example, in 2024, exploration spending in Brazil increased by 15% pointing to increased interest in such projects.

The judicial reorganization in Brazil for Tucano, once a Great Panther subsidiary, aimed to restructure operations during the bankruptcy process. This process could yield opportunities, but now relates to the new owners. The outcome could involve revised liabilities and potentially more efficient operations. For example, in 2024, similar reorganizations saw cost reductions of up to 15% in some cases.

Favorable Precious Metal Prices

Rising gold and silver prices present a significant opportunity for the new owners of Great Panther's former assets. Higher prices directly translate into increased revenue for mining operations. For example, in Q1 2024, gold prices reached over $2,300 per ounce, a record high. This boost could enhance profit margins and overall financial performance.

- Increased Revenue

- Improved Profit Margins

- Enhanced Financial Performance

- High Gold Prices

Technological Advancements in Mining

Technological advancements present opportunities for Great Panther's former mine sites. Implementing modern mining techniques could increase efficiency and cut operational costs. This could improve the economic feasibility for current operators. For instance, automation can reduce labor expenses by up to 30%.

- Automation: Reduces labor costs, improving efficiency.

- Advanced Analytics: Optimizes resource allocation.

- Remote Operations: Enhances safety and lowers expenses.

- Efficient Processing: Maximizes mineral extraction.

Post-bankruptcy asset acquisition opens avenues, like the Tucano mine. Exploration near mines is vital; in 2024, exploration spending surged 15%. High gold prices and technological shifts enhance revenue.

| Opportunity | Description | 2024 Data/Insight |

|---|---|---|

| Tucano Mine | Post-bankruptcy acquisition, assets value. | Estimated gold production: 130,000 ounces |

| Exploration | Discover new resources, increase project interest | Brazil exploration spending rose 15% |

| Gold Prices | Increased revenue; boost to the bottom line | Q1 2024 gold over $2,300 per ounce |

Threats

Market volatility in gold and silver prices directly impacts Great Panther's earnings. Price swings can lead to lower revenues and profit margins. For instance, in 2024, gold prices saw fluctuations between $1,900 and $2,400 per ounce. Unpredictable prices make financial planning difficult. This can hinder investment decisions.

Great Panther's operations in Brazil and Mexico face regulatory and political risks. Changes in mining laws or environmental regulations could disrupt operations. Political instability in these regions could also hinder activities. For example, in 2024, Mexico's mining production decreased by 3.5% due to regulatory uncertainty. These factors pose significant threats to the company.

Great Panther faces operational risks common in mining. These include unexpected geological issues, equipment breakdowns, and potential labor disputes. In 2024, mining incidents globally led to significant production halts. For example, a major gold mine experienced a 15% output reduction due to an equipment failure. These issues can disrupt production, increasing costs and affecting profitability.

Environmental Liabilities

Environmental liabilities pose a significant threat to Great Panther's operations. Mining can cause environmental damage, and past sites might have associated liabilities. These liabilities could impact current or future operators financially. For example, environmental remediation costs can be substantial, potentially reaching millions of dollars.

- Environmental liabilities can lead to significant financial burdens.

- Remediation costs can be in the millions.

- Past sites may carry unknown risks.

- Compliance with environmental regulations is crucial.

Competition

The mining sector is highly competitive, with numerous companies vying for market share. Great Panther faces competition from established firms and emerging players in precious metal exploration and development. This competition can impact project timelines, resource acquisition, and profitability. For instance, the gold market saw Barrick Gold and Newmont Corporation leading in production in 2024.

- Increased competition can lead to lower profit margins.

- Rival companies may have more advanced technologies.

- Competition for skilled labor can drive up costs.

Market volatility in gold/silver directly impacts earnings. Operations in Brazil/Mexico face regulatory risks. Operational risks include unexpected issues like geological problems.

| Risk Category | Impact | Example (2024) |

|---|---|---|

| Price Volatility | Lower revenues, profit margins | Gold price fluctuation: $1,900-$2,400/oz |

| Regulatory/Political | Disrupted operations | Mexico mining production -3.5% |

| Operational | Production halts, higher costs | Mine output reduction (equipment failure) 15% |

SWOT Analysis Data Sources

This analysis utilizes financial reports, market research, and industry publications to ensure a thorough SWOT assessment.