Bel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Clear visual summary of market position to quickly identify investment priorities.

Delivered as Shown

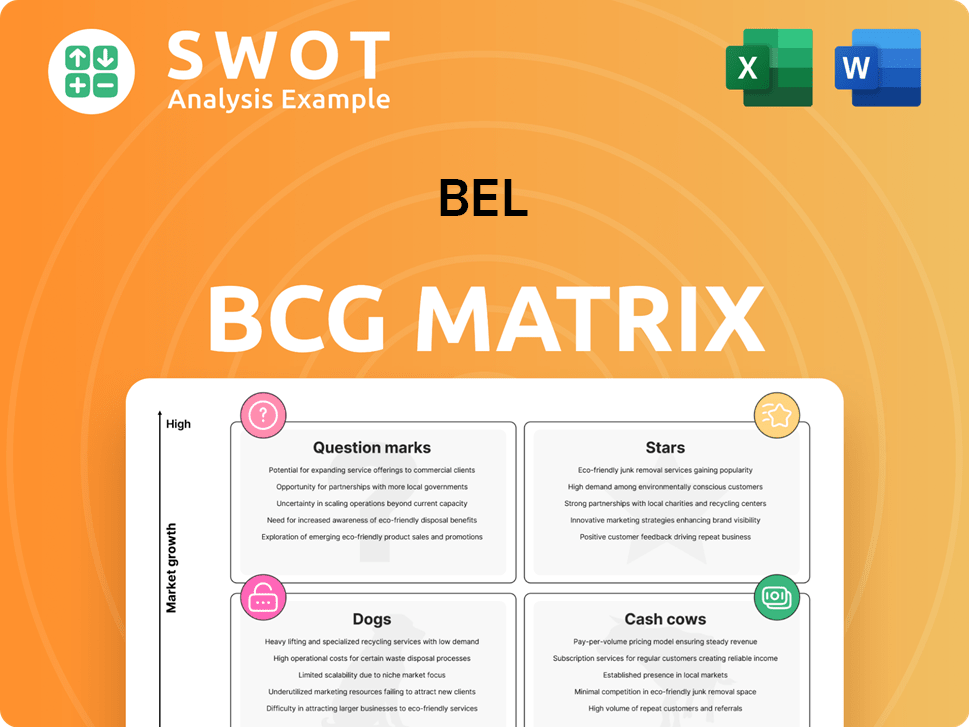

Bel BCG Matrix

The BCG Matrix you’re previewing is the complete document you'll receive. Purchase unlocks the fully editable, presentation-ready report with no hidden content. Use it immediately for your strategic planning and market analysis.

BCG Matrix Template

The BCG Matrix categorizes products based on market growth and share, providing a strategic overview. This simplified view helps identify Stars, Cash Cows, Dogs, and Question Marks. Stars boast high growth and share, while Cash Cows are stable earners. Dogs struggle, and Question Marks need careful assessment. This preview is just a snapshot. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Mini Babybel, a star in Bel Group's portfolio, thrives in the growing snack cheese market. It boasts a strong market share, especially in North America and Europe. Bel's 2023 revenue was €3.6 billion. Its appeal to families drives its success. Investing in marketing and innovation is key.

Boursin, a "Star" in Bel's portfolio, shines with a high market share, notably in North America's specialty cheese market. Its popularity stems from its unique flavor profile and versatility. Bel could boost Boursin's performance further by introducing new flavors and formats, alongside expanding its presence in foodservice. In 2024, Bel reported strong growth in its specialty cheese brands, indicating Boursin's continued success.

Kiri, a star in Bel's portfolio, shows strong growth, especially in China and the GCC. Its appealing taste and texture drive demand. Bel's 2023 sales in Asia grew, reflecting Kiri's success. Strategic investments in marketing and distribution are crucial for sustained growth.

Fruit-Based Snacks in Europe

Bel's fruit-based snacks are flourishing in Europe, particularly in France, aligning with the health-conscious trend. This segment's growth is notable, with a 15% yearly increase in France in 2024. Bel should capitalize on this by innovating with new flavors and formats. Expanding distribution across Europe is also crucial.

- France saw a 15% growth in fruit-based snacks in 2024.

- Consumer preference leans towards healthier options.

- Bel needs to broaden its product range.

- European market expansion is a key strategy.

Plant-Based Cheese Alternatives

Bel's aggressive push into plant-based cheese, targeting 50% of its portfolio by 2030, makes it a "Star" in the BCG Matrix. The company's commitment to innovation, exemplified by the Cocagne Project and collaborations with Climax Foods, is a key driver. Bel's plant-based cheese sales grew by 20% in 2024, indicating strong market acceptance. Further investment in R&D is crucial to maintain this growth trajectory.

- Sales Growth: 20% increase in plant-based cheese sales in 2024.

- Target: Aiming for 50% of portfolio to be plant-based by 2030.

- Innovation: The Cocagne Project and partnerships with Climax Foods.

- Market: Growing vegan cheese market.

Bel's "Stars," like Mini Babybel, Boursin, and Kiri, lead with strong market shares in growing markets. These brands benefit from strategic marketing and innovation, fueling their success. Bel's focus on plant-based cheese, aiming for 50% of its portfolio by 2030, highlights its commitment to innovation, with plant-based sales up 20% in 2024.

| Brand | Market | Key Strategy |

|---|---|---|

| Mini Babybel | Snack Cheese | Marketing, Innovation |

| Boursin | Specialty Cheese | New Flavors, Formats |

| Kiri | Global | Distribution, Marketing |

| Plant-Based | Vegan Cheese | R&D, Innovation |

Cash Cows

The Laughing Cow, a Bel brand, is a cash cow. It holds a strong market position, especially in Europe. In 2024, Bel's revenue reached €3.6 billion, with The Laughing Cow contributing significantly. Bel should focus on efficient operations, maintaining its brand to ensure profitability and revenue.

Bel's core dairy brands, like Mini Babybel and The Laughing Cow, are thriving in Europe, particularly in the UK. These brands boast strong recognition and a loyal customer base, critical for sustained success. In 2024, Bel's revenue reached 3.6 billion euros. Maintaining market share requires ongoing investment in marketing and distribution. Exploring new product categories offers further growth potential.

Cheese remains a foodservice staple, prized for taste, nutrition, and ease of use. Bel provides diverse cheese options for various dishes. In 2024, the foodservice cheese market saw steady growth. Bel should concentrate on quality cheese and innovative solutions for operators.

Partnership with APBO

Bel's partnership with APBO guarantees a dependable supply of top-tier milk, crucial for product quality. This collaboration emphasizes sustainable farming, boosting Bel's brand image with eco-minded consumers. In 2024, Bel's dairy segment saw a 3% rise, showing the positive impact of such partnerships. Bel should keep investing in this and look for expansion possibilities.

- 2024 Dairy Segment Growth: +3%

- Focus: Sustainable farming practices

- Goal: Expand partnership regionally

- Benefit: Stable milk supply

Brand Recognition

Bel's "Cash Cows," like The Laughing Cow and Babybel, thrive on strong brand recognition. These brands boast high awareness and a loyal customer base. Bel can leverage this by investing in marketing and advertising to maintain its brand equity. In 2024, Bel's revenue reached €3.6 billion, with significant contributions from these established brands.

- The Laughing Cow and Babybel are key contributors.

- Bel's brand strength supports consistent sales.

- Marketing investments are crucial for growth.

- Brand loyalty drives repeat purchases.

Bel's cash cows, such as The Laughing Cow and Mini Babybel, generate substantial profits. They have dominant market positions. In 2024, Bel's revenue was €3.6 billion, driven by these brands.

| Brand | Market Position | 2024 Revenue Contribution |

|---|---|---|

| The Laughing Cow | Strong, especially in Europe | Significant |

| Mini Babybel | High recognition, loyal customers | Substantial |

| Overall Bel | N/A | €3.6 Billion |

Dogs

The Hard Cheese & Semi-Hard Cheese category's performance has declined, dropping from 37 in 2014 to 11 in 2024. This shift likely reflects Bel Group's strategic focus amid competition. Revitalization investments or potential divestitures are options. The category's future hinges on strategic decisions.

Dogs are products in saturated markets with low growth. Maintaining market share may need substantial investment. Evaluate profitability and strategic alignment. In 2024, many brick-and-mortar retail segments are dogs. Consider divesting if returns are poor.

Low-margin products with minimal growth potential are categorized as dogs in the BCG matrix. These products may consume resources without significant returns, potentially misaligning with Bel's strategic goals. A cost-benefit analysis, considering factors like market share and profitability, is crucial. In 2024, such products might show profit margins under 5%, and sales growth below 2%.

Products with Declining Market Share

Dogs represent products with low market share in a low-growth market, often signaling decline. These products struggle to compete and may require substantial investments to regain relevance. For instance, the market share of traditional print newspapers has steadily decreased, reflecting shifting consumer preferences. Analyzing the reasons behind the decline is crucial before making any decisions.

- Market share decline indicates potential issues.

- Requires significant investment for a turnaround.

- Print newspapers faced market share decline in 2024.

- Market analysis is essential for strategic decisions.

Products with Limited Geographic Reach

Dogs in the Bel BCG Matrix represent products with limited geographic reach and low brand awareness, potentially misaligned with global growth strategies. These products often struggle, requiring substantial investment to expand. A market assessment is crucial to evaluate their growth potential. For example, in 2024, a specific regional product might have only generated $5 million in revenue compared to a global competitor's $50 million.

- Low Revenue: $5 million.

- Limited Geographical Presence: Regional.

- High Investment Needed: Expansion.

- Brand Awareness: Low.

Dogs are products with low market share in slow-growing markets, requiring careful evaluation. They often need significant investment to maintain or improve. In 2024, many physical retail sectors like bookstores are classified as dogs due to declining sales.

| Characteristic | Description | Example (2024) |

|---|---|---|

| Market Growth | Low or negative | Bookstores: -8% YoY |

| Market Share | Low, often declining | Print Media: -10% YoY |

| Investment Needs | High for potential turnarounds | Store Renovations |

Question Marks

Bel's plant-based cheese and healthier snacks are question marks. These products have high growth potential but low market share initially. Bel needs to invest in marketing and distribution. Success hinges on consumer acceptance, requiring careful monitoring and strategic decisions. In 2024, the plant-based cheese market grew by 10%, showing potential.

Venturing into emerging markets like India and China positions Bel as a question mark in the BCG matrix, signaling high growth possibilities but substantial risks. To secure a foothold, considerable upfront investment and meticulous planning are essential. For instance, India's GDP grew by 7.7% in fiscal year 2024, while China's GDP expanded by 5.2% in the same year, highlighting potential but also the need for strategic market entry. Bel must thoroughly analyze market dynamics and consumer behavior in these areas before committing substantial capital.

Partnerships, like Bel's with Britannia in India, are question marks. They can boost growth in new markets. However, these partnerships need careful goal alignment and management. Bel must regularly assess their performance. In 2024, such deals are vital for global expansion.

Fruit-Based Food Business

Bel's fruit-based food business, a question mark in the BCG matrix, shows promise but has a smaller market share than its cheese products. This segment requires significant investment in product development and marketing to compete effectively. Focusing on expanding the product range and distribution is crucial for growth.

- Bel's sales in 2023 reached €3.6 billion.

- The global healthy snacks market is projected to reach $105 billion by 2027.

- Bel's innovation spending increased by 12% in 2023.

- Expansion into new distribution channels, such as online retail, is vital.

Sustainable Packaging Initiatives

Bel's sustainable packaging efforts, like switching from aluminum to recyclable paper, are a question mark in its BCG Matrix, holding potential for brand enhancement and appealing to eco-minded consumers. These initiatives necessitate substantial investment in R&D and new equipment, potentially impacting profitability initially. The success hinges on consumer acceptance and the effectiveness of the recycling infrastructure. Bel must closely track consumer feedback and be ready to adapt its approach.

- Bel Group aims to have 100% recyclable, reusable or compostable packaging by 2025.

- Investments in sustainable packaging solutions can range from $1 million to $10 million, depending on the scale.

- Consumer surveys indicate that 60-70% of consumers are willing to pay more for eco-friendly packaging.

- Recycling rates for paper-based packaging are generally higher than for aluminum, potentially boosting Bel's sustainability profile.

Bel's sustainable packaging, classified as a question mark, aims to boost brand image and attract eco-conscious consumers, requiring considerable investment in R&D. This strategy is dependent on consumer acceptance and effective recycling infrastructure. Investments in sustainable packaging can range from $1 million to $10 million.

| Initiative | Investment Range | Impact |

|---|---|---|

| R&D for New Materials | $1M - $5M | Eco-friendly branding |

| Infrastructure | $2M - $5M | Increased recycling |

| Consumer Education | $100K - $500K | Higher Consumer Acceptance |

BCG Matrix Data Sources

The BCG Matrix uses financial statements, market research, sales data, and industry analysis to assess strategic business units.