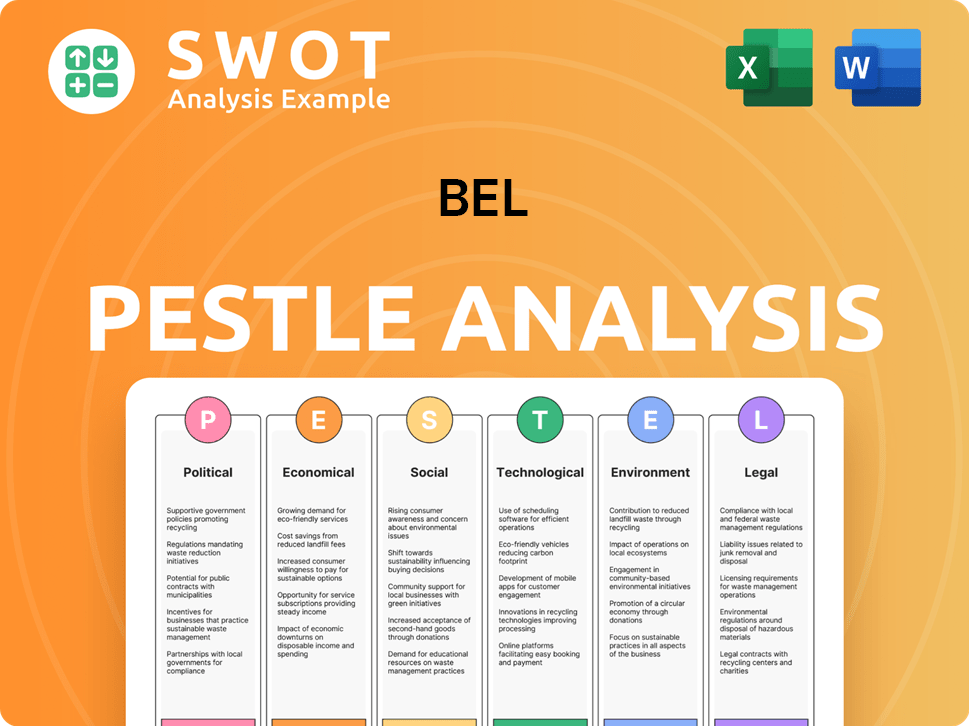

Bel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

What is included in the product

Assesses Bel's macro-environment using Political, Economic, etc., factors for strategic insights.

Easily shareable, this summary enables swift alignment and efficient information dissemination across teams.

Full Version Awaits

Bel PESTLE Analysis

The Bel PESTLE Analysis preview showcases the full report.

The format and details are precisely what you get post-purchase.

No edits or adjustments; download the exact analysis shown.

This preview mirrors the finished document.

What you see now is the actual file—ready after buying.

PESTLE Analysis Template

Explore Bel's future with our targeted PESTLE Analysis. Uncover key external factors shaping the company, from regulations to market trends. This analysis delivers actionable insights, perfect for strategic planning and competitive analysis. Understand the forces impacting Bel's performance today. Download the complete version for a deeper understanding and elevate your decision-making instantly.

Political factors

Government regulations and policies on food safety, labeling, and production are critical for Bel. Adapting to new rules domestically and globally is essential. Bel must comply with standards across 120+ countries. For example, the EU's Farm to Fork Strategy influences Bel's operations. In 2024, the global food safety market is valued at $48 billion.

Trade agreements and tariffs significantly impact Bel's import/export costs and market access. For instance, changes in EU trade policies, where Bel operates extensively, directly influence its dairy product pricing. In 2024, the EU imposed tariffs on certain dairy imports, affecting Bel's supply chain costs by approximately 3%. Fluctuating trade relationships with key ingredient sources, such as New Zealand, can destabilize pricing and supply, as seen in 2025 with a 2% increase in ingredient costs due to new trade regulations.

Political stability is crucial for Bel's operations, influencing consumer trust and market access. Regions like France, a key market, show moderate political risk. Any instability could hinder supply chains. For instance, in 2024, France's political climate affected business confidence slightly.

Agricultural Policies and Subsidies

Agricultural policies and subsidies play a crucial role in Bel's operations, affecting raw material costs and supply. These policies, particularly those related to milk production, can significantly impact Bel's profitability. Regional variations in agricultural support also influence Bel's relationships with dairy farmers and suppliers.

- EU milk production in 2024 is projected at around 143 million tonnes.

- The EU's Common Agricultural Policy (CAP) provides substantial subsidies to dairy farmers.

- Changes in subsidy levels can directly affect Bel's input costs and supply chain stability.

International Relations and Geopolitics

International relations and geopolitical events indirectly influence Bel, impacting global supply chains, currency exchange rates, and consumer sentiment. Bel's international presence requires navigating a complex global political landscape, with potential disruptions from trade wars or political instability. For instance, shifts in US-China relations can affect Bel's supply chain costs. The World Bank predicts global trade growth of 2.5% in 2024, impacting companies like Bel.

- Geopolitical risks, like the Ukraine war, increased supply chain costs by 10-15% in 2023.

- Currency fluctuations can affect Bel's profitability; a 5% change can shift earnings.

- Trade agreements and tariffs directly influence Bel's international market access.

Bel faces regulatory hurdles in over 120 countries, emphasizing the importance of food safety compliance; the global food safety market was valued at $48 billion in 2024. Trade agreements and tariffs impact import/export costs; the EU imposed tariffs on certain dairy imports, affecting Bel's supply chain costs by about 3% in 2024. Political stability in key markets and agricultural policies like the EU's CAP affect raw material costs.

| Political Factor | Impact on Bel | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance Costs | Food safety market at $48B in 2024. |

| Trade Policies | Import/Export Costs | EU tariffs affected costs by 3% in 2024; ingredient costs rose 2% in 2025. |

| Political Stability | Market Access, Trust | Moderate risk in France; global trade grew by 2.5% in 2024. |

Economic factors

Inflation rates significantly influence consumer behavior, directly affecting the demand for Bel's products. Rising inflation in 2024, with rates fluctuating, has already heightened consumer price sensitivity. This trend is expected to persist into 2025. Bel forecasts a challenging economic climate, anticipating that higher inflation will squeeze consumer purchasing power, impacting sales across its cheese range.

Bel's international presence makes it vulnerable to currency exchange rate swings. The Euro's value shifts against other currencies, influencing costs and international sales values. Unfavorable exchange rates negatively impacted Bel's sales in 2024. For example, in 2024, currency fluctuations reduced Bel's revenue by approximately 2.5%. This highlights the need for hedging strategies.

Raw material price volatility, especially for milk, is a key economic concern for Bel. Fluctuations in milk prices, driven by weather and global demand, directly affect Bel's production costs. The partnership with APBO, redefined for 2025, aims to stabilize milk prices. This partnership is critical, as milk accounts for a substantial portion of Bel's expenses, with prices varying significantly year to year. Milk prices in France rose by 3.5% in 2024, influencing Bel's financial results.

Economic Growth and Recession Risks

The global economy's health and recession risks significantly impact consumer spending on treats like cheese. Strong economic growth often boosts demand for Bel's products. In 2024, Bel maintained robust profitability despite top-line and macroeconomic challenges. The company navigated these conditions effectively.

- Global GDP growth in 2024 was around 3.1%.

- Bel Group's 2024 sales reached €3.4 billion.

- Inflation rates in key markets influenced pricing strategies.

Investment and Financing Environment

Bel's investment and financing landscape is vital for its strategic moves. Access to investments and favorable financing fuel projects in production, digitalization, and new products. In April 2024, Bel's €350 million bond issue extended its debt maturity. This environment supports Bel's growth initiatives.

- Bel's focus is on strategic investment.

- Favorable financing conditions are key.

- The 2024 bond issue was worth €350 million.

- This supports production, digitalization, and new product development.

Economic factors are crucial for Bel, heavily influencing its performance in 2024 and projecting into 2025. Inflation affects consumer spending, while exchange rate volatility impacts international sales negatively. Raw material price changes, especially milk, pose cost challenges for Bel. These dynamics require strategic management and flexibility.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Inflation | Reduces purchasing power | EU: ~2.5% (2024), forecast 2.0% (2025) |

| Exchange Rates | Affects sales | Euro fluctuations; -2.5% revenue in 2024 |

| Raw Material Costs | Impacts production costs | Milk +3.5% (France, 2024), APBO partnership |

Sociological factors

Changing consumer dietary habits are significantly impacting Bel's product demand. There's a growing interest in plant-based options, health, wellness, and convenient snacking. Bel is adapting by expanding its portfolio to include more fruit and plant-based items. The company aims for 50% of its products to be plant-based by 2030; in 2024, plant-based sales grew by 15%.

Consumer focus on health and nutrition significantly shapes food choices. Bel must ensure its products meet consumer demand for healthier options.

In 2024, health-conscious consumers drove demand for nutritious foods. Bel's focus on healthier, sustainable options aligns with this trend.

Bel's mission emphasizes providing healthier food, crucial for consumer alignment. The company's products' nutritional value is key.

Consider ingredients and portion control to meet consumer preferences. This includes transparency on nutritional information.

Research indicates a growing preference for natural ingredients, impacting product development. Bel's strategy must adapt.

Modern lifestyles drive demand for convenient food, benefiting Bel's portioned cheeses. On-the-go consumption trends boost Bel's relevance; quick meals are key. Bel's individual portions enhance accessibility and reduce waste. In 2024, the global snack market reached $650 billion, highlighting this trend. Bel's focus on convenience aligns well with market needs.

Cultural Influences on Food Consumption

Cultural factors significantly shape food choices. Bel, with its global reach, must adapt to these differences. For instance, dairy consumption varies widely. Bel's brands cater to diverse tastes worldwide.

- In 2023, Bel reported strong growth in Asia, reflecting adaptation.

- The company continuously adjusts its product lines to local preferences.

- Marketing campaigns are localized to resonate with specific cultures.

Social Responsibility and Ethical Consumerism

Consumers are now more aware of companies' social and ethical conduct. Bel's focus on sustainable sourcing, animal welfare, and fair labor significantly impacts consumer perception and brand loyalty. A 2024 study shows that 70% of consumers prefer brands with strong ethical values. Bel's commitment to healthier, sustainable food further boosts its mission-driven image.

- 70% of consumers prioritize ethical brands (2024).

- Bel's sustainable initiatives enhance brand loyalty.

- Mission-led approach resonates with consumers.

Sociological factors profoundly influence Bel's market dynamics. Health and nutrition drive consumer choices, with growing interest in plant-based options. Convenience is crucial, as is transparency in ingredient sourcing, shaping product development. Cultural nuances also demand adaptation, influencing product lines and marketing strategies to cater to diverse tastes globally.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Health Trends | Prioritize healthier foods | 70% seek ethical brands (2024) |

| Convenience | Demand for quick, portable food | Global snack market $650B (2024) |

| Cultural | Localised tastes drive product lines | Bel's Asia growth strong (2023) |

Technological factors

Advancements in food production tech can boost efficiency, cut costs, and boost product quality and safety for Bel. Modern manufacturing and automation are key for staying competitive. Bel invested over €192 million in industrial infrastructure and digitalization in 2024. This investment reflects Bel's commitment to innovation.

Technological advancements in plant-based food are key to Bel's strategy. R&D is crucial for creating appealing plant-based cheese. Bel invests in fermentation tech and partnerships. The plant-based cheese market is growing; it was valued at $1.8 billion in 2024. Expected to reach $3.5 billion by 2029.

Digital transformation and e-commerce are crucial for Bel. They enable online sales and digital marketing. Bel’s partnership with Dassault Systèmes in 2024 leveraged AI. This improves market presence and operational efficiency. Bel's e-commerce sales grew by 15% in 2024.

Supply Chain Technology and Logistics

Bel can leverage supply chain technology to streamline its logistics, cutting costs and ensuring product quality. Advanced tracking and inventory systems are crucial, especially for a company with a global reach. Bel's emphasis on global procurement further highlights the importance of tech in managing its supply chain effectively. This helps maintain product freshness and reduce waste.

- In 2024, the global supply chain management market was valued at approximately $20.3 billion.

- Bel's global procurement strategy aims to optimize sourcing across diverse regions.

- Implementing real-time tracking can reduce spoilage by up to 15%.

Data Analytics and Consumer Insights

Bel can leverage data analytics to gain deeper insights into consumer preferences and market dynamics. This allows for more targeted marketing and efficient resource allocation. Such insights can drive innovation in product development and improve sales strategies. Bel's focus on secure digital communication campaigns is crucial in today's data-driven environment.

- In 2024, the global data analytics market was valued at approximately $270 billion.

- Personalized marketing campaigns have shown a 10-30% increase in conversion rates.

- Bel's investment in data security reflects the growing importance of protecting consumer data.

Technological advancements in food production and manufacturing are key for Bel. Bel's investments in industrial infrastructure and digitalization, totaling over €192 million in 2024, improve efficiency. Focus on plant-based food tech and digital transformation enhances its market presence. Supply chain technology and data analytics help in optimization and insights, with the data analytics market at $270 billion in 2024.

| Tech Aspect | Key Strategies | 2024 Market Data |

|---|---|---|

| Food Production | Modern manufacturing, automation. | N/A |

| Plant-Based Foods | R&D, fermentation tech. | Plant-based cheese market: $1.8B (2024). |

| Digital Transformation | E-commerce, digital marketing, AI partnerships. | E-commerce sales grew by 15% (2024). |

| Supply Chain | Streamlined logistics, tracking. | Global supply chain market: ~$20.3B (2024). |

| Data Analytics | Consumer insights, marketing. | Global data analytics market: ~$270B (2024). |

Legal factors

Food safety is crucial for Bel, demanding strict adherence to regulations. Compliance with global standards, hygiene, and quality controls is legally binding. This is vital for consumer trust and avoiding legal problems. Continuous operational compliance is a must. In 2024, food recalls cost companies an average of $10 million.

Bel must navigate diverse labeling and marketing laws globally. Regulations on food labels, nutritional info, and marketing claims vary significantly. Accurate, compliant labeling is vital to avoid legal issues. Recipe changes and label wording adjustments pose legal risks. In 2024, food labeling fines reached $500,000 in some regions.

Bel, operating globally, must navigate varied labor laws concerning working hours, pay, and employee rights. Compliance is key for responsible global workforce management. Bel's benefits plan reflects employee value. In 2024, labor law changes in France impacted Bel's HR practices. Bel's total employee benefits expenses were approximately €300 million in 2023.

Environmental Regulations and Standards

Bel faces stricter environmental rules on emissions, waste, and sustainability in manufacturing and packaging. These regulations are legally binding and support Bel's sustainability goals. The Corporate Sustainability Reporting Directive (CSRD) will affect most EU firms, increasing Bel's reporting needs. As of 2024, environmental compliance costs rose by 7% for similar food manufacturers.

- CSRD implementation began in 2024, impacting approximately 50,000 EU companies.

- Bel's 2023 sustainability report showed a 10% reduction in packaging waste.

- EU's Green Deal aims for a 55% cut in emissions by 2030.

Intellectual Property Laws

Bel heavily relies on intellectual property laws to protect its brand and innovations. Trademarks safeguard iconic brands such as The Laughing Cow and Mini Babybel, ensuring brand recognition. Patents are crucial for protecting unique product formulations and packaging designs. Bel's brand portfolio is a significant asset. In 2024, the company invested €45 million in R&D, focusing on product innovation and IP protection.

- Trademarks: Protects brand names and logos.

- Patents: Safeguard unique product features.

- R&D Investment: €45 million in 2024.

- Brand Portfolio: Key asset for Bel.

Bel must follow food safety regulations, complying with global standards, and prioritizing hygiene to maintain consumer trust, and the cost of recalls in 2024 averaged $10 million. Bel faces the complexities of varied global labeling and marketing laws, focusing on accurate labels and marketing to avoid issues, and 2024 fines hit $500,000 in some regions. Labor laws and environmental regulations regarding emissions are critical to ensure compliance. In 2024, compliance costs rose, and the CSRD affects EU firms.

| Area | Legal Impact | Financial Data |

|---|---|---|

| Food Safety | Strict regulations and hygiene standards | Average recall cost of $10M (2024) |

| Labeling & Marketing | Diverse global laws requiring compliant practices | Fines up to $500,000 (2024) |

| Labor & Environment | Compliance needed; sustainability is vital | Compliance costs up 7% (2024) |

Environmental factors

Climate change affects agriculture and raw material costs for Bel. Shifting weather patterns, water scarcity, and feed production issues are key concerns. Bel collaborates with farmers to cut milk production's carbon footprint. In 2024, extreme weather caused a 15% rise in feed costs, impacting dairy prices.

Water is essential for dairy farming and food processing, and it’s a key environmental factor for Bel. They focus on sustainable water usage to reduce environmental impact and manage water scarcity risks. For instance, in 2024, Bel reported water consumption data as part of its environmental disclosures. Bel has implemented policies to conserve water resources.

Packaging sustainability is a key environmental factor for Bel. There's growing demand for eco-friendly packaging solutions. Bel is committed to eco-design, cutting down on materials, and using recyclable and biodegradable options. A key goal is for all Bel packaging to be recyclable or biodegradable by 2025. Bel's 2023 report showed a 6% reduction in packaging weight.

Biodiversity and Ecosystem Protection

Bel's agricultural operations touch upon biodiversity and ecosystem health. The company is actively involved in protecting and restoring biodiversity, especially in dairy farming regions. Bel is a strong advocate for regenerative agriculture to minimize environmental impact. In 2024, Bel invested €10 million in sustainable agriculture projects. The company aims to source 100% sustainable palm oil by 2025.

- Bel’s agricultural supply chain can affect biodiversity.

- Initiatives are in place to protect and restore biodiversity.

- Regenerative agriculture is a key part of Bel's strategy.

- Bel invested €10 million in sustainable agriculture in 2024.

Greenhouse Gas Emissions Reduction

Bel prioritizes reducing greenhouse gas emissions throughout its operations, from sourcing to distribution. The company actively invests in cleaner energy and operational efficiencies to meet its emission reduction goals. Bel has partnered to install biomass boilers at production sites.

- Bel aims to reduce its carbon footprint by 25% by 2025 compared to 2018.

- In 2024, Bel's use of renewable energy increased, contributing to emission reductions.

- Bel has invested over €100 million in sustainable initiatives, including emission reduction projects.

Bel faces climate change impacts like rising costs and supply chain disruptions. Water sustainability is vital, with Bel focusing on eco-friendly practices to manage risks. Packaging and agricultural practices, including biodiversity protection, also guide environmental actions. Renewable energy and emission reduction are core to its sustainability plans.

| Environmental Aspect | 2024 Data | 2025 Goal |

|---|---|---|

| Feed Cost Impact | 15% rise due to extreme weather | Reduce impact through sustainable sourcing |

| Packaging | 6% reduction in packaging weight | 100% recyclable or biodegradable |

| Sustainable Agriculture Investment | €10 million invested | Source 100% sustainable palm oil |

PESTLE Analysis Data Sources

Bel PESTLE analyses utilize data from government databases, industry publications, and economic forecasts.