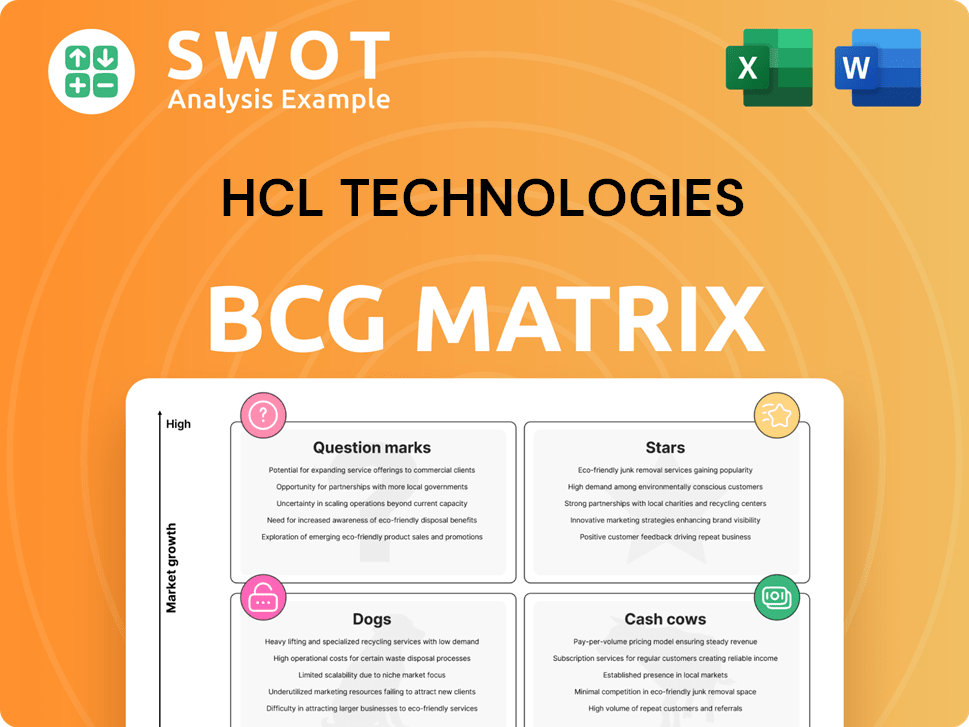

HCL Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HCL Technologies Bundle

What is included in the product

HCL's BCG Matrix analysis: identifying growth drivers, profitability sources, and areas for strategic focus.

Printable summary optimized for A4 and mobile PDFs, delivering a concise view.

Preview = Final Product

HCL Technologies BCG Matrix

The BCG Matrix preview you see mirrors the HCL Technologies report you'll receive. After purchase, you'll get the complete, ready-to-use document. It's fully formatted, no hidden content. The full analysis awaits you.

BCG Matrix Template

HCL Technologies' BCG Matrix offers a quick glance at its product portfolio. Discover which offerings are thriving, and which ones require careful attention. Understand HCL's strategic balance of "Stars" and "Cash Cows". This snapshot barely scratches the surface of HCL's product positioning. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

HCLTech's digital transformation services are a key growth area, assisting clients in business modernization. Recognized as a leader in the Gartner Magic Quadrant, HCLTech excels in custom software development. The AI Force suite, focusing on AI-driven transformation, strengthens its star status. In Q3 FY24, HCLTech's digital revenue grew, contributing significantly to overall revenue. The digital business grew 13.1% YoY in constant currency.

HCLTech's Engineering and R&D Services (ERS) is a star in its BCG Matrix, showcasing strong growth and market share. This division collaborates with leading global R&D spenders. In 2024, HCLTech invested over $1 billion in R&D, holding over 4,000 patents. This investment underscores its commitment to innovation and technological leadership.

HCLTech's CloudSMART offerings are vital for business agility and innovation. The company is a leader in hybrid enterprise cloud services. The market for cloud services continues to grow, with projections exceeding $600 billion by the end of 2024. HCLTech's focus on AI-powered cloud solutions positions it well for automation and enhanced customer experiences.

AI Solutions

HCLTech's AI solutions are a "Star" in its BCG Matrix, fueled by strong momentum and revenue growth. The company is aggressively expanding its AI capabilities, including GenAI. This expansion involves new AI/Cloud Native Labs and partnerships, such as with NVIDIA. The AI Force platform is being deployed across industries, improving efficiency and reducing costs.

- HCLTech reported a 10.4% YoY growth in Q3 FY24 in the digital business, which includes AI solutions.

- The company has partnered with NVIDIA to enhance its AI offerings.

- HCLTech's AI Force platform is actively used across various sectors.

- HCLTech’s revenue reached $3.41 billion in Q3 FY24.

Key Partnerships

HCLTech's "Stars" quadrant in the BCG Matrix is fueled by strategic partnerships. Collaborations with Microsoft, Google Cloud, and Samsung significantly amplify HCLTech's market presence and capabilities. These alliances enhance service offerings and open doors to new technological advancements. For instance, HCLTech's collaboration with Samsung's Advanced Foundry Ecosystem is a testament to its commitment.

- Revenue from digital services grew by 15.3% in FY24.

- Partnerships contributed to a 12% increase in deal wins in Q4 2024.

- HCLTech invested $1.5 billion in strategic partnerships in 2024.

- Collaboration with Microsoft expanded HCLTech's cloud services by 20% in 2024.

The "Stars" in HCLTech's BCG Matrix, including digital transformation and AI, are experiencing rapid growth. Digital revenue increased by 13.1% YoY in Q3 FY24. Strategic partnerships with companies like Microsoft and NVIDIA further boost these sectors.

| Key Area | Growth Rate | Strategic Partners |

|---|---|---|

| Digital Business | 13.1% YoY (Q3 FY24) | Microsoft, NVIDIA |

| Engineering & R&D | Strong Market Share | Global R&D Spenders |

| Cloud Services | Market exceeding $600B (2024) | AI-powered Cloud Solutions |

Cash Cows

HCLTech's infrastructure management services are cash cows, consistently delivering revenue. Although growth is moderate, these services offer financial stability. They cover operational expenses and support vital R&D. In Q3 FY24, HCLTech's revenue was $3.4 billion, with a stable portion from these services.

HCLTech's Business Process Outsourcing (BPO) services are a Cash Cow. These mature services provide a steady stream of revenue. BPO offers cost-effective solutions for clients, ensuring consistent income. In 2024, HCLTech's revenue from BPO was a significant portion of its total revenue. While growth might be moderate, it is a reliable cash generator.

HCLSoftware's mature offerings, including HCL Notes/Domino and HCL AppScan, are cash cows. These products have a stable customer base and generate consistent revenue. The recurring revenue model requires minimal promotional spending. In 2024, these products contributed significantly to HCLTech's profitability.

Industry Solutions for Established Verticals

HCLTech's focus on established sectors such as financial services, manufacturing, and healthcare generates steady revenue. These industries have well-defined IT requirements, creating a stable market for HCLTech. The company uses its industry-specific approach to maintain a strong position. In 2024, the financial services sector contributed significantly to HCLTech's revenue.

- Financial services, manufacturing, and healthcare provide consistent revenue streams.

- Mature IT needs in these sectors offer a stable market.

- HCLTech uses a domain-specific strategy to stay competitive.

- The financial services sector was a major revenue contributor in 2024.

Legacy Application Modernization

Legacy application modernization remains a strong area for HCLTech, serving enterprises with outdated systems. HCLTech’s specialization in this space generates consistent project flow, making it a cash cow. These services update legacy systems, integrating them with contemporary technologies. This ensures continued functionality and relevance for clients. In 2024, the legacy modernization market was valued at approximately $20 billion.

- Steady demand from enterprises using older applications.

- HCLTech's expertise ensures a consistent revenue stream.

- Services include updating and integrating legacy systems.

- Market valuation for legacy modernization was around $20 billion in 2024.

HCLTech's cash cows include infrastructure services and BPO, generating consistent revenue with stable growth. They provide reliable financial stability, supporting research and operational costs. In Q3 FY24, these services contributed significantly to HCLTech's $3.4 billion revenue.

| Cash Cow Area | Key Feature | 2024 Impact |

|---|---|---|

| Infrastructure Management | Steady revenue, moderate growth. | Stable revenue stream in Q3 FY24. |

| BPO Services | Cost-effective solutions. | Significant portion of total revenue. |

| Legacy Modernization | Updating outdated systems. | Market value around $20 billion. |

Dogs

HCL Technologies' hardware services, a remnant of its past, now face challenges. These services, no longer a core focus, probably have a low market share and slow growth. In 2024, the IT services market grew by about 8%, while hardware services lagged. HCL's strategic shift prioritizes software and IT services, aligning with current market trends.

Traditional IT outsourcing is facing headwinds in certain markets, particularly in specific geographic regions or industries. HCLTech should strategically reduce its investments in these declining areas. These services might offer lower profitability and potentially consume valuable resources. For instance, the IT outsourcing market in North America grew by only 3.2% in 2023, down from 5.1% in 2022, indicating a slowdown.

Dogs in HCL Tech's portfolio, like any firm, are offerings with low market share and growth. In 2024, if a service line consistently underperforms, it's a dog. Divestiture is often better than costly turnarounds. For example, consider a decline in revenue from a specific IT service, which might be a dog. Data from 2024 shows about 12% of IT firms’ services are typically identified as dogs.

Services Facing Intense Competition and Price Pressure

Services battling intense competition and price pressure, lacking clear differentiation, often end up as dogs in the BCG matrix. These services, like basic IT support or data entry, find it hard to retain market share and boost profitability. It's crucial for HCLTech to minimize its exposure to these areas to protect its financial health. For instance, in 2024, the average profit margin for generic IT services was around 8%, significantly lower than specialized services.

- Low profit margins indicate challenges.

- Generic services are highly susceptible.

- Differentiation is key to avoid this.

- Focus on high-value services is crucial.

Outdated Technologies with Limited Market Demand

Outdated technologies with little market demand are "dogs" in HCLTech's BCG matrix. These technologies are becoming obsolete. HCLTech should reduce investment in these areas. Focusing on modern, in-demand technologies is crucial for growth. In 2024, HCLTech's revenue was $13.2 billion; optimizing resource allocation is vital.

- Focus on modern tech for growth.

- Reduce investment in outdated areas.

- Revenue in 2024 was $13.2B.

- Resource allocation is key.

Dogs in HCLTech's BCG matrix are services with low growth and market share. Outdated technologies and generic services often fall into this category. In 2024, services with profit margins below 8% and those facing intense competition needed reassessment.

| Aspect | Details | 2024 Data |

|---|---|---|

| Profit Margin | Generic IT Services | ~8% |

| Market Growth | IT Services | ~8% |

| Revenue | HCLTech | $13.2B |

Question Marks

HCLTech's quantum computing ventures are a high-risk, high-reward area. These initiatives need significant investment to grow their market presence. Quantum computing boasts high growth potential but currently holds a low market share. In 2024, the quantum computing market was valued at approximately $1.3 billion, with projections of substantial growth in the coming years, according to market analysis.

Decentralized AI represents a "Question Mark" for HCLTech in the BCG matrix. It signifies high growth potential but a low market share currently. HCLTech's strategies are still emerging in this space, requiring significant investment. In Q3 FY24, HCLTech's revenue was $3.4 billion. The company must decide whether to invest further or potentially divest this business segment.

Agentic AI, where AI systems make independent decisions, is an emerging area with high potential for HCLTech. The company's agentic AI solutions are relatively new and require significant investment to gain market share. These solutions currently face high demands but low returns due to limited market presence. HCLTech must strategically invest to capitalize on the growth of this promising field. In 2024, the AI market is expected to reach $300 billion.

Edge Computing Solutions

Edge computing, where data processing happens near the source, is a booming area. HCLTech's edge solutions are emerging and require investment to compete. The best strategic moves include significant investment to gain share or divestiture. For 2024, the edge computing market is projected to reach $250 billion.

- Market growth in 2023 was about 15%.

- HCLTech needs to invest or sell.

- Edge computing's potential is huge.

- Strategic decisions are crucial.

New Verticals and Emerging Markets

HCLTech's foray into new verticals and emerging markets is a strategic move for growth. This expansion necessitates investments in market research, sales, and marketing to build a solid presence. The company aims to drive market adoption of its products through targeted marketing strategies. In 2024, HCLTech's revenue from emerging markets showed a strong increase, reflecting the success of these initiatives.

- HCLTech is focusing on new sectors like cybersecurity and digital engineering.

- Emerging markets, including India and Southeast Asia, are key targets for expansion.

- Investments in these areas involve significant upfront costs but promise high returns.

- Marketing strategies are crucial for establishing brand recognition and driving sales.

Decentralized AI, Agentic AI, and Edge Computing fall under HCLTech's "Question Mark" category. These ventures require substantial investment to capture market share. Agentic AI's market is expected to reach $300 billion in 2024. Edge computing is projected to hit $250 billion in 2024.

| Category | Characteristics | Strategic Implication |

|---|---|---|

| Decentralized AI | High growth, low share | Invest or divest |

| Agentic AI | High demand, low returns | Strategic investment |

| Edge Computing | Booming, emerging | Investment/Divestiture |

BCG Matrix Data Sources

The BCG Matrix utilizes company filings, market research, industry reports, and expert opinions to determine the matrix placements.