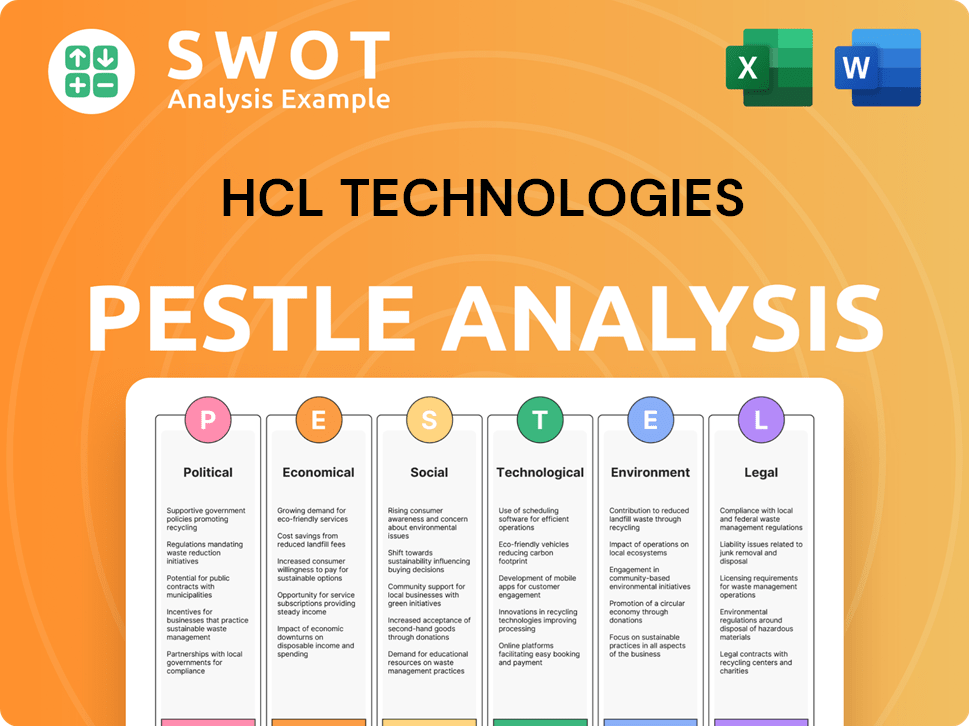

HCL Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HCL Technologies Bundle

What is included in the product

It examines external factors' impact on HCL Tech: Political, Economic, Social, Technological, Environmental, Legal.

A shareable, high-level format for instant alignment across teams and stakeholders.

Preview Before You Purchase

HCL Technologies PESTLE Analysis

This HCL Technologies PESTLE Analysis preview is the final version. The comprehensive analysis, its content, and all formatting is as shown.

PESTLE Analysis Template

Navigate the complex world influencing HCL Technologies with our PESTLE Analysis. Discover how political landscapes, economic shifts, and tech advancements shape its trajectory. This in-depth analysis explores key external factors. Download the full report and gain strategic advantage.

Political factors

Government regulations significantly affect HCLTech. Changes in IT service regulations, data privacy, and outsourcing policies in the US and Europe can alter operations and profitability. For instance, the EU's GDPR continues to shape data handling practices. HCLTech faces potential impacts from evolving immigration laws in key markets, influencing talent acquisition and operational costs. These factors necessitate careful strategic planning and compliance efforts.

Geopolitical instability affects IT service demand, creating market uncertainty for HCLTech. Macroeconomic challenges in North America and Europe have already slowed revenue growth. HCLTech's Q3 FY24 revenue was $3.41 billion, a 0.3% YoY growth. The company faces risks from political shifts in key markets.

Trade tariffs and protectionism pose risks. Increased costs from tariffs could reduce IT spending. For instance, in 2024, the US imposed tariffs on certain goods, potentially affecting tech supply chains. This could slow down global economic growth, impacting IT budgets. HCL Tech needs to monitor trade policies closely.

Government Spending on IT

Government spending on IT is crucial for HCLTech. Initiatives in digital transformation open doors for new contracts. The public sector is a key area for expansion. In 2024, global government IT spending is projected to reach $580 billion. HCLTech can leverage this trend.

- Public sector IT spending is expected to grow by 5% annually.

- HCLTech's focus on cloud services aligns with government IT modernization.

- Cybersecurity spending by governments is increasing significantly.

Political Stability in Operating Countries

Political stability is vital for HCLTech's global operations. Stable governments ensure consistent business environments and protect investments. Political instability can disrupt operations, particularly impacting labor and regulatory compliance. For example, India, a key operational hub, saw a stable government re-elected in 2024, boosting investor confidence.

- India's GDP growth in 2024 is projected at 6.5-7%, reflecting economic stability.

- HCLTech's revenue from the Americas (a region with varying political climates) was approximately 60% in FY24.

- The company's expansion plans include regions with stable political systems to mitigate risks.

Political factors heavily impact HCLTech’s global strategy. Government regulations, like those in the EU's GDPR, shape operational practices. Trade policies, such as tariffs, influence costs and IT spending, which directly affect profitability.

Geopolitical instability can slow revenue growth. Macroeconomic factors play a key role.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance Costs | GDPR fines up to 4% of global revenue |

| Trade | Cost Increase | US tariffs impacting supply chains |

| Instability | Market Uncertainty | Q3 FY24 revenue growth was 0.3% YoY |

Economic factors

Global economic growth is crucial for IT services demand. Slower growth in key markets can curb client IT spending, impacting HCLTech's revenue. In 2024, global GDP growth is projected around 3.2% by the IMF, a slight decrease from 2023's 3.1%. This directly affects HCLTech's financial performance.

HCLTech's substantial export revenue makes it sensitive to currency fluctuations. A stronger rupee against the US dollar or Euro can reduce the value of its foreign earnings when converted. In fiscal year 2024, HCLTech's revenue was approximately $13.2 billion. Currency volatility directly affects profitability.

Wage inflation is a key economic factor. HCLTech faces rising wage levels in India. This can increase operational costs. The IT sector saw wage hikes in 2024. Managing these costs is crucial for profit margins.

Client IT Budgets and Spending

Client IT budgets and spending are crucial for HCLTech's revenue. Economic downturns often cause clients to cut or postpone IT projects. IT spending growth in 2024 is projected at 6.8%, according to Gartner. This impacts HCLTech's service demand and revenue.

- Global IT spending is forecasted to reach $5.06 trillion in 2024.

- Cloud computing is a major growth area, with spending expected to increase.

- Economic uncertainty continues to be a key factor influencing IT investments.

Competition and Pricing Pressure

The IT services sector is highly competitive, creating pricing pressure that impacts companies like HCLTech. This can squeeze profit margins, especially with rising operational costs. HCLTech faces stiff competition from firms such as Tata Consultancy Services and Infosys. In Q3 FY24, HCLTech's revenue decreased by 6.5% YoY in constant currency.

- Intense competition leads to price wars, potentially reducing profitability.

- HCLTech must innovate and offer differentiated services to maintain margins.

- Cost optimization is critical to offset pricing pressures.

- The industry's growth rate and market share dynamics are also key factors.

Economic factors significantly impact HCLTech's financial performance. Global GDP growth, projected at 3.2% in 2024, influences IT spending and HCLTech's revenue. Currency fluctuations, like the stronger rupee, can decrease the value of foreign earnings.

Wage inflation, especially in India, elevates operational costs, crucial for profit margins within the IT sector. Client IT budgets, influenced by economic downturns, affect demand for HCLTech's services.

Economic uncertainty and IT spending influence investments. It is forecasted to reach $5.06 trillion in 2024.

| Factor | Impact | Data |

|---|---|---|

| GDP Growth | Affects IT spending | 3.2% global growth (2024) |

| Currency Fluctuations | Impacts foreign earnings | Rupee value |

| IT Spending Forecast | Influences Revenue | $5.06T (2024) |

Sociological factors

Attracting and retaining top IT talent is crucial for HCLTech. High attrition rates and a shortage of skilled workers can hinder service delivery. In Q3 FY24, HCLTech reported a voluntary attrition rate of 14.2%, reflecting the competitive job market. The firm invests heavily in reskilling programs.

Evolving employee expectations significantly shape HCLTech's HR strategies. Work-life balance, remote work, and diversity initiatives are key. HCLTech reported a ~36% women workforce in FY24. Investing in these areas boosts employee satisfaction and retention. These factors impact the company's ability to attract and retain top talent.

Societal focus on data privacy and security is rising. HCLTech must implement strong data protection measures to maintain client trust. In 2024, data breaches cost businesses an average of $4.45 million globally, emphasizing the need for robust cybersecurity. Failure to protect data can lead to significant financial liabilities and reputational damage for HCLTech.

Corporate Social Responsibility (CSR)

Corporate Social Responsibility (CSR) is increasingly vital for HCLTech. Clients, employees, and the community value ethical practices, impacting HCLTech's brand. HCLTech's commitment to CSR enhances its reputation and relationships. The company has received recognition for its ethical conduct and sustainability efforts. This focus is crucial for attracting and retaining talent and securing contracts.

- HCLTech's CSR spending in FY24 was approximately $50 million.

- HCLTech was ranked among the top 100 sustainable companies globally in 2024.

- Over 60% of HCLTech employees consider CSR a key factor in their employment.

Demographic Trends

Demographic shifts significantly influence HCLTech's operations. Changes in population age, education levels, and migration patterns directly impact the talent pool available. These trends also affect the demand for IT services across different sectors and regions. For instance, an aging population in developed nations may increase demand for healthcare IT solutions.

- India's IT sector is projected to employ 10 million people by 2025.

- The global IT services market is expected to reach $1.4 trillion by 2025.

Data privacy and security are critical, with breaches costing firms ~$4.45M in 2024. CSR is vital; HCLTech's FY24 CSR spending was ~$50M. Over 60% of employees value CSR.

| Factor | Impact | Data Point |

|---|---|---|

| Data Privacy | Financial & Reputational Risk | Avg. breach cost: $4.45M (2024) |

| CSR | Brand & Talent Attraction | HCLTech CSR spend: ~$50M (FY24) |

| Demographics | Talent Pool & Service Demand | IT sector employment: 10M by 2025 (India) |

Technological factors

Artificial Intelligence (AI) and Generative AI are rapidly changing the IT industry. HCLTech must use these technologies to stay innovative and competitive. In 2024, the global AI market was valued at over $200 billion, and is expected to reach $1.8 trillion by 2030, according to Statista. HCLTech is investing heavily in AI, with AI-related revenue expected to increase by 25% by 2025.

Cloud computing adoption is a key technological factor for HCLTech. The company needs to leverage its cloud expertise. In 2024, the global cloud computing market was valued at $670 billion, showing strong growth. This creates opportunities in migration and security services.

Digital transformation remains a key driver for HCLTech. The company benefits from increased demand for digital engineering, automation, and analytics solutions. HCLTech's revenue from digital services grew significantly. In Q3 FY24, digital revenue contributed 39.7% to the total revenue. This trend is expected to continue in 2024 and 2025.

Cybersecurity Threats

Cybersecurity threats are constantly evolving, making it crucial for HCLTech to invest in robust security measures. Recent data indicates a significant rise in cyberattacks globally. In 2024, the average cost of a data breach was $4.45 million, according to IBM. This necessitates continuous investment in cybersecurity solutions and expertise to safeguard client data and infrastructure.

- HCLTech must allocate substantial resources to protect against ransomware, phishing, and other sophisticated cyberattacks.

- The company needs to ensure compliance with evolving data privacy regulations.

- Regular security audits and employee training programs are essential.

Emerging Technologies (IoT, ML, etc.)

HCLTech must navigate the rapid evolution of emerging technologies like IoT and ML. These advancements open new markets and demand continuous innovation. For instance, the global IoT market is projected to reach $2.4 trillion by 2029. Staying ahead requires strategic investments in R&D, which in 2024, amounted to $300 million. This ensures HCLTech's competitiveness.

- IoT market projected at $2.4T by 2029.

- 2024 R&D investment of $300M.

HCLTech's tech landscape includes AI, cloud, and digital transformation, crucial for growth. The company focuses on cybersecurity due to rising threats, investing to protect data and infrastructure. Emerging technologies like IoT and ML also demand attention and R&D investments.

| Factor | Impact | Data |

|---|---|---|

| AI & Gen AI | Innovation, Competition | $1.8T by 2030 market |

| Cloud Computing | Migration, Security | $670B market (2024) |

| Digital Transformation | Revenue growth | 39.7% digital revenue (Q3 FY24) |

Legal factors

HCLTech must adhere to data protection laws like GDPR. The global data privacy market is expected to reach $104.7 billion by 2027. Non-compliance can lead to significant fines. This impacts operational costs and client trust. Cybersecurity spending is projected to hit $270 billion in 2025.

HCLTech must protect its intellectual property (IP) rights. This is crucial in the tech sector. The company needs to navigate complex IP laws. In 2024, global IP revenue reached approximately $1.7 trillion, showing its significance. HCLTech's IP strategy directly impacts its market position.

HCLTech must adhere to labor laws across various nations, affecting HR and costs. In 2024, global labor compliance spending reached $4.5 billion. Non-compliance can lead to hefty fines and legal battles. For instance, a 2024 study showed labor disputes cost tech firms an average of $2 million annually. These regulations influence hiring, wages, and employee relations.

Contract Law and Client Agreements

HCLTech operates under numerous contracts, making contract law crucial. Managing these complex client agreements and meeting contractual obligations is a core legal concern. Non-compliance can lead to significant financial penalties and reputational damage. In 2024, HCLTech reported that 15% of its legal expenditure was related to contract disputes. Strong contract management is vital to avoid these issues.

- Contractual disputes can cost HCLTech millions annually in legal fees and settlements.

- Adherence to data privacy clauses in client agreements is increasingly critical, reflecting global regulations.

- HCLTech must comply with diverse legal jurisdictions due to its global operations.

Regulatory Compliance in Specific Industries

HCLTech's operations in banking, healthcare, and life sciences face stringent industry regulations, impacting service delivery and compliance costs. For instance, the healthcare sector must comply with HIPAA in the US, and GDPR in Europe affects data handling across all sectors. In 2024, the global compliance market is estimated at $100 billion, growing annually. These regulations necessitate significant investment in compliance infrastructure and expertise.

- HIPAA compliance costs can range from $100,000 to over $1 million annually for large healthcare providers.

- GDPR non-compliance fines can reach up to 4% of a company's global annual turnover.

- The global compliance market is projected to reach $150 billion by 2025.

HCLTech must manage numerous contracts. Contract disputes led to 15% of their 2024 legal expenditure. Data privacy laws like GDPR and compliance in regulated sectors affect its operations. The global compliance market is expected to hit $150 billion by 2025.

| Legal Factor | Impact | Data |

|---|---|---|

| Contract Law | Financial Penalties, Reputational Damage | 15% legal expenditure on contract disputes (2024) |

| Data Privacy | Fines, Operational Costs, Client Trust | Global data privacy market at $104.7B by 2027 |

| Industry Regulations | Compliance Costs, Service Delivery | Global compliance market projected at $150B by 2025 |

Environmental factors

Climate change and sustainability are increasingly important. This boosts demand for "green IT" solutions. HCLTech is responding. For example, HCLTech aims to reduce emissions. They also plan to use more renewable energy. In 2024, HCLTech's sustainability initiatives included reducing carbon emissions by 10% compared to 2023.

HCLTech, as a tech firm, focuses on energy use and efficiency, vital for its data centers and offices. In 2024, data centers globally consumed over 2% of total electricity. HCLTech aims to cut energy use and boost efficiency across its operations. For example, in Q3 2024, HCLTech reported a 15% reduction in energy use.

HCL Tech must manage waste responsibly, especially e-waste. In 2024, global e-waste hit 62 million tonnes. The IT sector generates significant e-waste, requiring proper disposal. This includes recycling and reducing electronic waste to comply with environmental regulations. HCL's initiatives influence its environmental footprint.

Environmental Regulations and Compliance

HCLTech must adhere to environmental regulations in its operational countries. This includes managing waste, reducing emissions, and ensuring sustainable practices. Non-compliance can lead to significant financial penalties and reputational damage. For instance, in 2024, environmental fines for tech companies globally totaled over $500 million.

- Meeting ISO 14001 standards is crucial for demonstrating environmental responsibility.

- HCLTech's sustainability reports detail its environmental performance and goals.

- Investing in green technologies can reduce operational costs and improve brand image.

Supply Chain Environmental Impact

HCLTech must address its supply chain's environmental impact, a growing concern for stakeholders. It involves assessing and reducing the environmental footprint of its suppliers. This includes encouraging sustainable practices like using eco-friendly materials and lowering emissions. Implementing these changes can lead to better brand reputation and cost savings. For example, in 2024, 60% of companies are now actively monitoring their supply chain's environmental performance.

- Supply chain emissions account for up to 80% of a company's total carbon footprint.

- Companies with sustainable supply chains often see a 5-10% reduction in operational costs.

- By 2025, over 70% of consumers will prefer brands with sustainable practices.

HCLTech faces environmental factors like climate change and regulations. Focus is on reducing emissions, using renewable energy, and managing e-waste to ensure sustainability. In 2024, the IT sector globally generated 62 million tonnes of e-waste. Adherence to environmental standards is essential, impacting operations and reputation.

| Area | Impact | HCLTech Response |

|---|---|---|

| Emissions | Increased stakeholder scrutiny; compliance costs | 10% carbon emission reduction (2024) |

| Energy Use | Operational costs; data center energy demand (2% global electricity) | 15% reduction in energy use (Q3 2024) |

| E-waste | Regulatory fines; brand damage (Global e-waste 62M tonnes) | E-waste management; recycling programs |

PESTLE Analysis Data Sources

HCL Technologies' PESTLE uses data from industry reports, economic databases, and regulatory bodies.