Health Catalyst Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Health Catalyst Bundle

What is included in the product

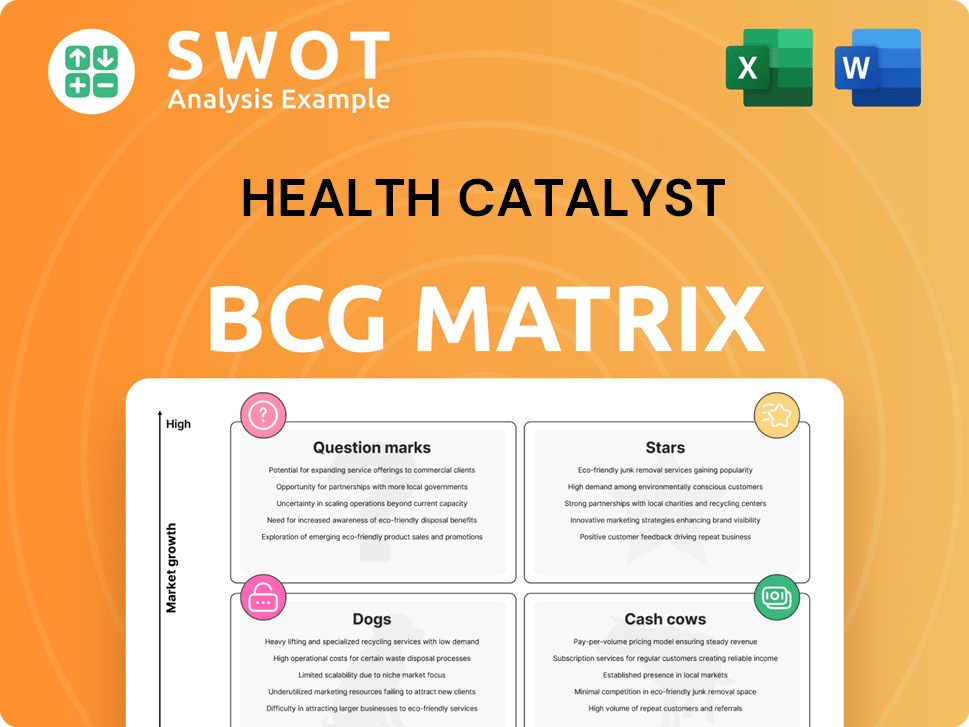

Health Catalyst's portfolio assessed via BCG Matrix, highlighting investment, hold, or divest strategies.

Interactive BCG Matrix to quickly spot opportunities & risks for better decision making.

Preview = Final Product

Health Catalyst BCG Matrix

The preview is identical to the Health Catalyst BCG Matrix you'll own after purchase. This is the final, downloadable document—ready for analysis and strategic planning, reflecting the full scope.

BCG Matrix Template

Health Catalyst's BCG Matrix reveals the growth potential of its products and services. We offer a glimpse into its Stars, Cash Cows, Dogs, and Question Marks. This strategic tool highlights market positions and guides resource allocation decisions.

Uncover detailed quadrant placements and gain strategic insights. Purchase the full BCG Matrix for a complete breakdown and data-backed recommendations.

Stars

The Ignite platform, including Ignite Spark, is a star for Health Catalyst, indicating high growth and market share. It's a flexible, modular solution designed for various healthcare organizations. In 2024, Health Catalyst's revenue grew, reflecting positive reception and market share gains for Ignite. This positions Ignite as a key driver for future success, with potential for further expansion.

Health Catalyst's AI-focused shift is a key growth area. Their Chief AI Officer and AI solutions target high-value contracts. Healthcare's need for predictive analytics boosts this segment. In 2024, the AI in healthcare market is valued at $10.9 billion, with Health Catalyst aiming to capture a significant share.

The Technology segment shines as a star within Health Catalyst's BCG matrix, boasting double-digit revenue growth. Its success stems from the increasing adoption of the Health Catalyst Ignite platform. This segment's ability to consolidate data and offer insights makes it a market leader. In 2024, the segment saw a 20% revenue increase.

Strategic Partnerships

Health Catalyst's strategic alliances with key healthcare entities represent a significant strength, particularly in 2024. These collaborations with major healthcare systems, academic medical centers, and integrated delivery networks enable Health Catalyst to tap into a broad client base. These alliances also facilitate growth within existing accounts.

- In 2024, Health Catalyst reported that over 70% of its revenue comes from existing client relationships, highlighting the importance of these partnerships.

- Partnerships include organizations such as Intermountain Healthcare and Allina Health, which contribute substantially to Health Catalyst's revenue.

- These partnerships are key in expanding the company's market reach and influence within the healthcare technology sector.

New Platform Clients

Health Catalyst's "Stars" are fueled by new platform clients, essential for revenue expansion. Contracts vary from $300K to $700K ARR, boosting financial performance. This focus on acquiring new clients is key to sustainable growth. The company's strong pipeline suggests continued success in client acquisition.

- Client contracts range from $300K to $700K ARR.

- Health Catalyst aims to expand its client base.

- New client acquisitions drive growth.

Health Catalyst's "Stars" shine, fueled by Ignite and AI initiatives, driving substantial revenue. The Technology segment saw a 20% increase in 2024. Key partnerships boost market share, with over 70% of revenue from existing clients. New platform clients' ARR varies between $300K and $700K.

| Metric | Data |

|---|---|

| Technology Segment Revenue Growth (2024) | 20% |

| Revenue from Existing Clients (2024) | Over 70% |

| Client Contract ARR Range | $300K - $700K |

Cash Cows

Health Catalyst is a cash cow, offering data and analytics to large healthcare organizations. They have a stable revenue stream, thanks to the constant demand for data insights. In 2024, the company's revenue reached $287.5 million, showing robust performance. High customer retention is crucial for maximizing cash flow.

Professional Services form a key part of Health Catalyst's revenue, even with tech's growth. They offer steady income through implementation, training, and consulting. These services are vital for the adoption of the Ignite platform. Optimizing their efficiency boosts cash flow; in 2024, this segment generated $100+ million in revenue.

Health Catalyst's recurring revenue model offers predictable cash flow. They focus on subscription-based access to their Ignite platform and analytics, ensuring a steady revenue stream. High customer retention and service expansion within existing accounts are crucial. In 2024, subscription revenue was a significant portion of their total revenue. The company reported a 97% client retention rate in Q3 2024, highlighting the success of their model.

Healthcare Analytics Warehouse

The Healthcare Analytics Warehouse (HAWK) is a crucial data and analytics hub. It's designed for automating data extraction, aggregation, and integration, centralizing clinical, financial, and operational information. This enterprise data warehouse supports comprehensive analysis. Health Catalyst's focus on data-driven solutions underscores its value. In 2024, the healthcare analytics market is projected to reach $47.3 billion.

- Data Integration: Automates data across various sources.

- Comprehensive Analysis: Supports detailed clinical and financial analysis.

- Market Growth: Healthcare analytics market is expected to grow significantly.

- Strategic Asset: Forms a key component of Health Catalyst's offerings.

Subscription-Based Model

Health Catalyst's subscription-based model provides reliable income, a key characteristic of a cash cow. Focusing on keeping clients highlights their dedication to lasting collaborations, crucial for this model's success. For 2024, subscription revenue contributed significantly to Health Catalyst's financial stability. This approach supports sustained profitability by ensuring a steady flow of funds.

- Recurring revenue models often yield higher valuation multiples than one-time sales.

- Client retention rates above industry averages signal strong customer satisfaction and loyalty.

- Subscription models allow for better financial forecasting and resource allocation.

- Long-term contracts create barriers to entry for competitors.

Health Catalyst is a cash cow, thriving in the healthcare analytics sector. They generate steady revenue, with 2024's revenue at $287.5 million. The company's strength lies in its subscription model and high client retention, ensuring consistent cash flow.

| Metric | Value | Year |

|---|---|---|

| Revenue | $287.5M | 2024 |

| Client Retention | 97% | Q3 2024 |

| Professional Services Revenue | $100M+ | 2024 |

Dogs

Health Catalyst's exit from Ambulatory Operations TEMS, set for mid-2025, suggests underperformance. This strategic shift allows focusing on more profitable areas. The decision aligns with cutting approximately $9M in annual revenue. This move aims to streamline operations and boost overall financial health.

As Health Catalyst shifts clients from its legacy DOS platform to Ignite, the old platform functions as a 'dog' in the BCG Matrix. Despite still bringing in revenue, it demands continuous upkeep and support, restricting its expansion prospects. Health Catalyst's 2023 revenue was $273.2 million. Migrating fully to Ignite is key to freeing up resources tied to the legacy system. By Q3 2024, 85% of Health Catalyst's revenue came from the newer platforms.

Health Catalyst's strategy involves streamlining operations and exiting less profitable areas. This focus indicates that some services may not be meeting financial targets. In Q3 2024, the company aimed at improving margins, emphasizing higher-return revenue streams. The goal is to boost overall financial performance through strategic restructuring and optimization. Management seeks to improve OpEx while increasing higher-margin revenue.

Non-Strategic Acquisitions

In the Health Catalyst BCG matrix, "dogs" represent acquisitions that haven't integrated well or don't align with strategic objectives. Evaluating acquisition performance is crucial, and corrective actions are needed if they underperform. For instance, in 2024, Health Catalyst's revenue grew, but not all acquisitions may have contributed equally to this growth. This highlights the importance of post-acquisition reviews.

- Acquisitions that do not contribute to the company's strategic goals

- Poorly integrated acquisitions

- Underperforming acquisitions

- The need for corrective action

Stalled Platform Clients

Health Catalyst's "Stalled Platform Clients" in the BCG matrix represent clients not fully leveraging its solutions. Despite a projected 40 net new platform clients in 2025, underperforming clients are a concern. These "dogs" may not generate expected revenue, impacting overall value. Prioritizing client success and platform adoption is vital.

- 2023 Revenue: $273.1 million

- Q1 2024 Revenue: $72.1 million

- 2024 Forecast: Revenue between $297 and $307 million

- Focus: Client success, adoption rates

In Health Catalyst's BCG matrix, "dogs" include underperforming acquisitions and clients not fully utilizing platforms. These elements hinder growth and value. Health Catalyst's 2024 revenue is projected between $297-$307 million. The focus is on strategic alignment and boosting client success.

| Category | Description | Impact |

|---|---|---|

| Underperforming Acquisitions | Poor integration or strategic misalignment. | Reduce revenue and value. |

| Stalled Platform Clients | Clients not fully using solutions. | Lower revenue potential. |

| Strategic Focus | Improve operational efficiency and client success. | Enhance financial performance. |

Question Marks

AI in clinical decision support is emerging. It's a relatively new field, so its market value is still unproven. Investment is needed to prove its worth and gain adoption. Early GenAI applications automate tasks like scheduling and note-generation. According to a 2024 report, the global clinical decision support systems market is projected to reach $3.7 billion by 2029.

Health Catalyst's forays into new healthcare segments are question marks. These ventures, such as the Carevive Systems acquisition, demand substantial investment. The Carevive deal, closing a life sciences agreement, also landed their first payer client. This move places them in the vast healthcare payer industry.

If Health Catalyst eyes international expansion, it's a question mark in the BCG Matrix. This move demands hefty investments and faces risks. Regulatory hurdles and market shifts add complexity. In 2024, Health Catalyst's international revenue was a small fraction of its total, signaling high growth potential.

Direct-to-Patient Analytics

Direct-to-patient analytics, powered by AI, is an emerging area. It's considered a "Level 9" investment, indicating its early stage. These strategies require substantial financial backing to prove their worth. The market is currently testing their effectiveness and building adoption. For example, in 2024, AI in healthcare saw $2.4 billion in funding.

- Early stage technology and market penetration.

- Requires significant investment in R&D.

- Focus on demonstrating value.

- Aiming for widespread adoption.

Predictive Analytics

Predictive analytics, a key component within the Health Catalyst BCG Matrix, currently faces challenges. These analytics need substantial upfront investment before demonstrating their value and achieving widespread adoption. The Clinical Risk Intervention & Predictive Analytics are relatively new, with unproven market performance. This area's potential is high, but its position is uncertain.

- Significant investments are necessary for predictive analytics.

- Clinical Risk Intervention & Predictive Analytics are new to the market.

- Market acceptance and proven value are still pending.

- Their future position and impact remain uncertain.

Question Marks require high investment. They are in early stages, needing R&D. The focus is on proving value and gaining adoption. However, their future impact is uncertain.

| Feature | Description | Data (2024) |

|---|---|---|

| Investment Need | High upfront investment. | AI in healthcare funding: $2.4B |

| Market Stage | Early stage, unproven. | Clinical Decision Support Market: $3.7B by 2029 |

| Goal | Prove value, drive adoption. | Direct-to-patient analytics: "Level 9" investment |

BCG Matrix Data Sources

Health Catalyst's BCG Matrix leverages health system financials, payer data, market reports, and clinical outcomes to provide robust analysis.