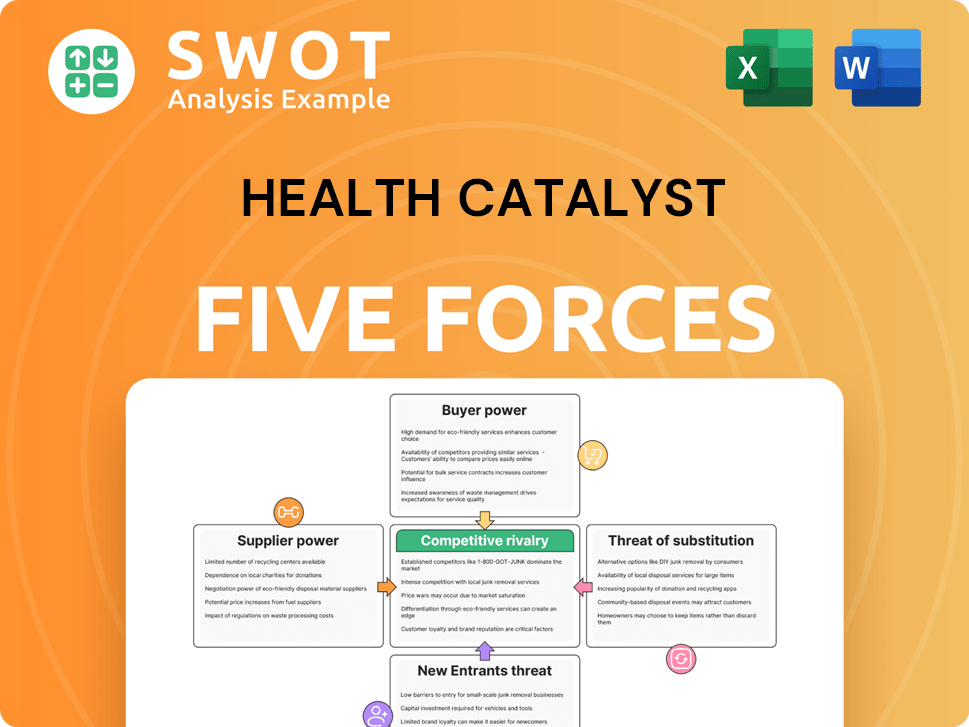

Health Catalyst Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Health Catalyst Bundle

What is included in the product

Analyzes Health Catalyst's market position, considering competitive forces and potential threats.

Quickly identify risks and opportunities in healthcare with clear force summaries.

Preview the Actual Deliverable

Health Catalyst Porter's Five Forces Analysis

This is the complete Health Catalyst Porter's Five Forces analysis. The preview you see is the actual, fully formatted document you'll receive. It's ready for immediate download and application to your strategic planning. No alterations or further steps are needed after purchase. The analysis provides an in-depth look.

Porter's Five Forces Analysis Template

Health Catalyst operates within a healthcare data analytics market, facing moderate rivalry due to several competitors. Buyer power is substantial as hospitals & health systems have negotiating leverage. Supplier power, particularly for specialized data & talent, is significant. The threat of new entrants is moderate, offset by high capital needs. Substitute products, like in-house analytics, pose a moderate threat. Ready to move beyond the basics? Get a full strategic breakdown of Health Catalyst’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Health Catalyst heavily relies on specialized data scientists and engineers. The limited supply of these professionals strengthens their bargaining power. This can result in higher labor costs, potentially affecting project timelines. For example, in 2024, the average data scientist salary in the US reached $120,000, reflecting high demand.

If Health Catalyst depends on proprietary software, those suppliers gain power. They can set prices, affecting Health Catalyst's costs and innovation. This reliance on a few vendors makes Health Catalyst vulnerable. In 2024, the healthcare IT market, where Health Catalyst operates, saw significant vendor lock-in issues. For example, Epic Systems, a major EHR vendor, has a substantial influence on its customer's choices, illustrating supplier power in this sector.

Access to comprehensive healthcare data is vital for Health Catalyst. Suppliers, like hospitals, influence pricing. High acquisition costs can hurt profitability. Securing long-term data deals is crucial. In 2024, data acquisition costs for healthcare analytics firms surged by 15%.

Cloud infrastructure providers

Health Catalyst relies on cloud infrastructure providers like AWS, Azure, and Google Cloud. These suppliers wield significant bargaining power due to the essential nature of their services and their market dominance. For instance, in 2024, AWS held approximately 32% of the cloud infrastructure market. Health Catalyst must negotiate favorable contracts to manage costs effectively. Diversifying cloud providers can also help mitigate supplier power.

- AWS's 32% market share in 2024 highlights its bargaining power.

- Negotiating favorable contract terms is crucial for cost management.

- Diversifying cloud providers reduces dependency and risk.

Consulting service rates

Health Catalyst's project costs can be affected by the rates charged by its consulting partners, especially if it subcontracts services. Consultants with specific expertise, like those in data analytics or healthcare IT, often have higher fees. This can squeeze profit margins. Building internal consulting capabilities may help reduce the reliance on external, more expensive consultants.

- In 2023, Health Catalyst's cost of revenue included significant consulting expenses.

- Specialized consultants can charge upwards of $300-$500 per hour.

- Developing in-house expertise can save 15%-25% on project costs.

- Negotiating fixed-price contracts can mitigate price hikes.

Health Catalyst faces supplier bargaining power from specialized labor and proprietary software providers. This can result in increased costs and vulnerability, impacting project economics. In 2024, data acquisition costs and consulting fees rose significantly. Strategic moves, like diversifying suppliers and building internal capabilities, are crucial for managing these challenges.

| Supplier Type | Impact | 2024 Data |

|---|---|---|

| Data Scientists/Engineers | Higher Labor Costs | Avg. Salary: $120,000+ |

| Proprietary Software | Price Setting, Vendor Lock-in | Healthcare IT vendor lock-in prevalent |

| Data Providers | High Acquisition Costs | Data acquisition costs rose 15% |

| Cloud Infrastructure | Essential Services | AWS holds ~32% market share |

| Consulting Partners | Project Cost Increases | Specialized consultants: $300-$500/hr |

Customers Bargaining Power

Large hospital systems are key Health Catalyst clients, wielding considerable buying power. These systems, representing a substantial portion of Health Catalyst's revenue, can negotiate advantageous terms. For example, in 2024, several major hospital networks sought discounts. Health Catalyst must prove its value to retain these clients and justify its prices. The ability to show a strong return on investment is crucial.

Smaller clinics often show greater price sensitivity due to limited budgets and resources. Health Catalyst might offer tiered pricing, with standardized solutions to meet these needs. In 2024, about 60% of U.S. healthcare providers are smaller clinics. Volume discounts and bundled services can improve appeal.

Switching costs are high for healthcare orgs adopting new data analytics platforms like Health Catalyst. Data migration, training, and integration require significant resources. Health Catalyst aims to retain customers. They do this through "sticky" solutions. In 2024, customer retention rates for similar SaaS companies averaged 90%. Strong customer support is crucial to keep clients.

Demand for demonstrable ROI

Healthcare organizations now demand a clear return on investment (ROI) from their tech spending, a trend intensifying in 2024. Health Catalyst faces pressure to prove its solutions improve clinical, financial, and operational results. They must offer compelling evidence of their impact. Case studies and performance guarantees boost buyer confidence.

- Demonstrate cost savings: 70% of healthcare executives prioritize cost reduction in 2024.

- Show improved outcomes: 65% of healthcare providers seek solutions that enhance patient care quality.

- Provide data-driven results: 80% of healthcare organizations rely on data analytics for decision-making.

- Offer performance guarantees: Companies with guarantees see a 20% increase in contract value.

Government regulations influence

Government regulations and healthcare policies indirectly shape customer bargaining power in the data analytics market. Changes in reimbursement models, like those from CMS, can influence hospitals' budgets and investment priorities. For example, the No Surprises Act and other cost transparency regulations impact hospital financial strategies. Health Catalyst must adapt to these shifts to maintain its market position.

- CMS finalized a rule in 2024 to increase price transparency in hospitals.

- The No Surprises Act, effective since 2022, protects patients from surprise medical bills.

- Healthcare spending in the US reached $4.5 trillion in 2022.

- The market for healthcare analytics is projected to reach $68.7 billion by 2028.

Health Catalyst faces customer bargaining power challenges, particularly from large hospital systems that can negotiate favorable terms, as evidenced by discount demands in 2024. Smaller clinics, with budget constraints, often exhibit greater price sensitivity, prompting Health Catalyst to consider tiered pricing strategies. These dynamics are influenced by the clear demand for ROI from healthcare organizations, with 70% prioritizing cost reduction in 2024.

| Factor | Impact | Data |

|---|---|---|

| Large Hospital Systems | High bargaining power | Major revenue source for Health Catalyst |

| Smaller Clinics | Price sensitivity | 60% of US healthcare providers |

| ROI Demand | Increased Pressure | 70% prioritize cost reduction |

Rivalry Among Competitors

Established companies like Epic and Cerner (now Oracle Health) are key rivals in healthcare analytics. The market is highly competitive, with these firms vying for contracts. Health Catalyst faces a tough battle for market share. In 2024, Epic's revenue was estimated around $6 billion, reflecting its strong position.

The healthcare analytics market sees new entrants due to lower barriers. Startups bring niche solutions, creating competition. Health Catalyst must innovate to counter these threats. In 2024, the healthcare analytics market was valued at $45.2 billion, with a projected CAGR of 15.7% from 2024 to 2032.

Competitive pressures can trigger pricing wars, squeezing profit margins. Health Catalyst needs to carefully balance its pricing strategy to stay profitable and fund future expansion. In 2024, the healthcare analytics market saw price wars, impacting margins. Value-based pricing models can be beneficial. For example, in Q3 2024, Health Catalyst's revenue was $75.1 million, up 12% year-over-year, showing the pressure.

Product differentiation crucial

In the competitive health IT market, product differentiation is key. Health Catalyst needs to continuously innovate to stand out. Focusing on unmet customer needs and specific clinical areas is essential. This approach helps carve a unique niche and attract clients. Recent reports show the healthcare IT market is projected to reach $82.6 billion by 2024.

- Innovation is key in a competitive market.

- Health Catalyst must focus on unmet customer needs.

- Target specific clinical areas for differentiation.

- The healthcare IT market is growing significantly.

Consolidation trends observed

The healthcare industry is seeing significant consolidation, as hospitals and health systems merge to gain market share and improve efficiency. This trend increases the bargaining power of customers, which in turn intensifies the competitive landscape for healthcare analytics providers like Health Catalyst. To stay competitive, Health Catalyst might need to explore strategic partnerships or even consider acquisitions to broaden its service offerings and customer base.

- Hospital merger and acquisition (M&A) activity has been robust, with 470 deals announced in 2022 and 487 in 2023.

- The top 25 health systems control a significant portion of the market, intensifying competition.

- Health Catalyst's competitors include large players like Optum and smaller, specialized firms.

Rivalry is intense due to established and new firms. Competitive pressures affect pricing and profit margins within the healthcare analytics market. Innovation and differentiation are key strategies.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Size | Healthcare analytics market value | $45.2 billion |

| Revenue | Health Catalyst Q3 2024 Revenue | $75.1 million |

| CAGR | Projected CAGR (2024-2032) | 15.7% |

SSubstitutes Threaten

Healthcare organizations sometimes stick with old reporting methods or simple spreadsheets, which can be a substitute for advanced platforms. Showing the benefits of advanced analytics is key to overcoming this. Education and training are essential to get people on board. In 2024, the global healthcare analytics market was valued at $38.2 billion, showing the value of the advanced platforms.

Healthcare providers might choose outsourced analytics from consultants or BPOs, posing a threat to Health Catalyst. To compete, Health Catalyst needs to offer better control and customization options. Data security and compliance are crucial differentiators. For example, the global healthcare analytics market was valued at $37.8 billion in 2023.

Open-source analytics tools pose a threat to Health Catalyst. These tools, like Apache Spark, offer alternatives to proprietary solutions. However, they demand high technical skills for upkeep. Health Catalyst can emphasize its user-friendliness and support, which is what many clients are looking for. In 2024, the open-source analytics market grew by 18%.

EHR-integrated analytics

The threat of substitutes for Health Catalyst includes EHR-integrated analytics. EHR vendors are adding analytics to their platforms, which could replace Health Catalyst's offerings. To compete, Health Catalyst needs to offer superior, specialized analytics, focusing on predictive analytics and machine learning to stand out. This differentiation is key to maintaining market share.

- EHR vendors' analytics market share grew to 15% in 2024.

- Health Catalyst's revenue from advanced analytics increased by 20% in 2024.

- The predictive analytics market is projected to reach $20 billion by 2025.

- Health Catalyst invested $50 million in AI and ML in 2024.

Internal development efforts

Large healthcare organizations could opt to build their own analytics solutions, posing a threat to Health Catalyst. To counter this, Health Catalyst must prove its services offer superior cost-effectiveness and efficiency compared to internal development. This involves showcasing the advantages of specialized external expertise to potential clients. In 2024, the healthcare analytics market was valued at approximately $30 billion, with a projected growth rate of 15% annually.

- Cost Savings: Health Catalyst can highlight reduced expenses compared to in-house development, including lower infrastructure and personnel costs.

- Expertise: Emphasize access to a team of experienced data scientists and healthcare specialists.

- Faster Deployment: Quick implementation of solutions can be a key differentiator, allowing clients to see results sooner.

- Scalability: Demonstrate the ability to scale services easily to meet evolving organizational needs.

Health Catalyst faces several substitutes, from old reporting methods to in-house solutions, impacting its market position. EHR-integrated analytics and open-source tools also pose threats, increasing competition. However, Health Catalyst can highlight its specialized expertise and cost-effectiveness.

| Substitute | Impact on Health Catalyst | 2024 Data |

|---|---|---|

| EHR Analytics | Direct competition | EHR market share: 15% |

| In-house solutions | Potential client loss | Market growth: 15% |

| Outsourced analytics | Alternative service | Market value: $38.2B |

Entrants Threaten

New entrants, especially those in specialized niches, pose a threat to Health Catalyst. These newcomers might focus on areas like population health management or precision medicine, quickly capturing market share by addressing specific needs. For instance, in 2024, the precision medicine market was valued at over $90 billion, indicating a significant area of potential competition. Health Catalyst needs to closely monitor these trends and adjust its strategies to stay competitive.

Cloud computing, AI, and machine learning advancements are reducing entry barriers. New companies can now build healthcare analytics solutions more easily. This increases competition. For example, the global healthcare analytics market was valued at $34.8 billion in 2024. Continuous innovation is key to success.

Data security and privacy concerns are a significant hurdle for new entrants in the healthcare analytics market. Healthcare organizations are often wary of sharing sensitive patient data with unproven vendors, creating a high barrier. Health Catalyst, with its established reputation and robust security certifications, holds a competitive edge. In 2024, the healthcare data breaches affected over 70 million individuals in the United States. This underscores the importance of data security.

Regulatory compliance hurdles

New entrants in the healthcare analytics market face significant regulatory hurdles. Compliance with regulations like HIPAA demands substantial investment and specialized knowledge. This can be a major barrier to entry, especially for smaller firms. Health Catalyst's established expertise in this area provides a competitive advantage. The cost of compliance can be substantial, with penalties for non-compliance potentially reaching millions.

- HIPAA compliance costs can range from $100,000 to over $1 million for initial implementation.

- Healthcare organizations paid over $30 million in HIPAA violation penalties in 2023.

- The average time to resolve a HIPAA data breach is 287 days.

- Health Catalyst's experience streamlines compliance, reducing risk and costs.

Partnerships enable entry

Partnerships significantly impact the threat of new entrants in the healthcare analytics market. New companies can team up with existing healthcare providers or tech firms to quickly access customers and crucial data. These collaborations speed up market entry and boost the new entrant's reputation. For Health Catalyst, proactively forming strategic alliances is essential to navigate this competitive landscape.

- Strategic partnerships can provide access to established customer bases, like the ones Health Catalyst serves, including over 300 healthcare organizations.

- Such alliances can facilitate data acquisition and analysis capabilities.

- Collaborations may involve joint ventures or technology integrations.

- These partnerships can help new entrants overcome barriers to entry.

New entrants pose a threat, especially in specialized areas. Cloud tech lowers entry barriers, increasing competition. Data security and privacy are hurdles, but partnerships can ease entry. Health Catalyst must adapt to stay ahead.

| Factor | Impact | 2024 Data |

|---|---|---|

| Specialization | Niche focus can steal market share. | Precision medicine market: $90B+ |

| Entry Barriers | Reduced by tech advancements. | Healthcare analytics market: $34.8B |

| Regulations | HIPAA compliance is costly. | Breaches affected 70M+ individuals |

Porter's Five Forces Analysis Data Sources

We compile data from industry reports, company filings, and market analyses to evaluate competitive dynamics.