Hecla Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hecla Mining Bundle

What is included in the product

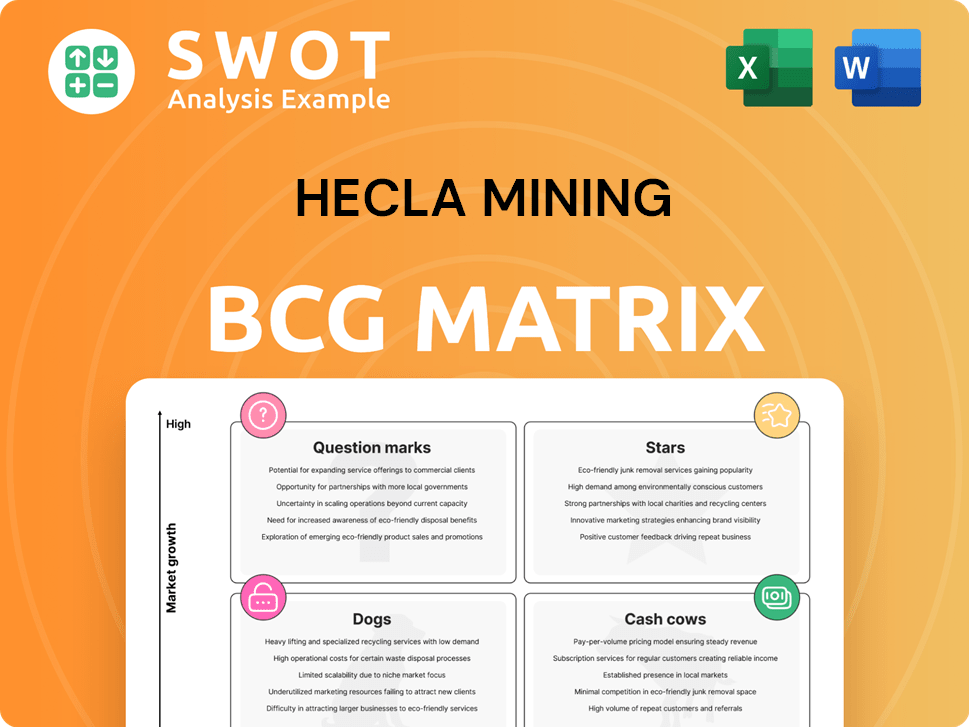

Hecla Mining's BCG Matrix analysis identifies investment, hold, and divest strategies for each unit.

Provides a dynamic, data-driven view that highlights areas needing urgent attention.

What You’re Viewing Is Included

Hecla Mining BCG Matrix

The Hecla Mining BCG Matrix preview shows the full document you'll receive. It's a ready-to-use analysis report with no alterations after purchase. Download the complete, professionally designed matrix immediately.

BCG Matrix Template

Hecla Mining's BCG Matrix helps visualize their product portfolio's market position. This framework categorizes products as Stars, Cash Cows, Dogs, or Question Marks. Understanding these classifications reveals growth potential & resource allocation needs. A glimpse shows strategic insights; it's just the surface.

Uncover detailed quadrant placements, strategic recommendations, and a roadmap for investment and product decisions with the full report.

Stars

Greens Creek, in Alaska, is Hecla's top silver producer. In 2024, it yielded 9.9 million ounces of silver. This mine provides substantial cash flow and boasts ongoing exploration success. Its strong performance secures long-term value for Hecla.

Lucky Friday, a key asset for Hecla Mining in Idaho, has recently shown strong performance. In 2024, the mine achieved record production levels. The UCB method boosted safety and productivity. Ongoing investments support throughput, aiming for sustained growth.

Hecla Mining boasts significant silver reserves. In 2024, they held roughly 240 million ounces. This makes them a major player in North America. These reserves support future silver production. Hecla also focuses on exploration to increase its reserves.

Financial Performance in 2024

In 2024, Hecla Mining demonstrated robust financial health. The company reported record revenues of $929.9 million. This was fueled by favorable metal prices and increased sales volumes, enhancing its financial stability. This financial strength supports strategic growth and shareholder value.

- 2024 Revenue: $929.9 million.

- Key drivers: Higher metal prices and increased sales.

- Financial Impact: Debt reduction and improved stability.

- Strategic Goal: Investment in growth initiatives.

Commitment to ESG

Hecla Mining's dedication to ESG is a significant strength, enhancing its long-term value. The company prioritizes environmental responsibility, community engagement, and First Nations partnerships. This focus improves Hecla's reputation and operational resilience. Safety performance improvements, like record-low AIFR at Greens Creek and Lucky Friday, highlight this commitment.

- In 2024, Hecla's ESG efforts included initiatives to reduce environmental impact and support local communities.

- Hecla's strong ESG practices are viewed positively by investors and stakeholders.

- Continuous improvement in safety metrics is a key focus.

- Hecla's engagement with First Nations is a part of its ESG strategy.

Hecla's "Stars" are high-growth, high-share assets like Greens Creek and Lucky Friday, both key silver producers. Greens Creek produced 9.9 million ounces in 2024, while Lucky Friday achieved record production. These mines drive significant revenue, supporting Hecla's growth strategy.

| Mine | 2024 Silver Production (oz) | Key Feature |

|---|---|---|

| Greens Creek | 9.9M | Top Silver Producer |

| Lucky Friday | Record | UCB Method |

| Total Revenue | $929.9M | Favorable Metal Prices |

Cash Cows

Hecla Mining demonstrates a consistent silver output, critical for steady revenue. Their operational focus ensures reliable production. In 2024, they produced 14.6 million ounces of silver. Production guidance for 2025 is 15.5 to 17 million ounces, showcasing stability. This makes Hecla a reliable cash generator.

Hecla Mining strategically positions its assets in politically stable and mining-friendly areas. Mines in Alaska, Idaho, and Quebec benefit from solid infrastructure and favorable conditions. These locations reduce operational and regulatory risks. This strategic focus supports consistent cash flow generation. Hecla reported $20.9 million in free cash flow for Q1 2024.

Hecla Mining uses hedging to manage price risks. The company uses forward contracts to hedge base metals and currency. In 2024, Hecla's hedging strategies aimed to protect revenue. This approach helps stabilize financial outcomes. These strategies are vital for financial stability.

Cost Management

Hecla Mining strategically emphasizes cost management, crucial for sustaining profitability amid metal price volatility. Their commitment involves enhancing operational efficiency, standardizing procedures, and closely monitoring cash costs and all-in sustaining costs (AISC) per silver ounce to maintain a competitive edge. In 2024, Hecla's AISC for silver was approximately $18.92 per ounce, underscoring their cost-control focus. This approach supports the company’s financial health.

- Cost management is key for profitability.

- Focus on operational efficiency.

- AISC per ounce is closely watched.

- AISC for silver was $18.92 per ounce in 2024.

Organic Growth Investment

Hecla Mining strategically invests in organic growth, focusing on projects with the best risk-adjusted returns. This approach aims to increase shareholder value by emphasizing internal growth. Exploration and pre-development expenses are prioritized at key locations like Greens Creek and Keno Hill. In 2024, Hecla's capital expenditures are projected to be around $200 million. This investment strategy is a key element of their financial planning.

- Projected 2024 capital expenditures: approximately $200 million.

- Focus on internal growth to maximize shareholder value.

- Prioritizing exploration and pre-development at Greens Creek and Keno Hill.

- Risk-adjusted returns are the primary focus.

Hecla Mining's consistent silver output and strategic location in stable regions make it a reliable cash generator. Their cost management and hedging strategies further stabilize financial outcomes. Capital expenditures in 2024 are projected at $200 million, supporting organic growth. These factors establish Hecla as a strong cash cow.

| Metric | 2024 Data | 2025 Guidance |

|---|---|---|

| Silver Production (oz) | 14.6M | 15.5-17M |

| Free Cash Flow (Q1 2024) | $20.9M | N/A |

| AISC per Silver oz | $18.92 | N/A |

Dogs

Casa Berardi, a gold mine in Quebec, faces a strategic review by Hecla Mining. The mine's shift to surface operations by mid-2025 hints at performance issues. In Q1 2024, Casa Berardi produced 20,335 ounces of gold. Hecla is considering alternatives, including a possible sale. This makes it a potential "Dog" in Hecla's portfolio.

High production costs can significantly affect profitability for Hecla Mining's operations. In Q1 2024, consolidated gold total cost of sales rose, partly due to lower sales at Casa Berardi. The company is actively managing costs and aiming for increased efficiency. Labor and power expenses are also anticipated to drive up costs in 2025.

Market volatility significantly impacts Hecla Mining. Fluctuations in silver and gold prices directly affect revenue and profitability. Hecla employs hedging, but substantial price drops still pose financial risks. In 2024, silver prices saw notable volatility. Investors should monitor metal price movements closely.

Permitting Delays

Permitting delays, especially at the Keno Hill project, pose a significant risk to Hecla Mining's growth and profitability. These delays can stem from regulatory challenges or community opposition, potentially slowing down critical project milestones. Such setbacks may postpone throughput optimization, which is essential for realizing returns at Keno Hill. The company's 2024 annual report highlighted ongoing efforts to navigate these complexities.

- Keno Hill's expected production impacted by permitting.

- Regulatory hurdles slow down project timelines.

- Community concerns add to permitting challenges.

- Throughput optimization delayed affecting returns.

Operational Disruptions

Operational disruptions pose a significant risk for Hecla Mining. Equipment availability challenges and power supply issues have directly impacted production at its operations. For example, equipment issues delayed mining sequences, affecting access to higher-grade stopes. Power problems have also hampered operations, highlighting the vulnerability to external factors. These disruptions can lead to production delays and increased costs.

- Equipment downtime impacted backfill cycles.

- Power supply issues have affected Keno Hill operations.

- These issues can lead to production delays.

- Disruptions increase operating costs.

Dogs in the BCG matrix are low-growth, low-share businesses. Casa Berardi, with its surface shift and possible sale, aligns with this. High costs and market volatility further cement this classification. In Q1 2024, Casa Berardi’s gold production was 20,335 ounces.

| Metric | Details | Impact |

|---|---|---|

| Casa Berardi Status | Surface operations planned by mid-2025; possible sale | Indicates underperformance, low growth |

| Q1 2024 Gold Production | 20,335 ounces | Low share compared to other assets |

| Cost Concerns | Rising costs, including labor and power | Reduced profitability and competitiveness |

Question Marks

Keno Hill, located in Yukon Territory, is positioned as a question mark in Hecla Mining's BCG Matrix. The mine's silver reserves grew by 17% to 64.3 million ounces in 2024, showing growth potential. However, permitting and power issues pose near-term production risks. These challenges could affect its valuation.

The Libby Exploration Project in Montana is on the FAST-41 Critical Minerals Dashboard. This project is still in the exploration phase, making its future success uncertain. Its potential value to Hecla Mining is significant, although contingent on exploration and permitting. Hecla's total proven and probable mineral reserves were 6.6 million ounces of gold and 189.3 million ounces of silver as of December 31, 2023.

Hecla's Nevada operations span 110 square miles across four land packages. These areas are in the exploration phase, representing potential growth. The success of these operations hinges on exploration outcomes and economic feasibility. In 2024, Hecla invested significantly in exploration, with $25.4 million allocated for Nevada. The future of these operations is dependent on these investments.

Strategic Review of Casa Berardi

The strategic review of Casa Berardi is ongoing, creating uncertainty. This review could significantly alter Hecla's asset mix. Casa Berardi is shifting to surface-only operations. Hecla is exploring strategic options, possibly including divestment. In 2023, Casa Berardi produced 101,463 ounces of gold.

- Review introduces uncertainty about Casa Berardi's future.

- Outcomes may lead to changes in Hecla's assets.

- Transition to surface-only operations is underway.

- Strategic alternatives, including divestment, are considered.

Exploration Portfolio

Hecla Mining's exploration portfolio includes several pre-development projects across North America, representing potential future growth opportunities. These projects require substantial financial investment and inherently involve exploration risks. The company is strategically managing its exploration portfolio to enhance returns.

- Hecla's exploration efforts are focused on high risk-adjusted return projects.

- The company aims to identify projects with the potential for strong free cash flow generation.

- Exploration projects are crucial for long-term sustainability.

- Success in exploration can significantly increase shareholder value.

Hecla Mining's question marks include Keno Hill, Libby, and Nevada projects, facing uncertainties. Their future hinges on exploration success and resolving permitting and operational challenges. These assets require strategic investment to unlock potential value. The strategic review of Casa Berardi further complicates the picture.

| Project | Status | Key Issue |

|---|---|---|

| Keno Hill | Silver mine; reserves up 17% | Permitting, power |

| Libby | Exploration phase | Exploration success, permitting |

| Nevada | Exploration phase | Exploration results, economic feasibility |

BCG Matrix Data Sources

The Hecla Mining BCG Matrix leverages financial reports, industry analyses, and market data, providing a foundation for strategic decisions.