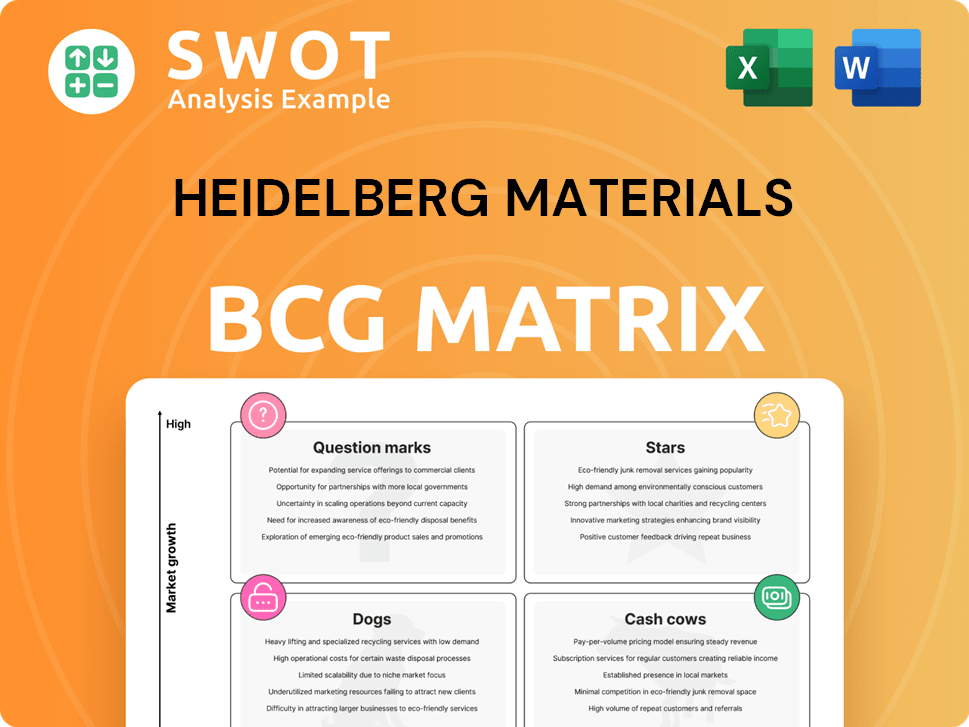

Heidelberg Materials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

What is included in the product

Strategic analysis of Heidelberg Materials using the BCG Matrix model to assess its portfolio.

Printable summary optimized for A4 and mobile PDFs, helping managers quickly assess and share portfolio data.

Preview = Final Product

Heidelberg Materials BCG Matrix

This preview is identical to the Heidelberg Materials BCG Matrix you'll receive post-purchase. It's a fully realized document for in-depth strategic analysis, ready for immediate application in your business. There are no modifications, just the complete, professional report designed for comprehensive decision-making.

BCG Matrix Template

Heidelberg Materials operates in a dynamic industry, making strategic product portfolio management crucial. Their BCG Matrix classifies products into Stars, Cash Cows, Dogs, and Question Marks, offering a snapshot of their market positioning. This framework helps understand growth potential and resource allocation needs. Analyzing these quadrants reveals valuable insights into Heidelberg Materials’ competitive landscape. The full version unveils detailed quadrant breakdowns, strategic recommendations, and data-backed analysis.

Stars

Heidelberg Materials is strategically focused on sustainable product innovation, specifically in low-carbon cement and concrete. This approach capitalizes on the expanding market for eco-friendly construction materials. Their evoZero line, including net-zero cement, is a key initiative. In 2024, the global green cement market was valued at $38.2 billion, reflecting growth.

Heidelberg Materials' CCS tech, like Brevik in Norway, leads in decarbonizing cement, a major CO2 emitter. This gives them a competitive edge. In 2024, they invested heavily in CCS. They plan to launch net-zero evoZero cement in Europe in 2025. This is a strategic move.

Heidelberg Materials shines in North America, a growth market fueled by infrastructure spending and private projects. Their strategic moves and operational efficiency enable them to thrive here. In 2024, North America led the pack with revenue up 1.8% to EUR5.31 billion, showcasing strong performance.

Digital Transformation Initiatives

Heidelberg Materials is actively pursuing digital transformation. Their strategy includes the Digital Hub Varna and Dynamics 365 Sales, enhancing customer experience and operational efficiency. These initiatives streamline processes, improve data access, and support better decision-making. The company aims to lead the heavy building materials industry in digitalization.

- Digital Hub Varna supports digital solutions.

- Dynamics 365 Sales improves customer interactions.

- Digitalization is a core strategic focus.

- The company aims to improve operational efficiency.

Strategic Acquisitions in Growth Markets

Heidelberg Materials strategically acquires companies in growth markets, like ACE Group in Malaysia, to boost its presence. This approach grants access to vital resources such as fly ash, which decreases cement's CO2 intensity. These strategic moves support both profitable growth and sustainability targets. In 2024, Heidelberg Materials' acquisition of ACE Group, the largest fly ash supplier in Malaysia, continues its growth trajectory.

- ACE Group acquisition expands Heidelberg Materials' footprint in Southeast Asia.

- Fly ash usage reduces CO2 emissions in cement production.

- The Malaysian market offers significant growth potential.

- Heidelberg Materials aims for sustainable and profitable expansion.

Heidelberg Materials shows Star status through rapid expansion and innovation. Their strong performance in North America and investments in CCS tech highlight their growth. In 2024, North American revenue rose to EUR5.31 billion. This position allows further investments.

| Key Aspect | Details |

|---|---|

| Market Position | Leading in green cement, CCS, and digital transformation. |

| Financials (2024) | North America Revenue: EUR5.31B, up 1.8%. |

| Strategic Initiatives | CCS investments, digital hubs, strategic acquisitions. |

Cash Cows

Heidelberg Materials' aggregates business is a cash cow, thriving in a mature market with steady demand. This segment demands low investment but yields strong cash flow because aggregates are vital for construction projects. In 2024, the aggregates market saw robust activity, reflecting the ongoing need for infrastructure development and housing, with Heidelberg Materials reporting solid sales figures. The consistent demand, coupled with efficient operations, makes aggregates a reliable source of revenue and profit.

Ready-mixed concrete is a cash cow for Heidelberg Materials, contributing significantly to revenue. This segment operates in a mature market, ensuring consistent demand. The business model yields steady cash flow due to its established infrastructure and customer base. In 2024, Heidelberg Materials reported strong revenue, with ready-mixed concrete playing a key role.

Heidelberg Materials' cement operations in established markets like Europe function as cash cows. These regions, including Northern Europe, benefit from stable demand and robust infrastructure. For example, in 2024, the Northern Europe region saw a steady performance. The company capitalizes on its established customer base and operational efficiencies to generate consistent profits.

Operational Efficiency Improvements

Heidelberg Materials boosts operational efficiency through the 'Transformation Accelerator' program, targeting network optimization and streamlined processes. This directly enhances cash flow within its established business segments, a key characteristic of a Cash Cow in the BCG Matrix. The initiative aims to generate EUR500 million annually by 2026, showcasing substantial financial impact. These improvements reduce costs, solidifying the company's strong financial position.

- 'Transformation Accelerator' focuses on network optimization.

- Enhances cash flow from existing operations.

- Expected to contribute EUR500m annually by 2026.

- Reduces costs and streamlines processes.

Strong Market Positions in Northern Europe

Heidelberg Materials' strong market positions in Northern Europe, particularly in cement production within Sweden, Norway, and Estonia, classify it as a cash cow in the BCG matrix. These nations offer a robust and reliable revenue stream, thanks to the continuous demand for cement in construction. This strategic regional dominance ensures consistent cash flow, driving financial stability. In 2024, Heidelberg Materials reported significant revenue from its Northern European operations.

- Leading cement producer in Sweden, Norway, and Estonia.

- Essential product for construction activities.

- Provides stable revenue and cash flow.

- Significant revenue from Northern European operations in 2024.

Heidelberg Materials' cash cows, like aggregates and cement in mature markets, generate reliable cash. These segments require low investment while yielding strong cash flows, essential for financial stability. The 'Transformation Accelerator' boosts cash flow by streamlining processes, targeting EUR500 million annually by 2026.

| Segment | Market Status | Investment Level |

|---|---|---|

| Aggregates | Mature | Low |

| Ready-Mixed Concrete | Mature | Low |

| Cement (Northern Europe) | Mature | Low |

Dogs

Heidelberg Materials faces challenges with older cement plants in areas with falling construction and high expenses, categorizing them as "dogs". These plants, with small market shares, yield little cash. The Hanover plant's clinker output will end in the second half of 2024. Restructuring in France will close sites by October 2025. In 2023, Heidelberg Materials' revenue was around €21.1 billion.

In competitive asphalt markets, Heidelberg Materials' asphalt business might face challenges in gaining significant market share or profitability. These operations could be considered dogs within the portfolio, potentially warranting divestiture consideration. Heidelberg Materials is a key asphalt producer, vital for construction. In 2024, the asphalt market saw intense competition, impacting profit margins.

Products with low sustainable revenue share, failing to meet sustainability criteria, are classified as dogs. These face pressure from regulations and changing preferences. Heidelberg Materials' net CO₂ emissions were 527 kg/t, with sustainable revenue at 43.3% in 2024. This signifies a need to shift away from unsustainable products.

Operations Lacking Digital Integration

Operations lacking digital integration at Heidelberg Materials might struggle. These units could face challenges in efficiency and customer service, potentially losing market share. Heidelberg Materials is actively pursuing digital transformation. The company aims to use real-time data for improved efficiency.

- In 2023, Heidelberg Materials invested €117 million in digital initiatives.

- Digitalization efforts aim to boost operational efficiency by 5-10%.

- Customer satisfaction scores are a key performance indicator (KPI).

- Inefficient units may see a decline in profitability.

Small Market Share in Specific Geographies

Heidelberg Materials' market share can be low in areas with limited presence or tough competition, potentially classifying these regional operations as "dogs." This necessitates strategic investment or divestment decisions. Soft demand is expected in Western and Southern Europe, while Eastern Europe may offer some offset. For instance, in Q3 2023, the company noted challenges in certain markets.

- Regional Market Share: Low in specific areas.

- Strategic Decisions: Investment or divestment needed.

- Demand Outlook: Soft in Western/Southern Europe.

- Geographic Focus: Eastern Europe offers potential.

Dogs in Heidelberg Materials' portfolio include cement plants with falling construction demand and high costs. Asphalt operations facing intense competition and lower profit margins are also categorized as dogs. Products with low sustainable revenue and lacking digital integration face market challenges. These units typically have low market shares and require strategic intervention.

| Category | Characteristics | Financial Impact |

|---|---|---|

| Cement Plants | Falling demand, high costs | Limited cash generation |

| Asphalt Operations | Intense competition, low margins | Potential divestiture |

| Unsustainable Products | Low revenue share, regulatory pressure | Need for strategic shift |

| Digitally Lagging Units | Inefficiency, service issues | Decline in profitability |

Question Marks

EvoBuild, Heidelberg Materials' CO2-reduced products, is a question mark in the BCG Matrix. It taps into the rising demand for sustainable construction. However, its current market share may be limited, requiring investment. In 2024, the sustainable building materials market is valued at over $400 billion. Heidelberg Materials' focus on evoBuild aligns with this trend, needing strategic marketing to grow.

Heidelberg Materials views calcined clay cement projects, like the one in Ghana, as question marks in its BCG matrix. These ventures, including the 0.4Mta plant in Ghana by CBI Ghana, offer lower-carbon cement options. Success hinges on market adoption and favorable regulations. In 2024, Heidelberg Materials invested significantly in sustainable solutions.

Heidelberg Materials' new digital services are question marks in its BCG Matrix. These offerings aim to improve customer experience and streamline construction. Success hinges on market acceptance and proving value. In 2024, digital solutions saw a 15% adoption rate. They help builders manage projects, cut costs, and stay on schedule.

Carbon Capture Utilization Projects

Heidelberg Materials is venturing into Carbon Capture Utilization (CCU) projects, moving beyond simple carbon capture and storage. These projects focus on using captured CO2 to create new materials, but their success hinges on market acceptance and economic feasibility. CCUS is vital for reducing process emissions in building materials manufacturing. The company invested €140 million in carbon capture projects in 2024.

- CCU explores using captured CO2 for new materials.

- Viability depends on market and economic factors.

- CCUS is key for emission reduction.

- Heidelberg Materials invested €140M in carbon capture in 2024.

Investments in Alternative Fuels

Investments in alternative fuels at Heidelberg Materials represent a question mark in the BCG matrix. The company's move towards alternative fuels, such as biomass, is driven by sustainability goals. However, the fluctuating availability and cost-effectiveness of these fuels introduce uncertainty. The alternative fuel rate increased from 29.9% in 2023 to 31.2%.

- Alternative fuel rate in 2023: 29.9%.

- Alternative fuel rate in 2024: 31.2%.

- Clinker ratio: 69.2%.

Heidelberg's alternative fuel initiatives are question marks. They aim for sustainability, but face fuel cost/availability challenges. The alternative fuel rate rose to 31.2% in 2024. Clinker ratio was 69.2%.

| Metric | 2023 | 2024 |

|---|---|---|

| Alternative Fuel Rate | 29.9% | 31.2% |

| Clinker Ratio | - | 69.2% |

| Investment in CCUS Projects | - | €140M |

BCG Matrix Data Sources

The Heidelberg Materials BCG Matrix is created using financial statements, industry research, market analysis, and expert opinions.