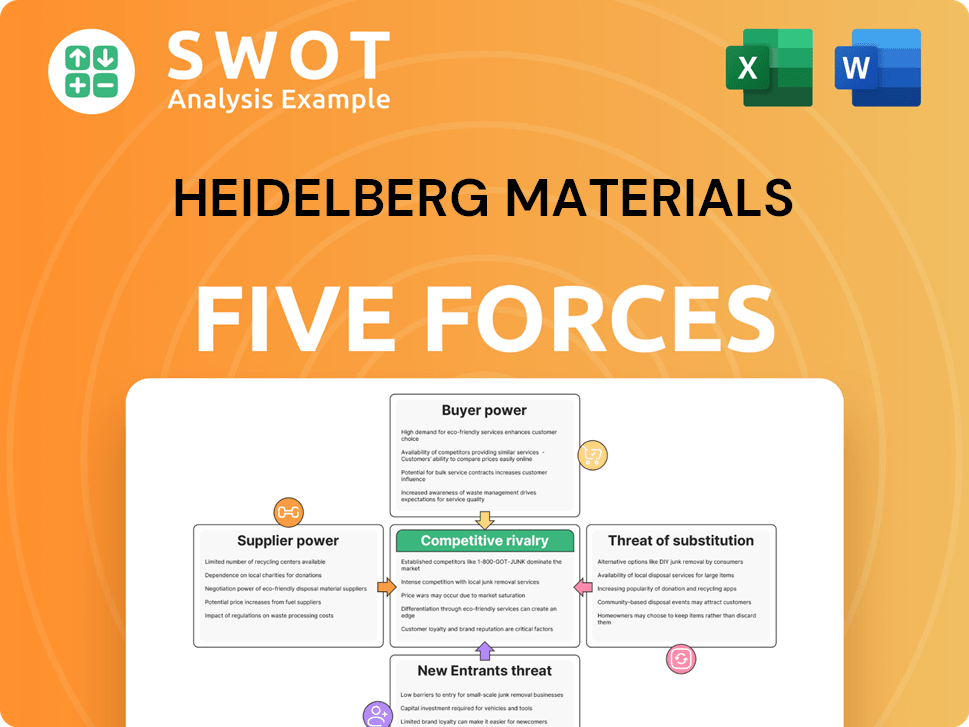

Heidelberg Materials Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Swap in your own data, labels, and notes to reflect current business conditions.

Same Document Delivered

Heidelberg Materials Porter's Five Forces Analysis

This is the complete Heidelberg Materials Porter's Five Forces analysis. The detailed document you're previewing is the same professional analysis you'll receive. It provides in-depth insights into the company's competitive environment. You'll get instant access to this ready-to-use resource upon purchase. The analysis requires no additional formatting or setup.

Porter's Five Forces Analysis Template

Heidelberg Materials operates in a market significantly shaped by the construction industry’s cyclical nature and regional variations. The threat of new entrants is moderate, influenced by high capital requirements. Buyer power fluctuates with project scale and market demand. Competitive rivalry is intense, driven by several large players. Substitute products, such as alternative building materials, pose a constant but manageable threat. Understanding these dynamics is critical for investment decisions.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Heidelberg Materials's real business risks and market opportunities.

Suppliers Bargaining Power

Heidelberg Materials faces supplier power due to limited options. The building materials sector has a concentrated supplier base. This can increase input costs. Key suppliers hold a large market share. In 2024, prices for cement and aggregates, key inputs, saw fluctuations, impacting Heidelberg Materials' margins.

Suppliers with strong market power can control pricing and availability, affecting Heidelberg Materials' profits. In times of high demand or material shortages, suppliers might raise prices significantly. This can reduce Heidelberg Materials' profit margins, impacting their ability to compete. For instance, in 2024, the cost of raw materials like cement and aggregates saw price fluctuations due to supply chain disruptions and increased demand, affecting the company's cost structure.

Suppliers with unique products hold more power. Heidelberg Materials' reliance on specialized materials increases dependence. This can lead to less favorable terms. For example, in 2024, the price of cement, a key material, fluctuated due to supplier dynamics.

Switching Costs

Switching costs significantly impact supplier power. High switching costs, encompassing time, effort, and potential disruptions, strengthen suppliers. Heidelberg Materials might accept less favorable terms if changing suppliers is costly, particularly if the new supplier lacks a proven track record. In 2024, the construction materials market saw increased consolidation, potentially raising switching costs.

- Disruptions in supply chains can increase switching costs.

- New supplier reliability is a key concern.

- Consolidation in the industry affects supplier options.

- Long-term contracts can lock in high switching costs.

Forward Integration Potential

Suppliers with forward integration possibilities, meaning they could enter the building materials market directly, increase their bargaining power. This ability to compete with Heidelberg Materials gives suppliers more leverage in negotiations. The threat of direct competition can significantly impact the bargaining dynamics, potentially reducing Heidelberg Materials' ability to secure favorable pricing or terms.

- Heidelberg Materials' 2024 revenue was approximately €21.1 billion.

- The construction materials market is highly competitive, with numerous suppliers.

- Forward integration by a major supplier could disrupt market share.

Heidelberg Materials faces supplier power from concentrated suppliers. The ability to control prices impacts margins. In 2024, cement and aggregate prices fluctuated. Switching costs and forward integration also affect bargaining power.

| Factor | Impact on Supplier Power | 2024 Context |

|---|---|---|

| Supplier Concentration | Higher Power | Consolidation in the market. |

| Switching Costs | Higher Power | Disruptions and reliability concerns. |

| Forward Integration | Higher Power | Potential for direct competition. |

Customers Bargaining Power

Customers in the building materials industry, like those buying from Heidelberg Materials, often show price sensitivity, particularly where competition is fierce. Customers may pressure for lower prices if they see similar products across suppliers. In 2024, price wars in specific regional markets reduced margins. This sensitivity can squeeze Heidelberg Materials' profits if they cut prices to keep market share.

The availability of substitutes significantly impacts customer bargaining power. Customers gain leverage if they can readily switch to alternatives like wood or steel. For instance, in 2024, the global construction materials market included diverse options. This competition affects Heidelberg Materials' pricing strategies.

Heidelberg Materials faces strong customer bargaining power if sales are concentrated. In 2024, key construction firms accounted for a substantial revenue share. These large customers can negotiate lower prices, affecting profitability. This concentration necessitates competitive pricing strategies and efficient operations to maintain margins.

Switching Costs for Customers

Customers' bargaining power is heightened by low switching costs. This means clients can readily choose between different cement, aggregate, or ready-mixed concrete suppliers. This ease of switching pushes Heidelberg Materials to be competitive on price and service. In 2024, the construction industry saw a 3.2% increase in material costs, impacting supplier negotiations.

- Competitive pricing pressures are evident in the construction sector.

- Customers can switch suppliers easily.

- Heidelberg Materials must remain competitive.

- Material costs saw a 3.2% increase in 2024.

Information Availability

Customers' access to information significantly shapes their bargaining power. Increased transparency in pricing and product details allows customers to compare Heidelberg Materials' offerings with competitors. This access, fueled by online resources and industry data, enables informed decision-making. Such readily available data can pressure prices and raise customer expectations, affecting Heidelberg Materials' profitability.

- Online platforms and industry reports provide real-time pricing data, influencing customer negotiation.

- In 2024, the construction industry saw a rise in digital procurement, enhancing price comparisons.

- Customer expectations for product quality and service levels have increased, impacting Heidelberg Materials' strategies.

Customer bargaining power significantly impacts Heidelberg Materials. Price-sensitive customers and readily available substitutes pressure prices, impacting margins. Key customers' concentration in 2024 further amplified negotiation power.

Switching costs' ease encourages price competition. The 3.2% rise in 2024 material costs influenced negotiations. Transparency in pricing, amplified by online resources, strengthens customer leverage.

| Factor | Impact on Heidelberg Materials | 2024 Data Point |

|---|---|---|

| Price Sensitivity | Reduced Margins | Price wars in regional markets |

| Substitute Availability | Pricing Pressure | Global construction material options |

| Customer Concentration | Negotiation Power | Key firms accounted for revenue share |

Rivalry Among Competitors

The building materials sector faces fierce competition, impacting profitability. Rivals engage in strategies like price wars and increased marketing. Heidelberg Materials competes with companies such as CRH and Holcim. In 2024, the industry saw fluctuating prices and margin pressures.

The cement industry is undergoing significant consolidation. UltraTech and Adani have been actively acquiring smaller firms. This trend intensifies rivalry among larger players. Heidelberg Materials must compete in this evolving market. The Indian cement market reached $37.4 billion in 2024.

Capacity additions in the cement industry intensify competition. Oversupply may occur as firms increase production. This can lead to price drops and lower profits. Heidelberg Materials must carefully manage capacity. In 2024, global cement production reached 4.1 billion tonnes, indicating significant capacity.

Geographic Factors

Competitive rivalry for Heidelberg Materials shifts geographically, impacting its performance. Markets vary in competitiveness; some are more intense than others. The Asia-Pacific region presents strong competition due to overcapacity. Heidelberg Materials must navigate these regional differences effectively.

- Asia-Pacific challenges reflect global overcapacity issues.

- Regional strategies are crucial for Heidelberg Materials' success.

- Market-specific dynamics influence profitability.

- Heidelberg Materials adapts to local competitive landscapes.

Product Differentiation

Heidelberg Materials actively differentiates its products to combat competitive rivalry. This involves creating value through sustainable materials and digital solutions. Such strategies help in commanding higher prices and improving market positioning. For instance, Heidelberg Materials' sales in 2023 reached approximately €21.1 billion, showing its strong market presence.

- Focus on eco-friendly products and digital tools.

- Custom concrete mixtures for tailored needs.

- Digitalization enhances customer experience.

Heidelberg Materials faces intense rivalry, marked by price wars and market share battles. Consolidation and capacity expansions amplify competition, particularly in regions like Asia-Pacific. Differentiating through sustainable products and digital solutions is crucial.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Market Consolidation | Increased competition. | UltraTech/Adani acquisitions. |

| Capacity Additions | Price pressure potential. | Global cement production: 4.1B tonnes. |

| Differentiation | Enhanced market positioning. | 2023 Sales: €21.1B. |

SSubstitutes Threaten

The threat of substitutes is notable within the building materials sector, as multiple materials can serve similar functions. For instance, wood, steel, and plastics offer alternatives to cement and concrete. This substitution potential constrains Heidelberg Materials' ability to set prices. In 2024, the global construction market's reliance on alternative materials like timber increased by roughly 5%.

Technological advancements pose a threat to Heidelberg Materials. Innovations like modular construction and 3D-printed structures offer alternatives. This could impact demand for traditional materials. Heidelberg Materials must adapt to stay competitive. For example, the global 3D construction market is projected to reach $1.8 billion by 2027.

Rising environmental awareness boosts demand for green construction. Alternatives like recycled aggregates and bio-based materials are becoming popular. Heidelberg Materials faces pressure to offer sustainable options. In 2024, the green building materials market grew by 10%. Investment in eco-friendly tech is vital to compete.

Price Performance of Substitutes

The price performance of substitutes significantly impacts customer choices. Cheaper alternatives with comparable performance can lure customers away. Heidelberg Materials needs to constantly evaluate its pricing against substitutes like recycled concrete and other materials. In 2024, the cost of recycled concrete has fluctuated, making it a key factor.

- Recycled concrete prices varied by up to 15% in different regions during 2024.

- The cement market experienced a 5-7% price increase due to energy costs in late 2024.

- Heidelberg Materials' Q3 2024 report highlighted a 3% decrease in sales volume, partly due to substitute material usage.

Regulatory Environment

Government regulations significantly shape the construction materials market. Building codes and sustainability mandates can either boost or hinder the use of substitutes. For instance, policies favoring green building practices can increase demand for alternatives.

Heidelberg Materials faces the challenge of adapting to evolving regulatory landscapes. Staying informed about changes and innovating its product line is critical. Consider the EU's emphasis on sustainable construction.

This involves embracing materials that meet new standards. Regulatory shifts can thus create opportunities or pose threats.

- EU's Green Deal focuses on sustainable construction, affecting material choices.

- Building codes increasingly require eco-friendly materials.

- Government incentives can promote alternatives.

The threat of substitutes significantly impacts Heidelberg Materials due to available alternatives like wood and steel. Technological shifts, such as 3D printing, also challenge traditional materials. The price of substitutes, like recycled concrete, and government regulations further influence this dynamic.

| Factor | Impact | 2024 Data |

|---|---|---|

| Substitution | Impact on pricing | Recycled concrete price varied up to 15% |

| Technology | Shifting demand | 3D construction market is projected to $1.8B by 2027 |

| Regulations | Material choices | Green building materials market grew by 10% in 2024 |

Entrants Threaten

The building materials sector demands substantial capital to set up operations. For example, Heidelberg Materials' investments in new cement plants and aggregate quarries are in the hundreds of millions. Such high initial costs act as a significant deterrent. This barrier limits the threat from new competitors, especially in 2024, as financial markets tighten.

Established firms like Heidelberg Materials enjoy significant economies of scale, a tough hurdle for newcomers. In 2024, Heidelberg Materials' revenue was approximately EUR 21.1 billion, reflecting its vast operational scale.

Their size allows for lower per-unit production costs, a critical advantage. For instance, Heidelberg Materials' cost of sales was around EUR 15.5 billion in 2024.

New entrants struggle to match these cost efficiencies. This cost advantage gives Heidelberg Materials pricing power. Heidelberg Materials' EBITDA in 2024 was approximately EUR 3.8 billion.

This makes it hard for new competitors to compete effectively on price. The company's strong market position is reinforced by these factors.

Established distribution networks are a significant barrier for new entrants. Companies like Heidelberg Materials already have well-established channels, giving them an edge. These networks take time and money to build, making it hard for newcomers to compete. Heidelberg Materials' distribution, including its 600+ locations, strengthens its market position. In 2024, Heidelberg Materials' sales reached approximately €21.0 billion.

Regulatory and Permitting Hurdles

The building materials sector faces significant regulatory barriers, making it hard for new companies to enter. Getting the green light to run quarries, cement plants, and concrete facilities is often a long and complicated task. These regulatory and permitting hurdles significantly slow down and discourage potential new entrants. For example, in 2024, the permitting process for a new cement plant in the EU could take up to 5 years. This is due to environmental impact assessments and public consultations.

- Lengthy approval processes can delay projects and increase costs.

- Environmental regulations, such as those related to emissions and land use, are major concerns.

- Compliance with safety standards and building codes adds complexity.

- The need to secure licenses and permits from multiple agencies is a challenge.

Access to Raw Materials

Securing access to raw materials is a significant barrier for new entrants in the building materials sector. Companies like Heidelberg Materials benefit from established relationships and long-term contracts for resources like limestone and aggregates. New companies face difficulties in competing for these vital resources, impacting their ability to operate effectively. Heidelberg Materials' control over key raw material sources strengthens its competitive edge.

- Heidelberg Materials has a global network of quarries and other raw material sources, ensuring a steady supply.

- New entrants may struggle to secure the necessary quality and quantity of raw materials at competitive prices.

- Established companies' existing infrastructure and supply chains create a significant advantage.

The building materials sector faces moderate threat from new entrants. High initial capital investments, such as Heidelberg Materials' substantial expenditures on plants, act as barriers. Existing firms benefit from economies of scale and established distribution.

Regulatory hurdles and access to raw materials further complicate market entry. These factors collectively limit the threat, although innovation could alter the landscape.

| Factor | Impact | Example |

|---|---|---|

| Capital Requirements | High barrier | Heidelberg Materials' capital expenditures. |

| Economies of Scale | Competitive Advantage | EUR 21.1B revenue in 2024. |

| Regulatory Hurdles | Significant barrier | Permitting can take 5 years. |

Porter's Five Forces Analysis Data Sources

The analysis leverages annual reports, market research, and industry publications to understand competitive dynamics and market positions.