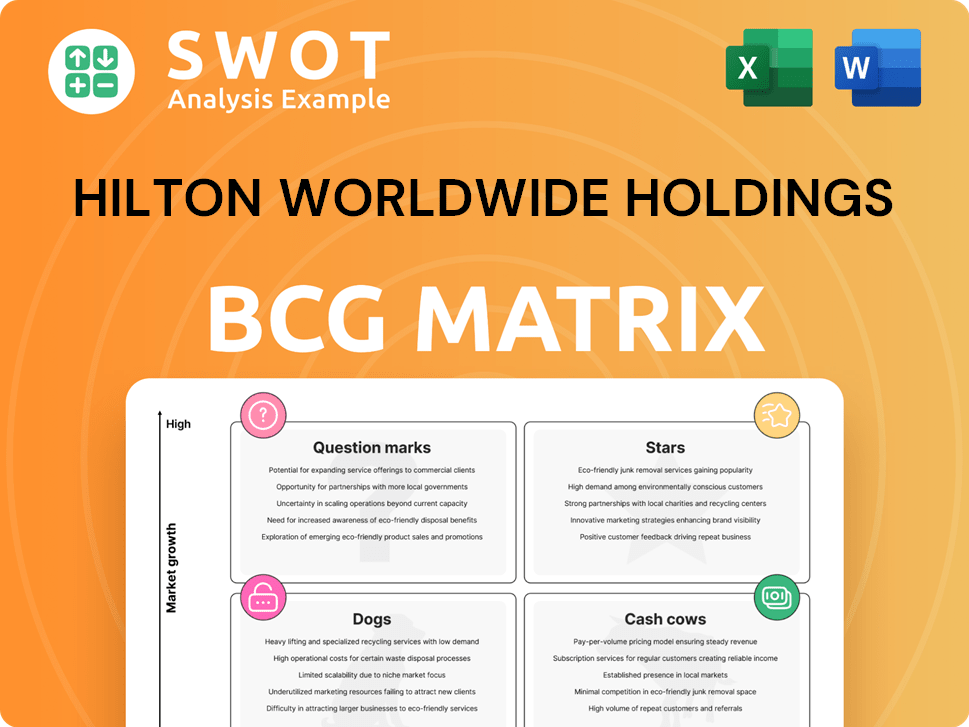

Hilton Worldwide Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Worldwide Holdings Bundle

What is included in the product

Strategic overview of Hilton's portfolio using the BCG Matrix, identifying growth opportunities and divestment targets.

Clean, distraction-free view optimized for C-level presentation of Hilton's diverse portfolio.

Preview = Final Product

Hilton Worldwide Holdings BCG Matrix

The preview you're viewing is the exact BCG Matrix report you'll receive post-purchase, featuring Hilton Worldwide Holdings. Get the full, ready-to-use document, complete with strategic insights and market data, immediately upon purchase.

BCG Matrix Template

Hilton Worldwide Holdings operates across diverse segments, from luxury hotels to budget-friendly options. This suggests a portfolio with varied growth potential. The company likely has "Stars," like premium brands, driving revenue and growth. "Cash Cows," perhaps established mid-range hotels, generate steady profits. "Dogs," or underperforming assets, need careful management. "Question Marks," new ventures, require strategic investment.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Luxury brands like Waldorf Astoria and Conrad are key for Hilton. They have a solid market share in the growing luxury travel sector. These brands need ongoing investment to stay ahead and keep their premium service. By the end of 2024, Hilton's luxury division had over 500 hotels globally, showing strong growth.

Hilton's Asia-Pacific expansion is a strategic move into a high-growth market, leveraging increasing tourism. This requires sustained investment to build a strong presence and adapt to local needs. In 2024, Hilton exceeded 1,000 hotels in the Asia-Pacific, showing its dedication to regional growth. The company reported a 15% increase in RevPAR (Revenue Per Available Room) in Q3 2024 for the Asia-Pacific region, driven by strong demand.

Hilton Honors is a star in Hilton's BCG matrix, fueling customer loyalty and repeat business. With over 210 million members, the program significantly boosts revenue. Strategic investments in benefits and personalization are key to maintaining its strong position. In 2024, Hilton's loyalty program continues to show strong growth, with members enjoying exclusive perks.

New Brands (Graduate, NoMad)

Hilton's Graduate and NoMad brands are "Stars" in its BCG matrix. These new lifestyle brands need initial investment to capture market share. Graduate expanded Hilton's presence in university communities and NoMad in luxury segments. This strategy has driven overall growth, with Hilton's Q3 2024 revenue reaching $2.7 billion.

- Graduate targets university towns, and NoMad focuses on luxury lifestyle.

- Both brands require marketing and establishment investments.

- These brands contribute to Hilton's overall growth strategy.

- Hilton's Q3 2024 revenue was $2.7 billion.

Technology and Innovation

Hilton's "Stars" quadrant highlights its strong focus on technology and innovation, crucial for maintaining its competitive advantage. Digital key and personalized experiences, like those offered through the Hilton Honors app, significantly boost customer satisfaction. In 2024, Hilton continued to invest heavily in these areas, with tech spending reaching approximately $300 million. The company’s innovative approach, including the introduction of Digital Key Share and automated room upgrades, positions it as an industry leader.

- 2024 tech spending: approximately $300 million.

- Focus on digital key and personalized experiences.

- Introduction of Digital Key Share.

- Automated complimentary room upgrades.

Hilton's "Stars" also include technology and innovation, such as digital keys and personalized experiences. These innovations boost customer satisfaction, with tech spending around $300 million in 2024. Hilton's strategies, including Digital Key Share, position it as an industry leader.

| Feature | Details |

|---|---|

| 2024 Tech Spending | Approximately $300 million |

| Key Innovations | Digital Key Share, Room upgrades |

| Customer Impact | Increased Satisfaction |

Cash Cows

Hilton Hotels & Resorts is a Cash Cow in the BCG Matrix due to its strong market position. The brand benefits from high recognition and customer loyalty. Investment should prioritize maintaining brand standards and operational efficiency. As of 2024, Hilton has over 584 hotels across 94 countries, generating substantial revenue.

Hilton's Management and Franchise segment is a Cash Cow. It brings in significant revenue via fees and licensing. This segment requires strong owner relationships and operational optimization. In 2024, this segment produced US$3.34 billion, which is 70% of Hilton's total revenue.

Hampton by Hilton is a "Cash Cow" in Hilton's BCG Matrix. This brand generates steady cash flow due to its established market presence and reliable service. Maintaining quality and customer satisfaction is key to retaining its strong position. In 2024, Hampton had a robust RevPAR (Revenue Per Available Room) demonstrating its financial stability. It boasts a large portfolio within the focused-service segment.

Timeshare and Vacation Ownership

Hilton Grand Vacations, a cash cow for Hilton, provides consistent revenue and cash flow. Efficient management and customer satisfaction are key to maintaining profitability. The spin-off maintains a strong affiliation with Hilton. In 2024, Hilton Grand Vacations reported a revenue of $3.6 billion.

- Revenue: $3.6B (2024)

- Focus: Efficient management and customer satisfaction.

- Relationship: Strong affiliation with Hilton.

Food and Beverage Services

Hilton's food and beverage services, particularly in established hotels, are cash cows, generating consistent revenue. These services, including restaurants, bars, and catering, are crucial for hotel profitability. Focusing on cost management and optimizing service is key to maximizing profits within these areas. For instance, food and beverage contributed significantly to Hilton's overall revenue in 2024.

- Steady Revenue: Food and beverage services offer reliable income.

- Profitability: Cost control and service optimization boost profits.

- Revenue Contribution: Restaurants, bars, and catering are essential.

- 2024 Impact: Food and beverage significantly contributed to Hilton's revenue.

DoubleTree by Hilton is a cash cow, known for steady revenue generation. Its success hinges on maintaining service quality and brand consistency. With a focus on operational efficiency, it consistently contributes to Hilton's financial stability. In 2024, DoubleTree's RevPAR remained robust, showcasing its strong market position.

| Brand | Segment | Focus |

|---|---|---|

| DoubleTree | Full-Service | Service quality, brand consistency |

| Financial Performance | Steady revenue & high occupancy | RevPAR in 2024 |

| Key Strategy | Operational efficiency | Maintain strong market position |

Dogs

Some older, full-service Hilton hotels face challenges. They might underperform due to evolving consumer tastes. These hotels often have higher operating expenses. In 2024, Hilton's RevPAR increased by 4.8%, but older properties may lag. Consider renovations or sales to boost returns.

Hilton's less popular brands, with low market share and growth, need careful evaluation. These brands, potentially dogs in the BCG matrix, require turnaround strategies or divestiture considerations. Their combined market share accounts for roughly 5% within the hospitality industry. This segment faces challenges in a competitive landscape.

Hotels in economically stagnant areas, categorized as "Dogs" in Hilton's BCG Matrix, often face revenue challenges. Long-term viability must be assessed, with strategic options like restructuring or divestiture considered. Economic downturns and market sensitivity severely affect operations; in 2024, occupancy rates in these regions might be below 50%, impacting profitability. For instance, a hotel in a declining industrial area could see RevPAR (Revenue Per Available Room) drop by over 15%.

Underperforming Joint Ventures

Underperforming joint ventures within Hilton's portfolio are classified as Dogs in the BCG Matrix, consistently missing financial goals. These ventures demand a thorough review of the partnership to assess their viability and potential for turnaround. If improvements aren't feasible, exiting the joint venture should be seriously considered to avoid further capital and resource drain. In 2024, Hilton's net income was $1.5 billion, indicating the importance of optimizing all ventures.

- Financial targets consistently unmet.

- Requires partnership review.

- Consider exit if underperforming.

- Ties up capital without adequate returns.

Services with Low Adoption Rates

In Hilton Worldwide Holdings' BCG Matrix, "Dogs" represent services with low adoption rates. These are offerings that may not be profitable or popular among guests. Discontinuing or re-evaluating these services can improve financial performance. For example, a specialized concierge service might see low usage.

- Examples include rarely used spa treatments or limited-appeal dining options.

- Hilton's 2024 financial reports show a focus on optimizing underperforming services.

- This aligns with strategies to boost overall revenue per available room (RevPAR).

- Hilton's goal is to streamline operations and improve profitability.

Hilton's "Dogs" include underperforming ventures. These consistently miss financial targets, demanding thorough partnership reviews. Divestiture is considered if improvements fail, aiming to avoid capital drain.

| Category | Characteristic | Action |

|---|---|---|

| Underperforming Ventures | Missed financial goals | Partnership review, possible exit |

| Underutilized Services | Low guest adoption | Discontinue or re-evaluate |

| Stagnant Area Hotels | Low occupancy rates | Restructuring or divestiture |

Question Marks

LivSmart Studios, Hilton's new long-stay brand, is a Question Mark in the BCG Matrix. It has high growth prospects but a low market share. The brand's launch involves significant investment for expansion. The inaugural location is scheduled for summer 2024 in Kokomo, Indiana. Hilton plans to negotiate for more properties, aiming to increase market presence.

The Curio Collection by Hilton, categorized as a "Question Mark" in the BCG Matrix, signifies high growth potential but a small market share. This segment requires significant investment in marketing and brand building to boost its presence. In 2023, the Curio Collection featured 135 properties, marking a 30% increase from 2022, indicating expansion efforts.

Tempo by Hilton, a recent addition to Hilton's portfolio, is positioned as a Star in the BCG Matrix. It targets modern travelers, indicating high growth potential. However, it currently holds a low market share. Strategic marketing is essential. Several Tempo properties are slated to open in 2025, suggesting ongoing investment.

Expansion into New Geographic Markets

Expansion into new geographic markets is a key strategy for Hilton Worldwide Holdings. Entering new markets like Paraguay and Nepal presents significant growth opportunities, but it also demands substantial investment. Successful expansion requires thorough market research and adaptation to local conditions. In 2024, Hilton demonstrated its commitment by entering markets such as Paraguay, Nepal, and Bonaire.

- Paraguay: Hilton opened its first hotel, signaling market entry.

- Nepal: Hilton expanded its presence, capitalizing on tourism.

- Bonaire: Hilton added a new resort, enhancing its portfolio.

- Market Research: Crucial for understanding local demands.

Small Luxury Hotels of the World Partnership

The Small Luxury Hotels of the World (SLH) partnership, integrated into Hilton's portfolio, expands its luxury offerings. While the full market share impact is still unfolding, the collaboration provides access to distinctive properties. Investment in seamless integration within the Hilton network is vital for maximizing the partnership's potential. This widens Hilton's reach in the luxury travel sector.

- The partnership adds over 500 hotels to Hilton's portfolio.

- SLH properties are in over 80 countries.

- Hilton's luxury brands include Waldorf Astoria and Conrad.

- The collaboration enhances Hilton's global presence.

Question Marks in Hilton's BCG Matrix, like LivSmart Studios and the Curio Collection, show high growth potential but have small market shares. These segments require significant investment in marketing and expansion. In 2023, the Curio Collection grew by 30%, illustrating efforts to increase presence.

| Brand | BCG Status | Key Focus |

|---|---|---|

| LivSmart Studios | Question Mark | New brand expansion, initial location in 2024. |

| Curio Collection | Question Mark | Brand building, 135 properties in 2023. |

| Expansion into New Markets | Question Mark | Entering Paraguay, Nepal, and Bonaire in 2024. |

BCG Matrix Data Sources

This BCG Matrix uses official financial reports, market share analysis, and industry-specific research for data accuracy.