Hilton Worldwide Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Worldwide Holdings Bundle

What is included in the product

Identifies disruptive forces, emerging threats, and substitutes that challenge market share.

A clear, one-sheet summary of all five forces—perfect for quick decision-making.

Same Document Delivered

Hilton Worldwide Holdings Porter's Five Forces Analysis

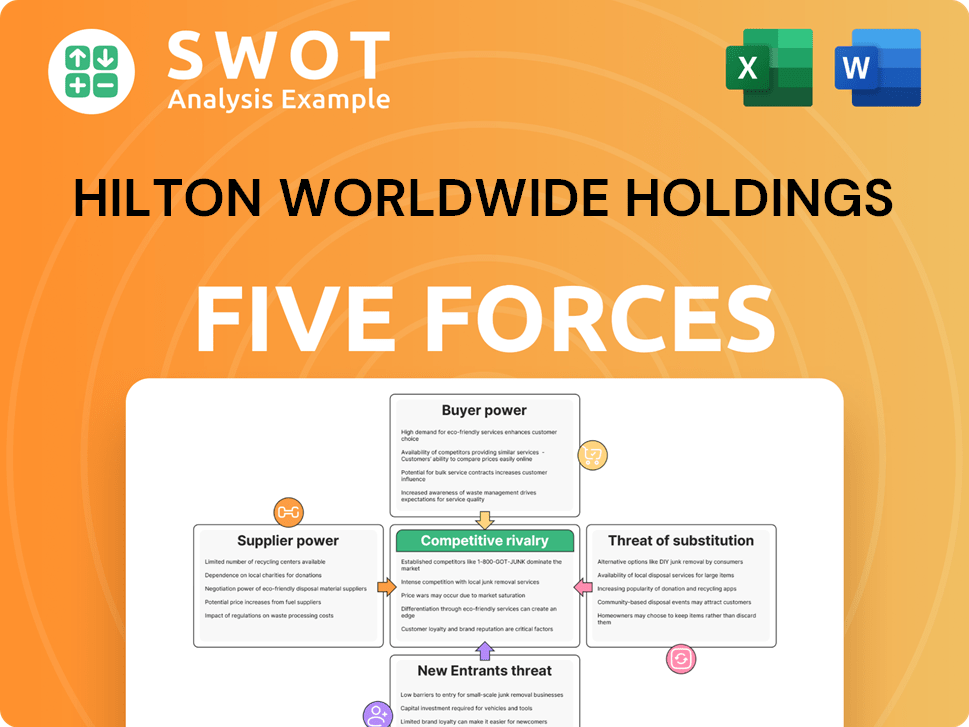

This is the complete, ready-to-use analysis file. You're previewing Hilton's Porter's Five Forces, covering competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. The document is expertly formatted for easy understanding. The analysis explores each force within Hilton's industry context. What you see here is what you get upon purchase.

Porter's Five Forces Analysis Template

Hilton Worldwide faces moderate competitive rivalry due to numerous hotel brands and varying service levels. Buyer power is significant, as consumers can easily compare prices and switch hotels. Supplier power from real estate owners is moderate, impacting operational costs. The threat of new entrants is lessened by high capital requirements and brand recognition. The threat of substitutes, like Airbnb, remains a concern.

Ready to move beyond the basics? Get a full strategic breakdown of Hilton Worldwide Holdings’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Hilton's supplier power is moderate, depending on various providers like food and tech. They have options, keeping costs in check. Hilton's size helps secure good deals. Some specialized suppliers might have more leverage. In 2024, Hilton's supply chain costs were about 35% of total operating expenses.

Supplier concentration significantly influences bargaining power; fewer suppliers mean greater power. Hilton faces this with specialized tech or unique amenity providers. For instance, in 2024, a critical software update could hinge on a single supplier. Switching suppliers is key; if Hilton can do so easily, supplier power decreases. In 2024, Hilton's vendor costs for supplies were about 28% of revenue.

Hilton's supplier switching costs are generally manageable. The company can often switch suppliers without major expenses, which limits the power of individual suppliers. Standardized products and services make switching easier. In 2024, Hilton's procurement strategies focused on diversifying its supplier base to maintain competitive pricing and service levels.

Backward integration is not a major threat

The threat of suppliers integrating backward into the hotel industry is minimal. The hotel business operates with distinct core competencies compared to suppliers. This difference significantly reduces the risk of suppliers successfully entering the market. As of late 2024, Hilton's strategy has been effective, with supplier integration attempts remaining rare. This strengthens Hilton's bargaining position.

- Low threat of supplier integration.

- Different core competencies protect Hilton.

- Hilton's negotiating power is enhanced.

- Supplier integration attempts remain uncommon.

Hilton's brand standards matter

Suppliers who meet Hilton's brand standards gain an advantage, potentially increasing their negotiating power. Hilton prioritizes quality, making it less likely to switch suppliers easily. Brand consistency is key for Hilton's reputation, further supporting supplier leverage. In 2024, Hilton had over 7,000 properties globally, emphasizing the importance of consistent supply. This focus on quality affects supplier relationships.

- Quality standards: Hilton's strict requirements.

- Negotiating power: Suppliers' advantage.

- Brand consistency: Key for Hilton's image.

- Global presence: Over 7,000 properties worldwide.

Hilton's supplier power is generally moderate. Switching costs are manageable, limiting supplier leverage. The threat of backward integration is low, enhancing Hilton's position. Strict brand standards favor some suppliers. In 2024, supply chain costs were about 35% of operating expenses.

| Aspect | Description | 2024 Data |

|---|---|---|

| Supplier Concentration | Fewer suppliers mean greater power. | Critical software updates from single suppliers. |

| Switching Costs | Manageable costs limit supplier power. | Vendor costs for supplies were about 28% of revenue. |

| Backward Integration | Low threat strengthens Hilton's position. | Supplier integration attempts are rare. |

| Brand Standards | Quality focus benefits suppliers. | Over 7,000 properties globally. |

Customers Bargaining Power

Customers wield significant power due to the wide array of lodging choices available. Options span budget hotels to luxury resorts, including alternatives like Airbnb. This extensive choice landscape intensifies their bargaining leverage. In 2024, Airbnb's revenue reached approximately $10 billion, showing the scale of alternative options. Hilton must differentiate itself to retain customers and justify its pricing strategies.

Customer bargaining power at Hilton varies across segments. Leisure travelers are often price-sensitive, increasing their power. Business travelers, valuing convenience, may have less power due to loyalty programs. In 2024, Hilton reported an occupancy rate of 73.6%, showcasing varying customer priorities. Hilton must tailor strategies for each segment.

Hilton's Honors program significantly reduces customer bargaining power. Repeat business is incentivized, making members less likely to switch. As of Q3 2024, Hilton Honors had over 180 million members. This boosts customer retention and brand loyalty, reflecting a strategic advantage.

Information availability empowers customers

Customers wield significant bargaining power, fueled by readily available information from online travel agencies (OTAs) and review sites. These platforms offer transparency in pricing, amenities, and guest experiences, enabling customers to compare options and seek better deals. To counter this, Hilton must actively manage its online reputation and pricing strategies. In 2024, the global online travel market was valued at $756.71 billion.

- OTAs and review sites provide customers with extensive information.

- This transparency empowers customers to compare options.

- Customers can negotiate for better deals.

- Hilton must manage its online reputation and pricing.

Group bookings can exert pressure

Large groups, like conferences, can negotiate lower rates due to their volume. Hilton balances filling rooms with profitability. In 2024, group bookings accounted for a significant portion of revenue. Strategic pricing and value-added services are vital in these deals. These services can include things like free Wi-Fi, complimentary breakfast, or airport shuttle.

- Group bookings influence revenue.

- Hilton uses strategic pricing.

- Value-added services are key.

- Negotiations impact profitability.

Customer bargaining power is significant due to ample lodging choices and information availability. Leisure travelers are price-sensitive, increasing their leverage. Hilton's Honors program and strategic pricing help counter this.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Choices | High power | Airbnb revenue ~$10B |

| Segments | Varying power | Occupancy rate 73.6% |

| Loyalty | Reduced power | Honors members >180M |

Rivalry Among Competitors

The hotel industry is incredibly competitive globally. Hilton competes with giants like Marriott and IHG. This intense rivalry impacts pricing and occupancy. For example, in 2024, Marriott's RevPAR grew by 4.5%. This competition squeezes profitability.

Hilton's brand differentiation strategy is key in the competitive landscape. With brands like Waldorf Astoria and Hampton, it targets varied customer segments. In 2024, Hilton operated over 7,500 properties globally. This allows Hilton to compete across different price points. Brand consistency and relevance are constantly maintained.

Location is crucial for hotel competitiveness. Hotels in prime areas like NYC or Paris see higher occupancy. Hilton strategically chooses locations, a key advantage. In 2024, Hilton's occupancy rate was around 70%, reflecting its location strategy. Hotels near airports often have higher rates.

Innovation in services and amenities

Hilton faces intense competition in services and amenities. Hotels constantly innovate to attract and retain guests. Hilton's focus on enhanced services, modern amenities, and tech solutions is crucial. This investment helps Hilton stay competitive and meet changing customer demands. In 2024, Hilton's revenue increased, reflecting successful innovation efforts.

- Customer satisfaction scores are a key metric for evaluating service innovations.

- Hilton's Honors loyalty program drives repeat business through exclusive amenities.

- Technology integrations, like digital keys, improve guest experiences.

- Competition in this area influences Hilton's pricing strategies.

Economic cycles impact rivalry

Economic cycles significantly influence competitive rivalry within the hotel industry. Downturns often lead to increased competition as fewer travelers reduce demand. This can trigger price wars and promotional activities, squeezing profit margins for companies like Hilton. Maintaining cost efficiency and high occupancy rates becomes critical for Hilton during these challenging periods.

- In 2023, the U.S. hotel occupancy rate was around 63%, reflecting ongoing recovery.

- During economic downturns, hotel revenue per available room (RevPAR) typically declines.

- Hilton's Q3 2023 system-wide RevPAR increased by 10.7% year-over-year.

- Aggressive promotions and discounts can erode the average daily rate (ADR).

Competitive rivalry in the hotel sector is fierce, heavily influencing pricing and occupancy rates. Hilton competes with major brands like Marriott and IHG, impacting profit margins. Factors such as brand differentiation and location are pivotal. Economic cycles also play a critical role.

| Metric | Data | Year |

|---|---|---|

| Marriott RevPAR Growth | 4.5% | 2024 |

| Hilton Properties Globally | Over 7,500 | 2024 |

| Hilton Occupancy Rate | ~70% | 2024 |

| U.S. Hotel Occupancy Rate | ~63% | 2023 |

| Hilton RevPAR Growth (Q3) | 10.7% | 2023 |

SSubstitutes Threaten

Alternative accommodations, like Airbnb and VRBO, are a growing threat to Hilton. These options often offer lower prices and unique experiences, taking market share. In 2024, Airbnb's revenue reached $9.9 billion. Hilton must adapt by improving its offerings to compete.

Rental homes, including those on platforms like Airbnb, serve as a substitute for traditional hotel stays, especially for those traveling in groups or families. These rentals offer a home-like experience with kitchens and laundry facilities, which hotels might not always provide. In 2024, the vacation rental market is estimated to reach $100 billion, highlighting its growing appeal. To compete, Hilton must emphasize its superior service, brand reputation, and the convenience of amenities like on-site dining and concierge services.

Budget hotels and limited-service accommodations present a cheaper option for travelers focused on price. These substitutes often lack extensive amenities but still offer a clean, comfortable stay. Hilton's focused-service brands, like Hampton by Hilton, directly compete in this segment. In 2024, the average daily rate for limited-service hotels was around $95, significantly less than full-service options.

Virtual meetings reduce travel

The threat of substitutes, such as virtual meetings, poses a challenge for Hilton. The increasing adoption of video conferencing and remote collaboration tools diminishes the need for physical travel, potentially lowering hotel occupancy rates, especially for business travelers. To mitigate this, Hilton needs to adapt by providing state-of-the-art meeting spaces and technology, ensuring that in-person meetings remain attractive. Hilton's revenue per available room (RevPAR) growth in 2024 was around 3.4%.

- Virtual meetings offer cost-effective alternatives to travel.

- Technology advancements facilitate seamless remote collaboration.

- Reduced business travel can impact hotel occupancy rates.

- Hilton must enhance meeting facilities to remain competitive.

Changing travel preferences matter

Changing travel preferences pose a threat. Consumers increasingly seek unique experiences, pushing them towards alternatives. Hilton needs to adapt, focusing on personalized services. The rise of sustainable travel also impacts choices.

- Airbnb's revenue in 2024 was $9.9 billion.

- Booking.com's revenue in 2024 was $21.4 billion.

- Hilton's Q1 2024 System-Wide RevPAR increased 3.9%.

- Sustainable travel is predicted to grow by 10% annually.

Substitutes like rental homes and budget hotels impact Hilton. Airbnb's 2024 revenue reached $9.9B, highlighting the competition. Virtual meetings and evolving travel preferences also pose challenges. Hilton must innovate to stay competitive.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Rental Homes (Airbnb, VRBO) | Lower prices, unique experiences | Vacation rental market: $100B |

| Budget Hotels | Cheaper stays, fewer amenities | Avg. daily rate: $95 |

| Virtual Meetings | Reduced travel, lower occupancy | Hilton's RevPAR growth: 3.4% |

Entrants Threaten

The hotel industry's high capital costs, including land, construction, and renovations, act as a significant barrier to entry. New entrants, especially independent operators, face substantial financial hurdles. In 2024, the average cost to build a hotel room ranged from $150,000 to $750,000, depending on location and type. Hilton, with its established brand and infrastructure, holds a competitive edge.

Building brand recognition and customer loyalty requires considerable time and financial resources. Hilton, with its established global presence, holds a substantial advantage over new hotel entrants. In 2024, Hilton's brand value was estimated at over $11.6 billion. New hotels face substantial marketing and promotional expenses to compete.

Large hotel chains like Hilton leverage economies of scale in areas like bulk purchasing, marketing campaigns, and streamlined operations, giving them a significant edge. This advantage makes it challenging for independent hotels or smaller chains to match Hilton's pricing and service offerings. Hilton's extensive global presence and vast network of properties further amplify these cost benefits. In 2024, Hilton's revenue reached approximately $10.4 billion, highlighting their operational efficiency and scale.

Stringent regulations exist

Stringent regulations pose a significant threat to new entrants in the hotel industry. Zoning laws, building codes, and health and safety standards increase the complexity and cost of launching a new hotel. Hilton's established presence and experience in complying with these regulations give it an advantage. These regulatory hurdles can be substantial barriers to entry.

- Compliance costs: Can reach millions of dollars.

- Permitting delays: Can take several years.

- Expertise: Hilton's regulatory knowledge.

- Competitive advantage: Established compliance.

Franchising lowers entry barriers

Franchising can reduce entry barriers for new competitors, allowing them to utilize established brand recognition and operational frameworks. Hilton's franchise model facilitates expansion while upholding brand consistency. This approach may also intensify competition within the Hilton brand itself, as various franchisees compete for market share. This strategic move has helped Hilton grow its portfolio significantly.

- Hilton had approximately 1.1 million rooms available globally as of 2024.

- In 2023, Hilton's revenue was around $9.8 billion.

- The hotel industry is experiencing strong travel demand, which supports growth.

- Franchising is a key strategy for expanding Hilton's presence.

New hotel entrants face high barriers, including huge capital costs and brand-building expenses. Regulatory hurdles like zoning and safety codes add complexity. Franchising eases entry, but can also increase competition.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Costs | High initial investment | $150K-$750K per room |

| Brand Building | Requires time, money | Hilton brand value: $11.6B |

| Regulations | Increase costs, delays | Compliance costs: Millions |

Porter's Five Forces Analysis Data Sources

Our analysis leverages public financial reports, market research, competitor analyses, and industry publications.