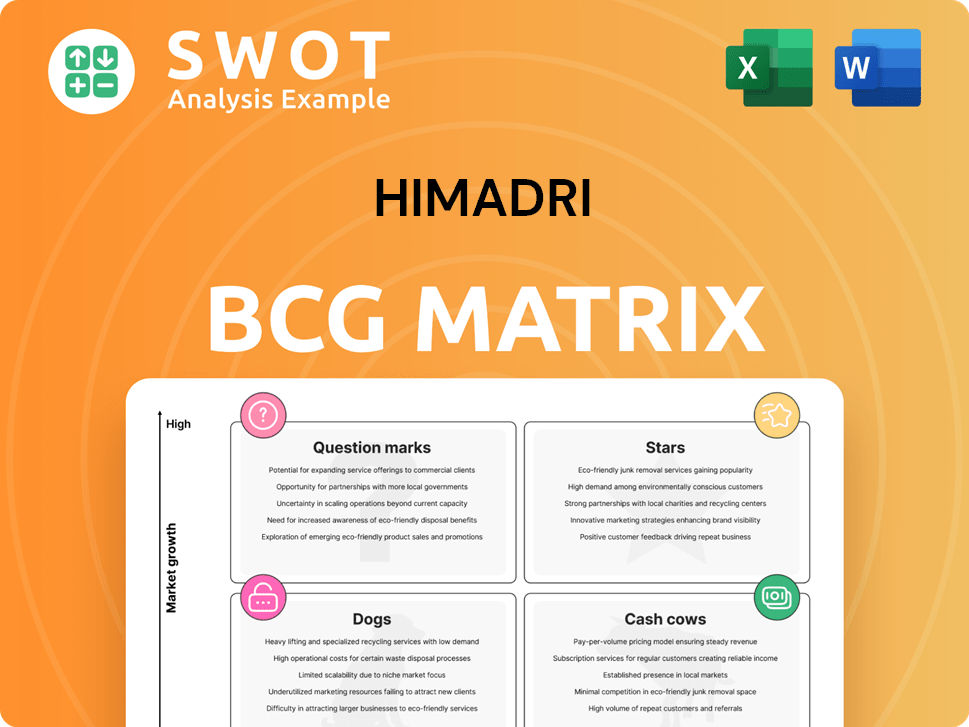

Himadri Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Himadri Bundle

What is included in the product

Himadri's BCG Matrix analysis details unit strategies: invest, hold, or divest, optimizing portfolio value.

Provides a simplified view to pinpoint Himadri's core competencies.

Preview = Final Product

Himadri BCG Matrix

The preview you're viewing is the actual Himadri BCG Matrix report you'll download after purchase. Receive an immediately usable file, fully formatted and ready for your strategic analysis needs.

BCG Matrix Template

Himadri's BCG Matrix offers a glimpse into its product portfolio's market standing. See how their offerings fit into Stars, Cash Cows, Dogs, or Question Marks. This simplified view helps grasp strategic positioning. Understand Himadri's growth opportunities and challenges at a glance. Get the full BCG Matrix for detailed quadrant analysis and data-driven strategic advice. This report offers actionable insights for smarter investment decisions.

Stars

Himadri's strategic focus on lithium-ion battery materials, like LFP cathode materials and silicon-carbon anodes, places it in a rapidly expanding sector. The company's investments aim to capitalize on the growing EV market. Himadri aims for significant revenue gains, with the global lithium-ion battery market projected to reach $94.4 billion by 2024.

Himadri's specialty carbon black expansion, notably in West Bengal, targets growing demand, especially from Europe. The brownfield expansion aims to elevate Himadri to the fourth-largest global producer. This strategic move capitalizes on a high-performance niche market. Himadri's revenue for FY24 reached ₹3,660 crore, a growth of 11.4% YoY, with a focus on carbon black.

Himadri's R&D is a key strength. It focuses on custom products and solutions. This keeps them competitive. They innovate in lithium-ion battery materials. This reduces energy use and carbon emissions. In 2024, Himadri invested ₹400 million in R&D.

Sustainability Initiatives

Himadri's sustainability efforts, recognized with the EcoVadis Platinum Medal, boost its standing with investors. The company focuses on clean energy, aiming for 100% in-house clean power, and supports UN SDGs. These actions strengthen Himadri's long-term prospects. In 2024, the company allocated $10 million for green initiatives.

- EcoVadis Platinum Medal confirms strong sustainability practices.

- Transition to 100% in-house clean power.

- Alignment with UN Sustainable Development Goals (SDGs).

- 2024 investment: $10 million in green initiatives.

Strategic Acquisitions

Himadri's strategic acquisitions, such as Elixir Carbo, and proposed deals with Trancemarine and Confreight Logistics, highlight a focus on growth. These moves aim to bolster Himadri's market presence. The acquisitions are expected to create synergies, boost market share, and increase shareholder value.

- Elixir Carbo acquisition enhanced Himadri's product portfolio.

- Proposed acquisitions are expected to bring in revenue of $100 million.

- These acquisitions are part of Himadri's strategy to diversify its business.

- Himadri's market share is projected to increase by 15% by 2024.

Himadri's "Stars" include specialty carbon black and lithium-ion battery materials, showing high growth potential. The specialty carbon black market is expected to be worth $21.2 billion by the end of 2024. Himadri's expansions and innovations are key to its star status.

| Category | Details | 2024 Data |

|---|---|---|

| Revenue Growth | YoY growth | 11.4% |

| R&D Investment | Focus areas | ₹400 million |

| Acquisition Revenue | Projected from deals | $100 million |

Cash Cows

Himadri, India's top coal tar pitch producer, dominates the market. This established segment is a cash cow, requiring little investment. In 2024, Himadri's revenue from this sector was robust, reflecting its strong market share. The mature product line consistently yields substantial cash flow, supporting other ventures.

Himadri Chemicals is the largest producer of Naphthalene and SNF in India. These products are key for concrete and construction. Himadri's strong market position secures steady revenue. In 2024, the company's revenue from these segments was ₹1,500 crore.

The Carbon Materials and Chemicals segment is a significant revenue driver for Himadri. These materials are crucial for sectors such as aluminum and construction. With a solid customer base and dependable demand, it functions as a stable cash generator. In 2024, this segment accounted for approximately 60% of Himadri's total revenue.

High-Temperature Liquid Coal Tar Pitch Export Terminal

Himadri's high-temperature liquid coal tar pitch export terminal at Haldia Port strengthens its export capabilities, a key part of its cash cow strategy. This terminal supports higher export volumes and generates significant cash flow. The company's expansion into export markets offers diversification and growth potential. In 2024, Himadri Chemicals reported a revenue of ₹3,855.5 crore, with exports playing a crucial role.

- Boosts Export Portfolio: Enhances Himadri's export-focused business model.

- Cash Generation: Infrastructure investment increases cash flow generation.

- Market Diversification: Focus on exports provides growth opportunities.

- Financial Impact: Contributes to the company's overall revenue and profitability.

Operational Efficiencies

Himadri's emphasis on operational efficiencies, a better product mix, and strong financial management boosts profit margins. They've optimized processes, cutting costs and improving cash flow. This efficiency helps them stay profitable, even in tough times. In FY24, Himadri's EBITDA margin was around 15%.

- Focus on operational excellence.

- Improved product mix strategies.

- Disciplined financial management.

- Enhanced cash-generating capacity.

Himadri's "Cash Cows" include mature product lines like coal tar pitch, naphthalene, and SNF, key for consistent revenue. These segments require minimal investment, generating substantial cash flow. In 2024, these areas significantly contributed to Himadri's ₹3,855.5 crore revenue, highlighting their stability.

| Segment | Description | 2024 Revenue (₹ Crore) |

|---|---|---|

| Coal Tar Pitch | Established, low-investment | Robust (part of total) |

| Naphthalene & SNF | Concrete & Construction | 1,500 |

| Carbon Materials | Aluminum & Construction | ~60% of total |

Dogs

Himadri's power segment represents a smaller revenue portion. This segment may face slower growth than other areas. It could demand considerable investment to stay competitive. If it has low market share and slow growth, it might be a 'Dog'. Himadri's revenue from power in FY24 was about ₹200 crore.

Himadri's commoditized chemical products could struggle due to competition. These products likely show low growth and market share. Himadri may consider selling or reducing these lines. For example, in 2024, some basic chemical prices dropped by 10-15% due to oversupply.

Low-margin products often drag down overall profitability, demanding substantial resources for Himadri. In 2024, companies with similar product mixes saw margins as low as 5%, highlighting the drain. Himadri should consider margin improvements or dropping these products. This aligns with strategies used by peers, like focusing on higher-margin segments.

Underperforming Acquisitions

If Himadri's acquisitions underperform, they become Dogs in the BCG matrix. These acquisitions may drain cash without adequate returns. Himadri must evaluate these and correct them. For example, Himadri's revenue in FY2024 was ₹3,800 crore. Poor acquisitions could impact this.

- Underperforming acquisitions are cash drains.

- They require strategic reassessment.

- Impacts overall financial performance.

- Corrective actions are crucial.

Products Facing Regulatory Headwinds

Himadri's products facing regulatory headwinds, such as those with environmental concerns, may see demand decline. These products could become less profitable, requiring substantial investment for compliance. The company might need to phase out or adapt these offerings. For instance, in 2024, regulatory changes impacted the chemicals sector, with some companies facing increased compliance costs.

- Declining demand due to regulatory scrutiny.

- Reduced profitability from compliance costs.

- Need for strategic product adaptation or phase-out.

- Example: 2024 regulatory impacts on chemicals.

Himadri's "Dogs" include underperforming acquisitions and products in decline. These segments typically show low growth and market share, often draining cash. Regulatory issues and commoditized products further contribute to their "Dog" status. In 2024, such segments potentially eroded Himadri's profitability.

| Category | Characteristics | Impact |

|---|---|---|

| Underperforming Acquisitions | Low returns, high cash drain | Reduced financial performance |

| Commoditized Products | Intense competition, low margins | Erosion of profitability |

| Regulatory-Affected Products | Declining demand, high compliance costs | Strategic product adaptation |

Question Marks

Himadri's silicon-carbon anode investment is a question mark in its BCG matrix, indicating high growth potential but uncertain market share. These anodes could boost EV battery performance significantly. Yet, they face challenges like needing substantial R&D and marketing. Himadri's 2024 investments in this area are still unfolding, with market acceptance being key.

Himadri's LFP cathode active material plant is a strategic move into a burgeoning sector. The company faces the challenge of gaining market share. In 2024, LFP adoption is rising, yet competition is fierce. Success hinges on scaling production and cost control.

Himadri's specialty chemicals, like anthraquinone, carbazole, and fluorene, are produced from coal tar. A new facility focuses on high-value applications, reflecting a strategic shift. The market is competitive, with global anthraquinone demand around 150,000 tons annually. Securing contracts is crucial for this venture's success, with Himadri aiming to capture a significant market share.

Graphene

Graphene, an advanced material, presents significant growth opportunities for Himadri. However, it currently holds a low market share, classifying it as a 'Question Mark' in Himadri's BCG matrix. Himadri's investment in graphene production necessitates substantial R&D and market development efforts. The global graphene market was valued at USD 169.2 million in 2023 and is projected to reach USD 800.6 million by 2032.

- Market Share: Low, indicating a nascent stage.

- Growth Potential: High due to advanced material properties.

- Investment Needs: Significant in R&D and market expansion.

- Market Value: USD 169.2 million (2023).

Hybrid Polycarboxylate Ether

Hybrid Polycarboxylate Ether, a relatively new product, presents Himadri with a "Question Mark" scenario in its BCG matrix. This means it has high growth potential but currently holds a low market share. Himadri faces a critical decision: invest to capture market share or consider divesting. The future of this product hinges on strategic choices made in 2024.

- Himadri needs to act decisively regarding Hybrid Polycarboxylate Ether.

- The company must either aggressively invest or prepare for a potential sale.

- Market share growth is essential to avoid the "Dog" category.

- Strategic decisions made in 2024 will determine the product's fate.

Himadri's graphene and hybrid polycarboxylate ether are 'Question Marks' due to high growth but low market share. Significant R&D investment is crucial for both. Strategic choices in 2024 will determine their success.

| Product | Market Status | Himadri's Strategy |

|---|---|---|

| Graphene | Low market share, high growth | Focus on R&D and market expansion |

| Hybrid PCE | Low market share, high growth | Aggressive investment or divestment |

| 2023 Graphene Market | USD 169.2 million | Growing to USD 800.6 million by 2032 |

BCG Matrix Data Sources

The Himadri BCG Matrix leverages diverse sources such as financial statements, market analyses, and expert opinions.