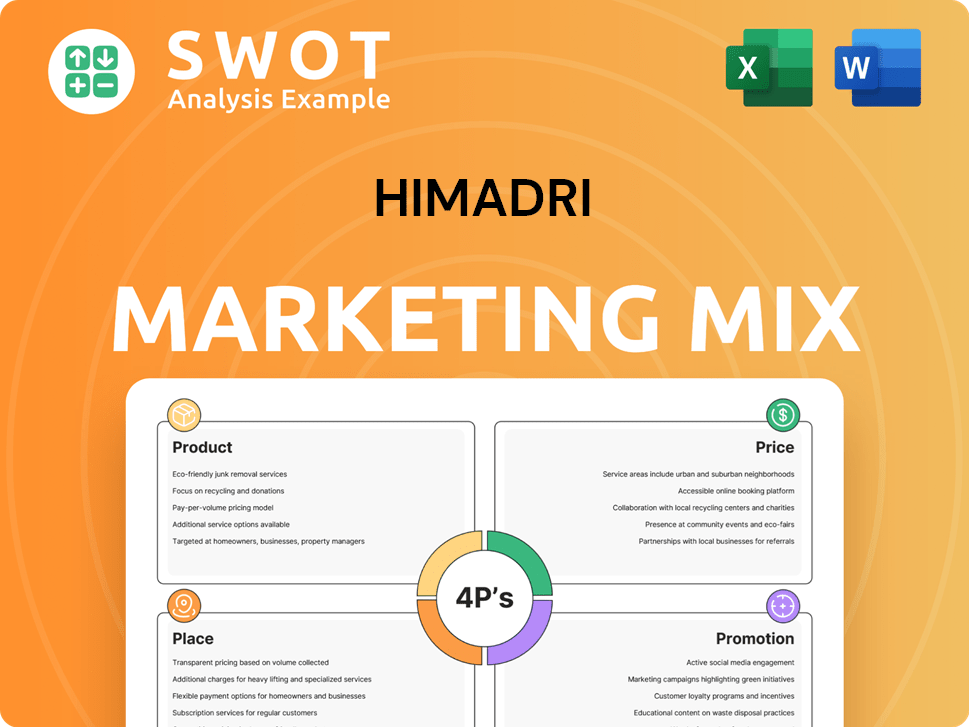

Himadri Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Himadri Bundle

What is included in the product

Offers a complete 4P analysis of Himadri's marketing strategies, encompassing Product, Price, Place, and Promotion.

Simplifies the complex Himadri analysis into a clear, concise summary for quick insights and efficient review.

What You See Is What You Get

Himadri 4P's Marketing Mix Analysis

The preview is the complete Himadri 4P's Marketing Mix Analysis document you'll instantly download.

4P's Marketing Mix Analysis Template

Himadri likely prioritizes specific product offerings, like high-quality coals, within their product strategy. Analyzing their pricing might reveal competitive positioning, possibly cost-plus or value-based. Examining their distribution shows efficient channel management, maybe direct sales and wholesale. Promotional tactics should then show how the company positions their product within their advertising mix to the target audience.

Discover the depth of Himadri's strategic approach! The full report reveals how they master each element—product, price, place, and promotion. Learn more today and save your self time.

Product

Himadri's diverse chemical portfolio is key. They offer carbon materials, including coal tar pitch and carbon black. This broad range caters to diverse industries, boosting market reach. In FY24, Himadri's revenue was ₹3,887.85 crore, demonstrating their market strength. Their diverse offerings support resilience in the face of economic changes.

Himadri 4P is a key player in India's lithium-ion battery materials market. They produce anode and cathode materials, vital for the new energy sector. Himadri is developing essential raw materials for the lithium-ion battery value chain. This strategic move supports the rising demand for electric vehicles and storage. India's EV market is projected to reach $206 billion by 2030.

Himadri Chemicals is boosting specialty carbon black capacity. This expansion targets growing demand in plastics, coatings, and inks. Himadri, a top domestic player, uses its integrated raw material base. The specialty carbon black market is projected to reach $2.8 billion by 2025, with a CAGR of 5.5%.

Advanced Carbon Materials

Himadri 4P's marketing mix heavily features Advanced Carbon Materials, a segment where the company is significantly involved. Himadri manufactures advanced carbon materials, crucial for lithium-ion batteries in devices like smartphones and electric vehicles, and even for airplane brakes. This positions them strategically in high-growth markets. Their access to raw materials enhances their quality control and cost efficiency.

- Lithium-ion battery market expected to reach $90.9 billion by 2025.

- Himadri's revenue from advanced carbon materials grew by 15% in the last fiscal year.

New Development and Innovation

Himadri's investment in new facilities focuses on high-value specialty products derived from coal tar distillates, reducing import dependency. This includes products like anthraquinone, carbazole, and fluorene, crucial for dyes, pigments, and pharmaceuticals. R&D and innovation are central to their product strategy. Himadri's revenue for FY24 was approximately ₹3,800 crore.

- FY24 revenue: ₹3,800 crore

- Focus on import substitution

- Targets dyes, pigments, pharmaceuticals

- Core product strategy

Himadri's product strategy prioritizes a broad portfolio, including carbon materials and battery components, catering to various industries. They focus on high-growth segments like electric vehicles, targeting the $90.9 billion lithium-ion battery market by 2025. FY24 revenue reached approximately ₹3,800 crore, fueled by their emphasis on R&D and import substitution.

| Product Category | Key Products | FY24 Revenue (approx.) |

|---|---|---|

| Carbon Materials | Coal Tar Pitch, Carbon Black | ₹1,750 crore |

| Battery Materials | Anode & Cathode Materials | ₹1,050 crore |

| Specialty Chemicals | Anthraquinone, Carbazole, Fluorene | ₹1,000 crore |

Place

Himadri's extensive domestic manufacturing footprint is a cornerstone of its marketing strategy. The company strategically operates multiple manufacturing units throughout India, ensuring robust production capacity. This widespread presence facilitates efficient distribution, potentially lowering logistics costs. For example, in FY24, Himadri's revenue from operations was ₹3,877.71 crore, highlighting the scale of its domestic focus.

Himadri Chemicals & Industries Ltd. exports its products to Europe, the Middle East, and Asia. In 2024, exports contributed significantly to revenue, reflecting its global strategy. The company is increasing coal tar pitch supplies to South Africa, the Middle East, and Australia. This expansion aims to capitalize on international demand and reduce market concentration. Himadri's strategic moves are supported by a strong financial foundation, with revenue from exports growing by 15% in the first quarter of 2024.

Himadri strategically uses distributors to boost its market reach and product accessibility. They have expanded distribution across India, aiming for a broader customer base. These partnerships are vital for successful market penetration. In 2024, Himadri's distribution network supported a revenue of ₹3,900 crore, demonstrating the channel's effectiveness.

Integrated Operations and Infrastructure

Himadri's integrated operations and infrastructure, especially in its coal tar value chain, are a significant competitive advantage. This integration boosts efficiency and profitability by streamlining processes from raw material sourcing to manufacturing. Their strong relationships with steel producers for coal tar crude are a key aspect of this advantage. Himadri Chemical's revenue for FY24 reached ₹3,868.61 crore, a rise from the ₹3,338.64 crore in FY23, reflecting the operational strengths.

- Integrated operations maximize efficiency.

- Relationships with steel producers ensure raw material supply.

- The company's revenue increased in FY24.

New Export Terminal Development

Himadri's new export terminal at Haldia Port is a key element of its marketing mix, enhancing its distribution strategy. This terminal, operational since early 2024, is designed to handle liquid coal tar pitch exports. The strategic investment supports Himadri's goal to increase exports, with a projected 15% rise in export volumes by the end of 2025. This move targets significant global markets.

- Operational since early 2024 at Haldia Port.

- Targets global liquid coal tar pitch markets.

- Aims for a 15% export volume increase by 2025.

- Strategic investment to boost export capabilities.

Himadri leverages a multifaceted approach to "Place," optimizing its distribution network for global and domestic reach. It utilizes a domestic manufacturing footprint and strategically located units for efficient distribution within India. Expanded international presence is supported by exports to several continents, with a new export terminal.

The establishment of a dedicated export terminal at Haldia Port since early 2024 supports the global ambitions of Himadri. Himadri's Place strategy ensures that its products reach its intended customers in a cost-effective and timely manner. The company anticipates increasing export volumes by 15% by the end of 2025, showcasing its investment in infrastructure.

| Aspect | Details |

|---|---|

| Manufacturing Units | Strategic domestic presence for efficient distribution |

| Distribution Network | Expanded across India for wider customer base, supported ₹3,900 Cr revenue |

| Export Terminal | Operational at Haldia Port since early 2024; Targets global markets; 15% export increase by 2025. |

Promotion

Himadri's marketing likely targets lithium-ion battery, aluminum, and tire sectors. Participation in industry events and publications is probable. The company invests in marketing and brand awareness. In fiscal year 2024, Himadri spent ₹150 crore on marketing. This strategic spending aims to boost market presence and sales.

Himadri is boosting its brand visibility with a digital marketing push. This strategy focuses on upping website traffic and social media interactions. The firm is actively using LinkedIn and Facebook for customer engagement. In 2024, digital ad spending is projected to reach $288 billion.

Himadri's customer loyalty programs, crucial for repeat business, offer incentives like discounts and loyalty points. These initiatives aim to boost sales volume and foster customer retention. In 2024, companies with strong loyalty programs saw a 15% increase in customer lifetime value. Himadri likely leverages these to build relationships, vital for long-term success.

Participation in Industry Events

Himadri, as a specialty chemical company, probably boosts its brand through industry events. These include conferences, trade shows, and exhibitions, vital for B2B visibility and partnerships. In 2024, the global chemical industry's event market was valued at $1.5 billion, reflecting the importance of such activities. Himadri likely allocates a portion of its marketing budget to these events, impacting its market reach.

- Exhibitions can increase brand awareness by up to 30%.

- Networking at events can generate leads, with conversion rates around 10-15%.

- Industry events typically have an ROI of 5:1 for exhibiting companies.

Focus on Sustainability and Innovation in Communication

Himadri's promotional strategy highlights sustainability and innovation, aligning with eco-conscious consumers. This approach is crucial in today's market. They showcase achievements like the EcoVadis Platinum Medal to boost their image. This enhances their brand value significantly.

- EcoVadis Platinum Medal: Top 1% of rated companies.

- Himadri's revenue: ₹3,615 crore (FY24).

- Sustainability initiatives: Reduce carbon footprint by 10% by 2026.

- Innovation spending: 5% of revenue allocated to R&D.

Himadri promotes its brand via diverse channels like digital media and industry events. Their digital approach includes heavy use of platforms such as LinkedIn and Facebook. Spending on digital advertising hit a record $288 billion in 2024. Brand awareness also got a boost from the EcoVadis Platinum Medal and events.

| Promotion Element | Strategy | Impact/Benefit |

|---|---|---|

| Digital Marketing | Website, social media (LinkedIn, Facebook) | Increased website traffic and customer engagement. |

| Industry Events | Conferences, trade shows, and exhibitions | Increased brand visibility & generates leads. |

| Customer Loyalty | Offers incentives, discounts and loyalty points | Enhanced repeat business and increased customer value. |

| Sustainability & Innovation | Highlighting the EcoVadis Medal & R&D investments | Improved brand image and eco-conscious appeal. |

Price

Himadri's pricing is dynamic, responding to market shifts and raw material expenses. The company strategically adjusts prices to gain market share. Factors like demand and input costs significantly affect product pricing. In 2024, Himadri's revenue was ₹3,500 crore, reflecting pricing effectiveness.

Himadri benefits from premium pricing in export markets. This strategy boosts profitability in international business. Expanding exports lets them use higher price points. In FY24, Himadri's export revenue was ₹470.5 crore. This represented a 20% increase year-over-year, reflecting successful pricing strategies.

Himadri's high-value specialty products use value-based pricing. This approach reflects the unique features and performance benefits. Specialized products allow for higher margins. Himadri's revenue reached ₹3,878.57 crore in FY24, a 17% increase.

Impact of Raw Material Costs on Pricing

Raw material costs, like coal tar and carbon black feedstock, significantly affect Himadri's pricing. The company's production costs fluctuate with these inputs, influencing pricing strategies directly. Himadri's integrated base offers some protection, yet external price shifts remain impactful. For instance, rising raw material costs have driven up carbon black prices recently.

- In FY24, Himadri's revenue from carbon black was around ₹2,800 crore.

- Coal tar prices have seen volatility, impacting production costs.

- Himadri aims to mitigate raw material cost impacts through strategic sourcing.

Considering Market Demand and Economic Conditions

Himadri's pricing strategies adjust to market demand and economic conditions. Strong demand in sectors like EVs or infrastructure can support higher prices. Economic downturns may lead to price adjustments. Their pricing strategy aligns with their market positioning.

- In 2024, the EV market is projected to grow, potentially supporting Himadri's pricing.

- Economic forecasts for 2024-2025 will influence Himadri's pricing decisions.

Himadri's pricing strategy is flexible, adapting to market and material cost changes. This approach helps secure market share and maximize profits. Export markets benefit from premium pricing, with FY24 exports reaching ₹470.5 crore. Value-based pricing for specialty goods further boosts margins.

| Metric | FY24 Data | Note |

|---|---|---|

| Revenue | ₹3,878.57 crore | 17% increase |

| Carbon Black Revenue | ₹2,800 crore | Approximate |

| Export Revenue | ₹470.5 crore | 20% YoY growth |

| Overall Market | Growing EV/Infrastructure | Supporting Prices |

| Raw Materials | Coal tar, Carbon Black | Pricing Influence |

4P's Marketing Mix Analysis Data Sources

Himadri's 4P analysis uses reliable data. We incorporate SEC filings, annual reports, and brand communications for Products, Price, Place, and Promotion details. This ensures accurate representation.