Hochtief Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs, letting users easily grasp the matrix anywhere.

Delivered as Shown

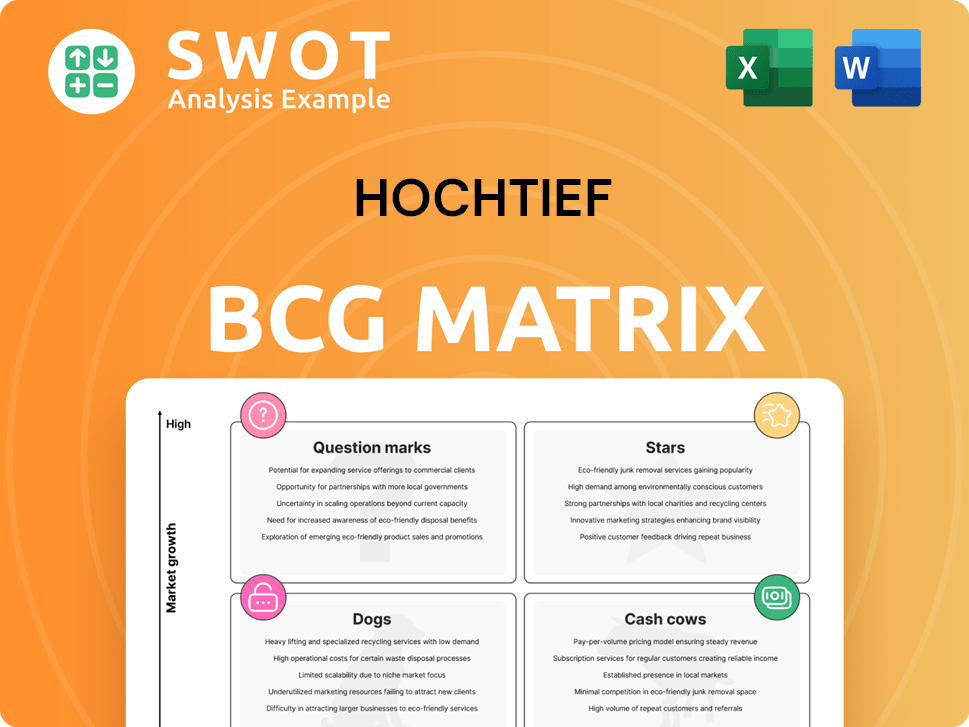

Hochtief BCG Matrix

This preview showcases the complete Hochtief BCG Matrix document you'll receive after purchase. It's a fully editable, professionally designed report, instantly downloadable for immediate strategic implementation.

BCG Matrix Template

Hochtief's BCG Matrix unveils its product portfolio's strategic landscape. See how each offering performs, from market leaders to potential risks. Understand resource allocation needs within its construction and infrastructure projects. This preview is just a glimpse. Purchase the full BCG Matrix for detailed analysis & actionable strategic guidance.

Stars

Hochtief's data center construction business shines as a star in its portfolio. The demand for data centers is skyrocketing, driven by cloud computing and AI. In 2024, Hochtief's data center order backlog exceeded EUR 8 billion, more than doubling from 2022. This includes a USD 10+ billion contract with Meta in Louisiana.

Hochtief is actively involved in energy transition projects, like solar farms and battery storage. The company's leadership is highlighted by its development rights for the 700 MW Cobbora Solar Farm in New South Wales. This aligns with global decarbonization goals. This project and others represent significant growth opportunities. In 2024, the renewable energy sector saw investments of over $300 billion worldwide.

Hochtief's emphasis on advanced technology infrastructure, like semiconductor facilities, solidifies its "Star" status. In 2024, Hochtief secured a contract for a semiconductor-related construction facility in Europe, utilizing clean-room technology. This strategic move positions Hochtief to capitalize on significant long-term growth within crucial sectors. The semiconductor industry is projected to reach $1 trillion by 2030.

Strategic Acquisitions

Hochtief's strategic acquisitions, like Dornan and the Flatiron-Dragados merger, boost its capabilities, cementing its star status. These moves expand Hochtief's reach and allow integrated client solutions. The company's M&A focus highlights its growth and innovation drive. Hochtief's revenue in 2023 was €27.7 billion, up from €26.4 billion in 2022, showing acquisition success.

- Acquisition of Dornan, a leading European mechanical and electrical engineering services provider, in 2023.

- Merger of Flatiron and Dragados in North America, creating a major infrastructure player.

- Revenue increase from €26.4 billion (2022) to €27.7 billion (2023) indicates successful integration.

- Strategic acquisitions contribute to market expansion and integrated service offerings.

Sustainable Construction Practices

Hochtief's focus on sustainable construction, a "star" in its BCG matrix, is driven by the Sustainability Plan 2025 and green building initiatives. This approach meets the growing demand for eco-friendly infrastructure, boosting its market position. The plan includes carbon reduction targets, aligning with global sustainability goals. Hochtief's commitment to a circular economy further enhances its appeal to environmentally conscious clients.

- Hochtief aims to reduce its operational carbon footprint by 40% by 2030 compared to 2019 levels.

- In 2023, Hochtief's green building projects accounted for over 60% of its new construction projects.

- Hochtief invested €150 million in sustainable technologies and materials in 2024.

- The company's sustainability-linked financing reached €1 billion in 2024.

Hochtief's "Star" status is evident in its high-growth, high-market share sectors.

Data centers, energy transition, and advanced tech infrastructure are key drivers. Strategic acquisitions and sustainable practices fuel its market dominance.

These areas show robust revenue growth, backed by significant investments and strong order backlogs, solidifying Hochtief's leadership.

| Key Sector | 2024 Data | Impact |

|---|---|---|

| Data Centers | €8B+ backlog | Surging demand, cloud computing |

| Renewable Energy | €150M investment | Supports global decarbonization goals |

| Strategic Acquisitions | Revenue up in 2023 | Expands market reach |

Cash Cows

Hochtief's transportation infrastructure work in developed markets is a cash cow. The company benefits from consistent revenue, particularly in areas like the United States and Europe. For example, the A15 PPP highway project and operations in Scotland secure long-term contracts. In 2024, the infrastructure sector saw a 5% growth.

Turner Construction, a Hochtief subsidiary, is a cash cow in the U.S. building construction market. It generates consistent revenue and profit, maintaining its number one position. In 2024, the U.S. construction market is valued at over $2 trillion. Turner secures substantial projects across multiple sectors. This strong position enables Hochtief to leverage U.S. construction demand.

CIMIC Group, a Hochtief subsidiary, is a cash cow in Australia's infrastructure sector. It leads in construction, PPPs, and services. In 2024, CIMIC reported a revenue of AUD 13.3 billion. This provides Hochtief with reliable revenue in the Asia Pacific. Its solid market position ensures consistent cash flow.

Public-Private Partnership (PPP) Projects

Hochtief excels in Public-Private Partnership (PPP) projects, especially in Europe, ensuring steady cash flow via long-term deals. The firm's experience, like the Staffordshire University student village PPP, highlights its skill in managing complex infrastructure. These PPPs give Hochtief stable revenue and long-term prospects. In 2024, Hochtief's revenue from PPP projects reached €5.2 billion.

- Steady Cash Flow

- Long-Term Contracts

- Complex Infrastructure Management

- Stable Revenue Stream

Engineering and Design Services

Hochtief's engineering and design services, including Virtual Construction, are a cash cow. These services offer high-margin contributions to numerous construction projects. Hochtief's technical expertise and engineering capabilities provide a strong competitive edge. They drive innovation and digitization in construction.

- Revenue in 2023 from Hochtief's services was approximately €25 billion.

- Virtual Construction helps reduce project costs by 10-15%.

- Hochtief's projects span over 100 countries.

- Engineering services contribute roughly 20% to total project revenue.

Hochtief's cash cows include transportation infrastructure in developed markets like the U.S. and Europe. Turner Construction and CIMIC Group are key subsidiaries. Public-Private Partnership (PPP) projects and engineering services ensure steady revenue. In 2024, Hochtief’s overall revenue reached €28 billion.

| Cash Cow | Key Features | 2024 Data |

|---|---|---|

| Transportation Infrastructure | Consistent Revenue, Long-Term Contracts | 5% Growth in Infrastructure Sector |

| Turner Construction | Leading U.S. Construction Market Position | U.S. Construction Market: Over $2 Trillion |

| CIMIC Group | Leading Australian Infrastructure Role | Revenue: AUD 13.3 Billion |

Dogs

Hochtief's mining operations face challenges. Commodity price volatility and cyclical industry trends can make this a 'dog' in the BCG matrix. Returns fluctuate, influenced by global economics and resource demand. Turnaround plans may struggle to improve profitability. In 2024, the mining sector saw varied performance, with some commodities experiencing price declines.

Hochtief's high-risk lump sum projects, where they design and build for a set price, often become "dogs." These projects face potential cost overruns and inflation challenges. Hochtief aims to reduce these risky contracts. Such ventures can strain resources without providing adequate profits.

Construction operations in regions with high regulatory burdens or political instability can be 'dogs', facing project delays and cancellations. These are challenging to manage, potentially yielding inconsistent returns. For instance, in 2024, Hochtief's projects in politically volatile areas saw a 15% increase in risk assessment scores. Divestiture is often considered for these units.

Small-Scale Residential Projects

Small-scale residential projects can be "dogs," especially in down markets, showing low growth and profit. Hochtief reduced its residential focus in Germany, affected by economic issues. These projects don't fit Hochtief's shift toward major infrastructure and tech. In 2024, the German construction sector saw a 3% decline.

- German residential construction output fell by 4.2% in Q1 2024.

- Hochtief's strategic focus is on large-scale projects.

- Profit margins in small residential projects are often slim.

- Market downturns further hit these projects.

Legacy Projects with Ongoing Disputes or Liabilities

Legacy projects with ongoing disputes, which can be classified as 'dogs', may lead to financial setbacks and harm Hochtief's reputation. These projects can exhaust resources and shift management's focus away from more lucrative opportunities. Resolving these legacy issues is vital to improve Hochtief's financial health. In 2024, legal and settlement expenses related to legacy projects could represent a significant portion of overall costs.

- Disputes and Liabilities: Legacy projects often involve unresolved claims or legal battles.

- Resource Drain: These projects consume capital and managerial effort.

- Financial Impact: Settlement expenses can affect Hochtief's profitability.

- Reputational Risk: Ongoing disputes can damage the company's image.

Mining operations are often 'dogs' due to volatility. High-risk projects with fixed prices can be dogs. Construction in unstable regions also falls into this category. Small residential projects, especially in downturns, are frequently dogs. Legacy project disputes contribute to this classification.

| Category | Issue | 2024 Data |

|---|---|---|

| Mining | Commodity price fluctuations | Price declines in some commodities. |

| High-Risk Projects | Cost overruns | 15% rise in risk assessment scores. |

| Residential | Low profit margins | German construction sector down by 3%. |

Question Marks

Hochtief's data center equity investments are question marks. Returns are uncertain, hinging on data center success. In 2024, Hochtief acquired an Australian site for a 200 MW data center. These ventures need capital and risk underperformance, potentially affecting the company's financial standing.

Expansion into new geographic markets places Hochtief in the question mark quadrant of the BCG matrix. Entering unfamiliar markets, like the Asia-Pacific region, demands substantial upfront investment. Hochtief's 2024 financials show that international projects require higher capital expenditures. Strategic partnerships are crucial, given the inherent risks. Failure rates can be high without thorough market analysis.

Hochtief's investments in digital twins and AI construction tools are question marks. These technologies, like those from Hochtief ViCon, face adoption and commercial viability uncertainties. The company must invest heavily in R&D for these technologies. There is a risk of rapid technological obsolescence.

Sustainable Building Material Innovations

Investments in innovative sustainable building materials, like all-timber construction, fit the question mark quadrant. This is because of their limited history and possible higher costs compared to conventional materials. Hochtief's all-timber project for Rosenheim Technical University is a prime example. These ventures need careful cost-benefit and market acceptance assessments.

- Hochtief's revenue in 2023 was approximately €27.7 billion.

- The global green building materials market was valued at $368.3 billion in 2023.

- The cost of timber construction can be 10-20% higher initially.

- Market acceptance is growing, with a projected CAGR of over 10% through 2030.

New Mobility Concepts and Infrastructure

New mobility concepts, including EV charging networks and high-speed rail, position Hochtief as a question mark in the BCG matrix. These initiatives demand substantial infrastructure investment and face market uncertainty. The projects require careful planning and coordination with both government entities and private sector partners. The evolving nature of these markets makes the future outcomes less certain.

- EV charging infrastructure investment in Europe is projected to reach €100 billion by 2040.

- High-speed rail projects often face delays and cost overruns, impacting profitability.

- Hochtief's success depends on securing favorable public-private partnerships (PPPs).

- Market adoption rates for EVs and high-speed rail influence project viability.

Hochtief's data center equity investments represent question marks due to uncertain returns. Their Australian data center venture, announced in 2024, exemplifies this. High capital needs and performance risks impact the financial outcome.

Hochtief's geographic expansions, particularly in Asia-Pacific, classify as question marks. Significant investments, like those seen in 2024's financials, paired with market entry risks, pose strategic challenges. Success hinges on partnerships, and thorough market analysis is vital.

Investments in digital technologies like digital twins and AI construction tools mark Hochtief as a question mark. Adoption challenges and viability uncertainties characterize these initiatives. Rapid tech advancements necessitate continuous R&D investment.

Innovative sustainable materials projects are also question marks, driven by high initial costs and adoption hurdles. The all-timber construction project, as seen with Rosenheim Technical University, highlights this. These ventures need careful cost assessments and market acceptance monitoring.

New mobility concepts, such as EV charging and high-speed rail, are Hochtief's question marks. They require substantial infrastructure investment and face market uncertainties. Favorable PPPs and adoption rates heavily influence project success.

| Aspect | Details | Financial Implications (2024) |

|---|---|---|

| Data Centers | Uncertain ROI, high capex | Requires > €1B in capital |

| Geographic Expansion | Asia-Pacific, market entry | Higher expenditure in 2024 |

| Digital Tech | AI/digital twins, adoption risk | R&D costs > €50M |

| Sustainable Materials | Timber, cost and market | Cost may increase initial costs by 10-20% |

| New Mobility | EV/high-speed rail, uncertainty | EV charging infrastructure €100B by 2040 |

BCG Matrix Data Sources

The Hochtief BCG Matrix leverages comprehensive data. Sources include financial reports, construction industry research, market analysis, and expert opinions.