Hochtief Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

What is included in the product

Detailed analysis of each competitive force, supported by industry data and strategic commentary.

Instantly visualize complex competitive forces with dynamic, interactive charts for clarity.

Preview Before You Purchase

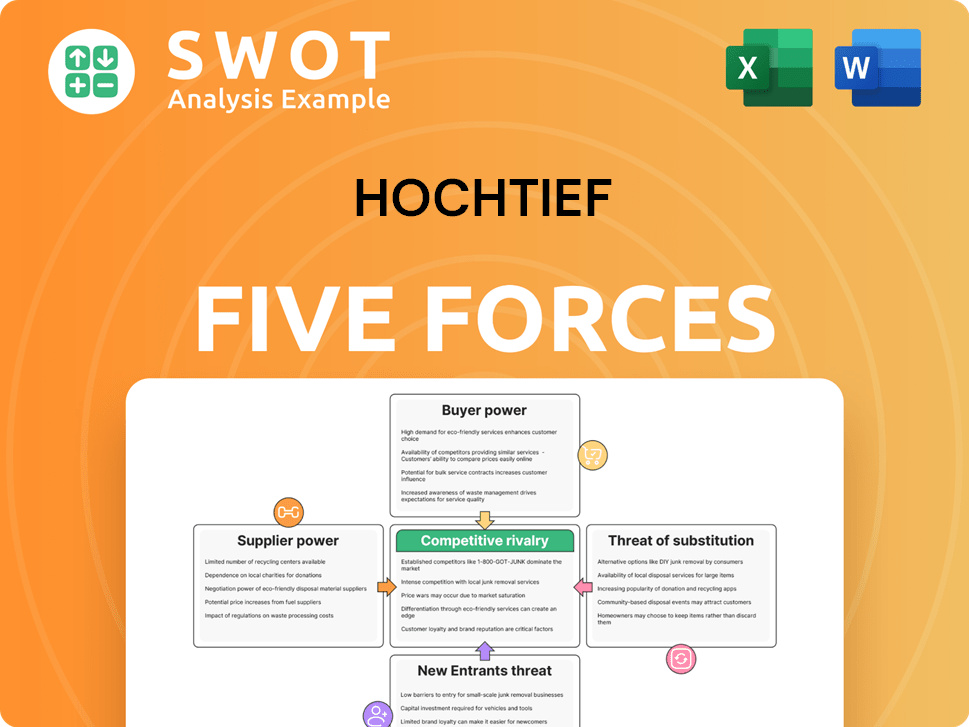

Hochtief Porter's Five Forces Analysis

This is the Hochtief Porter's Five Forces analysis you'll receive. The document previewed is identical to the purchased version, ensuring complete transparency. Expect a thorough assessment of industry competition, including supplier and buyer power analysis. It also includes the threat of new entrants and substitute products. This ready-to-use file requires no modifications.

Porter's Five Forces Analysis Template

Hochtief's industry faces diverse pressures. Analyzing supplier power reveals cost impacts. Buyer power influences pricing strategies. The threat of new entrants shapes market dynamics. Substitute products present alternative solutions. Competitive rivalry dictates market share battles.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hochtief’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

HOCHTIEF faces supplier power challenges. The construction industry relies on essential materials. Limited suppliers for cement and steel give them leverage. In 2024, steel prices fluctuated due to supply chain issues. Specialized tech further concentrates power.

Supplier concentration significantly impacts HOCHTIEF's operational costs and project timelines. If key suppliers are limited, they can raise prices or reduce service quality, affecting HOCHTIEF's profitability. For instance, the construction materials market saw price increases in 2024, influenced by limited supplier options. This situation can be exacerbated if these suppliers also serve HOCHTIEF's rivals, putting further pressure on HOCHTIEF.

Material cost volatility is a key concern for HOCHTIEF. Fluctuations in cement, concrete, and other materials directly affect project costs. Rising input costs can squeeze profit margins if contracts don't allow for price adjustments. Construction input costs increased by 38.7% since February 2020, impacting project budgets.

Dependence on Subcontractors

HOCHTIEF's dependence on subcontractors, especially for specialized tasks, gives these suppliers bargaining power. Limited availability of skilled subcontractors, such as those specializing in complex engineering or specific construction methods, allows them to negotiate favorable terms. This can impact project costs and schedules. In 2024, labor costs in the construction industry, including subcontractor fees, increased by approximately 5-7% due to skill shortages.

- Limited availability of specialized subcontractors increases their bargaining power.

- This can lead to higher project costs.

- Project timelines can also be affected by subcontractor availability.

- In 2024, labor cost increases were significant in construction.

Supply Chain Disruptions

Supply chain disruptions significantly impact HOCHTIEF's projects. Events like the COVID-19 pandemic and ongoing geopolitical instability have caused delays and increased material costs. HOCHTIEF must proactively manage its supply chains to lessen these effects. This involves diversification and strategic partnerships.

- In 2024, construction material prices rose by an average of 7% globally due to supply chain issues.

- Diversifying suppliers can reduce dependency on a single source, mitigating risk.

- Strategic partnerships with key suppliers can secure more favorable terms and supply continuity.

- Geopolitical tensions in regions like Eastern Europe have increased material costs by up to 15%.

HOCHTIEF navigates supplier bargaining power. Key materials like steel, saw price hikes in 2024, impacting project costs. Subcontractor availability also affects costs. Proactive supply chain management is vital.

| Aspect | Impact on HOCHTIEF | 2024 Data |

|---|---|---|

| Material Costs | Higher project expenses, squeezed margins | Steel prices up 8%, cement up 6% |

| Subcontractor Availability | Project delays, cost overruns | Labor cost rose 5-7% |

| Supply Chain Disruptions | Delays, increased costs | Avg. material price rise of 7% |

Customers Bargaining Power

Hochtief's clients, mainly governments and large corporations, hold considerable bargaining power. These clients, commissioning massive infrastructure projects, can negotiate favorable terms. In 2024, such clients often seek fixed prices and performance guarantees, impacting Hochtief's profitability. The size and complexity of projects amplify this dynamic, as seen in recent contract negotiations. This can lead to pressure on Hochtief's margins.

If HOCHTIEF serves a few large clients, these clients gain significant bargaining power. This can lead to pressure on pricing and project conditions. In 2024, HOCHTIEF's client concentration significantly influenced its project profitability. A diversified client base boosts HOCHTIEF's negotiating strength. For instance, expanding into new markets in 2024 helped to mitigate this risk.

A substantial part of HOCHTIEF's work involves public sector clients. Governments typically impose stringent budgets and procurement rules, affecting HOCHTIEF’s pricing power. In 2024, public infrastructure projects accounted for roughly 60% of HOCHTIEF's revenue. Political factors also heavily influence HOCHTIEF’s project flow. For example, shifts in government priorities can lead to project delays or cancellations, impacting HOCHTIEF's profitability and project pipeline.

Switching Costs

Switching costs significantly impact HOCHTIEF's bargaining power with customers, especially in large infrastructure projects. Changing contractors mid-project is often costly and causes delays, providing HOCHTIEF with leverage. This advantage is particularly strong if HOCHTIEF maintains good performance and meets deadlines. However, any failures can quickly diminish this leverage, as clients will seek alternatives.

- Project delays can incur penalties, with costs potentially reaching millions for major projects.

- Switching to a new contractor involves legal, administrative, and technical hurdles.

- In 2024, HOCHTIEF's revenue was approximately €27.4 billion.

- Customer satisfaction scores, measured through surveys, are critical in maintaining this bargaining power.

Demand for Specialized Services

HOCHTIEF's strong suit in complicated projects, such as data centers and energy infrastructure, acts as a buffer against customer influence. Clients needing specialized skills often prioritize HOCHTIEF's expertise over price. Around 50% of HOCHTIEF's 2024 contract wins were in its strategic growth areas, highlighting this advantage. This focus allows HOCHTIEF to negotiate better terms.

- Data center projects offer specialized expertise.

- Energy infrastructure projects require specific skills.

- Around 50% of contract wins in strategic markets.

- Clients value expertise over price.

Hochtief's clients, like governments and corporations, wield significant bargaining power due to the scale of infrastructure projects. In 2024, clients often push for fixed prices and performance guarantees. A diversified client base helps mitigate this pressure.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Client Type | Large clients impact terms. | Public projects made up 60% of revenue. |

| Switching Costs | High costs boost Hochtief's leverage. | Penalties for delays can reach millions. |

| Expertise | Specialized skills offset client influence. | 50% contract wins in growth areas. |

Rivalry Among Competitors

The construction industry is a battlefield of competition, especially in a fragmented market. This landscape features a multitude of players, from local firms to global giants, all vying for projects. Such intense competition can squeeze profit margins, as companies often lower prices to secure contracts. For example, Construction Partners, Inc. faces this reality, competing with numerous regional rivals across the southeastern U.S. In 2024, the construction market saw a slight increase in project bids, yet margins remained tight due to the high number of competitors, according to industry reports.

HOCHTIEF faces intense rivalry in construction projects, often through competitive bidding. They must compete on price, quality, and innovation to win contracts. This aggressive competition can squeeze profit margins. For example, in 2024, the average profit margin in the European construction market was around 3-5% due to these pressures.

HOCHTIEF competes with major international construction firms. Rivals like Grupo ACS and Ferrovial have comparable expertise and global presence.

In 2024, Grupo ACS reported revenues of over €34 billion, indicating strong competition. Hyundai E&C's 2024 revenue exceeded $10 billion, demonstrating industry rivalry.

The construction industry is highly competitive because projects are often awarded based on price and capability. Strabag's 2024 revenue exceeded €17 billion.

This rivalry affects HOCHTIEF's profitability and market share. Skanska, in 2024, had revenues of over $16 billion.

Facing these competitors, HOCHTIEF must maintain a strong focus on efficiency and innovation. Sacyr's 2024 revenue was approximately €6 billion.

Focus on Innovation

To gain a competitive edge, construction firms are increasingly prioritizing innovation, technology, and sustainability. HOCHTIEF must continuously invest in new technologies and processes to maintain a competitive advantage. The industry is seeing greater adoption of technologies like BIM, digital twins, robotics, and automation. In 2024, the global construction robotics market was valued at approximately $1.5 billion, reflecting the growing importance of these technologies.

- Investment in R&D is crucial for competitive advantage.

- BIM adoption rates are increasing globally, enhancing project efficiency.

- Sustainability initiatives are becoming a key differentiator.

- Automation and robotics are transforming construction processes.

Geographic Competition

HOCHTIEF faces diverse competition across its global markets. Competition intensity varies by region, impacting its strategic approach. HOCHTIEF's focus on developed markets means it contends with established players. Geographic diversification helps HOCHTIEF manage risk and seize opportunities. Adapting to local market dynamics is crucial for success.

- HOCHTIEF operates in Europe, North America, and Asia-Pacific.

- Key competitors include Vinci and ACS.

- In 2024, the construction market size was over $15 trillion globally.

- HOCHTIEF's revenue in 2023 was approximately €27 billion.

Competitive rivalry in the construction industry is fierce, driven by numerous competitors vying for projects. Firms like HOCHTIEF must compete on price, quality, and innovation, which can pressure profit margins. The global construction market was valued over $15 trillion in 2024, intensifying competition.

| Company | 2024 Revenue (approx.) | Notes |

|---|---|---|

| HOCHTIEF | €27 billion (2023) | Operates globally |

| Grupo ACS | €34 billion | Major international rival |

| Strabag | €17 billion | Focus on efficiency and innovation |

| Skanska | $16 billion | Strong focus on sustainability |

| Hyundai E&C | $10 billion | Growing in the global market |

SSubstitutes Threaten

Alternative building materials pose a threat to Hochtief. Innovations like cross-laminated timber challenge concrete and steel dominance. Eco-friendly materials are gaining traction; the global green building materials market was valued at $367.5 billion in 2023. The trend toward recycled and low-carbon materials is increasing, impacting traditional material demand.

Modular construction presents a threat to HOCHTIEF as it offers alternatives to traditional methods. This could impact demand for HOCHTIEF's services. The modular construction market is projected to reach $157 billion by 2024. This is due to its potential for cost savings and reduced project timelines, which can be up to 20-50% faster than conventional methods.

The threat of substitutes includes organizations building their own construction teams. This reduces dependence on external contractors such as HOCHTIEF.

Companies like Meta, which HOCHTIEF has partnered with on data centers, could opt for in-house solutions. This strategic shift impacts HOCHTIEF's market share.

In 2024, the trend of tech giants managing their own construction increased. This poses a risk to external firms.

This internal capability offers cost savings and control, thus becoming a viable alternative. The global construction market was valued at $15.2 trillion in 2023.

This poses a competitive challenge for HOCHTIEF. Internal projects may offer greater flexibility and potentially reduce costs.

Renovation vs. New Construction

Clients might opt for renovations over new builds, affecting HOCHTIEF's revenue. The residential sector's growth, predicted at 2.8% in 2024, could sway choices. Renovation costs can be lower, making them attractive substitutes for new construction. This shift poses a threat, especially if renovation demand rises. This could limit HOCHTIEF's market share in specific regions.

- Renovation projects often present a more cost-effective alternative to new construction.

- The decision between renovation and new construction is influenced by factors like budget and the condition of existing infrastructure.

- In 2023, the construction industry in Germany saw a slight decline, which might encourage more renovation activities.

- HOCHTIEF must focus on innovation to stay ahead of the competition.

Technological Substitutes

Technological substitutes pose a threat to Hochtief. Advances in 3D printing and automation are changing construction. They could replace some traditional labor, especially for smaller projects. Drones are also increasingly used for site surveys and monitoring. The global construction industry is expected to reach $15.2 trillion by 2030.

- 3D printing in construction market was valued at $1.2 billion in 2023.

- The drone services market in construction is projected to reach $7.7 billion by 2028.

- Automation in construction is growing, with a market size estimated at $1.8 billion in 2024.

- These technologies can lower costs and speed up construction.

The threat of substitutes for Hochtief includes alternative materials, such as eco-friendly options, and innovative construction methods. Modular construction, with a market forecast of $157 billion in 2024, offers faster project completion. Furthermore, self-built construction teams by clients like Meta impact HOCHTIEF's external projects.

Renovations are a cost-effective alternative to new construction, the residential sector grows 2.8% in 2024. Technological advancements, like 3D printing (valued at $1.2 billion in 2023), are reshaping construction. Drones' market is projected to reach $7.7 billion by 2028, and automation is estimated at $1.8 billion in 2024.

| Substitute Type | Market Value/Forecast | Impact on Hochtief |

|---|---|---|

| Eco-Friendly Materials (2023) | $367.5 billion | Reduces demand for traditional materials. |

| Modular Construction (2024) | $157 billion | Offers faster project completion. |

| Automation in Construction (2024) | $1.8 billion | May displace some traditional labor. |

Entrants Threaten

High capital requirements pose a significant barrier to entry in the construction industry. Large projects demand substantial upfront investment in equipment and labor. While new firms can subcontract, they often start with smaller, less profitable contracts. In 2024, the average cost of construction materials increased by 5%, adding to the financial strain. HOCHTIEF, with its established resources, benefits from this dynamic.

HOCHTIEF benefits from established relationships, creating a barrier against new entrants. Its long-standing ties with clients and suppliers are hard to duplicate. Reputation significantly influences tender wins; a strong track record is key. In 2024, HOCHTIEF's project backlog was substantial, indicating its strong market position.

Established construction giants like Hochtief leverage significant economies of scale. They gain advantages in areas like bulk procurement and efficient project management. New entrants often face higher costs, impacting their competitiveness. The construction aggregate market, a key cost factor, is projected to hit $452.4 billion in 2024.

Technical Expertise

The threat from new entrants is significantly impacted by the technical expertise required for infrastructure projects. HOCHTIEF and its established competitors possess a wealth of specialized knowledge and experience, a critical barrier to entry. New companies often struggle to replicate this, facing challenges in both managerial and technical skills. Obtaining these skills takes time and significant investment, hindering newcomers. For example, in 2024, the average project completion time for major infrastructure projects was 3-5 years.

- Specialized knowledge and experience are crucial.

- New entrants often lack the necessary skills.

- Both managerial and technical skills are required.

- Acquiring these skills is time-consuming and costly.

Regulatory Barriers

Regulatory barriers significantly impact the construction industry, posing a challenge for new entrants. This sector faces complex regulations and demanding permitting processes. These hurdles, coupled with compliance costs, substantially increase the initial investment needed. High regulatory complexity acts as a substantial deterrent to new firms.

- The construction industry is heavily regulated, with compliance costs often escalating project expenses.

- Navigating these regulations demands specialized expertise, adding to the barriers.

- Regulatory compliance can represent a substantial portion of overall project costs.

- The complexity and strictness of regulations vary by region, impacting entry costs.

New construction firms face considerable hurdles. Capital demands and established industry relationships create barriers. Expertise, regulatory complexities, and project timelines further restrict market entry.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Costs | High investment needed | Material cost up 5% |

| Relationships | Established firms' advantage | HOCHTIEF's backlog strong |

| Expertise | Skills gap for new entrants | Project time: 3-5 years |

Porter's Five Forces Analysis Data Sources

The analysis incorporates data from financial reports, market studies, and industry news to evaluate competitive dynamics. Sources include Bloomberg and Reuters.