Holcim Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

What is included in the product

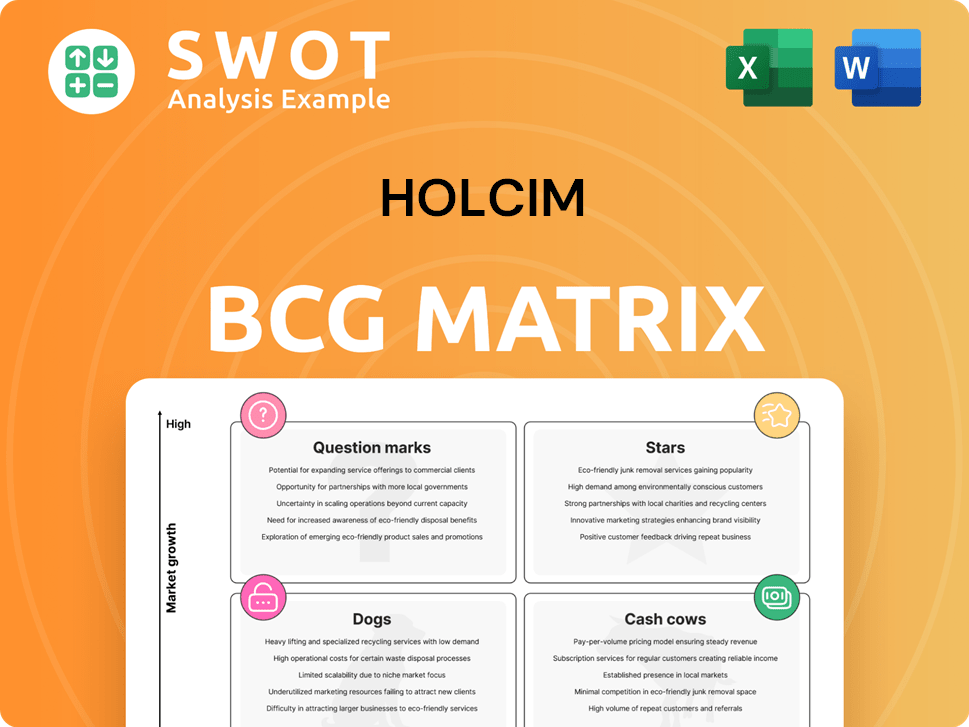

Holcim's BCG Matrix analysis: strategic insights for their portfolio, highlighting investment, holding, and divestment strategies.

Clear visual framework for efficient decision-making, simplifying complex business strategies.

Preview = Final Product

Holcim BCG Matrix

The Holcim BCG Matrix preview is identical to the file you'll receive. This complete report, optimized for strategic decision-making, is fully accessible after purchase.

BCG Matrix Template

Holcim's BCG Matrix offers a snapshot of its diverse product portfolio. Analyzing its offerings, from cement to aggregates, reveals where each stands in the market. Discover which are high-growth Stars and reliable Cash Cows. See which require strategic attention or represent Dogs. Understand how Holcim is allocating resources for maximum impact. For detailed quadrant placements, actionable recommendations, and a strategic roadmap, explore the full BCG Matrix report.

Stars

Holcim's ECOPact and ECOPlanet are key sustainable solutions. ECOPact accounted for 32% of ready-mix concrete sales in Q1 2025. ECOPlanet reached 29% of cement sales in the same period. These figures highlight their increasing market presence and importance.

Holcim's advanced roofing systems (Elevate) are a Star in the BCG Matrix. Elevate showed strong performance, with net sales up by 9.7% in 2023. Recurring EBIT grew by double digits, with margin expansion. This indicates a robust market position. The roofing segment benefits from new construction and renovation.

The Solutions & Products segment within Holcim's portfolio demonstrates robust performance. It has achieved consistent profitable growth, with net sales rising by 7.4% year-over-year. This expansion is driven by offerings like advanced roofing systems and specialty building solutions. This segment highlights strong market share and growth potential.

North American Business (Amrize)

Holcim's North American business, Amrize, is set for a spin-off in H1 2025. It has shown double-digit local currency growth in recurring EBIT. This business unit holds a leading cement position, with significant infrastructure projects. It indicates a strong market share and growth potential in North America.

- Double-digit growth in recurring EBIT.

- Leading cement position in the market.

- Significant infrastructure projects secured.

- Spin-off planned for H1 2025.

Recycled Construction Demolition Materials

Holcim's focus on recycled construction demolition materials is a star in its BCG matrix. The company saw a 20% increase in 2024, processing 10.2 million tons. This growth highlights its leadership in sustainable construction. Holcim is on track to meet its 2025 goals early.

- 20% rise in recycled construction demolition materials in 2024.

- 10.2 million tons of materials processed in 2024.

- Ahead of schedule for 2025 sustainability targets.

Holcim's Stars, like Elevate roofing and recycled materials, show strong growth. Elevate's net sales rose 9.7% in 2023. Recycled materials processing increased by 20% in 2024. Amrize, set to spin off in H1 2025, also shines.

| Star | Performance | Key Data (2024) |

|---|---|---|

| Elevate Roofing | Strong sales growth | Net sales increase, double-digit EBIT growth |

| Recycled Materials | Rapid expansion | 20% growth, 10.2M tons processed |

| Amrize | North American growth | Double-digit EBIT growth, spin-off H1 2025 |

Cash Cows

Cement is a key cash cow for Holcim, holding a significant market share. Despite a modest 0.6% YoY net sales growth in 2024, it's a revenue mainstay. Cement's established market presence ensures consistent demand and cash generation. Holcim's cement business contributes significantly to overall financial stability.

Aggregates are a key segment for Holcim, generating CHF 4,335 million in net sales during 2024. Despite a modest 0.2% year-over-year growth, aggregates provide consistent revenue. This steady income stream solidifies Holcim's cash cow position. The company's substantial aggregate operations are a cornerstone of its financial stability.

Holcim's Latin American operations are a financial stronghold, having achieved 18 consecutive quarters of profitable growth. This region benefits from robust market fundamentals and industrialization, providing a stable income stream. Holcim has strategically expanded its presence through acquisitions, like the 2024 purchase of a cement plant in Argentina. This cements its cash cow status, with the region's sales contributing significantly to the company's global revenue, showing a consistent positive trend. The Latin American market is expected to continue to grow, making it a valuable asset.

European Operations

Holcim's European operations are positioned as a cash cow, benefiting from positive market dynamics. The region shows promising prospects in new construction and renovations. Sustainable building solutions fueled profitable growth in Europe. In 2024, Holcim expanded its presence through 13 bolt-on acquisitions in the most appealing markets.

- Favorable outlook for both new construction and repair & refurbishment market.

- Sustainable building solutions drove profitable growth in Europe.

- Holcim acquired 13 bolt-ons in the region during the year to expand its footprint.

Asia, Middle East, and Africa (AMEA)

Holcim's Asia, Middle East, and Africa (AMEA) region demonstrated resilience, achieving a 3.2% year-over-year sales growth. This performance was bolstered by robust domestic demand in North Africa, a promising outlook in Australia, and a price recovery in China. The AMEA segment continues to be a significant contributor to Holcim's global revenue. This region's success underscores Holcim's strategic positioning.

- Sales growth in AMEA was 3.2% YoY.

- Strong demand in North Africa.

- Positive outlook in Australia.

- Price recovery in China.

Holcim's core operations, like cement, aggregates, and key regional markets, are cash cows, providing consistent revenue. These segments show steady performance with positive growth in 2024, for example, cement net sales grew by 0.6%. Strategic acquisitions and regional expansions bolster their financial stability. Strong demand and market positions ensure sustained cash generation.

| Segment | 2024 Net Sales (CHF Millions) | YoY Growth |

|---|---|---|

| Aggregates | 4,335 | 0.2% |

| Latin America | Significant Contribution | Profitable Growth (18 Qtrs) |

| AMEA | Significant Contribution | 3.2% |

Dogs

Ready-mix concrete, a "Dog" in Holcim's BCG Matrix, saw a 4% YoY sales decrease in 2024. This downturn, as of Q3 2024, may reflect regional market issues. Analyzing the causes is key to deciding on divestment or a turnaround strategy.

Holcim strategically divested businesses in Uganda, South Africa, and Tanzania. These moves often signal underperformance or a shift toward core markets. Such divested units typically fit the "Dogs" category, marked by low growth and market share. In 2024, Holcim's focus remained on streamlining operations, indicating a continued strategy of divesting non-core assets.

Holcim divested its 83.81% stake in Lafarge Africa PLC to Huaxin Cement Ltd. This decision likely stems from Lafarge Africa's underperformance relative to Holcim's strategic goals. Lafarge Africa, as a 'Dog,' may have shown low market share and growth. In 2024, Holcim's strategic shift included focusing on core markets.

Underperforming Geographic Regions

In 2024, Holcim faced challenges in North America, where net sales to external customers declined by 5.2%. European sales also experienced a slight downturn, slipping by 0.1%. These regions are potential "Dogs" in the BCG matrix, indicating low market share and growth. Holcim may need to consider strategic adjustments.

- North American sales decline: -5.2% in 2024.

- European sales decrease: -0.1% in 2024.

- "Dogs" classification: Low market share and growth.

- Strategic adjustments: Required for these regions.

Traditional Building Materials Without Sustainable Differentiation

Products without sustainable features, like some traditional materials, face challenges. These items may see declining market share and profitability. This situation classifies them as "Dogs." Holcim's focus on ECOPact and ECOPlanet is crucial.

- In 2024, demand for green construction materials increased by 15% globally.

- Traditional materials' market share decreased by 8% due to sustainable alternatives.

- ECOPact and ECOPlanet sales grew by 20% in the same year.

In Holcim's BCG matrix, "Dogs" represent underperforming products or regions. Ready-mix concrete saw a 4% YoY sales decrease in 2024. Declining sales in North America (-5.2%) and Europe (-0.1%) place them as potential "Dogs." These regions require strategic adjustments.

| Category | 2024 Performance | Strategic Implication | ||

|---|---|---|---|---|

| Ready-Mix Concrete | -4% YoY Sales | Divest or Turnaround | ||

| North America | -5.2% Sales Decline | Strategic Adjustment | ||

| Europe | -0.1% Sales Decline | Strategic Adjustment |

Question Marks

Holcim is investing in seven Carbon Capture, Utilization, and Storage (CCUS) projects, a substantial commitment to new technology. These projects, while promising for decarbonization, face uncertain market impact and ROI, classifying them as 'Question Marks.' For instance, Holcim invested €1.06 billion in green projects in the first half of 2023. The future of these projects will depend on their success.

The Holcim Sustainable Construction Academy, launched in September 2024, is a 'Question Mark' in the BCG Matrix. Its goal is to boost skills in low-carbon construction. As a new venture, its effect on market share and revenue is still uncertain. Success hinges on how quickly professionals adopt its methods, impacting sustainable building practices.

Holcim is growing its specialty building solutions in Latin America and other emerging markets. These regions present growth opportunities, but the current market share and profitability are unclear. Investments are required to improve their position. For instance, Holcim's 2023 sales in Latin America were $3.8 billion.

Circular Technology ECOCycle®

Holcim's ECOCycle® is categorized as a question mark within its BCG Matrix. This circular technology focuses on recycling, a relatively new venture for Holcim. As of 2024, its market acceptance is still being established, influencing its financial returns. Further investment and market penetration are essential for ECOCycle® to achieve its potential.

- ECOCycle® recycles construction and demolition waste.

- Holcim aims to increase recycled content in concrete.

- Financial returns are still developing.

- Further investment and market penetration.

AI-Driven Production and Automation Technologies

Holcim is delving into AI-driven production and automation technologies. These advancements aim to boost efficiency and cut costs within their operations. However, the full impact on Holcim's market share remains uncertain. Successful integration and realizing the expected benefits are crucial for this strategy to pay off. As of 2024, the adoption rate of AI in manufacturing has grown by 25%.

- AI-driven technologies aim to enhance efficiency.

- Cost reduction is a primary goal of automation.

- Market share impact is still being assessed.

- Effective integration is vital for success.

Holcim’s 'Question Marks' involve high-potential, but uncertain ventures.

Investments in CCUS and the Sustainable Construction Academy, for example, face an unclear market impact.

These initiatives, including AI and emerging market expansions, require strategic focus to realize their revenue potential.

| Venture | Investment (2023-2024) | Market Uncertainty |

|---|---|---|

| CCUS Projects | €1.06B in green projects | ROI, market impact |

| Sustainable Academy | Launched Sept. 2024 | Adoption, revenue |

| Latin America Expansion | $3.8B (2023 sales) | Market share, profitability |

BCG Matrix Data Sources

Holcim's BCG Matrix leverages financial statements, market reports, and competitive analyses, ensuring a robust and actionable strategic assessment.