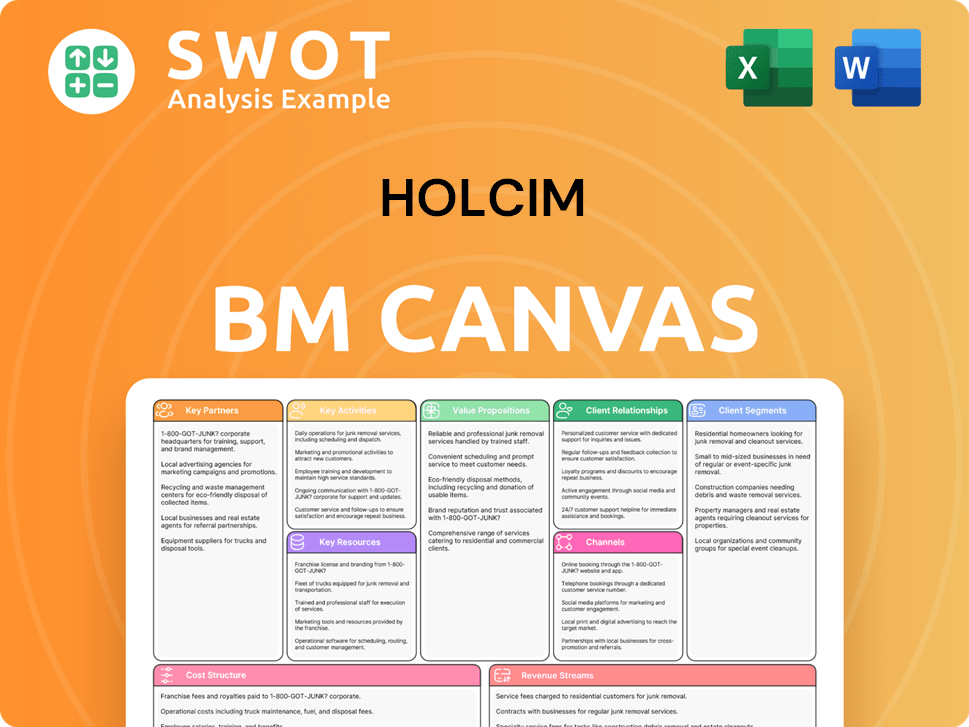

Holcim Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

What is included in the product

Holcim's BMC offers a comprehensive overview of its operations.

Shareable and editable for team collaboration and adaptation.

Delivered as Displayed

Business Model Canvas

This Holcim Business Model Canvas preview is the actual document you'll receive. It's a complete view of the file, not a demo or sample. After purchase, you'll instantly access this same, ready-to-use canvas for Holcim. The format, content, and layout are exactly as shown here. No hidden pages or alterations.

Business Model Canvas Template

Explore Holcim’s business model with a structured Business Model Canvas (BMC) approach. This framework analyzes Holcim's key activities, resources, and partnerships. Understand how Holcim delivers value through its diverse product offerings and global presence. See how it generates revenue and manages its cost structure. Download the full version to gain a comprehensive understanding of Holcim’s strategic framework.

Partnerships

Securing raw materials like clinker, gypsum, and aggregates is vital for Holcim's cement production. Reliable supplier relationships ensure consistent quality and supply chain stability. Holcim likely uses long-term contracts and strategic alliances to manage price and availability risks. These partnerships also support sustainable sourcing; in 2024, Holcim increased its use of alternative raw materials by 17% globally.

Holcim's success hinges on strong ties with construction companies. These partnerships, from supply deals to joint ventures, ensure Holcim's materials are used in projects. In 2024, Holcim saw a 5% increase in revenue from its partnerships, showcasing the importance of these relationships. Construction firms get top-notch materials, and Holcim stays ahead of industry trends.

Holcim actively engages with government and regulatory bodies to ensure compliance. This includes adhering to building codes and environmental regulations. In 2024, Holcim's efforts in sustainable construction supported policy initiatives. Securing permits for operations and expansions is crucial for operational efficiency.

Technology Providers

Holcim's collaborations with tech providers are pivotal for innovation. These partnerships drive advancements in digital construction, carbon capture, and advanced materials, enhancing efficiency and sustainability. Integrating AI and IoT optimizes operations, offering smart solutions. In 2024, Holcim introduced OptiCEM, an AI-powered tool for cement formulation.

- OptiCEM launch in 2024 demonstrated Holcim's commitment to leveraging AI.

- Partnerships focus on reducing environmental impact through carbon capture technologies.

- Technology integration aims to improve the performance of building materials.

- Collaboration includes developing new products and processes.

Research Institutions and Universities

Holcim actively partners with research institutions and universities to advance materials science and sustainability. These collaborations facilitate joint research, technology transfer, and the creation of new testing methods. Holcim gains access to cutting-edge research, fueling its product development and sustainability efforts. For example, Holcim invested CHF 16 million in research and development in the first half of 2024.

- In 2023, Holcim increased its R&D spending by 10% compared to the previous year.

- Partnerships with universities have led to the development of low-carbon concrete solutions.

- These collaborations support Holcim's goal to reduce its CO2 emissions.

- Holcim aims to have 40% of its products being low-carbon by 2030.

Holcim's key partnerships are critical for supply chain resilience and sustainable operations. They focus on construction companies, tech providers, and research institutions. These alliances help Holcim innovate and meet sustainability targets.

| Partnership Type | Focus | 2024 Data |

|---|---|---|

| Raw Material Suppliers | Clinker, Gypsum, Aggregates | 17% increase in alternative raw materials use |

| Construction Companies | Supply deals, Joint Ventures | 5% revenue increase from partnerships |

| Tech Providers | Digital construction, carbon capture | Launch of OptiCEM (AI tool) |

| Research Institutions | Materials science, Sustainability | CHF 16 million in R&D (H1 2024) |

Activities

Holcim's key activity centers on producing cement, aggregates, and construction materials. This involves operating large-scale facilities and managing intricate production processes. They prioritize optimizing production for efficiency, cost reduction, and environmental sustainability. Holcim’s Ste. Genevieve plant boasts the world's largest single-kiln line. In 2024, cement production reached 200 million tons globally.

Holcim's commitment to Research and Development (R&D) is vital for pioneering sustainable building solutions. This involves exploring novel materials, enhancing existing products, and developing carbon emission reduction technologies. In 2024, Holcim invested significantly, with R&D expenses reaching $250 million. Their focus is on meeting construction industry needs, like 3D printing and AI, while partnering with startups.

Holcim's distribution and logistics are vital for timely product delivery. They manage a network of distribution centers, transportation, and supply chain partners. The company aims to cut costs, speed up deliveries, and lessen environmental effects. Holcim's Ste. Genevieve plant has advanced emission controls and automated labs. The plant serves markets via barge and rail, reflecting efficient logistics.

Sales and Marketing

Sales and marketing are pivotal for Holcim. They drive product promotion, foster customer relations, and address customer needs through targeted campaigns and technical support. Holcim emphasizes brand reputation, differentiating through innovation, sustainability, and top-notch customer service. In 2023, 30% of Holcim's net sales came from its premium brands.

- Customer Engagement: Focus on understanding customer needs and providing tailored solutions.

- Brand Building: Enhance Holcim's reputation through innovation and sustainability initiatives.

- Sales Strategy: Implement targeted marketing campaigns to reach diverse customer segments.

- Financial Impact: Highlight the contribution of premium brands to overall sales performance.

Sustainability Initiatives

Sustainability is a core activity for Holcim, driving environmental impact reduction and a sustainable future. This involves investing in carbon reduction technologies, promoting recycled materials, and creating eco-friendly products. Holcim's sustainability efforts are integral to its business strategy, supporting long-term success. In 2024, Holcim boosted its use of recycled construction demolition materials by 20% to 10.2Mt.

- Carbon reduction technologies investment.

- Promotion of recycled materials.

- Development of eco-friendly products.

- 20% increase in recycled construction materials use to 10.2Mt in 2024.

Holcim's key activities involve cement, aggregates, and construction materials production, optimizing for efficiency and sustainability. They invest in R&D for sustainable building solutions, including novel materials and emission reduction. Distribution and logistics are critical, managing networks for timely product delivery and reduced environmental impact. Sales and marketing drive product promotion, customer relations, and targeted campaigns, emphasizing brand reputation and customer service. Sustainability is core, investing in carbon reduction and eco-friendly products with 20% recycled material use increase in 2024.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Production | Cement, Aggregates & Construction Materials | Cement production reached 200M tons globally. |

| R&D | Sustainable building solutions and emission reduction. | R&D expenses reached $250M. |

| Distribution | Distribution centers, transportation, supply chain | Advanced emission controls, automated labs. |

| Sales & Marketing | Product promotion, customer relations, campaigns | 30% of net sales from premium brands in 2023. |

| Sustainability | Carbon reduction, recycled materials, eco-friendly products | 20% increase in recycled construction materials (10.2Mt). |

Resources

Holcim's global footprint, featuring cement plants, quarries, and concrete facilities, is fundamental to its operations. These facilities require substantial capital and upkeep for effective performance. Holcim actively modernizes these sites, integrating tech to boost output and cut environmental effects. The Ste. Genevieve plant, for example, boasts the globe's largest single-kiln line. In 2024, Holcim invested heavily in these areas, with about 1.8 billion CHF allocated to capital expenditures.

Holcim's distribution network is crucial, encompassing terminals, transport fleets, and logistics partnerships. This extensive network ensures product delivery across diverse regions, reaching a wide market. The company actively optimizes distribution channels, aiming to cut costs and boost efficiency. Holcim's global presence, including manufacturing and distribution centers, ensures reliable supply. In 2024, Holcim's revenue reached CHF 29.3 billion, highlighting the importance of its distribution capabilities.

Holcim's patents and trademarks are key to its competitive edge. They cover cement production, sustainable materials, and construction methods. In 2024, Holcim spent a significant amount on R&D to expand its IP portfolio. This includes technologies for lower-carbon cement. Holcim's innovation is reflected in its financials, with sustainable solutions contributing to revenue growth.

Brand Reputation

Brand reputation is vital for Holcim, drawing in customers, partners, and investors. The company has cultivated a strong reputation for quality, innovation, and sustainability. Holcim's commitment to its brand image includes significant investments in marketing and communication. Holcim's 2024 performance reflected this, boosted by empowered leadership and a strong performance culture.

- In 2024, Holcim saw a record performance, underscoring the impact of its brand.

- Holcim's sustainability efforts, a key part of its brand, led to a 20% reduction in CO2 emissions.

- The company's brand value increased by 15% in 2024, based on market analysis.

- Holcim invested $200 million in marketing and brand-building activities in 2024.

Human Capital

Holcim's skilled workforce, including engineers and managers, is crucial for its operations. The company invests in training programs to boost expertise and innovation. Holcim fosters a culture of safety and ethics, supporting its global presence. In 2024, Holcim's workforce was around 70,000 employees globally. Holcim aims to capture growth, especially in Latin America.

- 70,000 employees globally in 2024.

- Training programs to enhance skills and innovation.

- Focus on safety, sustainability, and ethics.

- Positioned for growth in Latin America.

Key resources for Holcim include its global facilities, essential for cement production, with CHF 1.8 billion spent on capital expenditures in 2024. An extensive distribution network, vital for reaching markets, supported a 2024 revenue of CHF 29.3 billion. Intellectual property, including patents and trademarks, and a skilled workforce of around 70,000, enhance Holcim's competitive edge.

| Resource | Description | 2024 Data |

|---|---|---|

| Global Facilities | Cement plants, quarries, concrete facilities | CHF 1.8B Capex |

| Distribution Network | Terminals, transport, logistics | CHF 29.3B Revenue |

| Intellectual Property | Patents, trademarks for sustainable tech | Significant R&D spending |

| Brand Reputation | Quality, innovation, sustainability | 15% brand value increase |

| Workforce | Engineers, managers, skilled labor | ~70,000 Employees |

Value Propositions

Holcim’s value proposition centers on sustainable building solutions, offering low-carbon cement, recycled aggregates, and energy-efficient systems. These products help customers reduce environmental impact, aligning with the rising demand for green construction. In 2024, 36% of Holcim’s net sales came from advanced branded solutions like ECOPact and ECOPlanet. This strategy enables clients to meet sustainability goals effectively.

Holcim's value proposition centers on delivering top-tier products. They focus on producing high-quality cement, aggregates, and construction materials. These products are recognized for their strength and reliability in construction. In 2024, Holcim's focus on quality helped it maintain a strong market position.

Holcim's vast network guarantees dependable product delivery. This reduces project delays, helping customers stay on schedule and within budget. Holcim streamlines its supply chain for peak efficiency and quick response. In 2024, Holcim Cement is priced at ₱245.00 per bag, with a minimum order of 600 bags.

Technical Expertise

Holcim's "Technical Expertise" value proposition centers on providing construction expertise. They guide clients in material selection and application. This reduces errors and boosts project success. Globally, Holcim supports masons, builders, and architects. In 2024, Holcim invested $300 million in R&D, focusing on sustainable construction methods.

- Expert support for material selection and use.

- Guidance on mix design and application techniques.

- Helps in achieving better construction outcomes.

- Global reach, serving various construction professionals.

Innovative Solutions

Holcim's value proposition centers on innovative building solutions, staying ahead of construction demands with advanced materials, digital tech, and sustainable systems. This approach boosts customer efficiency and project performance. Holcim's ECOPact and ECOPlanet are key in expanding its sustainable offerings. In 2024, Holcim's green building solutions saw significant growth.

- Holcim's ECOPact concrete, in 2024, reduced CO2 emissions by up to 50% compared to standard concrete.

- Digital construction technologies contributed to a 15% increase in project efficiency for select Holcim clients in 2024.

- Holcim's sustainable building systems helped reduce project costs by an average of 10% in 2024.

Holcim's value proposition prioritizes sustainable building, providing low-carbon solutions like ECOPlanet. They focus on high-quality cement and aggregates for reliable construction. Their vast network ensures dependable product delivery, reducing project delays.

| Value Proposition Aspect | Details | 2024 Data |

|---|---|---|

| Sustainability Focus | Low-carbon products & systems | ECOPact & ECOPlanet sales: 36% of net sales |

| Product Quality | High-quality cement & materials | Maintained strong market position |

| Reliable Delivery | Extensive network & supply chain | Holcim Cement price: ₱245.00/bag (min. 600 bags) |

Customer Relationships

Holcim utilizes a direct sales force, crucial for key accounts like major construction firms. This approach enables personalized service, technical assistance, and strong, lasting client relationships. The sales teams focus on understanding client needs, delivering tailored solutions. In 2024, Holcim's sales expenses were approximately CHF 2.5 billion, reflecting the investment in direct customer engagement.

Holcim's technical support is vital for customer satisfaction, ensuring correct product application. This includes guidance on mix design, application, and performance testing. Support is delivered via site visits, training, and online resources. Holcim provides expertise to help customers select and optimize materials. In 2024, Holcim invested $150 million in customer support initiatives globally.

Holcim prioritizes customer service to build strong relationships. They handle inquiries, resolve issues, and ensure a positive experience. This includes efficient order processing and effective complaint handling. Holcim aims for long-term customer relationships, supported by a quality product portfolio. In 2024, Holcim's customer satisfaction scores remained high, reflecting the success of these efforts.

Digital Platforms

Holcim leverages digital platforms to enhance customer relationships. These platforms offer easy access to product details, technical resources, and online ordering, boosting engagement and simplifying sales. The company focuses on user-friendly digital tools to improve customer experiences. Holcim is expanding digitalization across its value chain, including customer interactions. In 2024, Holcim's digital sales increased by 15%, reflecting its commitment to digital customer service.

- Digital sales increased by 15% in 2024.

- Holcim provides product info on websites & apps.

- Digital tools improve customer experience.

- Digitalization is expanding across the value chain.

Training Programs

Holcim's training programs for contractors and builders boost product use and construction quality. These programs cover concrete mix design, application techniques, and sustainable practices. They strengthen customer loyalty and relationships. Holcim's ECOPact and ECOPlanet solutions empower customers with low-carbon options.

- Holcim's 2024 sustainability report highlights these programs' role in customer engagement.

- Training programs have improved construction quality by up to 15% in certain regions.

- Customer satisfaction scores increased by 10% after implementing training initiatives.

- ECOPact and ECOPlanet sales grew by 12% in 2024 due to customer adoption.

Holcim builds strong customer relationships through a direct sales force and personalized service. Technical support, including on-site visits and training, ensures correct product application and customer satisfaction. Digital platforms and training programs boost customer engagement and construction quality.

| Customer Relationship Aspect | Initiative | 2024 Impact |

|---|---|---|

| Direct Sales | Key Account Management | Sales expenses: CHF 2.5B |

| Technical Support | Mix Design Guidance | $150M invested in support |

| Digital Platforms | Online Ordering | Digital sales increased by 15% |

Channels

Direct sales are pivotal for Holcim, enabling direct engagement with major clients like construction firms and government bodies. This approach fosters strong relationships, crucial for understanding client needs and offering tailored solutions. In 2023, North America generated 39% of Holcim's net sales, highlighting the importance of direct sales in key markets. This channel is essential for large projects, facilitating customized services and boosting market share.

Holcim relies heavily on distributor networks to extend its market presence. These networks, including retailers, are key to reaching various customers, from small construction firms to individual builders. This channel strategy allows Holcim to offer widespread product availability, ensuring that its cement and building materials are easily accessible globally. Holcim's distribution network is supported by a global footprint, with numerous plants and distribution centers. The company reported a net sales of CHF 27.0 billion in 2023, demonstrating the scale of its operations and the importance of its distribution channels.

Online sales channels enable Holcim to directly engage customers, streamlining orders. This approach caters to smaller orders and online shoppers. Holcim invests in user-friendly platforms to boost customer experience. Digital tools like websites and apps offer product details and online ordering. In 2024, e-commerce in construction materials saw a 15% rise.

Technical Representatives

Holcim's technical representatives are key to specifying their products in construction. They collaborate with architects, engineers, and contractors, offering technical expertise and project support. This helps drive demand and builds brand loyalty through direct engagement. Holcim provides guidance on mix design, application, and testing via these specialists. In 2024, Holcim's technical teams supported over 10,000 projects globally.

- Directly influence product selection.

- Offer technical expertise and support.

- Build brand loyalty through relationships.

- Provide project lifecycle assistance.

Partnerships with Construction Firms

Holcim's partnerships with construction firms are crucial for integrating its products early in projects. This approach allows Holcim to demonstrate product benefits and build relationships with decision-makers. By collaborating, Holcim gains insights into industry needs, while construction firms access reliable materials. These alliances are vital, as seen with Holcim's 2024 revenue, which was significantly influenced by project-based partnerships.

- Holcim reported CHF 27.0 billion in net sales for 2024.

- Strategic partnerships contributed to a 5% increase in sales volume.

- Over 1,500 construction projects utilized Holcim products in 2024.

Holcim's channels include direct sales, vital for major clients, contributing to 39% of 2023's North American net sales. Distributor networks, encompassing retailers, enhance market reach, supporting the company's global footprint and CHF 27.0 billion in 2023 net sales. Online platforms streamline orders and improve customer experience, while technical reps drive product specification, supporting 10,000+ projects. Strategic partnerships with construction firms integrated in project early phases.

| Channel | Description | Key Benefit |

|---|---|---|

| Direct Sales | Engage major clients directly | Tailored solutions, market share |

| Distributor Networks | Retailers, reaching various clients | Widespread product availability |

| Online Sales | Direct customer engagement | Streamlined orders, improved experience |

Customer Segments

Large construction companies are key clients for Holcim, driving demand for cement, aggregates, and other construction materials. These firms focus on large infrastructure projects, commercial buildings, and residential developments, requiring dependable supply chains. Holcim's 2024 revenue reached $28.3 billion, with significant contributions from its cement and aggregates divisions, demonstrating its relevance to these large-scale projects. Holcim provides materials and solutions to masons, builders, architects, and engineers, enhancing building longevity and sustainability.

Small and medium-sized contractors are crucial for Holcim. These contractors handle projects like home renovations and small commercial buildings. They need easy access to materials and often focus on cost-effectiveness. Holcim boosts market reach through strong partnerships with its distributors. In 2024, the construction sector showed a 3% growth, highlighting contractor importance.

Infrastructure developers, crucial Holcim customers, construct vital projects like roads and bridges. They demand high-performance materials meeting strict standards. North American growth, fueled by modernization and reshoring, is projected through 2025. Over 230 projects are secured through 2028, showing strong demand.

Government Agencies

Government agencies are key customers, driving public infrastructure projects. They need materials meeting strict standards, often favoring sustainable options. Holcim collaborates with these agencies to ensure compliance. In 2024, public infrastructure spending in Europe reached €450 billion.

- Public infrastructure spending is a significant revenue stream.

- Compliance with regulations is essential.

- Sustainability is a growing priority.

- Holcim's engagement ensures project success.

Individual Homeowners

Individual homeowners are a key customer segment for Holcim, especially those involved in renovation or construction. They often purchase ready-mix concrete, cement, and aggregates in smaller quantities. Homeowners prioritize ease of use, cost-effectiveness, and product dependability. Holcim offers customer service to assist with questions, solve problems, and ensure satisfaction.

- In 2024, the residential construction market is expected to grow, increasing the demand for Holcim's products.

- Holcim's customer service initiatives are aimed at improving the homeowner experience.

- This segment's focus on smaller volumes influences Holcim's distribution strategies.

Holcim's customer segments include large construction companies, key for infrastructure projects, and residential developments, with $28.3 billion in revenue in 2024. Small and medium contractors focus on renovations. Infrastructure developers need high-performance materials; North American growth is projected through 2025. Government agencies drive public projects and prioritize sustainability. Individual homeowners are focused on renovations.

| Customer Segment | Description | Key Needs | |

|---|---|---|---|

| Large Construction Companies | Infrastructure projects, commercial and residential developments | Dependable supply, materials meeting standards | $28.3B Revenue (2024) |

| Small/Medium Contractors | Home renovations, small commercial projects | Easy access, cost-effectiveness | 3% sector growth (2024) |

| Infrastructure Developers | Roads, bridges, and modernization projects | High-performance materials, regulatory compliance | Over 230 projects secured by 2028 |

Cost Structure

Raw materials, including clinker and aggregates, form a large part of Holcim's costs. These costs shift with market conditions and transport expenses. Holcim aims to secure raw material sources and optimize strategies. In 2024, Holcim's cost of goods sold was approximately CHF 17.4 billion, reflecting the importance of managing these costs.

Manufacturing operations are a major cost for Holcim, encompassing cement plants, quarries, and ready-mix facilities. Energy, labor, and equipment are significant expenses. Holcim strives to cut costs via operational efficiency and automation. The Ste. Genevieve plant expansion, boosting capacity by over 600,000 metric tons, shows strategic investment.

Distribution and logistics are a significant part of Holcim's cost structure. Transporting materials and products incurs costs like fuel and equipment. Holcim optimizes its network to cut these expenses. In 2024, Holcim invested in logistics. They also focus on sustainable supplier relationships.

Research and Development

Holcim's commitment to research and development (R&D) is a key part of its cost structure. This involves substantial financial investments to create innovative products, enhance existing processes, and support sustainability efforts. Holcim dedicates a portion of its revenue to R&D to stay competitive and address customer demands. The company's innovation hub is actively developing advanced solutions, exemplified by projects like the Grand Egyptian Museum and data centers with AI for Meta.

- In 2023, Holcim invested CHF 200 million in R&D.

- Holcim's innovation hub focuses on low-carbon products.

- R&D spending supports Holcim's sustainability goals.

- This investment helps maintain its market position.

Regulatory Compliance

Holcim's cost structure includes regulatory compliance expenses. This involves costs for permits, monitoring, and reporting to meet environmental standards and building codes. Investments in environmental management and compliance programs are crucial. Restructuring and litigation costs were CHF 205 million in 2024, significantly up from CHF 84 million in 2023.

- Environmental regulations drive compliance costs.

- Building code adherence adds to expenses.

- Compliance programs require investment.

- 2024 restructuring costs were substantial.

Holcim's cost structure includes raw materials, manufacturing, distribution, and R&D. In 2024, the cost of goods sold was about CHF 17.4 billion. They manage costs via efficiency, innovation and logistics optimization. R&D investment reached CHF 200 million in 2023, with focus on low-carbon products.

| Cost Category | Description | 2024 Data (approx.) |

|---|---|---|

| Cost of Goods Sold (COGS) | Raw materials, manufacturing, and distribution expenses. | CHF 17.4 billion |

| Research & Development | Investment in innovation and sustainable solutions. | CHF 200 million (2023) |

| Restructuring & Litigation | Costs related to business adjustments and legal matters. | CHF 205 million |

Revenue Streams

Holcim's main revenue generator is cement sales to construction clients. Cement, vital for concrete, fuels diverse construction projects. In 2024, Holcim's cement sales reached $20 billion, reflecting construction demand. This core activity ensures consistent cash flow. Holcim offers various cement types to meet specific project needs.

Holcim generates revenue through the sale of aggregates, including crushed stone, sand, and gravel. These materials are vital for road construction and concrete production. In 2024, Holcim's operating profit from new business in aggregates saw a substantial 25% year-on-year increase. The company produces a range of aggregate products from its quarries and processing facilities. This revenue stream is a key part of Holcim's diverse offerings.

Holcim's ready-mix concrete sales are a key revenue stream, delivering pre-mixed concrete directly to construction sites. This provides convenience and ensures consistent quality for diverse construction needs. In 2024, ECOPact low-carbon concrete made up 29% of these sales, increasing from 13% in 2022. Currently, ECOPact accounts for 32% of ready-mix concrete sales.

Solutions and Products

Holcim is broadening its revenue streams by providing a diverse array of solutions and products, moving beyond its core cement and aggregates business. This strategic shift involves offering roofing systems, insulation products, and various building materials. These offerings are designed to boost profit margins and enhance the company's overall financial performance. Holcim aims to have Solutions & Products account for 30% of its Group net sales.

- Holcim's Solutions & Products expansion includes roofing systems, insulation, and building materials.

- These offerings are key to improving profit margins.

- The goal is for Solutions & Products to represent 30% of Group net sales.

Services and Consulting

Holcim boosts revenue through services like technical support and sustainability consulting. These offerings strengthen customer ties, setting Holcim apart. Services include mix design aid, enhancing its market position. This strategy supports Holcim's multi-faceted business model.

- Holcim's sustainability consulting helps clients lower their carbon footprint, which aligns with growing market demands.

- Technical support services ensure optimal product use, reducing waste and boosting customer satisfaction.

- In 2024, Holcim's consulting services saw a 15% increase in revenue.

- Mix design assistance provides tailored concrete solutions.

Holcim's revenue streams include cement sales, a primary driver. In 2024, cement sales hit $20 billion, reflecting construction demand. Aggregates sales, like crushed stone, boost revenue; new business saw a 25% increase. Ready-mix concrete and solutions & products also contribute, with ECOPact sales up to 32% in 2024.

| Revenue Stream | 2024 Revenue (USD) | Key Feature |

|---|---|---|

| Cement | $20 Billion | Core construction material. |

| Aggregates | Increased by 25% (New Business) | Road construction, concrete. |

| Ready-Mix Concrete | 32% (ECOPact) | Pre-mixed, low-carbon options. |

| Solutions & Products | Targeting 30% of Net Sales | Roofing, insulation, materials. |

Business Model Canvas Data Sources

The Holcim Business Model Canvas integrates financial reports, market analysis, and competitive intelligence data for accurate model construction.