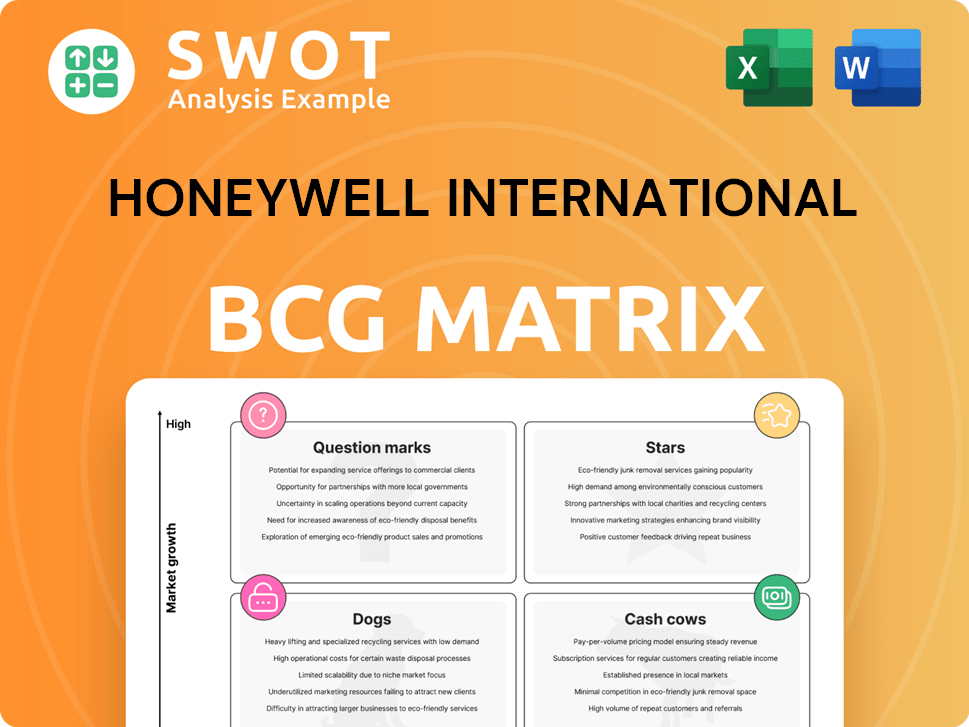

Honeywell International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honeywell International Bundle

What is included in the product

Tailored analysis for Honeywell’s product portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, making it easy to share the BCG matrix report with stakeholders.

Preview = Final Product

Honeywell International BCG Matrix

The BCG Matrix preview is identical to the document you'll receive after purchase. This in-depth analysis of Honeywell International is ready to download and implement directly into your strategic plans. Get the complete, fully formatted report without any alteration upon purchase. No extra steps, just instant access to essential strategic insights.

BCG Matrix Template

Honeywell International operates in diverse sectors, presenting a complex landscape for strategic decision-making. This simplified look at their BCG Matrix identifies key products in each quadrant. Understanding the positioning is crucial for investment strategies and resource allocation. The full BCG Matrix report provides detailed quadrant placements and insightful recommendations.

Stars

Honeywell's Aerospace Technologies is a Star in its BCG Matrix, showcasing robust growth and market dominance. This segment thrives on rising demand in commercial and defense aviation, a trend expected to continue into 2024. In Q3 2023, Aerospace saw a 16% organic sales growth, a testament to its strong performance. The planned spin-off aims to leverage this momentum fully.

Honeywell's Building Automation thrives on energy efficiency and sustainability trends. AI and digital integration, supported by partnerships, enhance its position. This leads to growing demand for smart building solutions. In 2024, Honeywell's Building Technologies saw a 7% organic sales increase. The building automation segment specifically benefits from this growth.

Honeywell's Industrial Automation segment is a Star in its BCG Matrix, driving digital transformation by connecting assets, people, and processes. It's poised to benefit from rising automation demand across industries. The segment leverages Honeywell's tech leadership and domain expertise. In 2024, this segment generated significant revenue, reflecting its strong market position.

Sustainable Aviation Fuel (SAF) Technologies

Honeywell's Sustainable Aviation Fuel (SAF) technologies are positioned for growth, driven by the rising demand for sustainable energy solutions. Their Ecofining process converts sustainable sources into renewable jet fuel, meeting aviation's environmental and regulatory needs. This aligns with industry shifts towards greener practices.

- Honeywell's SAF production capacity is expanding, with agreements to supply SAF to major airlines.

- The company's SAF solutions are designed to meet stringent aviation standards.

- Honeywell's investments in SAF technologies reflect a long-term commitment to the aviation industry's sustainability.

Quantum Computing Ventures

Honeywell's quantum computing ventures are positioned as stars due to their high-growth potential. These ventures could revolutionize sectors like pharmaceuticals and finance, offering new capabilities. Investment in quantum computing is rising; in 2024, global spending reached $1.3 billion. This growth suggests Honeywell's focus could yield market leadership.

- Market projections estimate the quantum computing market to reach $6.5 billion by 2030.

- Honeywell has invested significantly in quantum computing, with ongoing developments in hardware and software.

- Early applications include optimization, drug discovery, and financial modeling.

- Partnerships with research institutions and tech companies are key to Honeywell's strategy.

Honeywell's Star segments include Aerospace Technologies, Building Automation, Industrial Automation, SAF technologies, and quantum computing.

These segments show high growth and market share, driven by innovation and demand.

Honeywell's investments in these areas reflect a commitment to long-term growth and leadership, anticipating further market expansion in 2024 and beyond.

| Segment | 2024 Performance Highlights | Strategic Focus |

|---|---|---|

| Aerospace Technologies | 16% organic sales growth (Q3 2023) | Commercial and defense aviation; spin-off for growth. |

| Building Technologies | 7% organic sales increase (2024) | Energy efficiency, AI integration, smart buildings. |

| Industrial Automation | Significant revenue in 2024 | Digital transformation, automation across industries. |

Cash Cows

Honeywell's Building Management Systems (BMS) are a solid "Cash Cow." They consistently bring in revenue due to their strong market presence. Demand remains stable because commercial buildings always need these systems. In 2024, Honeywell's Building Technologies segment, which includes BMS, reported over $10 billion in sales. This reflects the ongoing need for efficient and sustainable building solutions.

Honeywell's Process Solutions offers lifecycle solutions across industries. This segment shows consistent growth because its services are critical. Honeywell's deep expertise and solid customer base solidify its strong market position. In 2024, Process Solutions' revenue was a significant portion of Honeywell's total, reflecting its importance.

Honeywell's Advanced Materials segment, a cash cow, held strong market positions in diverse areas. This unit consistently delivered solid revenue and cash flow for Honeywell. However, the company decided to spin off this segment. This strategic move allows Honeywell to concentrate on high-growth sectors.

Sensing and Safety Technologies

Honeywell's sensing and safety technologies are a cash cow, delivering essential safety and productivity solutions. This segment benefits from consistent demand across multiple industries. Honeywell's strong market position and quality reputation ensure stability. In 2023, Honeywell's Safety and Productivity Solutions segment generated $6.7 billion in revenue. This demonstrates its reliability as a cash generator.

- Consistent revenue streams from diverse industrial applications.

- Strong brand recognition and customer loyalty.

- High profitability due to established market leadership.

- Steady growth driven by regulatory requirements and safety standards.

Security Solutions

Honeywell's security solutions, including Carrier's Global Access Solutions, are a solid cash cow. This segment benefits from growing security demands and recurring revenue, generating stable profits. The business provides consistent financial returns, making it a reliable part of Honeywell. This contributes to the company's overall financial stability and growth.

- In 2024, Honeywell's Security and Fire segment saw strong growth, with revenues increasing by 7%.

- The recurring revenue stream from security services provides a predictable income source.

- Honeywell's strategic acquisitions in the security sector have enhanced its market position.

- The business's consistent performance makes it a key contributor to Honeywell's cash flow.

Honeywell's cash cows, like BMS and security solutions, generate stable revenue. These segments benefit from strong market positions and recurring revenue streams. For example, in 2024, Security & Fire saw revenue growth of 7%, proving its cash-generating capability.

| Segment | Description | 2024 Revenue (Approx.) |

|---|---|---|

| Building Technologies | BMS, HVAC | $10B+ |

| Process Solutions | Lifecycle services | Significant portion of total |

| Safety and Productivity | Sensing & Safety Tech | $6.7B (2023) |

Dogs

Honeywell's PPE business, facing low growth and market share, was divested. Classified as 'assets held for sale,' it suffered an impairment. This strategic shift made it a less desirable component. The company reported a 3% organic sales decline in Safety and Productivity Solutions in Q3 2024.

Honeywell's legacy scanning and mobility solutions operate in a mature market, showing slower growth. These products encounter tough competition from advanced technologies. In 2024, this segment likely saw revenue stagnation. Honeywell is prioritizing growth in high-potential sectors.

Honeywell's short-cycle building products, like HVAC components, are sensitive to economic shifts. In 2024, these products faced challenges due to market fluctuations. Honeywell anticipates its long-cycle building automation businesses will perform better. For instance, in Q3 2024, Building Automation sales grew 7%, while overall building products saw varied results.

Industrial Safety Products

Honeywell's industrial safety products, a part of its BCG matrix, currently operate in low-growth markets, facing strong competition. The company is shifting its focus toward more innovative and higher-growth sectors. This strategic realignment means less emphasis and investment in these particular product lines. In 2024, Honeywell's Safety and Productivity Solutions segment, which includes industrial safety products, saw revenue of $6.9 billion, reflecting the strategic shift.

- Market competition impacts growth.

- Honeywell is prioritizing higher-growth areas.

- Less investment in industrial safety products.

- 2024 revenue: $6.9 billion.

Resins and Chemicals

Honeywell's resins and chemicals, part of the Advanced Materials segment, faces a mature market with limited growth. The planned spin-off reflects a strategic pivot away from this area. This business likely generates stable, but not spectacular, returns. Honeywell's Advanced Materials segment generated $2.9 billion in revenue in 2023. The strategic move signals a focus on higher-growth opportunities.

- Mature market with limited growth potential.

- Part of the Advanced Materials segment, soon to be spun off.

- Strategic shift away from this business area.

- Stable returns, but not high growth.

Honeywell's "Dogs" include industrial safety products and resins. These businesses face low growth and tough competition. The company is shifting investments to higher-growth sectors. In 2024, Safety and Productivity Solutions revenue was $6.9B, highlighting this focus.

| Characteristic | Industrial Safety | Resins & Chemicals |

|---|---|---|

| Market Growth | Low | Limited |

| Competition | Strong | Mature Market |

| Strategic Action | Reduced Investment | Planned Spin-off |

| 2024 Revenue (est.) | Part of $6.9B SPS | Part of Advanced Materials |

Question Marks

Honeywell's energy storage technologies, a question mark in its BCG matrix, show promise in a growing market. These emerging technologies require substantial investment for market share gains. The global energy storage systems market was valued at $14.4 billion in 2023, with projections to reach $39.8 billion by 2029. Honeywell's focus on sustainable solutions offers a chance to lead.

Honeywell's AI-powered solutions tap into a booming market. These offerings, though promising, are in their infancy. To thrive, Honeywell must strategically invest and form partnerships. In 2024, the AI market's value is projected to reach $300 billion, showing immense growth potential.

Honeywell's sustainable building solutions are positioned in a high-growth market, driven by the rising demand for eco-friendly buildings. These solutions demand significant investment to gain a competitive edge. The emphasis on sustainability gives Honeywell a chance to lead. In 2024, the global green building materials market was valued at $367.4 billion.

Advanced Automation Systems for Manufacturing

Honeywell's advanced automation systems are positioned in a high-growth market. They require significant investment to capture market share, reflecting their potential for increased productivity and efficiency. The growing use of automation in manufacturing offers Honeywell a chance to become a key player. In 2024, the global industrial automation market is valued at $200 billion.

- Market Growth: The industrial automation market is growing rapidly, fueled by the need for increased efficiency and productivity.

- Investment Needs: Significant upfront investments are needed to develop and deploy advanced automation systems.

- Honeywell's Opportunity: Honeywell can capitalize on the automation trend by expanding its market presence.

- Market Size: The global industrial automation market was estimated at $200 billion in 2024.

Connected Building Platforms

Honeywell's connected building platforms are categorized as question marks within its BCG matrix. This indicates a high-growth market with significant investment needs. The company aims to capture market share in smart building management. It leverages IoT and digital tech for leadership.

- The global smart building market is expected to reach $107.9 billion by 2024.

- Honeywell's Building Technologies segment saw sales of $6.1 billion in 2023.

- Investments in R&D for smart building solutions are crucial for Honeywell.

- Digital transformation is a key strategic priority for Honeywell.

Honeywell's connected building platforms are question marks in the BCG matrix, highlighting high-growth potential with investment needs. The smart building market is expected to reach $107.9 billion by 2024, which presents a big opportunity. Honeywell's Building Technologies segment had $6.1 billion in sales in 2023.

| Aspect | Details |

|---|---|

| Market Growth | Smart building market projected at $107.9B by 2024. |

| Honeywell Sales | Building Technologies segment: $6.1B in 2023. |

| Strategic Focus | Digital transformation and R&D investments are crucial. |

BCG Matrix Data Sources

This Honeywell BCG Matrix utilizes financial statements, market analysis, and expert assessments, ensuring credible data integration.