Honeywell International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honeywell International Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Swiftly grasp Honeywell's strategic landscape with an interactive, dynamic model that updates automatically.

Full Version Awaits

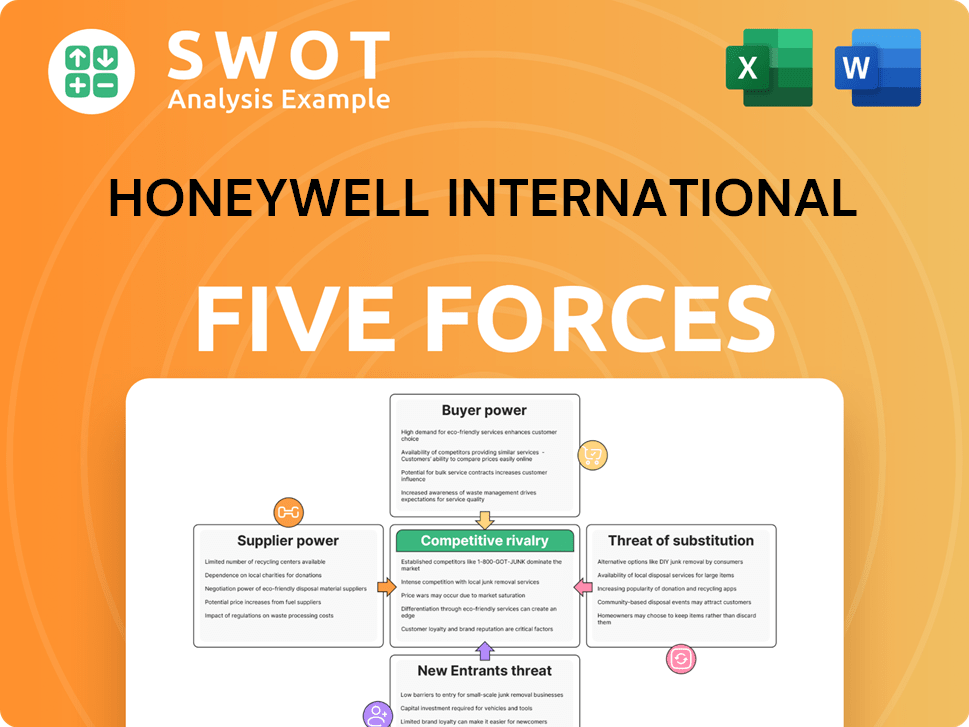

Honeywell International Porter's Five Forces Analysis

This is the actual Honeywell Porter's Five Forces analysis you will receive. The preview showcases the complete, ready-to-use document—fully formatted.

Porter's Five Forces Analysis Template

Honeywell International operates within a complex landscape, shaped by competitive rivalry among industry players, influenced by supplier bargaining power, and affected by the threat of new entrants. Buyer power plays a role, and the availability of substitute products further shapes its market position. Understanding these forces is crucial for assessing Honeywell's long-term sustainability and growth potential.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Honeywell International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Honeywell's reliance on specialized suppliers grants them substantial bargaining power. In 2024, Honeywell sourced from approximately 15,000 suppliers globally. However, the aerospace sector, a key area for Honeywell, faces high supplier concentration, with a few dominant players. This limited competition allows these critical suppliers to influence pricing and terms significantly.

Honeywell faces high supplier switching costs, especially for unique components. Changing suppliers requires re-qualification, process adjustments, and quality checks. This dependence boosts suppliers' power, potentially raising input costs for Honeywell. In 2024, Honeywell's cost of goods sold was around $26 billion, indicating the scale of supplier impacts.

Honeywell's reliance on large suppliers gives them leverage. These suppliers, boasting financial might and expertise, can pressure prices. For example, in 2024, raw material costs surged, impacting Honeywell's margins. Managing supplier relationships is crucial to maintain a competitive edge.

Supplier Product Differentiation

Honeywell faces supplier bargaining power when suppliers offer unique components. These suppliers, with highly differentiated or proprietary tech, hold leverage. This limits Honeywell's alternatives, potentially increasing costs. In 2024, Honeywell's cost of revenue was approximately $35 billion, highlighting the impact of supplier costs.

- Proprietary technology increases supplier power.

- Honeywell's dependence on unique components affects costs.

- Negotiating leverage decreases with differentiation.

- Cost of revenue is a key indicator of supplier impact.

Supplier Forward Integration

Supplier forward integration poses a moderate threat to Honeywell. If suppliers, like those in raw materials or specialized components, decide to manufacture products that compete with Honeywell's offerings, it could reduce Honeywell's pricing power. Honeywell's ability to counteract this threat depends on its innovation and brand strength. In 2024, Honeywell's R&D spending was approximately $2.4 billion. This investment helps to create a buffer against supplier-led competition.

- Honeywell's strong brand helps to retain customer loyalty.

- The company's diverse product portfolio reduces the impact of supplier-led competition.

- Honeywell's focus on aerospace and defense markets provides some protection.

- In 2024, Honeywell's revenue was about $36.6 billion.

Honeywell's suppliers wield significant bargaining power, especially in aerospace and specialized components. The company's reliance on key suppliers and high switching costs amplify this leverage. In 2024, raw material cost surges impacted Honeywell's margins, emphasizing supplier influence.

| Aspect | Details | 2024 Data |

|---|---|---|

| Supplier Concentration | Aerospace suppliers are often highly concentrated. | Limited Competition |

| Switching Costs | High costs to change suppliers for unique parts. | $26B Cost of Goods Sold |

| Forward Integration Threat | Suppliers could compete directly. | $2.4B R&D Spending |

Customers Bargaining Power

Honeywell's broad customer base, spanning aerospace, building technologies, and performance materials, dilutes customer concentration. This diversification limits any single customer's ability to exert significant pricing or demand pressure. In 2024, Honeywell's revenue distribution across diverse sectors showcases this strength. The company's strategic advantage is its reduced reliance on a few key clients. This is a crucial factor in maintaining stable profitability and market position.

Customer switching costs significantly influence bargaining power. In aerospace, high costs due to certification requirements limit customer power. Conversely, building technologies see lower switching costs, increasing customer influence. Honeywell aims to boost loyalty through integrated solutions. For instance, in 2024, Honeywell's aerospace segment saw a 20% increase in long-term service agreements, enhancing customer retention.

Customer price sensitivity varies across Honeywell's diverse markets. In 2024, price pressure was notable in certain segments. This can erode profitability if Honeywell cannot maintain pricing power. Honeywell strategically emphasizes value-added offerings and strong customer relationships to counter price sensitivity.

Availability of Information

Customers' access to information about Honeywell's offerings and competitors significantly impacts their bargaining power. This transparency allows customers to compare products and negotiate favorable terms. Honeywell must maintain a strong value proposition. Competitive pricing is essential to retain customers in this information-rich environment.

- Honeywell's 2024 revenue was approximately $37.7 billion.

- The company's focus on digital transformation enhances transparency.

- Competitive pricing is crucial in the aerospace and technology sectors.

- Honeywell's customer retention rate is a key performance indicator.

Customer Backward Integration

The threat of customer backward integration at Honeywell is generally low, yet it's present in certain segments. Large, well-resourced customers might opt for in-house solutions instead of Honeywell's offerings. This is a strategic consideration, especially for those with the technical know-how. Honeywell mitigates this by constant innovation and superior technology delivery. For example, in 2024, Honeywell invested $1.9 billion in R&D.

- Low threat overall, but present in specific sectors.

- Large customers may develop their own solutions.

- Honeywell counters with innovation and better tech.

- Honeywell's 2024 R&D investment was $1.9B.

Honeywell faces varied customer bargaining power across its segments, tempered by its diversified customer base. High switching costs in aerospace limit customer influence, while building technologies see more customer power. Price sensitivity and access to information also shape this dynamic, requiring Honeywell to maintain competitive pricing. The threat of backward integration is low but managed through innovation.

| Factor | Impact | Mitigation |

|---|---|---|

| Customer Base | Diverse, reducing concentration | Focus on broad market reach |

| Switching Costs | High in aerospace, lower elsewhere | Develop integrated solutions |

| Price Sensitivity | Variable across segments | Value-added offerings |

| Info Access | Increases customer negotiation | Competitive pricing, value |

| Backward Integration | Low threat, some risk | Continuous innovation |

Rivalry Among Competitors

Honeywell's competitive landscape is diverse. In 2024, the aerospace sector saw Honeywell competing with Boeing and Airbus. Honeywell's building tech faced Johnson Controls and Schneider Electric. Honeywell's broad portfolio ensures its presence across industries, fostering resilience in the face of rivalry. It is a major player in the market.

Honeywell's product differentiation varies; aerospace products are highly differentiated, reducing price competition. Commodity chemicals face more intense rivalry due to less differentiation. The company invests heavily in R&D, with $2.1 billion in 2023, and holds 26,500 active patents. Honeywell's global presence in 75 countries supports its competitive strategy.

Switching costs significantly influence competitive rivalry for Honeywell. High costs in aerospace and industrial automation, reduce rivalry intensity. Customers hesitate to switch if it's costly or disruptive. Honeywell boosts loyalty with integrated solutions and service agreements. In 2024, Honeywell reported $37.7 billion in sales.

Growth Rate of the Industry

The growth rate of an industry significantly impacts competitive rivalry. High-growth sectors often see less intense competition, while slower-growth sectors intensify it. The business aviation industry, a key area for Honeywell, is experiencing healthy growth. This positive trend is expected to continue, fueled by increasing user numbers and production ramp-ups.

- Honeywell's Aerospace segment saw a 12% organic sales growth in 2023.

- Business aviation deliveries increased by 14% in 2023.

- Honeywell anticipates continued growth in the business aviation sector through 2024 and beyond.

- The company's focus on innovation and new product introductions supports its competitive position.

Exit Barriers

High exit barriers can intensify rivalry in Honeywell's sectors. These barriers make it harder for companies to leave a market. This can lead to overcapacity and price wars among competitors. Honeywell's diverse business structure helps offset these risks.

- Honeywell's Aerospace segment faces high exit costs due to specialized assets.

- The company's performance materials businesses might have lower exit barriers.

- Honeywell's broad portfolio helps spread the risks associated with industry-specific exit challenges.

- In 2024, Honeywell's revenue was approximately $38.1 billion, showing its market presence.

Honeywell faces intense rivalry, but its diversification and innovation buffer it. The company's product differentiation varies, impacting the intensity of competition across its segments. High switching costs and growth rates also shape rivalry dynamics.

| Factor | Impact on Rivalry | Honeywell Example |

|---|---|---|

| Product Differentiation | High differentiation lowers rivalry. | Aerospace products are highly differentiated. |

| Switching Costs | High costs decrease rivalry intensity. | High switching costs in aerospace. |

| Industry Growth | High growth often reduces rivalry. | Business aviation growth supports Honeywell. |

SSubstitutes Threaten

The threat of substitutes for Honeywell varies significantly across its business segments. For example, digital and AI-driven solutions are emerging as substitutes in traditional mechanical systems. Conversely, substitutes are less available in specialized areas like aerospace components. Honeywell competes with digital transformation technologies that can replace industrial control systems. The industrial automation market is projected to reach $296.8 billion globally by 2024.

The attractiveness of substitutes is heavily influenced by their relative price and performance. If a substitute offers similar performance at a lower price, it becomes a significant threat. Honeywell must continually innovate and provide value-added solutions to justify its premium pricing in the market. Advanced software and AI platforms are increasingly challenging traditional mechanical control systems. The global AI in industrial automation market is estimated at $15.7 billion in 2024.

Low switching costs for buyers amplify the threat of substitutes for Honeywell. If customers find it easy to switch, Honeywell must constantly compete. For instance, in 2024, the aerospace industry saw a 7% rise in demand for alternative aircraft components, pressuring Honeywell. To counter this, Honeywell focuses on integrated solutions.

Honeywell uses long-term service agreements to boost customer loyalty and increase switching costs. This strategy is evident in its building automation segment, where multi-year contracts grew by 12% in 2024. These agreements make it less appealing for clients to switch providers.

Technological Advancements

Rapid technological advancements pose a significant threat to Honeywell. New technologies could offer better performance or lower costs, potentially replacing Honeywell's products. Honeywell invests heavily in R&D, spending $2.4 billion in 2023, to stay ahead. Industries like aerospace and automation, where Honeywell is active, see constant technological shifts. Competitors continuously innovate, intensifying rivalry.

- Honeywell's R&D spending in 2023 was $2.4 billion.

- The aerospace and automation industries are prime examples of sectors experiencing rapid tech advancement.

- Technological substitution is a key factor in the competitive landscape.

- Honeywell's strategy involves proactive innovation.

Brand Reputation

Honeywell's brand reputation significantly impacts its ability to fend off substitutes, especially in safety and building tech. A robust brand fosters customer loyalty and allows premium pricing, diminishing the appeal of alternatives. Honeywell's diverse portfolio, including aerospace and performance materials, benefits from its strong brand image. For example, in 2024, Honeywell's brand value in the aerospace sector was estimated to be around $10 billion, reflecting its strong market position.

- Brand strength deters substitutes in critical sectors.

- Customer loyalty allows for premium pricing strategies.

- Honeywell's brand value is substantial, around $10 billion in aerospace.

- The company's reputation is a key competitive advantage.

Substitutes pose a diverse threat across Honeywell's sectors, influenced by price, performance, and switching costs. AI-driven solutions and digital tech challenge traditional systems, affecting market dynamics. Honeywell counters with innovation, service agreements, and strong branding to maintain a competitive edge.

| Factor | Impact | Data (2024) |

|---|---|---|

| Digital Substitutes | Challenge to traditional systems | Industrial automation market projected at $296.8B |

| Switching Costs | Influences buyer behavior | Aerospace component demand increased by 7% |

| R&D | Competitive Advantage | $2.4B R&D spending in 2023 |

Entrants Threaten

Honeywell faces a moderate threat from new entrants. High barriers to entry, like capital needs and regulations, protect its market position. In 2023, Honeywell's $1.9 billion R&D investment created financial hurdles for newcomers. Specialized knowledge and industry experience further limit new competitors. These factors collectively make it challenging for new firms to enter Honeywell's sectors.

High capital needs act as a barrier for new firms eyeing Honeywell's markets. Significant investments in R&D, production, and marketing are essential. These large upfront costs make it difficult for smaller entities to compete. Honeywell allocated over $6 billion for capital expenditures in 2024. The company's strategy includes deploying at least $25 billion by 2025.

Honeywell faces substantial threats from new entrants due to stringent regulatory and legal requirements. Aerospace and safety solutions, key Honeywell sectors, demand complex regulatory navigation and certifications. New entrants struggle with compliance, lacking established regulatory relationships. Honeywell's 2024 revenue from Aerospace Technologies was $12.6B, demonstrating the high stakes involved in regulatory compliance.

Economies of Scale

Honeywell's substantial economies of scale pose a significant barrier to new entrants. These economies enable competitive pricing and sustained profitability, a feat difficult for newcomers. The company's global reach and scale provide a considerable competitive advantage. New entrants often struggle to match Honeywell's cost efficiencies and market presence.

- Honeywell generated $37.7 billion in revenue in 2023.

- Honeywell operates in over 100 countries.

- The company's size allows for efficient resource allocation and lower per-unit costs.

- New entrants face high capital requirements to compete effectively.

Access to Distribution Channels

Honeywell's extensive distribution networks present a significant barrier to entry. New competitors often struggle to replicate these established channels, hindering their market access. Honeywell's operations span over 70 countries, showcasing its global reach and influence. This broad presence allows Honeywell to swiftly distribute products and services worldwide. The company's established relationships with 15,000 global suppliers further solidify its competitive advantage.

- Established distribution channels are difficult for new entrants to access.

- Honeywell's global presence in over 70 countries enhances market reach.

- Honeywell's established relationship with 15,000 suppliers is key.

- The company's international operations enhance market reach.

Honeywell faces a moderate threat from new entrants. High capital needs and regulations act as barriers. Honeywell's substantial economies of scale and established distribution networks further limit new competitors.

| Factor | Impact on New Entrants | Honeywell's Advantage |

|---|---|---|

| Capital Requirements | High upfront costs | $6B+ CapEx (2024); $25B deployment by 2025 |

| Regulations | Compliance challenges | $12.6B revenue from Aerospace (2024) |

| Economies of Scale | Competitive pricing difficulty | $37.7B revenue (2023); Global reach |

Porter's Five Forces Analysis Data Sources

Honeywell's analysis leverages annual reports, SEC filings, industry analysis, and market share data to assess competitive pressures. We integrate economic indicators for contextual analysis.