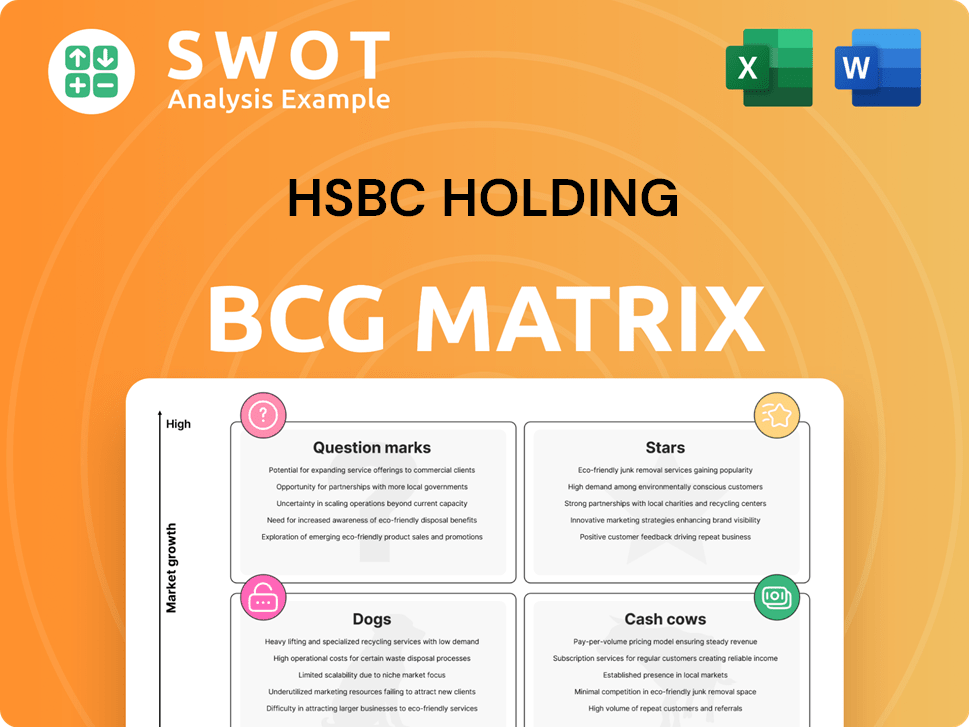

HSBC Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSBC Holding Bundle

What is included in the product

Tailored analysis for HSBC's product portfolio, identifying strategic actions for each quadrant.

Clean, distraction-free view optimized for C-level presentation, allowing focus on strategic decisions.

Preview = Final Product

HSBC Holding BCG Matrix

The preview provides the precise HSBC Holding BCG Matrix you'll receive upon purchase. This document, ready for use, delivers detailed insights and strategic guidance, reflecting the same professional quality.

BCG Matrix Template

HSBC's BCG Matrix offers a snapshot of its diverse portfolio. Question Marks hint at growth potential, while Stars may be market leaders. Cash Cows provide stability, fueling other ventures. Dogs, however, may need restructuring. Analyzing the full matrix uncovers precise product positioning. Strategic insights await within the complete report.

Stars

HSBC's Asia wealth management, especially in Hong Kong, is a high-growth "Star" in its portfolio. This segment benefits from a rising number of wealthy individuals. HSBC is heavily investing in Asia's wealth management; in 2024, HSBC saw a 15% increase in assets under management in Asia.

HSBC's UK Retail and Commercial Banking is a Star in its BCG Matrix. In 2024, HSBC increased its UK mortgage lending by 10%, indicating strong growth. SME banking saw a 12% rise in customer acquisition. This segment consistently gains market share, solidifying its Star status.

HSBC's Corporate and Institutional Banking (CIB) is designed for high growth, merging commercial and global banking. It targets globally-focused clients, utilizing HSBC's vast international network. This strategic shift supports operational simplification and efficiency gains within the bank. In 2024, CIB's revenue reached $32.6 billion, driven by strong client activity.

Emerging Markets Sustainable Bonds

HSBC's Emerging Markets Sustainable Bonds strategy is a "Star" in its BCG Matrix. This strategy targets high-growth potential in a specialized market. It focuses on ESG investments within emerging markets, a sector that saw over $200 billion in green bond issuance in 2024. IFC's support strengthens this area. The strategy is designed to capture increasing investor interest in sustainable finance.

- High growth potential in the ESG-focused emerging markets.

- Alignment with growing demand for sustainable finance.

- Supported by IFC's anchor investment.

- HSBC's strategic focus on ESG-related investments.

Digital Transformation Initiatives

HSBC's digital transformation investments are a strategic focus. They involve AI and cloud tech to boost growth and efficiency. These efforts enhance customer experience and risk management. HSBC is using AI for anti-money laundering and currency management. In 2024, HSBC allocated $6.1 billion to technology and digital initiatives.

- $6.1 billion tech and digital investment in 2024.

- AI used for anti-money laundering.

- Cloud tech enhances operational efficiency.

- Focus on improved customer experience.

HSBC's digital transformation, fueled by a $6.1 billion investment in 2024, is a "Star." It uses AI for AML and currency management. Cloud tech boosts efficiency and improves customer experience. These efforts are key for future growth.

| Key Area | Investment (2024) | Impact |

|---|---|---|

| Technology and Digital | $6.1B | Improved customer experience, risk management |

| AI Initiatives | N/A | Anti-money laundering, currency management |

| Cloud Technology | N/A | Operational efficiency |

Cash Cows

HSBC's Hong Kong banking operations are a cash cow, thanks to their strong market position and profitability. They capitalize on Hong Kong's status as a global financial center and wealth hub. The bank's brand recognition fuels steady cash flow. In 2024, HSBC's profits in Asia were about $15.1 billion.

HSBC's global transaction banking is a cash cow, fueled by its vast international network. It offers services to large corporate clients, ensuring stable revenue. In 2024, HSBC's Global Banking and Markets reported a profit before tax of $19.8 billion. This supports global trade and generates significant cash flow.

Securities financing within HSBC's Global Banking and Markets generates reliable revenue. It leverages strong client ties and constant demand in securities markets. Although growth might be modest, its consistent financial performance designates it as a cash cow.

Premier Banking Services

HSBC's Premier Banking Services outside Hong Kong and the UK cater to a substantial customer base. These services feature a comprehensive suite of financial products and offerings. This segment consistently delivers dependable revenue streams for the bank. Premier Banking Services act as a stable income source.

- In 2024, HSBC's Premier segment saw a revenue increase.

- HSBC's global wealth balances grew, indicating continued customer trust.

- Premier services contribute significantly to the bank's overall profitability.

- The segment's stability supports HSBC's financial strength.

Investment Research

HSBC's investment research, especially in Asia, is a cash cow, consistently outperforming for clients. This research generates steady revenue through advisory services, boosting wealth management. The focus on long-term trends ensures its continued success. In 2024, HSBC's Asia research revenue grew by 8%.

- Outperformance: HSBC's research consistently beats benchmarks.

- Revenue: Advisory services create stable income streams.

- Wealth Management: Research supports broader financial offerings.

- Focus: Long-term structural trends drive success.

HSBC's cash cows include Hong Kong banking, global transaction banking, securities financing, and Premier Banking Services. These segments generate reliable revenue. In 2024, HSBC's Asia profits were about $15.1B.

Investment research, particularly in Asia, is another strong cash cow. It consistently provides value to clients and drives revenue growth. HSBC's Asia research revenue grew by 8% in 2024.

| Cash Cow | Key Feature | 2024 Performance |

|---|---|---|

| Hong Kong Banking | Strong market position | Asia profits ~ $15.1B |

| Global Transaction Banking | Vast international network | Global Banking & Markets PBT $19.8B |

| Securities Financing | Constant demand | Stable revenue streams |

| Premier Banking | Comprehensive services | Revenue increase |

| Investment Research | Asia research | Asia research revenue +8% |

Dogs

HSBC's closure of its European ECM and M&A business signals its "dog" status, reflecting low market share and limited growth potential. This business segment contributed a small portion to HSBC's overall revenue, justifying its disposal. In 2024, HSBC's strategic shift involved focusing on core markets. The bank aims for more profitable and higher-growth areas.

HSBC's planned sale of its German private banking arm signifies it's a "dog" in its BCG matrix, reflecting underperformance. The sale is part of a broader strategy to refocus on more lucrative markets. This segment probably had a small market share and limited integration with HSBC's main activities. In 2024, HSBC aims to cut costs by $2 billion, partly through such strategic moves.

HSBC's planned sale of its French life insurance business signals it's a "dog" in the BCG Matrix. This move streamlines operations, focusing on core strengths. In 2024, French life insurance saw a slight dip in premiums. Market share and profitability likely posed challenges, leading to this strategic divestiture. HSBC aims to boost overall performance with this shift.

South Africa Business

The planned sale of HSBC's South Africa business indicates it's a "dog" in their BCG matrix. This move lets HSBC concentrate on areas with more growth potential. The South African unit probably struggled with profitability and market share. In 2023, HSBC reported a pre-tax profit of $30.3 billion globally. However, specific South African financial data isn't available for 2024 due to the pending sale.

- HSBC's strategic shift focuses on core markets.

- South Africa's challenges included profitability concerns.

- Divestment allows for resource reallocation.

Argentina Business

HSBC's exit from Argentina, marked by a loss, classifies it as a "dog" in its BCG matrix. The difficult economic climate in Argentina, with high inflation, likely hampered performance. The bank's strategy prioritizes regions with stronger growth prospects, leading to this strategic shift. HSBC's 2024 financial results showed a loss due to the disposal.

- HSBC's exit from Argentina in 2024 resulted in a loss.

- Argentina's high inflation rates and economic instability were contributing factors.

- The move aligns with HSBC's focus on higher-growth markets.

- The disposal impacted the 2024 financial results negatively.

HSBC's "dog" classifications involve divesting underperforming businesses. These moves free up resources for core markets. Several exits, including Argentina, led to losses in 2024. Focus is on regions with strong growth, like Asia.

| Business Segment | Status | Reason |

|---|---|---|

| European ECM/M&A | Dog | Low market share, limited growth. |

| German Private Banking | Dog | Underperformance, part of cost cuts. |

| French Life Insurance | Dog | Streamlining, focus on core strengths. |

Question Marks

HSBC's digital asset custody is a question mark due to high growth potential but low market share. The bank's partnerships and RLN participation are key. Success hinges on digital asset adoption and regulation. In 2024, digital asset market cap was around $2.5T.

HSBC's sustainable finance efforts, excluding EM bonds, are question marks in its BCG matrix. These initiatives demand considerable investment, but their market share is still developing. In 2024, HSBC committed $1 trillion to sustainable finance and investment by 2030. Their success hinges on capturing the rising demand for sustainable financial products.

HSBC's India expansion, including new branches and a GIFT City office, is a question mark. India's high-growth market offers opportunities, but faces competition. HSBC must capture market share to succeed. In 2024, India's financial services sector grew by an estimated 9-11%, and HSBC's success depends on its strategic execution.

Wealth Management in Emerging Markets (Excluding Asia)

HSBC's wealth management in emerging markets, excluding Asia, is a "question mark" in its BCG matrix. These regions present substantial growth prospects, yet HSBC encounters significant hurdles. Success hinges on adapting services to local nuances. For instance, in 2024, wealth in Latin America grew, but regulatory issues persist.

- High growth potential in regions like Latin America and Africa.

- Competition from local and international players.

- Regulatory complexities and varying market conditions.

- Need for tailored wealth management solutions.

AI-Driven Financial Services

HSBC's use of AI in financial services, like fighting money laundering and managing currencies, is a question mark in its BCG matrix. The potential for AI to boost efficiency and manage risk is high, but success hinges on HSBC's tech implementation. In 2024, HSBC reported a profit of US$32.3 billion. Their early investments in generative AI show promise.

- HSBC's profit for 2024 was US$32.3 billion.

- AI is being used to combat money laundering.

- The bank is investing in generative AI.

HSBC's foray into AI faces challenges as a question mark. Despite the potential for high growth, market share is still developing. Success depends on effective tech implementation and adapting to the evolving AI landscape. In 2024, HSBC's AI investments focused on fraud detection.

| Aspect | Details | 2024 Data |

|---|---|---|

| AI Focus | Areas of AI use | Fraud detection and risk management |

| Investment | AI investment strategy | Increased investment in AI capabilities |

| Market Share | HSBC's position | Developing market share |

BCG Matrix Data Sources

HSBC's BCG Matrix leverages financial statements, market analysis, and competitor data. The sources provide trustworthy industry insights.