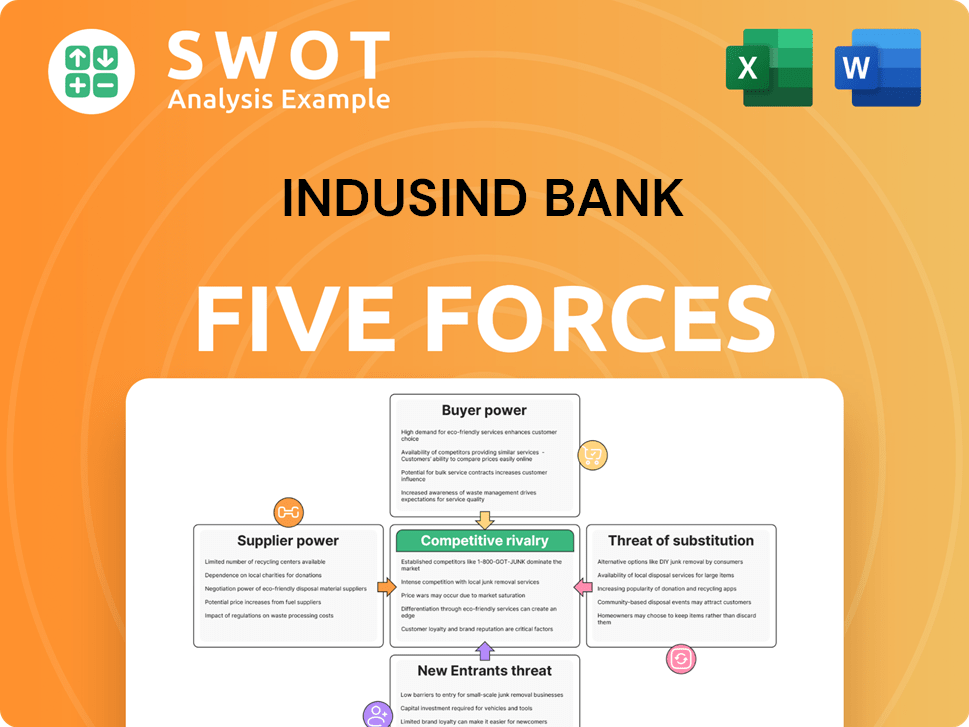

IndusInd Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

What is included in the product

Tailored exclusively for IndusInd Bank, analyzing its position within its competitive landscape.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview the Actual Deliverable

IndusInd Bank Porter's Five Forces Analysis

This preview presents the complete IndusInd Bank Porter's Five Forces analysis. The document you're viewing is exactly what you'll receive after your purchase—a ready-to-use, comprehensive analysis. It includes detailed insights on each force, and is fully formatted. No edits needed, download and use immediately.

Porter's Five Forces Analysis Template

IndusInd Bank faces moderate rivalry in India's competitive banking sector. Buyer power is somewhat high, with customers having many choices. Threat of new entrants is moderate, given regulatory hurdles. Substitute threats are present via digital payment platforms. Supplier power is low.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IndusInd Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

IndusInd Bank significantly depends on technology providers for its operations. The bank's efficiency hinges on its IT infrastructure, including software and digital platforms. The limited number of specialized banking software suppliers increases IndusInd Bank's dependency. This dependence gives these suppliers substantial bargaining power, potentially impacting costs. In 2024, the IT spending of banks in India is estimated to be around $10 billion.

The Reserve Bank of India (RBI) significantly impacts IndusInd Bank's operations. Compliance, requiring software and process investments, boosts regulatory influence. Stricter digital lending rules and Prompt Corrective Action frameworks are currently in effect. In 2024, banks faced increased scrutiny, with compliance costs rising by approximately 10%. These measures aim to enhance financial stability.

IndusInd Bank depends on data and analytics services for risk management and fraud detection. The adoption of AI and ML boosts the value of these services in banking. The need for AI, data analytics, and compliance experts is rising. The global data analytics market in banking was valued at $20.3 billion in 2024, expected to reach $36.6 billion by 2029.

Cybersecurity Firms

IndusInd Bank faces significant bargaining power from cybersecurity firms due to the critical need for robust digital protection. Banks increasingly rely on these firms to safeguard sensitive data and systems against rising cyber threats. The surge in malware detections necessitates urgent IT governance improvements, thereby boosting cybersecurity providers' influence. Financial institutions are actively reinforcing their cybersecurity frameworks to counter escalating digital risks. In 2024, the global cybersecurity market is valued at over $200 billion, highlighting the industry's strength.

- Cybersecurity spending is projected to reach $210 billion in 2024.

- Ransomware attacks increased by 13% in Q1 2024.

- Banks allocate approximately 8-10% of their IT budgets to cybersecurity.

- The average cost of a data breach for financial institutions is $5.9 million.

Consulting Services

IndusInd Bank relies on consulting services for strategic planning, risk management, and regulatory compliance. The demand for specialized expertise in the complex financial sector strengthens the bargaining power of consulting firms. These firms assist banks in adapting to market shifts and evolving regulatory demands. The consulting industry's revenue in India was estimated at $3.8 billion in 2023.

- Consulting firms offer specialized expertise.

- Banks need help with strategy, risk, and compliance.

- The sector's revenue was $3.8 billion in 2023.

- Consultants help banks adapt to changes.

IndusInd Bank’s suppliers, especially in technology and cybersecurity, have considerable bargaining power. The bank depends on these suppliers for essential services like IT infrastructure and cybersecurity. The rising costs of these services and the need for robust security solutions increase supplier influence. In 2024, cybersecurity spending is projected to reach $210 billion.

| Supplier Type | Impact on IndusInd Bank | 2024 Data |

|---|---|---|

| IT Providers | Essential for operations, IT infrastructure | Banks' IT spending ~$10B |

| Cybersecurity Firms | Critical for data protection, digital security | Cybersecurity market >$200B |

| Consulting Services | Strategy, risk, and regulatory compliance | Consulting industry revenue ~$3.8B |

Customers Bargaining Power

Customers show high sensitivity to interest rates on deposits and loans. With rising competition, they can switch to banks offering better rates, boosting their bargaining power. IndusInd Bank customers negotiate terms annually, aiming for improved rates and services. In 2024, the average savings rate was 3.5%, and the prime lending rate was 9.5% influencing customer choices.

Customers of IndusInd Bank, like those of other banks, have high service quality expectations, including digital banking and personalized experiences. To meet these demands, the bank must invest in technology and customer service. For example, in 2024, the bank allocated a significant portion of its budget to digital transformation initiatives. AI and predictive analytics are used for hyper-personalized services, while fintech collaborations streamline operations and improve customer experiences. IndusInd Bank's net profit for FY24 reached ₹8,079 crore, reflecting investments in customer service.

Switching costs for IndusInd Bank customers are low due to digital banking advancements. This ease of switching boosts customer bargaining power. In 2024, over 60% of Indian banking customers use digital platforms, increasing their ability to switch. Customers often switch banks for better interest rates and services, pressuring IndusInd Bank to provide competitive offerings to retain them.

Financial Literacy

The bargaining power of IndusInd Bank's customers is influenced by India's growing financial literacy. A 2023 study by the Reserve Bank of India (RBI) showed a rise in financial awareness. This enables customers to compare products and negotiate favorable terms. Consequently, transparency and control are increasingly demanded.

- RBI's 2023 study indicates rising financial literacy.

- Customers leverage knowledge for better deals.

- Demand for transparency and control is increasing.

Demand for Digital Services

Customers' preference for digital banking significantly impacts IndusInd Bank. This demand drives the need for robust digital services, like mobile and online banking. Banks must invest in technology to stay competitive. Digital banking trends are boosting innovation.

- Mobile banking users in India reached 174 million in 2024.

- IndusInd Bank's digital transactions grew by 30% in 2024.

- Banks allocate about 15% of their budget to digital infrastructure.

Customers' bargaining power at IndusInd Bank is significant due to interest rate sensitivity and digital banking advancements. In 2024, the average savings rate was 3.5%, influencing customer choices. This power is amplified by India's growing financial literacy and the ease of switching banks.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Rate Sensitivity | Customers switch for better rates | Prime Lending Rate: 9.5% |

| Digital Banking | Easy switching via digital platforms | Digital transaction growth: 30% |

| Financial Literacy | Informed decisions and demands | Mobile banking users: 174M |

Rivalry Among Competitors

The Indian banking landscape is fiercely competitive, with a multitude of players. IndusInd Bank contends with both public and private sector giants, impacting its market share. Banks must innovate constantly due to evolving customer needs and intensifying competition. In 2024, the banking sector saw aggressive strategies, with IndusInd Bank's net profit at ₹2,338 crore in Q3 FY24.

IndusInd Bank faces intense competition in India's banking sector. Banks vie for market share through competitive pricing and innovative products. Digital transformation and strategic partnerships are key to staying ahead. In fiscal year 2024, IndusInd Bank's net profit increased by 15% demonstrating its competitive efforts.

Technological innovation significantly fuels competitive rivalry in banking. IndusInd Bank faces pressure to invest in cutting-edge tech to stay relevant. The industry is evolving with AI, digital-only banks, and open finance models. In 2024, fintech investments hit $150 billion globally, highlighting the rapid pace of change. This forces banks to adapt quickly.

Customer Acquisition Costs

Customer acquisition costs are high, fueling intense rivalry for customer loyalty. Banks compete fiercely through incentives and rewards. IndusInd Bank focuses on early engagement to build lasting relationships. Competition is tough; banks vie for clients by offering attractive deals. The Indian banking sector saw digital banking transaction values reach ₹123.6 trillion in FY24.

- High Customer Acquisition Costs: Banks spend significantly on attracting new customers.

- Incentives and Rewards: Banks use various programs to retain customers.

- Early Engagement: Focus on building relationships with clients early on.

- Digital Banking Growth: Digital transactions are increasing significantly.

Regulatory Compliance

Regulatory compliance significantly impacts competitive rivalry, increasing the costs for IndusInd Bank and its competitors. Banks must dedicate resources to meet evolving regulatory demands. Stricter rules on digital lending and Prompt Corrective Action frameworks heighten the pressure to maintain financial stability. These requirements intensify competition by raising operational expenses.

- In 2024, banks faced increased scrutiny from the Reserve Bank of India (RBI).

- Compliance costs, including technology and personnel, rose by 5-10% for major banks.

- RBI implemented new digital lending guidelines and enhanced PCA frameworks.

- IndusInd Bank invested heavily in 2024 to meet these regulatory standards.

Intense competition in India's banking sector challenges IndusInd Bank. Banks compete via pricing, products, digital innovation, and customer incentives. High acquisition costs and regulatory compliance add further pressure. Digital transactions reached ₹123.6 trillion in FY24, intensifying rivalry.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Net Profit | Competitiveness | IndusInd Bank: ₹2,338 Cr (Q3 FY24), 15% increase (FY24) |

| Fintech Investments | Technological Pressure | $150 Billion Globally |

| Digital Transactions | Market Trend | ₹123.6 Trillion (FY24) |

SSubstitutes Threaten

Non-Banking Financial Companies (NBFCs) present a notable threat as substitutes by offering comparable financial services like loans and investments. Credit extended to NBFCs saw some recovery, signaling their increasing significance. For instance, in 2024, the NBFC sector's assets under management (AUM) grew by approximately 15%. NBFCs are leveraging GenAI, enhancing their competitiveness.

Fintech companies pose a significant threat to IndusInd Bank by offering innovative financial solutions. Digital wallets and payment apps, like PhonePe and Paytm, substitute traditional banking services. The widespread adoption of UPI and Buy Now Pay Later models is reshaping transactions. India's FinTech sector, the world's third largest, grew at 14% CAGR in 2024.

Digital wallets and payment apps pose a significant threat by offering easy alternatives to traditional banking. These platforms, enhanced by AI, ensure secure and smooth transactions, boosting their appeal. India's digital payment market, particularly UPI, saw a staggering 10 billion transactions in a single month in 2024. This rapid adoption rate underscores the growing preference for digital payment methods over conventional banking options, intensifying the competitive pressure on IndusInd Bank.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms pose a threat to IndusInd Bank by providing an alternative funding source for borrowers. These platforms connect borrowers directly with lenders, bypassing traditional banking channels. This can lead to loss of market share for IndusInd Bank, especially in the retail and SME lending segments. The P2P lending market in India has grown significantly.

- In 2024, the P2P lending market in India is projected to reach $2.5 billion.

- P2P platforms offer competitive interest rates, attracting borrowers.

- Increased adoption of digital lending platforms.

- Regulatory changes can impact the growth of P2P lending.

Cryptocurrencies

Cryptocurrencies and DeFi pose a threat to IndusInd Bank by offering alternative financial solutions. India's push for digital money, with initiatives like the Digital Rupee, reflects the growing acceptance of digital assets. The potential for disintermediation and disruption from these digital assets is a key consideration. The banking sector faces both opportunities and challenges from this shift.

- India's crypto market is evolving, with trading volumes fluctuating.

- DeFi platforms offer services like lending and borrowing, potentially bypassing traditional banks.

- The Reserve Bank of India (RBI) is actively exploring and regulating digital currencies.

- IndusInd Bank must adapt to the evolving digital landscape to remain competitive.

Several entities pose a threat to IndusInd Bank through financial service substitution. NBFCs offer loans and investments, with the sector's AUM rising about 15% in 2024. Fintech firms and digital wallets, like PhonePe and Paytm, provide alternate payment solutions, with India's fintech sector growing 14% in 2024.

P2P lending platforms provide funding alternatives, projected to reach $2.5 billion in 2024, and DeFi offers other financial options. Cryptocurrencies and digital rupee initiatives are evolving in India.

| Substitute | Impact | 2024 Data |

|---|---|---|

| NBFCs | Offer loans, investments | AUM growth ~15% |

| Fintech/Digital Wallets | Alternative payments | Fintech CAGR 14% |

| P2P Lending | Alternative funding | Projected $2.5B |

Entrants Threaten

High capital requirements pose a significant threat to new entrants in the banking sector. Banks need substantial capital for operations and to meet regulatory standards. In India, the Reserve Bank of India (RBI) mandates capital adequacy ratios, increasing the financial burden. As of December 2024, the Indian banking sector's capital adequacy ratio is robust, around 16%, making it tough for new players to compete.

Regulatory hurdles significantly impact new entrants in the banking sector. Obtaining licenses and adhering to banking regulations is a complex, time-intensive process. Stricter digital lending rules and Prompt Corrective Action frameworks present challenges. The Indian banking sector's heavy regulation means any law changes can affect new bank operations. For example, in 2024, RBI increased scrutiny on digital lending, increasing compliance burdens.

Existing banks, like IndusInd Bank, benefit from strong brand loyalty and customer relationships, posing a challenge for new entrants. IndusInd Bank's established image as a reliable bank is a key advantage. Building customer trust and credibility requires considerable time and resources. In 2024, the banking sector's customer retention rate averaged around 80%, highlighting the difficulty new competitors face.

Technological Infrastructure

Setting up technological infrastructure is a major hurdle for new entrants in banking. This includes substantial investments in IT systems, essential for core banking functions. Digital transformation, incorporating AI and advanced analytics, demands further significant financial commitments. New banks must invest heavily in IT infrastructure to compete effectively with established players such as IndusInd Bank.

- IndusInd Bank's IT spending in FY23 was approximately ₹1,498 crore.

- Building a digital banking platform can cost new entrants hundreds of millions of dollars.

- The complexity of regulatory compliance adds to the technological burden.

- AI integration requires specialized talent and significant financial outlay.

Cybersecurity Risks

New entrants in the banking sector face significant cybersecurity risks, necessitating substantial investment in robust security measures. Banks are increasingly vulnerable to cyberattacks, which could compromise sensitive financial data and disrupt operations. Establishing strong IT governance and cybersecurity frameworks is crucial for new entrants to build and maintain customer trust. These measures are vital for protecting against the rising number of cyber threats.

- Cybersecurity spending is projected to reach $270 billion in 2024.

- The average cost of a data breach in the financial sector was $5.97 million in 2023.

- Globally, cyberattacks increased by 38% in 2022.

New banks face high capital demands and stringent regulations, increasing entry barriers. Established banks benefit from brand loyalty, making market penetration difficult. Significant tech infrastructure investments and cybersecurity measures also challenge new entrants.

| Factor | Impact | Data |

|---|---|---|

| Capital Requirements | High Initial Investment | RBI mandates 16% capital adequacy ratio (2024). |

| Regulatory Hurdles | Complex Compliance | Digital lending scrutiny increased in 2024. |

| Brand Loyalty | Established Advantage | Banking sector customer retention at 80% (2024). |

| Technology | Major Investment | IndusInd Bank's IT spending: ₹1,498 crore (FY23). |

| Cybersecurity | Rising Threat | Cybersecurity spending projected to $270B in 2024. |

Porter's Five Forces Analysis Data Sources

IndusInd Bank's analysis leverages financial statements, market research, and industry publications.