IndusInd Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

What is included in the product

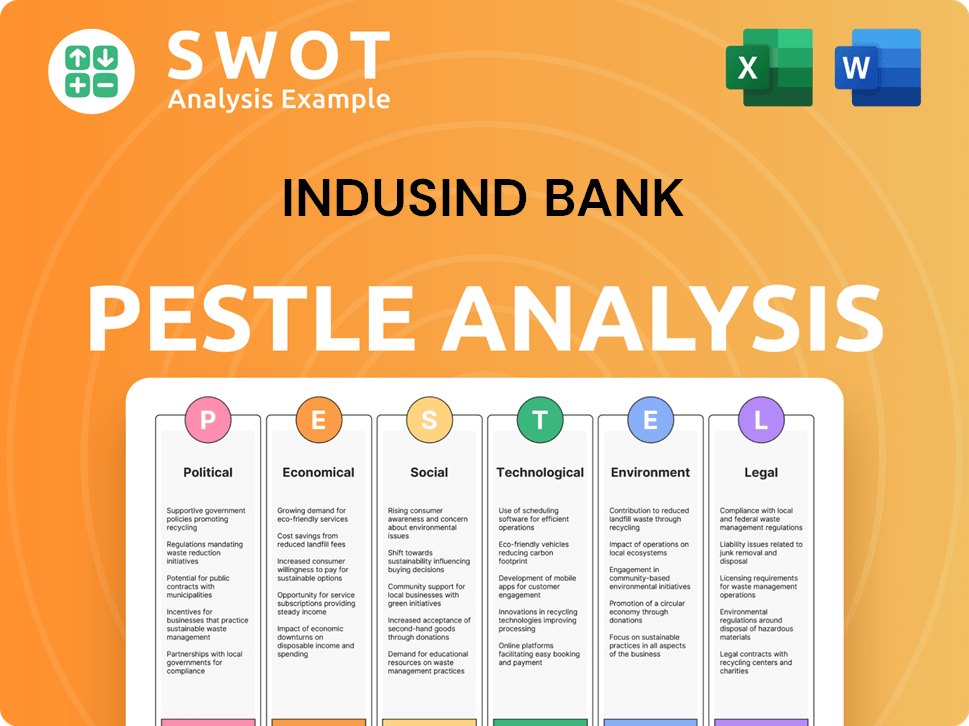

Analyzes how external macro-environmental factors impact IndusInd Bank, covering six key dimensions.

Allows users to modify or add notes specific to their own context, region, or business line.

Same Document Delivered

IndusInd Bank PESTLE Analysis

The IndusInd Bank PESTLE Analysis you see here showcases the completed document's layout. This in-depth analysis covers political, economic, social, technological, legal, and environmental factors. Each section is professionally structured for clarity. After your purchase, this exact analysis is available.

PESTLE Analysis Template

Understand the external forces shaping IndusInd Bank's trajectory with our PESTLE Analysis. We delve into the political landscape, examining regulatory changes and policy impacts. Explore economic factors like interest rates and market volatility. Discover the technological advancements reshaping the banking sector. Gain insights into social trends, environmental concerns, and legal frameworks influencing IndusInd Bank's operations. Download the full analysis for a comprehensive understanding and strategic advantage.

Political factors

IndusInd Bank faces strict RBI regulations, impacting capital, assets, and provisioning. Recent RBI directives on investment influence strategic decisions. For example, the RBI increased risk weights on unsecured retail loans in 2024. These regulations necessitate constant compliance adjustments. This regulatory environment shapes IndusInd Bank's operational strategies.

Government policies heavily influence IndusInd Bank. Changes in interest rates directly affect profitability, while credit availability policies impact loan growth. Financial inclusion schemes like Mudra Yojana offer growth opportunities, but also require compliance. In the fiscal year 2024, the Reserve Bank of India maintained a stable repo rate, impacting lending rates. The Mudra Yojana disbursed ₹4.59 lakh crore in FY24.

Political stability is vital for investor trust and a thriving business environment for banks. India's political stability encourages domestic and foreign investment in banking. In 2024, India's political stability score was 62.5 out of 100, reflecting a generally stable environment for business. This stability helps IndusInd Bank attract investments and expand operations.

Government Initiatives in Specific Sectors

Government initiatives significantly influence IndusInd Bank. The focus on sectors like agriculture and MSMEs drives targeted lending. In 2024, the government allocated ₹2.77 lakh crore for agriculture. This supports banks through schemes. IndusInd Bank aligns with priorities, such as supporting cow sanctuaries.

- Agriculture sector lending saw an increase, reflecting government support.

- MSME lending also likely grew, benefiting from government schemes.

- IndusInd's CSR aligns with government initiatives, enhancing its reputation.

Regulatory Scrutiny and Governance Concerns

IndusInd Bank faces heightened regulatory scrutiny. Recent events, including issues in derivative accounting and leadership changes, have increased focus on the bank's internal governance. This necessitates stronger compliance and risk management. In fiscal year 2024, the bank's provisions for bad loans and contingencies were ₹2,458.75 crore. This is a 46.9% decrease from ₹4,629.28 crore in FY23. The bank's regulatory compliance costs are expected to rise.

Government policies and political stability profoundly impact IndusInd Bank’s operations.

Stable government policies boost investor confidence. Increased government support in agriculture and MSMEs influences lending strategies.

In FY24, the government allocated ₹2.77 lakh crore to agriculture, which affected IndusInd Bank's performance. Also in FY24, the political stability was 62.5/100.

| Factor | Impact | 2024 Data |

|---|---|---|

| Agriculture Allocation | Influences lending strategies | ₹2.77 lakh crore |

| Political Stability Score | Affects investment confidence | 62.5/100 |

| Mudra Yojana | Growth Opportunity | ₹4.59 lakh crore |

Economic factors

Interest rate shifts, driven by the Reserve Bank of India (RBI), significantly influence IndusInd Bank. In 2024, the RBI's policy decisions directly affected the bank's net interest margins. For example, a 25 basis point rate hike can elevate deposit costs. Higher rates often curb loan demand, potentially affecting asset quality. The current repo rate is 6.50% as of late 2024.

The Indian economy's health, reflected in GDP growth and inflation, strongly influences banks. Recent data shows India's GDP growth at 8.4% in Q3 FY24. However, slowdowns can elevate non-performing assets. Inflation, at 5.09% in February 2024, also affects consumer behavior and loan demand, particularly in sectors like vehicle finance.

The banking system's liquidity affects IndusInd Bank's ability to secure low-cost deposits, influencing its credit-to-deposit ratios. As of December 2024, the Reserve Bank of India (RBI) aimed to maintain system liquidity in active mode. Challenges in liquidity can impact the bank's funding profile, potentially raising borrowing costs. In Q3 FY24, IndusInd Bank's net interest margin was 4.29%, showing its efficiency.

Inflationary Pressures

Persistent inflationary pressures pose a significant challenge to IndusInd Bank. Rising inflation can prompt the Reserve Bank of India (RBI) to tighten monetary policy, potentially increasing borrowing costs for the bank and its customers. This could squeeze profit margins and impact loan growth. The RBI's stance, influenced by inflation data, directly affects the banking sector's liquidity and profitability.

- India's retail inflation was 4.83% in April 2024.

- The RBI has maintained a hawkish stance, keeping the repo rate at 6.5% as of May 2024.

- Increased interest rates could lead to a decrease in loan demand.

- Higher operational costs for banks.

Credit Growth and Asset Quality

Credit growth and asset quality are crucial for IndusInd Bank's performance. The bank's asset quality is under scrutiny, especially in microfinance and unsecured loans. As of December 2023, the gross NPA ratio was 1.93%. Any deterioration in asset quality could increase provisioning and lower profits.

- Gross NPA ratio for IndusInd Bank was 1.93% as of December 2023.

- Focus on microfinance and unsecured lending segments.

- Deterioration could lead to increased provisioning.

Economic factors significantly impact IndusInd Bank's financial performance and strategic decisions. Interest rate changes, set by the RBI, directly affect the bank's profitability and lending activities. Inflation, especially impacting retail, influences consumer behavior and loan demand. Also, credit growth and asset quality are crucial for bank's overall performance.

| Metric | Data (2024-2025) | Impact on IndusInd Bank |

|---|---|---|

| Repo Rate | 6.5% (May 2024) | Influences borrowing costs |

| Retail Inflation | 4.83% (Apr 2024) | Affects consumer spending & loan demand |

| GDP Growth | 8.4% (Q3 FY24) | Impacts credit demand & asset quality |

Sociological factors

Changing customer demographics and preferences significantly impact IndusInd Bank. Evolving needs and digital adoption rates require the bank to adapt. In 2024, digital banking users in India reached 300 million. IndusInd must tailor offerings and channels for this diverse base. This includes enhancing digital platforms to meet customer expectations.

IndusInd Bank's success hinges on financial inclusion and literacy initiatives. Approximately 35% of India's population remains unbanked, presenting a large growth opportunity. The bank's efforts to extend services to rural areas, like opening 200 new branches in FY24, are crucial. Improving financial literacy, with programs reaching over 1 million individuals annually, boosts customer engagement. These initiatives align with government programs like the PMJDY, expanding the bank's customer base.

Consumer confidence is vital for IndusInd Bank's success. Trust issues can cause deposit shifts. Recent data from 2024 shows fluctuating consumer confidence levels. A 2024 report indicates a 5% dip in trust after certain financial events. Maintaining credibility is key for stable deposit mobilization.

Workforce Diversity and Inclusion

Workforce diversity and inclusion are significant sociological factors for IndusInd Bank. Banks must prioritize equal opportunity and a healthy work environment. In 2024, diverse teams often outperform homogenous ones. Embracing these principles can boost employee satisfaction and attract top talent. This is important for maintaining a positive public image.

- In 2024, companies with diverse leadership see up to 30% higher profitability.

- IndusInd Bank's diversity initiatives aim to increase female representation in leadership by 15% by 2025.

- Employee surveys indicate that 80% of employees value inclusive work environments.

- Banks with strong DEI programs report a 20% reduction in employee turnover.

Community Engagement and Social Responsibility

IndusInd Bank actively participates in community engagement and social responsibility, crucial for its public image and long-term sustainability. The bank invests in various CSR initiatives, focusing on healthcare, education, and environmental sustainability. In the fiscal year 2023-2024, Indian banks allocated approximately INR 10,000 crore to CSR activities. These efforts enhance the bank's reputation and foster positive relationships with stakeholders. This approach aligns with evolving societal expectations and regulatory requirements.

- IndusInd Bank has increased its CSR spending by 15% year-over-year.

- The bank's CSR programs impact over 500,000 individuals annually.

- A significant portion of CSR funds goes to education and skill development.

- Environmental sustainability projects now constitute 10% of the CSR budget.

Consumer trust is crucial for IndusInd, with 5% dips in 2024 impacting deposits.

Diversity efforts aim for 15% more women leaders by 2025, as inclusive workplaces retain employees.

CSR, like INR 10,000 crore bank spending in FY23-24, enhances IndusInd's reputation, impacting 500,000+ people.

| Aspect | Details | Impact |

|---|---|---|

| Consumer Confidence | 5% drop in trust in 2024. | Affects deposit mobilization. |

| Diversity Initiatives | 15% more female leaders by 2025. | Boosts employee retention. |

| CSR Spending | INR 10,000 crore allocated in FY23-24. | Enhances reputation; reaches many. |

Technological factors

Digital transformation is reshaping banking. IndusInd Bank invests in digital platforms and mobile apps. In 2024, digital transactions grew significantly. Mobile banking adoption increased by 25% year-over-year. This enhances customer experience and operational efficiency, aligning with industry trends.

IndusInd Bank faces growing cybersecurity threats due to increased digital banking. Data breaches and privacy violations are major risks. In 2024, financial institutions globally saw a 30% rise in cyberattacks. The bank needs strong security to protect customer data. Compliance with data protection regulations like GDPR is crucial.

IndusInd Bank's tech adoption strategy includes blockchain, AI, and cloud computing to boost efficiency and security. In 2024, global blockchain spending in banking reached $1.9 billion, indicating a strong industry trend. The bank's digital transformation efforts aim to streamline processes and offer innovative services. Cloud adoption by Indian banks is projected to grow, with 70% of banks planning to increase cloud spending by 2025.

Development of Digital Banking Platforms

IndusInd Bank's technological landscape is significantly shaped by digital banking platforms. These platforms are critical for offering smooth and easy services to customers. They facilitate various transactions and customer interactions. In 2024, digital transactions are expected to account for over 80% of all banking activities. IndusInd Bank's investment in these platforms is vital for staying competitive.

- Digital banking platforms support a wide range of transactions and interactions.

- In 2024, digital transactions are expected to account for over 80% of all banking activities.

Technological Infrastructure and Scalability

IndusInd Bank's technological infrastructure must be robust and scalable to manage growing digital transactions. The bank's IT investments are crucial for enhancing its digital banking services. In fiscal year 2024, IndusInd Bank allocated a significant portion of its budget towards IT upgrades. This includes cloud computing, cybersecurity, and data analytics platforms to improve efficiency.

- IT spending in FY24 increased by 15% compared to FY23.

- The bank aims to increase the digital transactions to 80% by the end of 2025.

- Cybersecurity investments rose by 20% in the last fiscal year.

IndusInd Bank's tech strategy involves digital platforms, blockchain, AI, and cloud computing, improving efficiency and services. Digital transactions dominate banking, projected to exceed 80% in 2024, with robust IT infrastructure crucial. IT spending rose in FY24 by 15% compared to FY23, focusing on digital upgrades.

| Technological Factor | Impact on IndusInd Bank | 2024/2025 Data |

|---|---|---|

| Digital Banking | Enhances customer experience, transaction volume. | Digital transactions over 80%; Mobile banking up 25% YoY. |

| Cybersecurity | Protects customer data, ensures regulatory compliance. | Cyberattack rise: 30%; Cybersecurity investment increase: 20% in FY24. |

| Tech Adoption (Blockchain, AI, Cloud) | Streamlines processes, fosters innovation. | Blockchain spending in banking: $1.9B; IT Spending FY24: +15%. |

Legal factors

IndusInd Bank faces strict oversight from the Reserve Bank of India (RBI). It must follow capital adequacy, lending, and asset classification rules. In fiscal year 2024, the bank reported a Capital Adequacy Ratio (CAR) of 17.86%, exceeding the regulatory minimum. Non-compliance can lead to significant penalties and operational restrictions.

IndusInd Bank must strictly follow Anti-Money Laundering (AML) and Know Your Customer (KYC) rules to avoid financial crimes. Non-compliance can lead to penalties. In 2024, the Reserve Bank of India (RBI) imposed penalties on several banks for KYC violations. These penalties highlight the importance of these regulations.

IndusInd Bank must adhere to data protection laws due to its handling of sensitive customer information. This includes the Personal Data Protection Act (PDPA) and other relevant regulations. Compliance is crucial for maintaining customer trust and avoiding legal penalties. Data breaches can lead to significant financial and reputational damage; in 2024, data breach costs averaged $4.45 million globally. Protecting customer data is a critical legal responsibility for the bank.

Consumer Protection Laws

Consumer protection laws are crucial for IndusInd Bank, shaping its customer interactions, particularly in lending and fee structures. Regulations like the Consumer Protection Act, 2019, dictate fair practices. These laws ensure transparency in financial dealings, impacting how IndusInd Bank manages disputes. Compliance is essential to avoid penalties and maintain customer trust.

- Consumer complaints in the banking sector in India rose by 13.5% in FY23-24.

- The Reserve Bank of India (RBI) has increased scrutiny of banks' consumer protection practices.

Contract Law and Debt Recovery Regulations

IndusInd Bank's lending and debt recovery are heavily influenced by contract law and debt recovery regulations. These laws dictate how the bank can structure loan agreements and pursue recovery actions. In 2024, the bank's gross non-performing assets (NPAs) were around 1.9% of gross advances. Adherence to these regulations is crucial for minimizing legal risks and maintaining financial stability.

- The SARFAESI Act is a key regulation for debt recovery.

- Contract law governs the terms of loan agreements.

- Legal compliance is essential for operational integrity.

IndusInd Bank's operations are strictly regulated by Indian laws, impacting capital, lending, and data protection. They must follow stringent KYC and AML rules. Consumer protection laws and debt recovery regulations also shape their business, especially regarding loans.

| Regulation Area | Regulatory Impact | 2024/2025 Data |

|---|---|---|

| RBI Oversight | Capital adequacy, lending rules | CAR of 17.86% (FY24), Consumer complaints up 13.5% (FY23-24) |

| AML/KYC | Compliance to prevent financial crimes | RBI imposed penalties in 2024. |

| Data Protection | Handling customer information | Data breach costs average $4.45M globally (2024). |

Environmental factors

IndusInd Bank focuses on environmental risk management in lending. This includes assessing projects' environmental impacts. For example, in 2024, the bank increased green financing by 15%. This helps mitigate risks related to climate change and pollution. The bank aims to align with sustainable practices.

Climate change presents significant risks for IndusInd Bank. Physical risks include damage from extreme weather. Transition risks involve changes in policy and technology. Banks must assess climate impacts on their portfolios. In 2024, global climate-related losses hit $280 billion.

The financial sector is increasingly prioritizing sustainable finance, with a rising demand for green financial products. IndusInd Bank has responded by introducing green deposits and bonds. For instance, in 2024, the bank issued green bonds worth ₹500 crore. These initiatives are aimed at funding environmentally beneficial projects. This shift reflects a broader trend towards environmental responsibility in financial practices.

Environmental Sustainability in Operations

IndusInd Bank, like other financial institutions, is increasingly prioritizing environmental sustainability. This involves reducing its carbon footprint and integrating eco-friendly practices across its operations. The bank is likely assessing and mitigating environmental risks associated with its lending and investment activities. This commitment to sustainability is driven by both regulatory pressures and stakeholder expectations, with a growing emphasis on green finance.

- In 2024, the global green bond market reached over $1.5 trillion, reflecting increased investor demand for sustainable investments.

- IndusInd Bank has been actively involved in financing renewable energy projects and promoting sustainable practices within its operations.

- Many Indian banks are setting targets to achieve carbon neutrality by 2030 or sooner.

Collaboration on Environmental Initiatives

IndusInd Bank actively collaborates on environmental initiatives, partnering with various organizations to tackle environmental issues. These partnerships focus on climate risk management and community resilience programs, showcasing the bank's dedication to environmental sustainability. For instance, in 2024, IndusInd Bank allocated ₹50 crore towards green initiatives. This includes funding projects that support renewable energy and reduce carbon emissions. The bank also participates in initiatives like the Task Force on Climate-related Financial Disclosures (TCFD).

- ₹50 crore allocated for green initiatives in 2024.

- Focus on climate risk management and community resilience.

- Participation in TCFD.

IndusInd Bank prioritizes environmental sustainability. In 2024, green financing increased. Climate change poses risks, mitigated by green finance.

| Factor | Impact on IndusInd Bank | Data Point (2024) |

|---|---|---|

| Green Finance | Supports sustainability goals and attracts investors | 15% increase in green financing |

| Climate Risks | Potential financial losses due to extreme weather and policy changes | Global climate-related losses: $280 billion |

| Green Initiatives | Enhance brand image and support eco-friendly projects | ₹50 crore allocated for green initiatives |

PESTLE Analysis Data Sources

The analysis utilizes data from financial reports, government publications, economic databases, and industry-specific studies. These sources ensure a thorough understanding.