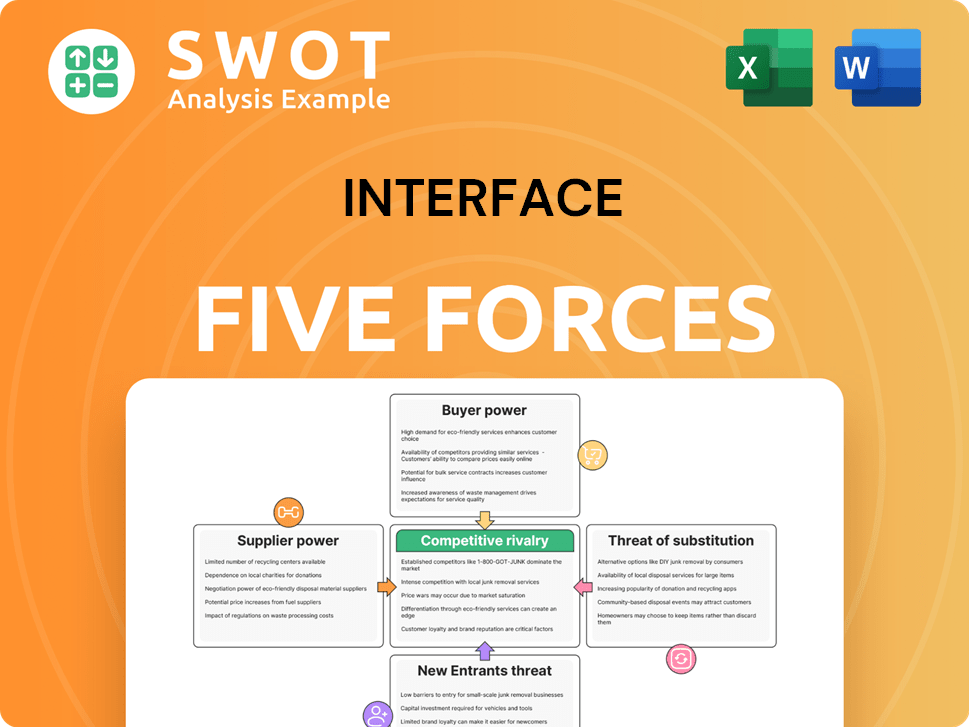

Interface Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

What is included in the product

Analyzes Interface's position, examining competitive forces, including market dynamics, threats, and buyer/supplier influence.

Instantly see how the forces impact your business, empowering immediate strategic adjustments.

What You See Is What You Get

Interface Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis for Interface. You're seeing the exact document you'll receive instantly upon purchase—no editing is needed.

Porter's Five Forces Analysis Template

Interface's competitive landscape is shaped by five key forces. Buyer power, supplier power, and the threat of substitutes are crucial factors. The intensity of rivalry and the threat of new entrants also influence Interface. Understanding these forces is vital for strategic decision-making. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Interface’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Interface often depends on a few specialized suppliers for materials like fibers and adhesives. This limited supplier base can increase their bargaining power. For example, if a key supplier raises prices, Interface's profit margins could be squeezed. In 2024, raw material costs affected the company's profitability. Interface must manage these supplier relationships to control costs and ensure supply.

Interface's sustainability drive shapes supplier dynamics. Vendors meeting environmental standards gain leverage. In 2024, Interface's focus on eco-friendly materials narrowed its supplier options. This boosted the power of compliant suppliers. Interface's negotiations reflect these goals.

Raw material price volatility, like for vinyl and carpet fibers, influences supplier power. Interface faces cost increases from suppliers, impacting profits. For example, in 2024, raw material costs rose, affecting gross profit margins. Interface uses strategies like long-term contracts and hedging to manage these risks.

Supplier concentration affects leverage

Supplier concentration significantly impacts Interface's leverage. In the flooring industry, fewer, larger suppliers possess greater bargaining power. This can lead to higher input costs for Interface, affecting profitability. Evaluate supplier concentration to understand its impact on Interface's cost structure and competitive positioning.

- Interface's 2023 cost of revenues was $1.1 billion.

- The global flooring market was valued at $347.5 billion in 2023.

- Key suppliers in the flooring sector include manufacturers of raw materials like polymers and fibers.

- Concentration can be measured by market share held by the top suppliers.

Integration potential of suppliers

The ability of Interface's suppliers to integrate forward significantly influences their bargaining power. If suppliers can move into Interface's manufacturing or distribution, their threat level rises. This potential for vertical integration must be closely examined. Such moves could disrupt Interface's supply chain and market position.

- Supplier integration could lead to increased costs for Interface.

- Consider the impact of suppliers establishing direct sales channels.

- Assess the likelihood of suppliers acquiring Interface's competitors.

- Monitor supplier investments in related technologies.

Interface faces supplier power due to material specialization and sustainability demands. Raw material costs, like those for polymers, impact profitability. In 2023, Interface's cost of revenues was $1.1B. Key suppliers' concentration and potential integration further affect Interface's bargaining power.

| Factor | Impact on Interface | Mitigation Strategies |

|---|---|---|

| Supplier Concentration | Higher input costs | Diversification, long-term contracts |

| Raw Material Volatility | Margin squeeze | Hedging, alternative sourcing |

| Supplier Integration | Increased competition | Strategic partnerships, innovation |

Customers Bargaining Power

Interface's diverse customer base, spanning commercial and residential sectors, dilutes individual customer influence. With no single customer dominating revenue, as of Q3 2024, no client could leverage significant bargaining power. This distribution allows Interface to maintain pricing strategies without facing undue pressure. For instance, the firm's Q3 2024 revenue was $383.7 million.

Price sensitivity differs among Interface's customers. Commercial clients might prioritize lifecycle costs and sustainability, while residential customers often focus on initial price. Interface's 2024 sales data shows a 60/40 split between commercial and residential, impacting pricing strategies. The company must tailor offerings to these differing needs. Consider how discounts or specialized products address these varying sensitivities.

Switching costs in the flooring market are moderate, allowing customers to explore alternatives. This includes options like hardwood, tile, or other flooring brands. Interface, as a flooring provider, faces pressure to offer competitive prices and maintain high product quality. In 2024, the average cost to install new flooring was between $5-$10 per square foot, impacting customer decisions. This influences Interface's pricing strategies and product offerings.

Information availability empowers buyers

Customers' access to information significantly impacts their bargaining power. They can easily compare Interface's flooring options with competitors, like Mohawk Industries or Shaw Industries, assessing factors such as price, quality, and environmental impact. This transparency allows buyers to negotiate better deals, potentially pressuring Interface to lower prices or offer more attractive terms. In 2024, the global flooring market was valued at approximately $380 billion, with online sales continuing to grow, further empowering buyers.

- Price Comparison: Customers can quickly compare Interface's pricing with competitors.

- Product Information: Access to detailed product specs, performance data, and sustainability reports.

- Negotiation Leverage: Informed buyers can negotiate better deals and terms.

- Market Dynamics: The increasing influence of online sales, accounting for around 15% of the total flooring market.

Demand for sustainable solutions

The rising demand for eco-friendly flooring gives customers leverage, especially those valuing sustainability. Interface's dedication to sustainability is a key differentiator, yet customers might seek premium pricing for these green products. In 2024, the global green building materials market was valued at approximately $360 billion, showcasing customer interest. Interface's ability to use its sustainability to influence buying choices is crucial.

- Sustainability-focused customers can negotiate better terms.

- Interface's sustainability efforts might justify higher prices.

- Customer purchasing decisions are influenced by Interface's sustainability strategies.

- The green building materials market is substantial.

Interface faces moderate customer bargaining power. Diverse customers and a $380B market in 2024 limit individual influence. Price sensitivity varies, impacting pricing and product choices based on 2024 sales data split.

| Factor | Impact | Data (2024) |

|---|---|---|

| Customer Base | Diverse; no dominant buyer | Q3 Revenue: $383.7M |

| Price Sensitivity | Varies (Commercial vs. Residential) | 60/40 Commercial/Residential Split |

| Market Info | High; easy comparison | Flooring Market: $380B, Online Sales ~15% |

Rivalry Among Competitors

The flooring industry is fiercely competitive, featuring many firms selling comparable goods. This rivalry pushes Interface to stand out. Interface focuses on innovation and sustainability. In 2024, the market size was valued at $360 billion. Interface competes by offering unique products and excellent service.

The flooring market is fragmented, featuring many small and medium-sized companies. This fragmentation intensifies competition, as smaller firms target niche markets or compete on price. For Interface, this means facing diverse competitors, increasing the pressure to innovate and maintain competitive pricing. In 2024, the global flooring market was valued at over $370 billion, highlighting the scale of competition.

Product differentiation is vital for Interface to gain an edge. Interface offers modular carpet tiles and sustainable flooring. Their focus on unique products and eco-friendly practices sets them apart. This differentiation impacts their competitive advantage. In 2024, Interface's revenue was approximately $1.2 billion, showing strong market positioning.

Price competition affects profitability

Price competition is a significant factor influencing profitability in the flooring industry, impacting companies like Interface. Interface must balance competitive pricing with its sustainability and quality commitments. Analyzing Interface's pricing strategies reveals their direct effects on the company's financial performance.

- In 2023, Interface's gross profit margin was approximately 38.5%, indicating the impact of pricing on profitability.

- The flooring market's competitive landscape includes many players, intensifying the pressure to offer competitive prices.

- Interface's ability to maintain margins relies on its brand value and innovative products.

Innovation drives competition

Innovation significantly fuels competition in the flooring sector. Companies like Interface, which consistently introduce new materials, designs, and installation methods, gain a strategic advantage. Interface's commitment to research and development, with investments reaching $20 million in 2024, showcases its focus on staying ahead. This focus enables them to compete effectively.

- Interface's R&D spending in 2024 was approximately $20 million.

- New product launches are key to gaining market share.

- Innovation leads to differentiation and competitive edge.

- Material science advancements are crucial.

Competitive rivalry in the flooring market is intense, driven by many firms and product similarity. Interface competes through innovation and sustainability, differentiating itself. Price competition affects profitability, requiring strategic pricing approaches. Innovation and differentiation are crucial for gaining an edge.

| Aspect | Details | Impact on Interface |

|---|---|---|

| Market Size (2024) | $370+ billion | Large market; intense competition |

| Interface Revenue (2024) | $1.2 billion | Strong market positioning |

| R&D Investment (2024) | $20 million | Drives innovation and differentiation |

SSubstitutes Threaten

The threat from substitute flooring is significant, given the wide array of options available. These include hardwood, tile, and concrete, offering diverse styles and functionalities. In 2024, the global flooring market was valued at approximately $390 billion. This competition pressures Interface to innovate and differentiate its products. The availability of alternatives impacts pricing and market share.

Price significantly drives the substitution of flooring materials. If substitutes provide similar functionality at a reduced cost, consumers may switch. Interface's price competitiveness is crucial in this context. In 2024, the average cost of luxury vinyl tile (LVT), a substitute, was $2-$5 per square foot, while Interface's modular carpet tiles can range from $4-$10.

Performance characteristics significantly influence customer choices, including durability, maintenance, and aesthetics. Customers might opt for substitutes based on these factors, impacting demand for Interface's products. For example, in 2024, the market for resilient flooring, a substitute, saw a 4% growth. Analyzing Interface's products against these alternatives is crucial.

Sustainability as a differentiator

Sustainability can be a key differentiator, lowering the threat of substitutes. Interface's eco-friendly products attract customers valuing sustainability, reducing the likelihood of switching to less sustainable options. For instance, in 2024, the market for sustainable flooring grew by 7%, indicating increasing consumer preference. Interface’s focus on recycled materials and reduced carbon footprint strengthens its market position. This strategy shields against substitutes by fostering brand loyalty and appealing to environmentally conscious consumers.

- Market growth in sustainable flooring reached 7% in 2024.

- Interface uses recycled materials.

- Focus on reducing carbon footprint.

- Enhances brand loyalty through sustainability efforts.

Changing consumer preferences

Changing consumer preferences significantly impact the threat of substitutes for Interface. As design trends shift, the demand for specific flooring materials fluctuates. For instance, the popularity of luxury vinyl tile (LVT) has surged, challenging traditional carpet and other materials. Analyze evolving preferences to stay ahead of potential substitutes and maintain market relevance.

- LVT sales increased, posing a threat.

- Sustainability preferences drive demand.

- Changing home design trends matter.

- Technological advancements affect choices.

The threat of substitutes hinges on price, performance, and sustainability. Cheaper, comparable alternatives can lure customers away. Superior performance and eco-friendly options mitigate this threat.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price | Lower prices boost substitutes. | LVT: $2-$5/sq ft vs. Interface: $4-$10. |

| Performance | Durability and aesthetics drive choices. | Resilient flooring grew by 4%. |

| Sustainability | Eco-friendly options reduce substitution. | Sustainable flooring grew by 7%. |

Entrants Threaten

Entering the flooring industry demands substantial capital investment, particularly in advanced manufacturing equipment and extensive research and development. Specialized knowledge and cutting-edge technology further elevate the financial barriers. For example, starting a new flooring manufacturing plant can easily require an investment of tens of millions of dollars. This high capital outlay significantly reduces the likelihood of new competitors.

Established brands, like Interface, hold a substantial edge due to customer recognition and trust. New flooring companies face hurdles in building brand awareness and credibility. In 2024, Interface's strong brand helped maintain a solid market share, reflecting its competitive advantage. The brand presence significantly impacts the threat of new entrants in the flooring industry. Interface's brand recognition is a key barrier.

Establishing a distribution network poses a significant hurdle for new entrants. Incumbents often have strong ties with retailers and distributors, making it difficult to secure shelf space or favorable terms. For example, in 2024, the average cost to establish a basic distribution network in the beverage industry was around $500,000. New companies face high initial investments and potential delays. This limits their ability to reach customers effectively.

Economies of scale advantages

Established flooring companies often enjoy substantial economies of scale. They benefit from lower manufacturing costs due to large-scale production, bulk purchasing of raw materials, and efficient marketing campaigns. These cost advantages make it challenging for new entrants to compete on price, a critical factor in the competitive flooring market. For example, in 2024, major flooring manufacturers like Mohawk Industries and Shaw Industries reported significant cost savings from their large-scale operations.

- Manufacturing: Large-scale production reduces per-unit costs.

- Purchasing: Bulk buying lowers material expenses.

- Marketing: Spreading marketing costs across a larger customer base.

- Financial Data: Mohawk Industries' 2024 annual report showed a 5% reduction in production costs due to economies of scale.

Regulations and standards compliance

Regulatory compliance, including environmental standards, presents a significant barrier for new entrants. Companies like Interface, Inc. must adhere to various industry-specific regulations. New businesses face substantial investment in technology and processes to meet these demands. This includes costs associated with sustainable practices, which are increasingly important.

- Interface, Inc. reported a net sales of $335.6 million for Q4 2024.

- The company's focus on sustainability reflects the importance of regulatory compliance.

- Meeting environmental standards can be costly for new entrants.

- Compliance costs influence the overall threat of new competitors.

High capital needs, like those over $10M for plants, deter new flooring firms. Strong brands, such as Interface, build trust, and limit new entry. Distribution hurdles, along with economies of scale, offer advantages. Regulatory compliance adds to entry costs.

| Factor | Impact | Example |

|---|---|---|

| Capital Costs | High Barriers | Plant investment over $10M |

| Brand Strength | Customer Loyalty | Interface's strong market share |

| Distribution | Challenging | Establishing a network is costly |

| Economies of Scale | Cost Advantages | Mohawk Industries' cost savings |

| Regulations | Compliance costs | Environmental standards investments |

Porter's Five Forces Analysis Data Sources

Interface's Five Forces assessment utilizes financial statements, market share data, and industry reports for a comprehensive view.