Intralot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intralot Bundle

What is included in the product

Tailored analysis for Intralot's product portfolio, guiding investment, holding, or divesting.

Printable summary optimized for A4 and mobile PDFs, providing a concise business overview.

What You’re Viewing Is Included

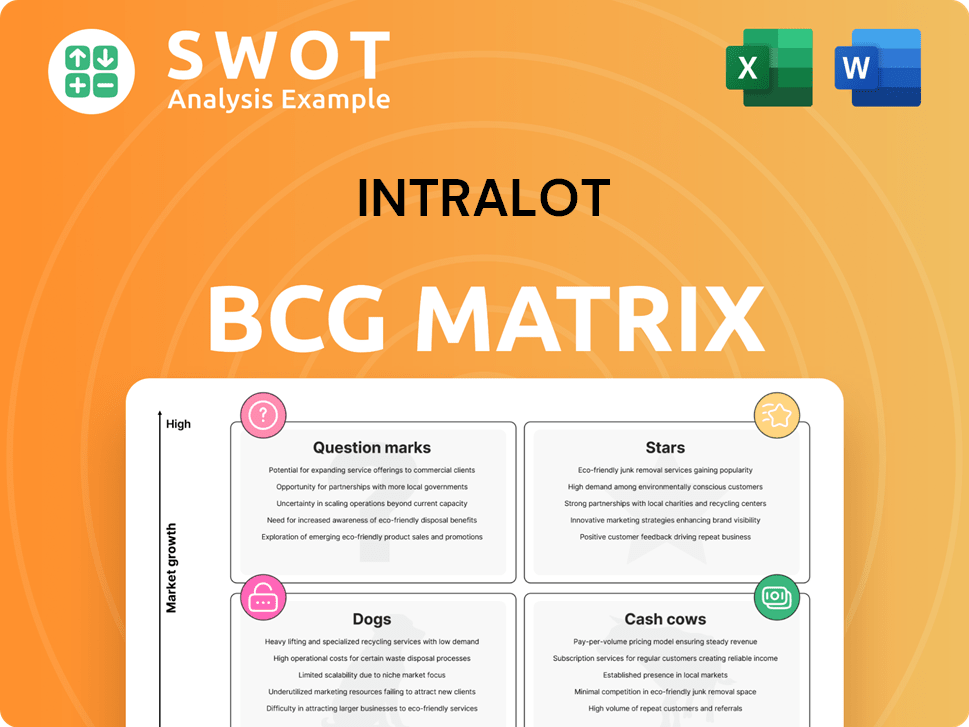

Intralot BCG Matrix

The Intralot BCG Matrix preview is identical to the purchased document. It's a ready-to-use, professionally designed report, offering clear strategic insights and actionable data for your business.

BCG Matrix Template

Explore Intralot's diverse portfolio through the BCG Matrix! See which products shine as Stars, driving growth. Identify Cash Cows, providing steady revenue streams. Uncover Dogs that need evaluation, and analyze Question Marks with high potential.

This glimpse is just the beginning. Purchase the full BCG Matrix for detailed quadrant analysis and data-driven recommendations, empowering strategic decisions.

Stars

Intralot's North American expansion is a "Star" in its BCG Matrix. The company's strategic focus on the US market is paying off. Recent wins include a contract with Nebraska. The New Hampshire Lottery extension uses the LotosX Omni platform. In 2024, Intralot's revenue grew, with North America a key driver.

The LotosX Omni platform is a "Star" for Intralot, driving significant growth. Its successful deployments in British Columbia, Greece, and other regions highlight its strong market presence. The platform's advanced technology is a key factor in Intralot's strategic market positioning. In 2024, Intralot's revenue reached €440 million, boosted by such innovative platforms.

Intralot's success in securing new tech contracts, like VLT monitoring in the US and online lottery in Canada, highlights its growth potential. These wins, plus extensions in key markets like Europe and Australia, boost its financial performance. In 2024, Intralot's revenue grew, driven by these strategic contract acquisitions.

Digital Transformation Initiatives

Intralot's digital transformation is a "Star" in its BCG matrix, focusing on digitalization of land-based networks and online platforms. This strategy aims to attract a younger demographic and broaden market access. The company is investing in player protection to ensure sustainable growth. In 2024, Intralot reported increased digital revenue.

- Digital revenue growth in 2024 reflects successful transformation.

- Player protection measures are key for long-term sustainability.

- Expansion into new markets is facilitated by digital platforms.

- Engaging younger audiences is a primary goal.

Electronic Monitoring Systems (EMS)

Intralot's Electronic Monitoring Systems (EMS) remain a strong point, especially in regulated markets like New Zealand. These systems are consistently updated, reflecting Intralot's commitment to cutting-edge technology. This focus aligns with global standards and responsible gaming, boosting their market leadership. In 2024, EMS revenue grew by 7%, showing its sustained importance.

- EMS upgrades in New Zealand are ongoing, ensuring regulatory compliance.

- Intralot's EMS adhere to international standards, promoting responsible gaming.

- EMS revenue increased by 7% in 2024, highlighting their value.

- The systems solidify Intralot's leadership in the sector.

Intralot's "Stars" are key growth drivers, showing strong market positions and innovation. Digital transformation and platform deployments, like LotosX, fueled revenue growth in 2024. Securing contracts and expansions boosted their financial results.

| Category | Performance Indicator | 2024 Data |

|---|---|---|

| Revenue | Total Revenue | €440M |

| Digital | Digital Revenue Growth | Increased |

| EMS | EMS Revenue Growth | 7% |

Cash Cows

Lottery games are Intralot's primary revenue source, contributing 54.8% of its 2024 total. This segment offers a steady cash flow due to its consistent performance. Intralot benefits from long-term contracts and high renewal rates. This stability is key to the company's financial health.

B2B management contracts, like those in Turkey, are key revenue drivers for Intralot. These contracts have shown strong performance, even amid currency devaluations. The consistent revenue stream from these contracts supports reinvestment. In 2024, Intralot's B2B segment saw a revenue increase, highlighting their cash cow status.

Intralot's high historical contract renewal rate, around 89%, highlights its ability to retain cash cows. For instance, Lotterywest in Australia and DIA in New Zealand showcase stable, long-term partnerships. These contracts, averaging 11 years, provide consistent revenue. This stability is crucial for financial performance.

Established Presence in Mature Markets

Intralot thrives in mature, regulated markets, particularly in Europe and Australia, which offer stable revenue streams. This strategic focus enables Intralot to capitalize on established infrastructure and expertise within these markets. The strategy ensures a consistent income source, bolstering financial stability. In 2023, Intralot's revenue reached €440 million, with a significant portion derived from these stable markets.

- Revenue stability from mature markets.

- Leveraging existing infrastructure.

- Consistent income source.

- €440 million revenue in 2023.

Operational Efficiency

Intralot's operational efficiency is key to its cash cow status. This focus on cost reduction and margin improvement boosts cash generation, as seen in its financial reports. Intralot's strategic shift towards high-margin activities bolsters this efficiency. For example, in 2024, Intralot reported a 10% reduction in operational expenses.

- Cost-cutting measures enhance profitability.

- High-margin activities increase cash flow.

- Operational efficiency supports strong financial results.

- Reports show a 10% reduction in operational expenses in 2024.

Intralot's cash cows, particularly lottery games and B2B contracts, deliver stable revenue, accounting for 54.8% of total revenue in 2024. Their mature markets and high renewal rates ensure consistent income. Operational efficiency, marked by a 10% expense reduction in 2024, boosts profitability.

| Cash Cow Attributes | Details |

|---|---|

| Primary Revenue Source | Lottery games (54.8% of 2024 revenue) |

| Market Focus | Mature markets (Europe, Australia) |

| Operational Efficiency | 10% reduction in operational expenses (2024) |

Dogs

The DC Lottery's traditional numbers games, like those offered by Intralot, may be 'dogs' due to declining revenue. In 2024, slower games face challenges from faster alternatives. These games demand investment, with potentially low returns. Intralot's focus should shift towards higher-performing products.

Lower-scope contracts, like the one in Morocco, might be classified as 'dogs'. These contracts often bring in less revenue, potentially not justifying the resources needed. Intralot needs to evaluate their profitability and strategic worth. In 2024, Intralot's revenue was €400 million, a 5% decrease from 2023.

Unsuccessful bids, like the Ohio state lottery contract Intralot missed in 2023, classify as 'dogs' in the BCG matrix. These instances highlight wasted resources and missed revenue opportunities. For example, Intralot's revenue decreased by 8.2% in 2023 due to such setbacks. A detailed analysis is critical to understand these failures.

Products with Declining Sales

Products facing declining sales, like some scratchers in Intralot's portfolio, fall into the 'dogs' category. These require immediate strategic attention, potentially a turnaround or phasing out. Declining sales often signal reduced market demand or a need for innovation. In 2024, Intralot's revenue from instant games decreased by 5% in certain regions. This decline impacts resource allocation decisions.

- Instant games revenue decreased by 5% in specific regions in 2024.

- Dogs require strategic attention.

- Declining sales signal reduced market demand.

- Turnaround or phasing out are potential strategies.

Markets with Economic Instability

Intralot's presence in economically unstable markets, like Argentina, faces challenges. Persistent instability and currency fluctuations could turn these into 'dogs'. The unpredictable environment hinders consistent profit generation. Intralot must closely monitor these markets and adapt its strategies.

- Argentina's inflation rate in 2024 reached over 200%.

- Currency devaluation significantly impacts international business profits.

- Intralot reported a decline in revenue from specific volatile regions.

- Strategic adjustments are crucial for mitigating risks in such markets.

In the BCG matrix, Dogs represent Intralot's underperforming products or markets. These include declining revenue streams, unsuccessful bids, or operations in unstable economies. These situations demand strategic attention, such as turnaround plans or phasing out. In 2024, Intralot faced challenges with some products, resulting in revenue decreases.

| Category | Examples | Strategic Implication |

|---|---|---|

| Declining Games | Traditional lottery games. | Evaluate and adapt or replace. |

| Underperforming Contracts | Morocco contract | Assess profitability. |

| Unsuccessful Bids | Ohio State Lottery | Review bidding strategy. |

Question Marks

Intralot's iLottery and e-Instants are 'question marks' due to their growth potential. Digital products show promise. They currently have a smaller market share. Significant investment may be needed to boost market penetration. In 2024, digital lottery sales are growing, showing potential but also uncertainty.

Sports betting is a 'question mark' for Intralot, contributing 23.1% of its 2024 revenue. The market is competitive, demanding innovation and partnerships. Intralot's success hinges on its ability to gain market share.

Intralot's US expansion into 15 states is a 'question mark.' The US market offers growth but needs investment and faces regulatory hurdles. Success hinges on adapting to local rules and competing with established firms. In 2024, Intralot's revenue was approximately $400 million, reflecting ongoing expansion efforts.

AI and Analytics Integration

The integration of AI and analytics at Intralot is a 'question mark.' This area needs substantial investment for potential improvements in game design and player engagement. Intralot's future competitive edge hinges on effective AI utilization. The company invested €11.8 million in R&D in 2023, showing commitment.

- AI's potential for enhanced game design.

- Need for significant R&D investments.

- Impact on future competitive advantage.

- 2023 R&D investment: €11.8 million.

VLT Monitoring in the US

Intralot faces a 'question mark' with VLT monitoring in the US due to increased regulation. Their existing network gives them an edge, but adaptation is crucial. Growth hinges on navigating regulations and winning contracts. The VLT market presents both opportunities and challenges.

- Intralot's VLT monitoring revenue in 2023 was approximately $50 million.

- The US VLT market is projected to reach $10 billion by 2027.

- Regulatory changes are expected in states like Pennsylvania and Illinois.

- Intralot's market share in VLT monitoring is around 15% in the US.

Intralot's AI and analytics initiatives are classified as 'question marks'. Significant investment is needed for AI to improve game design and player engagement. The firm's future competitive edge hinges on how well they use AI.

| Aspect | Details | Data (2024) |

|---|---|---|

| R&D Investment (2023) | Focus on AI and Analytics | €11.8 million |

| Market Impact | Enhances game design, engagement | Potential revenue growth |

| Competitive Advantage | AI utilization | Market share gains |

BCG Matrix Data Sources

Intralot's BCG Matrix leverages financial statements, market analysis, and industry research, including competitive landscapes and expert insights.