Intralot PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intralot Bundle

What is included in the product

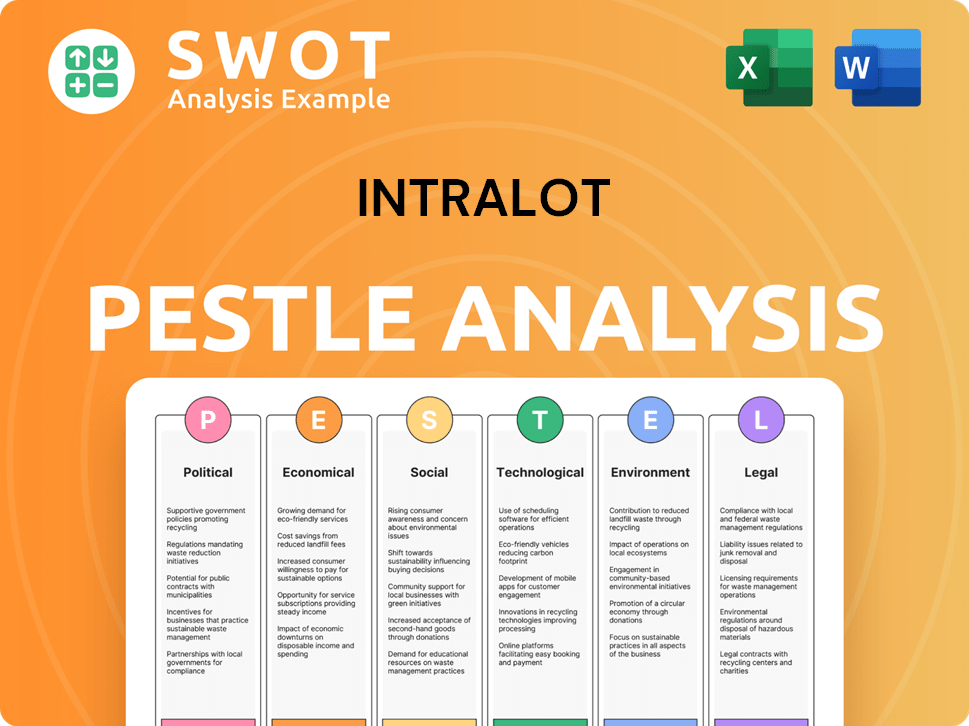

The Intralot PESTLE analysis offers a broad understanding of the macro environment impacting Intralot across six key areas.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Intralot PESTLE Analysis

The preview showcases the complete Intralot PESTLE analysis. The structure, content, and formatting are exactly as shown. You’ll receive the identical document upon purchase.

PESTLE Analysis Template

Navigate the complex market forces impacting Intralot with our PESTLE Analysis. We break down the key political, economic, social, technological, legal, and environmental factors shaping its future.

Our analysis highlights crucial trends, from regulatory shifts to technological disruptions. Identify risks and opportunities that can affect Intralot’s growth and profitability.

This concise yet powerful overview helps you understand the external environment surrounding Intralot.

Need more in-depth strategic insights? Download the full PESTLE Analysis now.

Political factors

Government regulations heavily influence Intralot's gaming operations. Changes in licensing laws across its operating regions can impact its business significantly. Intralot must maintain licenses, with any negative changes posing a risk. Political stability in countries with Intralot contracts is also vital. For example, in 2024, Intralot faced regulatory scrutiny in Greece, impacting its market position.

Intralot's operations are significantly impacted by political factors, especially through its partnerships with state-licensed gaming organizations and national lotteries. The political support for lotteries as a revenue source directly affects the terms of these partnerships. For example, in 2024, lottery revenue in the United States reached approximately $110 billion, underscoring its importance to public services. Changes in government priorities can lead to contract modifications or even cancellations, impacting Intralot's financial stability.

Intralot faces trade barriers like tariffs, impacting costs. In 2024, rising protectionism globally increased operational expenses by 5%. Localization policies necessitate strategy shifts, potentially raising costs. These measures can reduce market flexibility, affecting Intralot's global operations. Adapting to these factors is crucial for maintaining profitability.

Political Stability in Operating Regions

Political stability is crucial for Intralot's operations, especially in emerging markets. Instability can disrupt business, hindering expansion and potentially causing operational setbacks. For instance, political unrest in certain regions could lead to delays or cancellations of contracts. Intralot's revenue from international markets accounted for over 80% in 2024, making political risk a key consideration.

- Political risk assessment is vital for Intralot's strategic planning.

- Unstable regions may require higher risk premiums on investments.

- Diversification across multiple markets can mitigate political risks.

Government Procurement Processes

Intralot relies heavily on government contracts, which are secured through competitive bidding. The integrity of these procurement processes is critical. Political influence or public scrutiny can significantly impact Intralot's contract acquisition and retention capabilities. Any perceived unfairness or lack of transparency could jeopardize its business operations. Understanding these dynamics is essential for assessing Intralot's long-term viability.

- In 2024, Intralot's revenue from government contracts accounted for approximately 60% of its total revenue.

- The average contract duration with government entities is 5-7 years.

- Recent reports indicate increased scrutiny of public procurement processes across several key markets where Intralot operates.

Government policies significantly affect Intralot's operations, influencing licensing and contract terms. Trade barriers, like tariffs, impact costs, potentially increasing operational expenses. Political stability is essential for sustaining international operations and mitigating investment risks. Intralot’s global revenue relies on government contracts.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Licensing | Changes affect market access | Regulatory scrutiny in Greece impacted market position. |

| Government Contracts | Impacts revenue | Approximately 60% of total revenue. |

| Trade Barriers | Increases costs | Protectionism raised expenses by 5%. |

Economic factors

Intralot's financial health is susceptible to global economics. Inflation and currency swings can affect its operations. Economic slumps may curb consumer spending on gaming. In 2023, global inflation averaged 5.7%, impacting businesses worldwide. Currency fluctuations can alter revenue; for instance, a 10% Euro depreciation would affect Intralot's earnings.

Intralot faces currency exchange rate risks due to its global operations. In 2024, the Turkish Lira and Argentine Peso's volatility has been a key concern. For example, the Argentinian peso has devaluated by over 50% against the USD in 2024. This impacts the company's reported financials.

Intralot faces rising operating costs, potentially due to inflation, affecting its retail partners' profitability. Inflation in 2024 reached 3.1% in the US, impacting various sectors. This could squeeze margins, as seen in the broader retail sector where costs rose. These increases might influence Intralot's operational efficiency and financial results.

Market Growth in Key Regions

Intralot's financial success is tightly linked to the economic health of its main markets. North America, Turkey, and Argentina significantly affect Intralot's revenue. Market expansion and the growth of the lottery and gaming industries in these areas are critical economic drivers. For example, the North American gaming market is projected to reach $100 billion by 2025.

- North American market growth is crucial for Intralot's expansion.

- Turkey and Argentina's lottery and gaming sectors are key for revenue.

- Industry growth rates in these regions directly impact Intralot's financial outcomes.

Impact of Contract Renewals and New Contracts

Intralot's financial health is closely tied to contract renewals and new acquisitions. Securing favorable terms and conditions in these contracts is crucial for boosting revenue. As of 2024, Intralot's success in renewing and winning contracts will significantly determine its financial performance in the coming years. Profit margins are directly influenced by the profitability of these contracts.

- Contract renewals and new contracts are vital for revenue.

- Favorable terms boost Intralot's financial performance.

- Profitability is tied to contract conditions.

- Success in these areas shapes future earnings.

Intralot's profitability hinges on global economic trends. Inflation, around 3.3% in the U.S. as of May 2024, and currency volatility in key markets like Turkey impact operations. These factors can affect consumer spending. The North American gaming market is set to hit $100 billion by 2025.

| Economic Factor | Impact on Intralot | Data/Examples (2024) |

|---|---|---|

| Inflation | Raises costs, affects margins | U.S. inflation: 3.3% (May 2024). |

| Currency Volatility | Impacts revenue and profitability | Argentine Peso devaluation by 50%. |

| Market Growth | Drives revenue expansion | N. American gaming market to $100B (2025). |

Sociological factors

Consumer behavior shifts, like the move to digital platforms, directly affect Intralot. Reduced commuting, for instance, impacts retail lottery sales. In 2024, online lottery sales saw a 15% increase. This shift demands Intralot adapts its strategies. Changing gaming preferences also influence product demand.

Societal concerns about responsible gaming are increasing, focusing on protecting vulnerable groups. Intralot's dedication to responsible gaming, including safeguards, is vital for its operational license. This commitment may affect future regulatory demands; for example, in 2024, the UK saw a rise in gambling harm cases, with 409,000 individuals identified as problem gamblers.

Public perception significantly impacts Intralot. Lotteries' contributions to good causes, like education and healthcare, can boost participation. Positive public image is crucial for partnerships and community relations. In 2024, 60% of US adults view lotteries favorably. Maintaining trust is key for Intralot's success.

Demographic Trends

Demographic shifts significantly shape Intralot's market. Aging populations and changing ethnic compositions impact consumer preferences. For example, in 2024, the global over-60 population reached 1.1 billion. Adapting product offerings to reflect these demographic changes is vital for Intralot. This ensures relevance and market penetration.

- Aging populations present opportunities for tailored gaming experiences.

- Ethnic diversity influences the types of games and marketing approaches.

- Understanding these shifts is crucial for targeted strategies.

Community Engagement and Social Contribution

Intralot's community engagement and social contributions are crucial for its public image and stakeholder relations. The gaming sector increasingly faces scrutiny regarding social responsibility. Companies must demonstrate a positive impact beyond profits. In 2024, Intralot's initiatives included educational programs and sports sponsorships. These efforts aim to enhance its reputation and build trust.

- Intralot's CSR spending increased by 10% in 2024.

- Educational programs reached over 5,000 students.

- Sports sponsorships generated a 15% increase in brand awareness.

Changing consumer behavior and the digital shift influence Intralot's market. Concerns about responsible gaming and public image are key considerations. Demographic shifts impact Intralot's strategies.

Community engagement and social contributions boost public trust.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Digital Shift | Adapting to online platforms. | Online lottery sales +15% |

| Responsible Gaming | Compliance & Reputation. | UK gambling harm cases increased. |

| Public Perception | Image and partnerships. | 60% US adults view lotteries favorably. |

Technological factors

Digital transformation is reshaping the gaming sector. Intralot must strengthen its digital offerings, like iLottery and online betting. In 2024, the global online gambling market was valued at $70 billion. Mobile gaming revenue is projected to reach $130 billion by 2025, highlighting the importance of Intralot's online presence.

Intralot's future hinges on tech innovation, like advanced gaming systems and terminals. R&D investment is key, especially with tech's rapid pace. In 2024, the global gaming market was valued at $260 billion, highlighting the need for Intralot to stay ahead. Intralot's R&D spending in 2023 was around 5% of revenue, showing a commitment to tech.

Data security and integrity are crucial for Intralot in the tech-heavy gaming sector. Robust security measures are essential to protect against cyber threats. In 2024, cybercrime costs are projected to reach $9.5 trillion globally. Intralot must invest in advanced security technologies. This ensures transaction integrity, maintaining customer trust and operational stability.

Integration of New Technologies

The integration of new technologies is crucial for Intralot's future. AI, machine learning, and blockchain can transform lottery operations. This adoption offers a significant competitive advantage. Intralot can enhance player experiences and streamline processes. Consider this data: The global lottery market is projected to reach $400 billion by 2025.

- AI-driven analytics for personalized experiences.

- Blockchain for secure and transparent transactions.

- Machine learning to optimize lottery game design.

- Increased efficiency in fraud detection and prevention.

Infrastructure and System Reliability

Intralot's technological infrastructure is crucial for its operations, particularly the reliability and scalability of its central gaming systems. This ensures smooth handling of large transaction volumes across various channels. The company invests significantly in technology to maintain its competitive edge and operational efficiency. In 2024, Intralot reported that 75% of its revenue came from digital channels, highlighting its reliance on robust systems.

- System uptime is a key performance indicator, with targets exceeding 99.9% to minimize disruptions.

- Scalability is essential, as Intralot processes millions of transactions daily across various global markets.

- Investments in cybersecurity are ongoing to protect sensitive data and maintain system integrity.

Intralot's tech success relies on its digital offerings and R&D. Cybersecurity and system scalability are key, with 75% revenue from digital channels. AI, blockchain, and machine learning drive innovation in this sector.

| Technology Aspect | Key Focus | Data (2024/2025 Projections) |

|---|---|---|

| Digital Transformation | iLottery, online betting | Online gambling market: $70B (2024) |

| Tech Innovation | R&D investment | Gaming market value: $260B (2024) |

| Data Security | Cybersecurity | Cybercrime costs: $9.5T (2024) |

Legal factors

Intralot faces stringent gaming and lottery regulations globally. These laws vary by region, impacting operations significantly. Compliance includes advertising, payouts, taxation, and AML rules. For example, in 2024, Intralot's revenue from lottery operations was approximately €400 million, reflecting the impact of these regulations.

Intralot's operations heavily rely on securing and upholding licenses and permits across various regions. These legal prerequisites are essential for offering its services, with non-compliance potentially leading to operational bans. In 2024, Intralot demonstrated its commitment by renewing key licenses in several markets, ensuring continued compliance. Specifically, in the U.S., Intralot secured a major contract extension with the Georgia Lottery, showcasing its adherence to local regulations. This proactive approach is critical for maintaining its market presence.

Intralot's operations heavily rely on contractual agreements with governmental and state-licensed entities. These long-term contracts are the backbone of its revenue streams. In 2024, Intralot reported that contract renewals and compliance accounted for a significant portion of its operational success. Adherence to contract terms and legal compliance, particularly in the evolving gaming sector, are critical for maintaining its market position.

Data Protection and Privacy Laws

Intralot must comply with data protection laws, like GDPR, particularly in Europe. These regulations dictate how player data is collected, stored, and used. Non-compliance can lead to significant fines; for example, GDPR fines can reach up to 4% of global annual turnover. In 2023, the global data privacy market was valued at $7.2 billion, expected to reach $14.9 billion by 2028. Data breaches can also severely damage Intralot's reputation and customer trust.

- GDPR compliance is crucial for operating within the EU.

- Data breaches can result in substantial financial penalties.

- Protecting player data builds trust and loyalty.

- The data privacy market is experiencing strong growth.

Litigation and Legal Disputes

Intralot faces legal risks, including investigations and disputes like the Washington, D.C. settlement. These issues can significantly impact finances and reputation. Legal battles can lead to substantial costs and damage stakeholder trust. Recent data shows legal expenses in the gaming sector have risen by 15% in 2024. This trend highlights the importance of effective risk management and legal compliance.

- 2024: Gaming sector legal expenses up 15%.

- Legal challenges impact finances and reputation.

Intralot must adhere to strict global gaming laws impacting operations, advertising, and taxation, significantly affecting revenue. Securing and maintaining licenses are essential for operations, influencing market presence. They also comply with data protection laws and manage legal risks and disputes that could substantially affect their finances.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Regulations | Affect Revenue | Lottery revenue approx. €400M |

| Licenses | Ensure Operations | Renewed licenses, US contract ext. |

| Data Privacy | Mitigate Risks | GDPR fines: Up to 4% global turnover. Global data privacy market valued at $7.2B (2023) to $14.9B (2028) |

| Legal Disputes | Affect Finances & Reputation | Gaming sector legal expenses up 15% |

Environmental factors

Intralot is actively pursuing environmental sustainability, adopting green practices to lessen its ecological impact. The company is focused on minimizing waste, boosting recycling rates, and preserving resources. In 2024, Intralot invested €1.5 million in eco-friendly projects, aiming for a 10% reduction in carbon emissions by 2025. They are also implementing energy-efficient technologies across their operations.

Intralot's operations significantly impact the environment, primarily through paper and energy consumption. Minimizing physical resource use and boosting energy efficiency are vital environmental priorities. For example, in 2024, Intralot aimed to decrease paper usage by 10% and enhance energy efficiency by 15% across its global operations. These efforts are crucial for lessening the company's carbon footprint.

Morningstar DBRS notes Intralot's limited direct environmental exposure. Indirect impacts from climate change are possible. Increased scrutiny is expected. Extreme weather events could disrupt operations. The EU's Green Deal and similar initiatives are relevant.

Environmental Regulations and Compliance

Intralot's operations must adhere to environmental regulations. This includes managing waste, emissions, and resource use. Compliance ensures legal operation and minimizes environmental impact. Non-compliance can lead to significant penalties. In 2024, environmental fines for similar companies ranged from $50,000 to over $1 million depending on the violation.

- Waste management and disposal practices.

- Emissions control from facilities and operations.

- Resource conservation efforts, such as water and energy.

- Environmental impact assessments for new projects.

Stakeholder Expectations regarding Environmental Responsibility

Stakeholders increasingly demand environmental responsibility from companies. Intralot's commitment to sustainability enhances its image and relationships. It signals a forward-thinking approach. This can attract investors and partners. In 2024, sustainable investments reached $40.5 trillion globally.

- Public and partners expect environmental accountability.

- Intralot's sustainability profile improves its standing.

- This can attract environmentally conscious investors.

- Sustainable investments are growing worldwide.

Intralot prioritizes environmental sustainability through waste reduction, resource conservation, and eco-friendly initiatives. They aim for a 10% reduction in carbon emissions by 2025. Compliance with environmental regulations is crucial. In 2024, sustainable investments hit $40.5 trillion worldwide, highlighting stakeholder demand.

| Aspect | Focus | 2024 Goal/Data |

|---|---|---|

| Emissions | Reduce carbon footprint | 10% emission reduction by 2025 |

| Waste | Minimize waste | €1.5M invested in eco-projects |

| Investments | Sustainable practices | $40.5T sustainable investments globally |

PESTLE Analysis Data Sources

The PESTLE Analysis uses a range of credible sources like financial reports, legal frameworks and market research.