IQVIA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IQVIA Bundle

What is included in the product

Focus on product portfolio, identifying investment, holding, or divestment units.

Export-ready design for quick drag-and-drop into PowerPoint, enabling fast strategy presentations.

Delivered as Shown

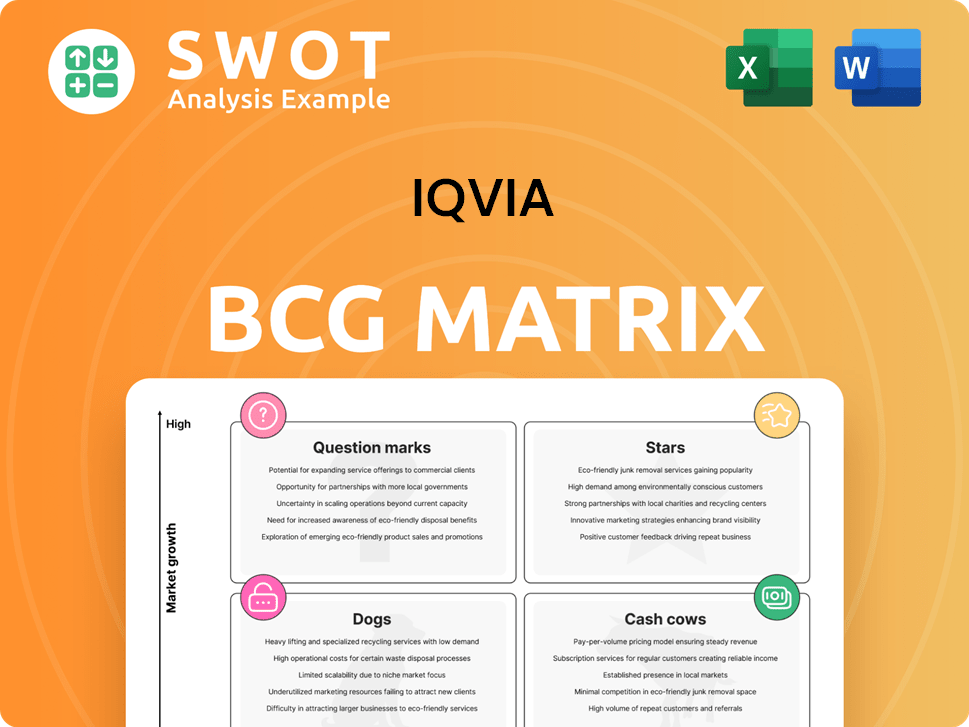

IQVIA BCG Matrix

The preview provides the complete IQVIA BCG Matrix you'll receive after buying. This is the final, ready-to-use document—fully formatted and instantly accessible for your strategic needs. No watermarks or hidden content: it's the full analysis report.

BCG Matrix Template

IQVIA's BCG Matrix provides a snapshot of its diverse product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This analysis helps understand the market share and growth potential of each offering. Gaining insights into these classifications is crucial for strategic decision-making. This overview only scratches the surface. Purchase the full BCG Matrix for detailed quadrant assessments, strategic recommendations, and actionable insights.

Stars

IQVIA's Technology & Analytics Solutions (TAS) is thriving, especially in AI. TAS saw substantial revenue growth in Q4 2024, thanks to AI tools for drug pricing and regulatory compliance. Maintaining this momentum is crucial. TAS is a star performer, showing strong market demand.

Research & Development Solutions (R&DS) is a key revenue driver for IQVIA. In 2024, R&DS achieved record bookings, increasing its contracted backlog to $31.1 billion. Efficiently converting this backlog into revenue is essential for ongoing growth. Maintaining a focus on efficient trial management and innovative solutions is crucial for preserving its leading market position.

IQVIA's strategic alliances are crucial for innovation and market growth. Collaborations with Salesforce and NVIDIA are prime examples. The Salesforce partnership focuses on the Life Sciences Cloud, a customer engagement platform. Leveraging AI through NVIDIA accelerates research and clinical development. These partnerships boost IQVIA's competitive edge. In 2024, IQVIA's revenue was approximately $15 billion, showcasing the impact of these strategies.

Decentralized Clinical Trials (DCTs)

IQVIA's mastery and tech in decentralized clinical trials (DCTs) mark it as a frontrunner in the field. DCTs are growing, improving patient access and cutting costs. IQVIA is a leader in DCT tech and consulting. Offering full DCT solutions can boost its market standing.

- In 2024, the DCT market was valued at over $6 billion.

- IQVIA's DCT solutions have shown up to a 30% reduction in trial timelines.

- Patient enrollment in DCTs has increased by 40% in the last two years.

- IQVIA's revenue from DCT services grew by 25% in 2024.

Global Public Health Initiatives

IQVIA actively supports global public health, partnering with organizations like The Global Fund. This enhances its image and fosters lasting change. These actions fit the rising focus on social responsibility, opening new markets. IQVIA's initiatives drive social impact and business value, addressing tough global health challenges.

- In 2024, The Global Fund disbursed over $4 billion to combat HIV, TB, and malaria.

- IQVIA's work in this area can lead to increased brand value and market access.

- Such initiatives align with the ESG (Environmental, Social, and Governance) investment trends.

- The global health market is projected to reach $9.8 trillion by 2030.

Stars within IQVIA’s portfolio like TAS and R&DS, are flourishing, experiencing significant growth and market demand. These segments drive high revenue, underpinned by innovative solutions and strategic partnerships. For example, R&DS saw its backlog increase to $31.1 billion in 2024. Successful conversion of backlog to revenue is key.

| Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Technology & Analytics Solutions (TAS) | AI-driven tools for drug pricing and regulatory compliance | Significant Growth |

| Research & Development Solutions (R&DS) | Contracted backlog for clinical trials and research services | $31.1 billion (Backlog) |

| Decentralized Clinical Trials (DCTs) | DCT market size in 2024 valued over $6 billion | 25% growth in services |

Cash Cows

IQVIA's commercial insights offer a stable revenue stream. This segment leverages strong industry relationships. It supports pharma, biotech, and med-tech firms. Growth is steady, not explosive. Maintain data quality to stay competitive.

Healthcare intelligence, encompassing data and analytics, forms a dependable revenue stream, fueled by the persistent need for market insights and strategic decisions. This sector thrives on the growing demand for real-world evidence and data-driven insights. For instance, in 2024, the global healthcare analytics market was valued at approximately $37.8 billion. Maintaining a strong position involves investing in advanced analytics, with a focus on data security. IQVIA, a major player, reported over $14 billion in revenue in 2023, demonstrating the financial strength of this area.

Contract Sales & Medical Solutions (CSMS) saw a revenue dip in 2024, yet remains a revenue source. CSMS offers vital life sciences services like sales support. Streamlining operations can boost cash flow. In 2024, CSMS accounted for around 30% of IQVIA's revenue.

Data Science Catalytic Fund

The Data Science Catalytic Fund, a collaborative initiative between The Global Fund and the Rwandan government, exemplifies a 'Cash Cow' within the IQVIA BCG Matrix by fostering technological innovation in healthcare. This fund provides a consistent revenue source, supporting ongoing projects and system enhancements. It enables rapid disease outbreak detection and response, crucial for public health. This is particularly important given the increasing frequency of outbreaks.

- The Global Fund committed $2.5 billion to fight AIDS, TB, and malaria in 2023.

- The Rwandan government invested significantly in healthcare technology in 2024.

- The fund supports over 100 projects in Rwanda.

- Early disease detection saves lives and reduces healthcare costs by up to 30%.

PharMetrics® Plus Data Repository

IQVIA's PharMetrics® Plus data repository, a cash cow within its BCG Matrix, is enhanced through collaboration with HealthCore. This partnership aims to boost real-world evidence (RWE) generation for better healthcare decisions. The integration of HealthCore's data creates a more comprehensive dataset. This is projected to increase RWE studies by 15% and reduce study completion times by 10% by late 2024.

- Increased RWE Studies: Projected 15% increase.

- Reduced Turnaround Times: Expected 10% reduction.

- Enhanced Clinical Outcome Measures: Improved data quality.

- Data Integration: HealthCore's de-identified data.

Cash Cows, like IQVIA’s PharMetrics® Plus, provide steady revenue. These segments, including the Data Science Catalytic Fund, generate consistent cash flow. These initiatives contribute significantly to the company's revenue, like the $14 billion reported in 2023.

| Category | Description | Impact |

|---|---|---|

| Revenue Streams | PharMetrics®, Data Science Fund, Healthcare Intelligence | Stable, consistent |

| Financial Metrics | 2023 Revenue | Over $14 Billion |

| Market Demand | RWE, Disease Detection | Growing, Crucial |

Dogs

IQVIA's OCE CRM, due to its Salesforce partnership and Life Sciences Cloud focus, is becoming a 'dog' in its BCG Matrix. As IQVIA licenses OCE to Salesforce, its market share within IQVIA shrinks. This segment needs careful management to minimize losses during the transition. In 2024, the life sciences CRM market is estimated at $1.5B, with IQVIA's share decreasing.

Navigating varying global trial regulations can slow growth. Sponsors face complex regulatory hurdles. Streamlining processes and focusing on favorable markets is crucial. In 2024, regulatory delays cost the pharmaceutical industry billions. Prioritizing efficiency is key to success.

IQVIA's commoditized services could see pricing pressure due to competition. Pharma cost-cutting might lead to contract renegotiations and trial delays. In 2024, the global CRO market, where IQVIA operates, was valued at approximately $70 billion. Differentiating services through innovation is crucial to maintain profitability. IQVIA's focus on high-value offerings is key for future success.

Non-AI Driven Analytics

Non-AI driven analytics in IQVIA's BCG Matrix are akin to Dogs, facing challenges. These services, lacking AI integration, risk losing market share. The demand for AI-driven solutions is rising across drug pricing, patient outcomes, and regulatory compliance. To stay competitive, upgrading these services with AI is crucial. For example, the AI in healthcare market was valued at $11.6 billion in 2023, and is projected to reach $147.8 billion by 2030.

- Traditional analytics services are losing ground.

- Demand for AI in healthcare is increasing.

- Focus on AI upgrades to remain competitive.

- The AI in healthcare market is growing.

Regions with Economic Instability

Economic instability in regions like APAC can hinder growth, as IQVIA has seen challenges in China. Diversifying revenue streams geographically is crucial to counter regional economic risks. In 2024, China's economic slowdown affected various sectors. IQVIA's strategy includes expanding in stable markets to offset such impacts.

- China's GDP growth in 2024 slowed to around 4.6%.

- IQVIA's revenue from APAC was approximately $4.5 billion in 2024.

- Diversification aims to reduce reliance on any single region by 15%.

- Expanding in North America and Europe is a key focus.

IQVIA's "Dogs" struggle due to market shifts and competition. Traditional analytics, without AI, face decline. Diversification and AI integration are vital for competitiveness. The global CRO market was around $70B in 2024.

| Category | Details | 2024 Data |

|---|---|---|

| AI in Healthcare Market | Projected growth | $147.8B by 2030 |

| Global CRO Market | Market Size | Approximately $70B |

| China's GDP Growth | Economic Slowdown | ~4.6% |

Question Marks

IQVIA's AI initiatives, like the AI Assistant, are in early phases, requiring substantial investment. This includes securing market share and proving their worth. For instance, in 2024, IQVIA increased its R&D spending by 10% to boost AI capabilities. Strategic marketing is key to evolving these solutions into market leaders.

Venturing into emerging markets, like those in Southeast Asia, offers growth prospects but also complexities. This expansion demands considerable capital and poses risks such as regulatory hurdles and competition. For instance, the pharmaceutical market in China grew by 5.1% in 2023. Strategic alliances and thorough market analysis are vital for success.

Real-World Evidence (RWE) is increasingly vital, yet producing top-tier, regulatory-ready RWE is complex. IQVIA's partnership with HealthCore, Inc. aims to enhance RWE generation. The focus is showing RWE's value to regulatory bodies and healthcare providers. This drives adoption and boosts market share, as seen in 2024's data.

Personalized Medicine Solutions

Personalized medicine solutions are in the "Question Marks" quadrant of the IQVIA BCG Matrix, indicating high market growth potential but uncertain market share. The market is expanding, yet adoption is still nascent, requiring substantial investments in data analytics, genomics, and patient engagement. The key is to prove the clinical and economic benefits of personalized medicine. In 2024, the global personalized medicine market was valued at $600 billion.

- Market size in 2024: $600 billion.

- Investment needs: Data analytics, genomics, and patient engagement.

- Objective: Demonstrate clinical and economic value.

New Digital Health Platforms

New digital health platforms, like One Home for Sites, are emerging as high-growth, uncertain areas. One Home aims to simplify site operations by integrating applications. These platforms need user adoption and integration to prove their worth. Feedback from pilot programs and improved user experience are crucial for driving adoption.

- One Home for Sites simplifies daily operations.

- User adoption and integration with existing systems are key.

- Pilot programs are used to gather feedback.

- User experience refinement is a focus.

Personalized medicine solutions are in the "Question Marks" quadrant, signaling high growth but uncertain market share. This sector needs substantial investments, particularly in data analytics and genomics. Proving clinical and economic benefits is crucial for market penetration.

| Characteristic | Details |

|---|---|

| Market Value (2024) | $600 billion |

| Investment Areas | Data analytics, genomics, patient engagement |

| Objective | Prove clinical and economic value |

BCG Matrix Data Sources

The IQVIA BCG Matrix leverages diverse data, encompassing sales & prescription data, patient insights, and competitive intelligence, ensuring accurate market assessments.