IQVIA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IQVIA Bundle

What is included in the product

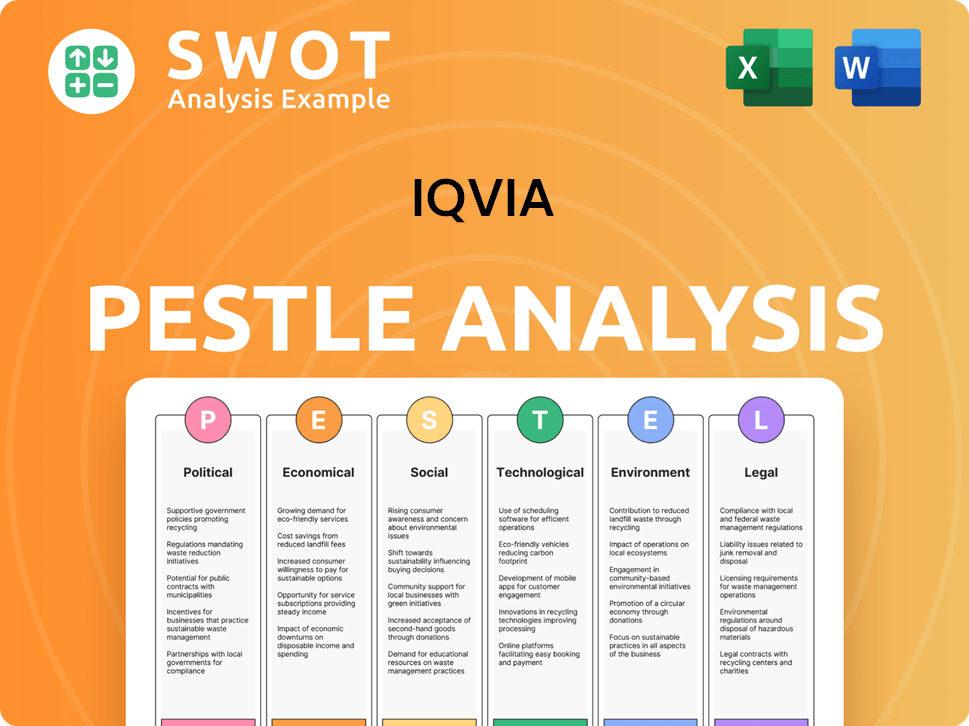

IQVIA PESTLE Analysis examines external factors' impact across six dimensions: Political, Economic, Social, Technological, Environmental, Legal.

The PESTLE analysis enables easy alignment by offering a shareable summary across diverse teams.

What You See Is What You Get

IQVIA PESTLE Analysis

What you're previewing here is the full IQVIA PESTLE Analysis. It includes detailed analysis of political, economic, social, technological, legal, and environmental factors.

This is the complete, ready-to-use document. It offers valuable insights for your strategic planning.

The content is fully formatted and professionally structured.

The final document has been carefully reviewed.

You will have immediate access after your purchase!

PESTLE Analysis Template

Navigate the complexities surrounding IQVIA with our comprehensive PESTLE Analysis. We examine crucial political, economic, social, technological, legal, and environmental factors influencing its success. This detailed report gives you the insights needed for effective strategic planning. Uncover opportunities and mitigate risks affecting IQVIA today. Get actionable intelligence—download the complete PESTLE Analysis now!

Political factors

Government healthcare policy shifts significantly influence clinical research. New regulations from bodies like the FDA and EMA reshape research protocols. These changes increase compliance needs, impacting cross-border studies. For example, in 2024, the FDA issued 15 new guidance documents affecting clinical trials. This impacts IQVIA's operational strategies.

US healthcare reforms, especially Medicare/Medicaid changes, affect clinical research funding. The Inflation Reduction Act of 2022 includes Medicare drug pricing reforms. These reforms might lower reimbursements for drug development costs. This increases scrutiny on clinical trial costs, impacting IQVIA. Medicare spending reached $944 billion in 2023.

International trade policies and tensions, particularly between the US and China, directly affect cross-border clinical trials. These policies can disrupt supply chains, as seen during the 2018-2023 US-China trade war, which led to increased costs for pharmaceutical companies. For example, tariffs on imported medical supplies and APIs increased the cost of drug development by up to 5% in some cases. Furthermore, the ongoing geopolitical instability, including the war in Ukraine, adds another layer of complexity, potentially delaying trial timelines and increasing operational expenses.

Political Stability in Operating Regions

Political stability is crucial for IQVIA's global operations. Instability can disrupt supply chains and create regulatory uncertainties. IQVIA operates in over 100 countries; some face political risks. According to the World Bank, in 2024, countries with high political risk saw a 5-10% decrease in foreign investment. This affects IQVIA's investments and expansion plans.

- Global operations span over 100 countries, with varying political climates.

- Political instability can lead to supply chain disruptions, impacting operational efficiency.

- Regulatory uncertainty can increase operational costs and hinder long-term planning.

- Countries with high political risk often experience reduced foreign investment.

Government Support and Incentives

Government backing significantly influences the life sciences sector. Supportive policies, like tax incentives, subsidies, and infrastructure investments, foster growth. R&D incentives, in particular, boost innovation. For example, the U.S. government allocated $49.8 billion for NIH in 2024, supporting research.

- Tax credits for R&D can lower operational costs.

- Subsidies can offset the high costs of drug development.

- Infrastructure grants support lab construction and expansion.

- These incentives attract investment and spur innovation.

Political factors significantly impact IQVIA's operations, with changing government healthcare policies reshaping clinical research protocols and trial costs. Trade policies and international relations introduce complexities, influencing supply chains and operational expenses. Political stability in over 100 operating countries is essential for long-term planning and foreign investment.

| Factor | Impact | Data |

|---|---|---|

| Healthcare Policy | Regulatory changes & compliance burdens | FDA issued 15 guidance docs in 2024 |

| Trade Policies | Supply chain disruptions & cost increases | Up to 5% increase in drug dev costs (2018-2023) |

| Political Stability | Investment, expansion & supply chains risks | Countries with high risk saw 5-10% FDI drop in 2024 |

Economic factors

Global healthcare spending trends significantly influence IQVIA's business. Healthcare spending is projected to reach $11.9 trillion by 2025. This growth, fueled by population increases and chronic diseases, creates opportunities for IQVIA's services. Specifically, the US healthcare spending is expected to reach $4.8 trillion by the end of 2024.

Economic uncertainty and downturns significantly influence IQVIA. Healthcare spending fluctuations directly affect IQVIA's business performance. Pharmaceutical clients' budget constraints can curb project bookings. The 2023 global pharmaceutical market grew 6.5%, showing resilience. However, future growth faces economic headwinds.

Inflation and currency fluctuations are crucial for global businesses like IQVIA. Rising inflation in key markets, such as the US, which saw a 3.2% inflation rate in February 2024, can increase operational costs. Changes in exchange rates, like the EUR/USD, which fluctuated throughout 2024, directly impact revenue and profitability.

Increasing Payer Price Sensitivity

Payers are becoming more cost-conscious, heightening price sensitivity in the pharmaceutical sector. This trend affects new drug approvals and market access, directly influencing IQVIA's services. The life sciences industry faces challenges due to this, requiring strategic market access approaches. Recent data shows a 10-15% rise in payer scrutiny for drug pricing.

- Payer focus on cost management.

- Impact on market access for new treatments.

- Influence on IQVIA's market access services.

Investment in Pharmaceutical R&D

Investment in pharmaceutical R&D significantly impacts IQVIA's clinical research services. Large pharma companies' R&D spending drives clinical trial activity, a crucial economic factor. Despite increases, broader economic trends influence overall clinical trial activity and investment decisions. In 2023, global pharmaceutical R&D spending reached approximately $250 billion. This investment is projected to continue growing, albeit subject to economic fluctuations.

- R&D Spending: ~$250B in 2023 globally

- Projected Growth: Continued, but with economic sensitivity

Economic factors deeply impact IQVIA's operations. Global healthcare spending, forecasted to hit $11.9T by 2025, drives growth. Economic uncertainty, inflation (3.2% in the US, February 2024), and currency rates create risks. Pharma R&D, reaching $250B in 2023, fuels IQVIA's services.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Healthcare Spending | Market Growth | $11.9T (2025 projected) |

| Inflation (US) | Operational Costs | 3.2% (February 2024) |

| Pharma R&D | Clinical Trial Activity | $250B (2023) |

Sociological factors

Globally, the population is aging, with those aged 65+ projected to reach 16% by 2050. Chronic diseases are rising, boosting demand for pharmaceuticals and healthcare services. This fuels IQVIA's clinical research and market analysis needs. For example, in 2024, spending on chronic disease management hit $1.2 trillion in the US alone.

Growing health awareness fuels pharmaceutical and healthcare market expansion, especially in emerging markets. This trend boosts demand for IQVIA's data and consulting services. For instance, the global health and wellness market is projected to reach $7 trillion by 2025. IQVIA's revenue in 2024 was around $15 billion, reflecting this growth.

Patient advocacy groups are growing, boosting patient involvement in healthcare choices, especially regarding drug costs and availability. This shift impacts the market and regulations. IQVIA's focus on real-world data and patient-focused trials is significant. Patient engagement is projected to grow by 15% in 2024. In 2023, patient advocacy spending reached $2.5 billion.

Diversity and Inclusion in Clinical Trials

Diversity and inclusion are increasingly vital in clinical trials. The goal is to ensure that treatments are effective for all populations. IQVIA actively works to broaden clinical trial diversity and geographic reach. This approach addresses societal needs for equitable healthcare. In 2024, only 30% of clinical trial participants represented diverse racial groups.

- IQVIA's focus on diversity aims to reflect real-world patient demographics.

- Geographic expansion ensures trials include diverse populations.

- This helps to improve treatment outcomes for all patients.

- The company's efforts support healthcare equity.

Cultural Shifts Towards Health and Wellness

Societal trends prioritizing health and wellness significantly shape consumer behavior in healthcare. This shift affects demand for related products, directly impacting consumer health brands, a sector where IQVIA offers crucial data and consulting. The market reflects this change, with wellness spending projected to reach $7 trillion by 2025. This evolving landscape requires brands to adapt.

- Wellness market is projected to reach $7 trillion by 2025.

- Consumer health brands need to adapt to these shifts.

Societal attitudes toward health and wellness profoundly impact consumer behaviors and demand. This drives growth in related sectors where IQVIA's insights are crucial, such as consumer health brands. In 2024, the US wellness market reached $578 billion, with continued expansion expected. IQVIA's role becomes vital as brands navigate these shifts and adapt to changing consumer needs.

| Trend | Impact | 2024/2025 Data |

|---|---|---|

| Health and Wellness Focus | Increased demand for health products | US Wellness market at $578B (2024); Projected to grow |

| Consumer Behavior Shift | Needs adaptation from consumer health brands | IQVIA services aid in adapting brands, data insight |

| Societal health emphasis | Drives investment and demand for related services | Continued growth with changing preferences |

Technological factors

Technological advancements in AI and machine learning are revolutionizing drug discovery and clinical development. IQVIA is at the forefront, heavily investing in AI. For example, in 2024, IQVIA's AI solutions increased efficiency by 20% in clinical trial data analysis. Furthermore, the company allocated $1.5 billion to AI-driven innovations.

The rise of Real-World Evidence (RWE) is transforming healthcare, a trend IQVIA actively capitalizes on. RWE uses data from various sources to inform healthcare choices. IQVIA's focus on RWE is reflected in its revenue, with 2024 revenues at $15.1B. This data-driven approach is crucial for value-based care initiatives.

The rise of Decentralized Clinical Trials (DCTs) is reshaping clinical research, spurred by the pandemic. IQVIA leads in DCT solutions, offering consulting services to support this shift. In 2024, the DCT market is valued at $4.7 billion, with a projected growth to $10.8 billion by 2029. This expansion highlights the increasing adoption of decentralized trial technologies.

Importance of Data Analytics and Big Data

Data analytics and big data are at the core of IQVIA's operations, enabling them to extract valuable insights from extensive healthcare datasets. IQVIA leverages advanced analytics to support various activities, from drug development to market access strategies. The company's success hinges on its ability to manage and analyze vast amounts of data efficiently. This capability is critical for providing data-driven solutions to its clients. In 2024, the global big data analytics market in healthcare was valued at approximately $40.1 billion.

- IQVIA manages over 500 petabytes of healthcare data.

- The company's analytics solutions support over 100,000 users globally.

- IQVIA's technology processes over 10 billion healthcare transactions annually.

Evolution of Regulatory Technology Solutions

Technology is crucial for navigating the complex, ever-changing global regulatory landscape. IQVIA creates regulatory information management systems and productivity tools to support clients in compliance and submissions. The RegTech market is projected to reach $19.7 billion by 2025, showing significant growth. IQVIA's solutions help streamline processes and ensure adherence to regulations, with a focus on efficiency and accuracy.

- RegTech market expected to reach $19.7 billion by 2025.

- IQVIA offers regulatory information management systems.

- Productivity tools assist with compliance and submissions.

- Focus on efficiency and accuracy in regulatory processes.

IQVIA leverages AI and machine learning, exemplified by a 20% efficiency boost in 2024 clinical trial data analysis and $1.5 billion investment in AI initiatives.

Data analytics, central to IQVIA, is crucial for drug development and market access strategies, as demonstrated by the global big data analytics market in healthcare valued at approximately $40.1 billion in 2024.

The growth of DCTs, valued at $4.7 billion in 2024 with a projected $10.8 billion by 2029, highlights the trend toward decentralized trial technologies.

| Technology Aspect | IQVIA Initiatives | 2024/2025 Data |

|---|---|---|

| AI and Machine Learning | Investment in AI, AI solutions for clinical trials. | 20% efficiency increase, $1.5B allocated |

| Real-World Evidence (RWE) | Leveraging RWE for healthcare decisions. | $15.1B Revenue (2024) |

| Decentralized Clinical Trials (DCTs) | DCT solutions and consulting. | $4.7B market (2024), $10.8B (2029) |

| Data Analytics | Big data analysis for drug development and market access. | $40.1B global market (2024) |

| Regulatory Technology (RegTech) | Regulatory information management systems. | $19.7B market by 2025 |

Legal factors

IQVIA, like other life sciences companies, faces a complex global regulatory landscape. Compliance is crucial, with regulations varying by region and constantly evolving. For instance, the FDA issued over 1,500 warning letters in 2024, highlighting the need for rigorous adherence to standards. This includes data privacy laws like GDPR, impacting how IQVIA handles client information. Maintaining compliance requires significant resources and adaptability.

Data privacy and security regulations like GDPR are crucial for IQVIA. They must comply strictly. Investing in privacy-enhancing tech is essential.

IQVIA faces antitrust scrutiny, particularly regarding market dominance. In 2024, the FTC and other agencies are actively investigating mergers and acquisitions within the healthcare data sector. Companies like IQVIA must ensure compliance to avoid substantial fines, potentially impacting profits. Recent enforcement actions saw penalties exceeding $100 million for antitrust violations in similar industries, highlighting the stakes.

Anti-Corruption Laws

IQVIA must strictly adhere to anti-corruption laws globally. The U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act are key. Non-compliance can lead to hefty fines and legal repercussions. In 2024, FCPA fines averaged $25 million per case.

- Risk mitigation is crucial for international operations.

- Compliance programs are essential to prevent violations.

- IQVIA's reputation depends on ethical conduct.

- Regular audits and training are vital.

Intellectual Property Rights and Litigation

IQVIA must safeguard its intellectual property, including its vast datasets and analytical tools, to maintain a competitive edge. Litigation, often involving data privacy, usage disputes, and antitrust concerns, poses a significant risk. Recent legal battles and settlements, such as those related to data breaches or misuse, have cost the company millions. IQVIA's legal expenses in 2024 were approximately $150 million, reflecting the complexities of data protection and regulatory compliance.

- Data privacy lawsuits can result in significant fines.

- Patent infringement claims can impact product offerings.

- Antitrust scrutiny may limit market expansion.

- Compliance costs continue to rise.

IQVIA navigates a complex legal landscape focusing on data privacy, antitrust issues, and IP protection. They face regulatory challenges. GDPR compliance is vital. Litigation and antitrust scrutiny drive legal expenses.

| Aspect | Details | Impact |

|---|---|---|

| Data Privacy | GDPR & similar laws. | Compliance costs rising. |

| Antitrust | FTC investigations of M&A. | Fines; market limits. |

| Intellectual Property | Data protection, patents. | Litigation risk, costs ~$150M in 2024. |

Environmental factors

Environmental sustainability is gaining traction in pharma. Stakeholders demand reduced environmental impact from manufacturing and supply chains. For example, the industry is seeing a rise in green chemistry initiatives. This includes efforts to cut carbon emissions.

Climate change has significant impacts on health and healthcare. Rising temperatures and extreme weather events increase the incidence of heat-related illnesses. These changes can also affect the spread of infectious diseases, increasing healthcare demands. IQVIA analyzes these trends, noting increased healthcare utilization due to climate-related health issues.

Health Technology Assessment (HTA) bodies are increasingly evaluating environmental sustainability of health technologies. This shift impacts market access for pharmaceuticals. In 2024, 30% of HTA reports included environmental impact assessments. By 2025, expect a rise to 40%, affecting product approvals. This trend is driven by growing environmental concerns.

Reduction of Greenhouse Gas Emissions

IQVIA and other life sciences companies are actively working to lower greenhouse gas emissions, aligning with global climate targets. IQVIA has demonstrated progress in reducing its carbon footprint. For example, in 2023, IQVIA reported a 15% reduction in Scope 1 and 2 emissions compared to the 2019 baseline. These efforts are part of a broader trend toward sustainability within the industry, driven by both regulatory pressures and investor expectations.

- 2023: IQVIA achieved a 15% reduction in Scope 1 & 2 emissions vs. 2019.

- Companies are setting emission reduction targets.

- Sustainability efforts are driven by regulations and investor expectations.

Waste Reduction and Circular Economy Practices

IQVIA is increasingly focused on reducing waste, including single-use plastics, in its clinical trials and labs. This shift aligns with the growing importance of circular economy principles within the healthcare sector. The company is implementing various strategies to minimize its environmental footprint. These efforts are driven by both regulatory pressures and a commitment to sustainability.

- In 2024, the global waste management market was valued at approximately $2.1 trillion.

- The circular economy is projected to create $4.5 trillion in economic output by 2030.

- IQVIA's sustainability reports detail specific waste reduction targets and progress.

Environmental factors are critical in pharma, driven by sustainability demands. Climate change impacts health, influencing healthcare needs. Health Technology Assessment (HTA) bodies evaluate environmental impact.

Companies target emissions cuts; IQVIA reduced Scope 1 & 2 emissions by 15% in 2023 vs. 2019. Waste reduction efforts align with circular economy principles. The waste management market reached $2.1 trillion in 2024.

| Aspect | Impact | Data Point |

|---|---|---|

| Climate Change | Increased healthcare demand | Rise in heat-related illnesses, infectious diseases. |

| HTA Evaluation | Market access influence | 40% of HTA reports will include impact assessments in 2025. |

| Waste Management | Industry shift | $2.1 trillion market value in 2024. |

PESTLE Analysis Data Sources

IQVIA's PESTLE draws on diverse data: government sources, healthcare reports, market analysis, and academic research.