Jamieson Wellness Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jamieson Wellness Bundle

What is included in the product

Tailored analysis for Jamieson's product portfolio within the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, allowing for easy distribution of strategic insights.

What You’re Viewing Is Included

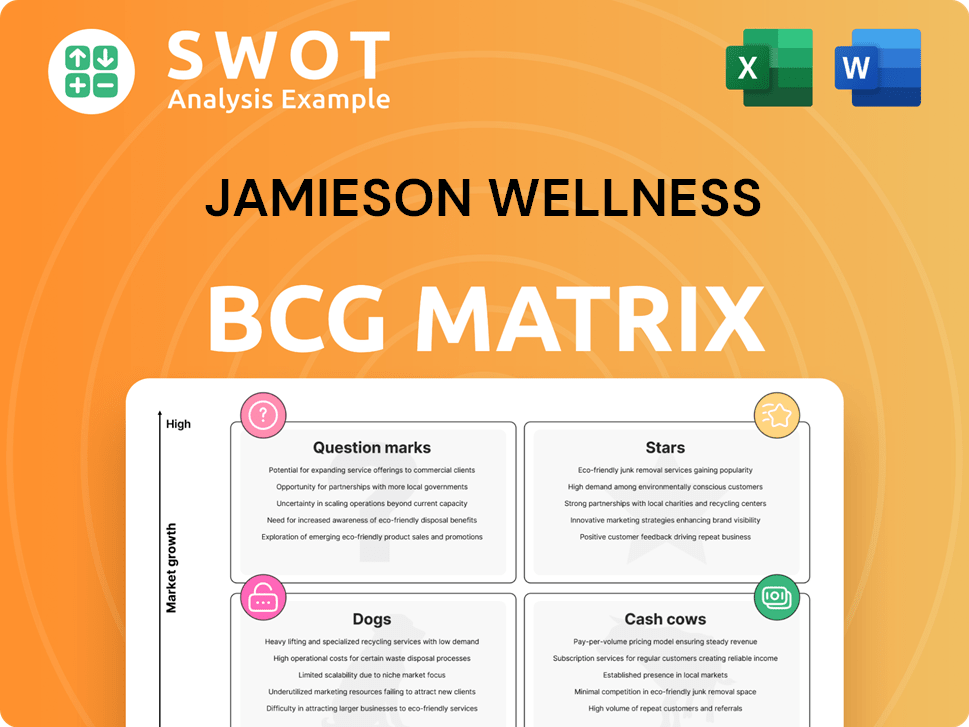

Jamieson Wellness BCG Matrix

The Jamieson Wellness BCG Matrix you're previewing is the complete report you'll receive after purchase. This ready-to-use document provides a strategic analysis, perfect for presentations and business planning.

BCG Matrix Template

Uncover the strategic landscape of Jamieson Wellness through its BCG Matrix.

See how their products are categorized—Stars, Cash Cows, Dogs, or Question Marks.

This initial look offers a glimpse into market positioning and growth potential.

Understand resource allocation priorities and strategic implications.

The preview is just a teaser.

Get the full BCG Matrix report to unlock quadrant specifics and actionable insights for confident decision-making.

Purchase now for strategic advantage!

Stars

Jamieson Brand, the flagship in Canada, is a Star. It boasts a strong market share due to its 102-year history. Jamieson's brand recognition and consumer trust is sustained by ongoing marketing and innovation efforts. In 2024, the Canadian VMS market was valued at approximately $1.8 billion, with Jamieson holding a significant portion.

Youtheory, acquired in 2022, is a star brand. It has shown strong growth in the US and internationally. Revenue increased due to expansion and e-commerce, making it a key growth driver. The focus on ingredients like Ashwagandha boosts its success. In Q1 2024, Jamieson Wellness's revenue grew, with Youtheory contributing significantly.

Jamieson Wellness has strategically expanded into the Chinese market, showing strong revenue growth and enhanced brand visibility. Investments in digital marketing and e-commerce have driven this expansion; China is now a vital growth area. In 2024, Jamieson's Asia-Pacific sales rose, fueled by China's e-commerce success. Continued growth is projected via market expansion and digital program optimization.

Sports Nutrition Brands

Jamieson Wellness's "Stars" include sports nutrition brands like Progressive, Smart Solutions, Iron Vegan, and Precision. This segment is growing, targeting active consumers with specialized supplements. Acquisitions have expanded their premium supplement offerings. This strategy is fueled by the rising demand for health and wellness products.

- Sports nutrition market is valued at $45.27 billion in 2024.

- Jamieson Wellness's sales increased by 10% in the last year.

- Progressive and Iron Vegan are known for their vegan-friendly products.

- Smart Solutions focuses on innovative supplement delivery.

E-commerce Growth

Jamieson Wellness shines in e-commerce, fueled by robust consumer engagement and digital marketing. A new e-commerce partnership boosts efficiency and revenue reporting. Online sales are key to reaching more customers, tapping into the growing online supplement market. This focus is reflected in their financial performance, with digital channels playing a crucial role.

- E-commerce sales increased significantly in 2024, representing a substantial portion of total revenue.

- Digital marketing investments have yielded higher conversion rates and customer acquisition.

- The partnership streamlined processes, enhancing operational efficiency.

- Online supplement purchases are trending upwards, benefiting Jamieson.

The "Stars" for Jamieson Wellness—Jamieson Brand, Youtheory, and its sports nutrition brands—drive significant revenue and market share gains. These brands benefit from the company's strategic focus on digital marketing and e-commerce. This is further supported by growing demand for health and wellness products.

| Brand | Market | Key Growth Drivers |

|---|---|---|

| Jamieson Brand | Canada | Brand recognition, consumer trust, innovation |

| Youtheory | US, International | Expansion, e-commerce, ingredient focus |

| Sports Nutrition | Global | Rising demand, premium offerings, specialized products |

| E-commerce | Global | Digital marketing, consumer engagement, partnerships |

Cash Cows

In Canada, Jamieson's VMS products are a cash cow, holding a significant market share with steady demand. The brand enjoys strong consumer loyalty and a robust distribution network. Maintaining its position requires minimal investment, ensuring a consistent cash flow. For example, in 2024, Jamieson Wellness reported strong sales in Canada, reflecting the brand's solid performance. This stability allows for strategic investments in other areas.

Jamieson Wellness benefits from strategic partnerships, like those with consumer health companies, fostering stable revenue streams. These contracts utilize Jamieson's manufacturing expertise, minimizing investment needs. Efficient contract management guarantees consistent income, improving overall cash flow. In 2023, Jamieson's revenue was $489.8 million. The company's gross profit grew 1.7% to $181.3 million.

Progressive Nutritional Therapies, part of Jamieson Wellness, caters to health-focused consumers with supplements. It boasts a loyal Canadian customer base and solid distribution. Although it needs marketing, it provides steady revenue, fitting the cash cow model. In 2024, Jamieson Wellness reported a revenue of $473.2 million CAD.

Smart Solutions Brand (Canada)

Smart Solutions, part of Jamieson Wellness, targets women's health with products for hormone balance and nutrient needs. This Canadian brand holds a stable market share, supported by a dedicated customer base. Its consistent performance requires minimal marketing, generating dependable cash flow. In 2024, Jamieson Wellness reported strong sales, with brands like Smart Solutions contributing to overall financial health.

- Focus on women's health products.

- Stable market share in Canada.

- Loyal customer base.

- Requires limited marketing investment.

Iron Vegan Brand (Canada)

Iron Vegan, a Canadian plant-based supplement brand, is a cash cow for Jamieson Wellness. It benefits from the rising demand for plant-based diets and has a loyal customer base. Despite needing focused marketing, it produces steady revenue with modest growth, bolstering the company's cash flow. In 2024, the plant-based supplement market in Canada grew by 8%, showing continued demand.

- Consistent Revenue: Generates steady income.

- Moderate Growth: Shows stable, but not explosive, expansion.

- Targeted Marketing: Requires specific advertising efforts.

- Loyal Customer Base: Benefits from repeat purchases.

Jamieson Wellness's cash cows, such as VMS and Smart Solutions, generate consistent revenue with minimal investment. These brands hold stable market shares, particularly in Canada. Despite moderate growth, they require targeted marketing, supported by loyal customer bases.

| Brand | Market | 2024 Revenue (CAD) |

|---|---|---|

| VMS | Canada | Strong |

| Smart Solutions | Canada | Strong |

| Iron Vegan | Canada | Stable |

Dogs

The Strategic Partners segment, a Dog in Jamieson Wellness's BCG Matrix, saw revenue declines as specific customer contracts ended. These contracts, no longer contributing significantly, demand resources for management. In Q3 2024, the company noted the completion of strategic partner contracts. For example, in 2024, the company's revenue was $365 million.

Precision Sports Supplements, a part of Jamieson Wellness' sports nutrition, could be a 'Dog' due to low market share in a slow-growth area. In 2024, the global sports nutrition market was valued at approximately $45 billion. The brand might find it hard to compete with stronger market players. Careful assessment is needed to decide on continued investment or selling off.

Niche international markets with low penetration and brand recognition present challenges for Jamieson Wellness. These markets demand substantial investment in brand building and distribution. For example, in 2024, Jamieson's expansion into Southeast Asia showed slow growth. Returns may be limited, potentially leading to divestiture or strategic shifts. In 2024, the company allocated $5 million to marketing in these regions.

Over-the-Counter Remedies (Select Products)

Some of Jamieson Wellness's OTC remedies could be "Dogs" if they struggle against generics and offer limited growth. These products may not contribute significantly to revenue and demand ongoing resource allocation. A detailed evaluation of their profitability and market potential is essential. In 2024, the OTC market saw increased competition. The company must assess these products' performance.

- Market competition from generic brands poses a significant challenge.

- Limited growth prospects may indicate a need for strategic adjustments.

- Reviewing profitability is crucial for efficient resource allocation.

- A detailed market analysis is necessary to determine the best course of action.

Lorna Vanderhaeghe Health Solutions Inc (LVHS)

Lorna Vanderhaeghe Health Solutions Inc. (LVHS) is a key brand for Jamieson Wellness, specializing in women's natural health products. Acquired in 2014, LVHS maintains a strong market presence. It holds a significant 26% share of retail dollars compared to the top competitors, demonstrating its market leadership. LVHS focuses on women's health, offering products for hormone balance, skin health, weight management, and nutritional support.

- Market Share: LVHS holds 26% of retail dollars among its top competitors.

- Acquisition Year: Jamieson acquired LVHS in 2014.

- Product Focus: Women's health, including hormone, skin, and weight management.

- Brand Positioning: Top women's natural health brand in Canada.

Strategic Partners, Precision Sports Supplements, niche international markets, and some OTC remedies may be "Dogs." These areas face declining revenues, low market share, and slow growth. For instance, in 2024, $5 million was allocated for niche market marketing. Careful evaluation and strategic shifts are necessary.

| Category | Description | 2024 Data |

|---|---|---|

| Strategic Partners | Ending contracts, resource-intensive management. | Revenue decline noted. |

| Precision Sports | Low market share, slow growth sports nutrition. | Global sports nutrition market ~$45B. |

| Niche International | Low brand recognition, slow expansion. | $5M marketing allocation. |

| OTC Remedies | Competition, limited growth potential. | Increased competition. |

Question Marks

Jamieson's GLP-1 support products are question marks. They're in a growing, uncertain market. Success hinges on consumer adoption and market trends. Marketing and distribution require significant investment. In 2024, the GLP-1 market is projected to reach $1.5 billion.

International expansion for Jamieson Wellness is a question mark because of the high investment and unpredictable returns. Success requires adapting to local markets and consumer preferences. Market research and strategic partnerships are key. In 2024, expanding into new markets could involve significant upfront costs, potentially impacting short-term profits. For instance, marketing expenses in a new region could be around $500,000.

Jamieson Wellness's foray into personalized nutrition and cognitive health represents a question mark, aligning with emerging health trends. These innovative product lines demand substantial investment in R&D and marketing. Their market success hinges on consumer adoption and competitive positioning. In 2024, the global personalized nutrition market was valued at $12.5 billion, highlighting the opportunity.

Probiotics (Specific Formulations)

Specific probiotic formulations, such as those aimed at digestive aging or mental wellness, are question marks in Jamieson Wellness's BCG matrix. These niche products need scientific backing and focused marketing efforts. The probiotics market was valued at $54.6 billion in 2023, indicating substantial growth potential. Success hinges on proving effectiveness and capturing market share.

- Market size in 2023: $54.6 billion.

- Need for scientific validation and targeted marketing.

- Focus on niche health needs.

- Success depends on efficacy and market share capture.

Plant-Based Innovations

Further innovations in plant-based supplements, beyond Jamieson's Iron Vegan brand, are a question mark. These products address the increasing consumer demand for plant-based options. Success hinges on effectively differentiating these products in a competitive market. Targeted marketing towards health-conscious and environmentally aware consumers is crucial. In 2024, Jamieson Wellness reported strong sales, indicating potential for growth in this area [2, 3].

- Focus on plant-based supplement innovation.

- Address the growing consumer demand.

- Differentiation is key to success.

- Target health-conscious consumers.

Jamieson's plant-based supplements are question marks, aiming at the growing market. Success needs product differentiation and marketing efforts to appeal to health-conscious consumers. The plant-based market is competitive.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Focus | Plant-based supplements | Strong Sales Reported |

| Consumer Base | Health-conscious consumers | Increasing Demand |

| Challenge | Product Differentiation | Competitive Market |

BCG Matrix Data Sources

Jamieson's BCG Matrix is fueled by company financials, market data, consumer trends, and competitor analysis for precise strategic insights.