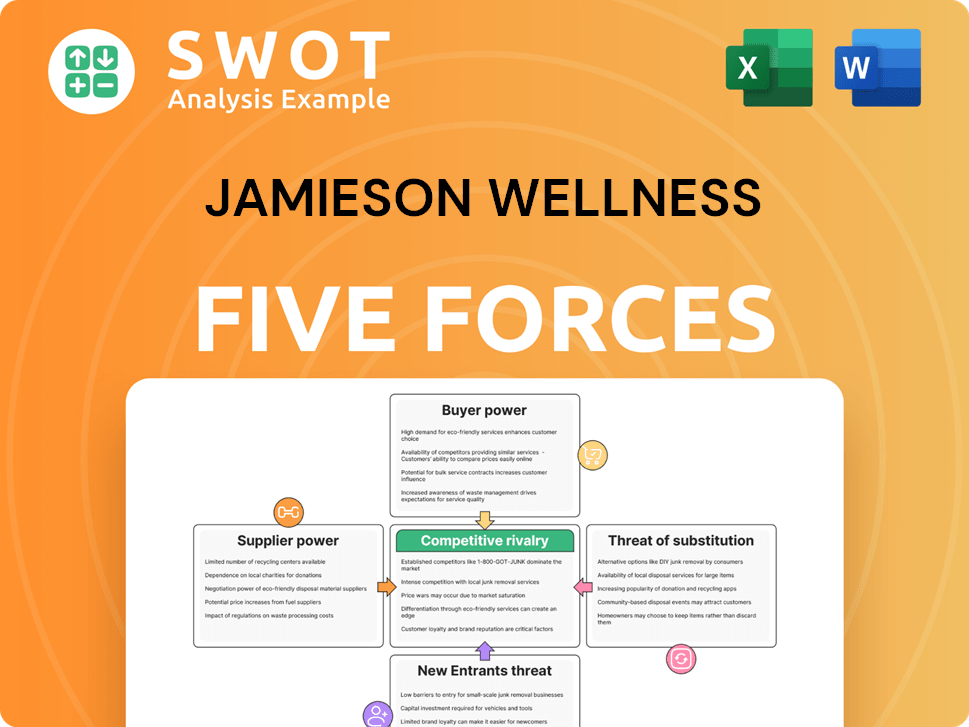

Jamieson Wellness Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jamieson Wellness Bundle

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the specific company.

Instantly assess Jamieson's competitive forces with a dynamic, interactive visual.

Preview Before You Purchase

Jamieson Wellness Porter's Five Forces Analysis

This preview reveals the complete Jamieson Wellness Porter's Five Forces Analysis. You'll gain instant access to this same, fully realized document upon purchase. It includes a comprehensive assessment of the company's competitive landscape. The analysis is professionally formatted and ready for immediate application.

Porter's Five Forces Analysis Template

Jamieson Wellness faces moderate rivalry in the competitive vitamins and supplements market. Buyer power is somewhat concentrated, influencing pricing and product offerings. The threat of new entrants is moderate due to brand loyalty and regulatory hurdles. Substitute products, like functional foods, pose a notable challenge. Supplier power is relatively low, with diversified ingredient sourcing.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Jamieson Wellness’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier power for Jamieson Wellness is moderate because of the diverse supplier base. The company sources inputs like raw materials and packaging from many suppliers. A 2024 report showed that diversified sourcing helps manage costs. This reduces supplier concentration risk, giving Jamieson more negotiating leverage.

The availability of substitute raw materials impacts supplier power. If Jamieson Wellness can switch suppliers easily, their negotiation power increases. Consider the uniqueness of resources supplied. In 2024, Jamieson Wellness's revenue was $466.8 million, showing its scale. This impacts its ability to negotiate.

Switching costs significantly influence supplier power for Jamieson Wellness. If Jamieson Wellness faces high switching costs, perhaps due to specialized ingredients or long-term agreements, suppliers gain leverage. Conversely, if Jamieson Wellness can easily switch suppliers, it gains negotiating power. For instance, in 2024, ingredient costs accounted for about 30% of revenue, demonstrating the impact of supplier pricing on profitability.

Supplier Forward Integration

Supplier forward integration, or their ability to become direct competitors, significantly impacts their bargaining power. This happens when suppliers can potentially control more of the value chain. Assessing the ease and likelihood of this integration is vital for understanding the power dynamics. For example, in 2024, the cost of establishing a new manufacturing facility varies greatly, affecting the feasibility of forward integration.

- Forward integration can lead to suppliers controlling the distribution of their products.

- High switching costs for buyers can increase supplier power, making forward integration a strategic move.

- If suppliers can create their own brand, they increase their control and bargaining power.

- The threat of forward integration is amplified when suppliers have excess capacity.

Impact of Inputs on Quality

The quality of raw materials profoundly impacts Jamieson Wellness's product quality. If input quality is critical, suppliers gain leverage. High standards may mean relying on specific, powerful suppliers. This reliance can affect costs and production. Consider the sourcing of ingredients; 2024 data shows a 5% rise in essential vitamin prices, impacting supplier dynamics.

- Ingredient quality directly affects product efficacy and safety.

- Specialized ingredients from a few sources increase supplier power.

- Price fluctuations in key materials can squeeze margins.

- Supplier reliability is vital for consistent product quality.

Jamieson Wellness's supplier power is moderate due to varied factors. Diversified sourcing and the availability of substitutes weaken supplier control. However, switching costs and ingredient quality can affect leverage.

Supplier forward integration risk must be assessed. In 2024, ingredient costs were about 30% of revenue. The ability to switch and the criticality of the input significantly influence bargaining power.

High-quality ingredients and reliable suppliers are essential. In 2024, vitamin prices increased by 5%. This data highlights how supplier dynamics affect Jamieson Wellness's profitability and operations.

| Factor | Impact on Supplier Power | 2024 Data/Insight |

|---|---|---|

| Supplier Diversity | Reduces supplier power | Diversified sourcing helps manage costs |

| Switching Costs | Increases supplier power (high) | Ingredient costs approx. 30% of revenue |

| Ingredient Quality | Increases supplier power (critical) | Vitamin prices rose by 5% |

Customers Bargaining Power

Buyer volume significantly impacts Jamieson Wellness. Large buyers can pressure for lower prices or better terms. Consider the concentration of buyers and their purchasing power. In 2024, Jamieson's key customers, like major retailers, could influence profit margins. Assessing their volume is crucial for strategic decisions.

Price sensitivity significantly shapes Jamieson Wellness's customer bargaining power. Highly price-sensitive customers readily switch, boosting their leverage. Factors like product differentiation and brand loyalty heavily influence this sensitivity. In 2024, the vitamin and supplement market saw increased price competition. Jamieson's brand strength helps mitigate this.

Switching costs are a crucial factor in customer bargaining power. If consumers face low switching costs, they can easily switch to competitors, increasing their power. However, high switching costs, perhaps due to brand loyalty or product differentiation, decrease buyer power. For example, in 2024, Jamieson Wellness's strong brand reputation and product quality may create higher switching costs for customers, reducing their power.

Availability of Information

Customers' access to information significantly shapes their bargaining power, especially for products like health supplements. Increased information access allows buyers to compare prices and product details, enhancing their ability to make informed choices. This transparency in pricing and specifications strengthens customer power, as seen in the competitive supplement market. Data from 2024 indicates that online supplement sales are up 15% compared to the previous year, highlighting the impact of readily available information on consumer behavior.

- Online reviews and ratings significantly influence purchasing decisions.

- Price comparison websites enable easy comparison of product costs.

- Detailed product specifications are readily available online.

- Consumers can quickly identify and avoid overpriced products.

Customer Backward Integration

Customer backward integration refers to their ability to produce a company's products themselves. If customers can easily manufacture their own vitamins and supplements, their bargaining power rises significantly. This is less common with individual consumers but is a potential threat from large retailers. In 2024, the global dietary supplements market was valued at approximately $160 billion, demonstrating the scale of consumer spending.

- Large retailers like Walmart and Amazon could theoretically develop their own supplement brands, increasing their leverage.

- The complexity of supplement manufacturing, including regulatory hurdles and specialized equipment, somewhat limits this threat.

- Jamieson Wellness's brand reputation and product quality offer a degree of protection against backward integration.

- However, the increasing trend of private-label brands poses a continuous challenge.

Buyer power significantly influences Jamieson Wellness. Key retailers' volume impacts pricing and margins, crucial in 2024. Price sensitivity and switching costs also shape this power, especially given increased market competition.

Customer access to information, including online reviews and price comparisons, strengthens their position. Backward integration poses a threat, with large retailers potentially developing their brands. In 2024, the global supplements market was valued at $160B.

| Factor | Impact | 2024 Data |

|---|---|---|

| Buyer Volume | Affects pricing power | Retailer concentration |

| Price Sensitivity | Influences switching | Vitamin market competition |

| Switching Costs | Determines ease of change | Brand reputation |

Rivalry Among Competitors

Jamieson Wellness faces a competitive landscape with many supplement brands vying for market share. This high number intensifies rivalry, potentially leading to price wars and reduced profit margins. In 2024, the Canadian vitamin and supplement market showed over 500 competitors. Consolidation, such as mergers, could ease this rivalry.

The industry growth rate significantly influences competitive rivalry. Slow growth often leads to fierce battles for market share, intensifying competition among existing players. Conversely, rapid expansion can ease rivalry, as there's ample demand for everyone. For example, the global nutraceuticals market, where Jamieson operates, is projected to reach $713.5 billion by 2027, with a CAGR of 8.3% from 2020 to 2027, indicating substantial growth. This robust growth may help ease rivalry.

Jamieson Wellness faces moderate product differentiation. Many supplement products offer similar vitamins and minerals, making it easy for consumers to switch. However, Jamieson differentiates through branding and formulations. In 2024, the global vitamins and supplements market was valued at $163.9 billion, showing the broad competition. Strong branding helps Jamieson compete.

Switching Costs

Switching costs significantly influence competitive rivalry in the wellness industry. When customers face high switching costs to change brands, rivalry decreases because they are less likely to switch. Conversely, low switching costs intensify rivalry, making it easier for customers to choose competitors. In 2024, the average customer acquisition cost in the nutraceuticals market was approximately $25-$75, indicating moderate switching costs.

- High switching costs decrease rivalry.

- Low switching costs increase rivalry.

- Customer acquisition costs impact switching.

- 2024 average customer acquisition cost: $25-$75.

Exit Barriers

Exit barriers in the wellness market can significantly affect competitive rivalry. High barriers, such as specialized manufacturing equipment, keep companies in the game even with poor profits. Conversely, low exit barriers, like easily transferable assets, let firms leave, easing competition. For Jamieson Wellness, these barriers include brand reputation and consumer loyalty, making exits less likely. In 2024, the global wellness market was valued at over $7 trillion, showing the stakes are high.

- High Exit Barriers: Specialized manufacturing, brand loyalty.

- Low Exit Barriers: Easily transferable assets, generic products.

- Market Context: $7+ trillion global wellness market in 2024.

- Impact: Affects rivalry intensity and profitability.

Competitive rivalry for Jamieson Wellness is intense due to many supplement brands. Rapid market growth, projected at 8.3% CAGR to 2027, somewhat eases competition. Moderate product differentiation and switching costs also shape the competitive landscape. In 2024, the global supplements market was valued at $163.9B.

| Factor | Impact on Rivalry | 2024 Data/Context |

|---|---|---|

| Number of Competitors | High number increases rivalry | Over 500 competitors in the Canadian market. |

| Industry Growth | High growth eases rivalry | Nutraceuticals market projected to $713.5B by 2027. |

| Product Differentiation | Low diff. increases rivalry | Global vitamins/supplements market: $163.9B. |

SSubstitutes Threaten

The availability of substitutes significantly impacts Jamieson Wellness. Functional drinks and personalized dietary plans serve as alternatives. This limits Jamieson's pricing power. In 2024, the global dietary supplements market was valued at approximately $160 billion, reflecting the ongoing competition and the availability of various substitutes.

The price-performance ratio of substitutes significantly impacts the threat level. If alternatives like generic vitamins offer similar benefits at a lower cost, customers might switch. The perceived value also matters; for example, consumers may favor supplements with proven health benefits. In 2024, the market saw increased demand for cheaper, comparable supplements, highlighting this threat. This trend suggests Jamieson Wellness must carefully manage its pricing to remain competitive.

Switching costs significantly influence the threat of substitutes. If customers face low switching costs, they can easily choose alternatives, heightening the threat. Conversely, high switching costs reduce this threat, as customers are less likely to change. For instance, in 2024, the dietary supplements market saw a rise in generic brands, indicating lower switching costs for consumers. This facilitated a 7% shift towards cheaper substitutes.

Brand Loyalty

Brand loyalty is a crucial factor in assessing the threat of substitutes for Jamieson Wellness. Strong customer loyalty can significantly protect Jamieson Wellness from alternative products. This loyalty is often built through effective marketing strategies and consistent product quality. High brand loyalty means customers are less likely to switch to other brands, even if substitutes are available. For example, in 2024, Jamieson Wellness's brand recognition scores in key markets remained high, indicating sustained customer loyalty.

- Marketing efforts are key to building brand loyalty, with Jamieson Wellness investing significantly in advertising and promotional activities.

- Product quality is a cornerstone, reflected in the company's stringent manufacturing standards and health supplement formulations.

- Customer satisfaction scores, tracked through surveys and feedback mechanisms, show a positive trend, reinforcing brand loyalty.

- Competitive pricing strategies also play a role in retaining customers, especially in a market with numerous supplement alternatives.

Perceived Differentiation

The threat of substitutes for Jamieson Wellness hinges on how customers view product differences. If consumers see little difference between Jamieson's products and alternatives, the threat grows. This perception directly affects market share and pricing power. Innovation and unique product offerings help lessen this threat by creating a distinct advantage.

- In 2024, the global vitamins and supplements market was valued at approximately $160 billion, with continued growth projected.

- Jamieson Wellness's focus on product quality and innovation aims to differentiate its offerings.

- Successful differentiation allows for premium pricing and customer loyalty.

- Conversely, generic or less differentiated products face higher price competition.

The threat of substitutes for Jamieson Wellness depends on consumer perceptions. Functional drinks and personalized dietary plans act as direct alternatives, influencing market dynamics. In 2024, the supplements market saw substantial growth, but faced intense competition. High brand loyalty and product differentiation are key strategies to mitigate this threat.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price-Performance | High impact | Generic vitamins sales up 7% |

| Switching Costs | Moderate | Generic brands increased in popularity |

| Brand Loyalty | Protective | Jamieson brand recognition high |

Entrants Threaten

The threat of new entrants for Jamieson Wellness is moderate, influenced by several barriers. High capital requirements and regulatory hurdles, such as those related to health product approvals, present challenges. Established brand recognition and consumer loyalty also make it difficult for new players to gain market share. For instance, in 2024, the Canadian vitamin and supplement market, where Jamieson operates, saw a 5% increase in sales, indicating existing competition and the need for new entrants to offer strong value propositions.

Starting a wellness business requires significant capital. New entrants face high costs for facilities, marketing, and distribution. Jamieson Wellness, for example, invested heavily in its manufacturing capabilities. In 2024, initial investments can range from $5 million to $50 million or more, discouraging new competitors.

Jamieson Wellness faces regulatory hurdles. Stringent health and safety standards, like those enforced by Health Canada, raise entry costs. New entrants must comply with rigorous testing and approval processes. This can delay market entry significantly. In 2024, compliance costs rose by 7% due to stricter oversight.

Brand Loyalty

Brand loyalty significantly impacts the threat of new entrants. Strong customer loyalty to existing brands, like Jamieson, creates a barrier. Consumers' trust and recognition of established brands can be tough for newcomers to overcome. This loyalty often stems from perceived quality and past positive experiences.

- Jamieson's brand strength is evident in its sustained market presence.

- Customer retention rates are a key indicator of brand loyalty.

- Loyal customers are less price-sensitive.

- New entrants face higher marketing costs to compete.

Access to Distribution Channels

Access to distribution channels significantly impacts the threat of new entrants in the wellness market. New companies face challenges gaining shelf space in established retail outlets. Existing relationships with retailers give companies like Jamieson Wellness a competitive edge. Limited access to these channels can deter new competitors from entering the market effectively.

- Jamieson Wellness products are sold in over 40 countries, indicating a broad distribution network.

- The wellness market is highly competitive, with numerous brands vying for distribution.

- Established brands often have long-term contracts with major retailers.

- New entrants may need to rely on less efficient or more expensive distribution methods.

The threat of new entrants for Jamieson Wellness is moderate. High capital needs and regulatory compliance, such as health product approvals, hinder new firms. Strong brand loyalty and distribution networks also act as barriers to entry, although these can be overcome with robust value propositions.

| Factor | Impact | 2024 Data |

|---|---|---|

| Capital Requirements | High | Initial investment: $5M-$50M+ |

| Regulatory Hurdles | Significant | Compliance costs up 7% |

| Brand Loyalty | High | Retention rates key. |

Porter's Five Forces Analysis Data Sources

This Porter's analysis leverages company reports, industry studies, and market analysis data to gauge competitive forces. SEC filings and economic indicators also inform the study.