John B. Sanfilippo & Son Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

John B. Sanfilippo & Son Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Printable summary optimized for A4 and mobile PDFs, it helps with easy shareability and accessibility.

What You’re Viewing Is Included

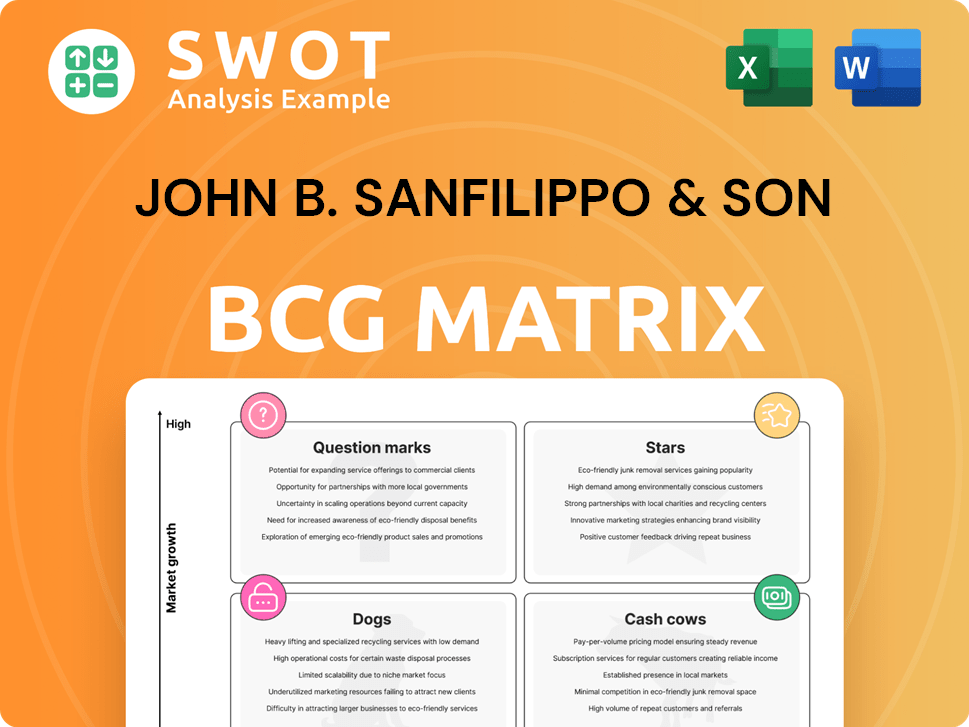

John B. Sanfilippo & Son BCG Matrix

The preview you see is identical to the John B. Sanfilippo & Son BCG Matrix you'll get. Download the complete, ready-to-use document, featuring our strategic analysis, after your purchase.

BCG Matrix Template

John B. Sanfilippo & Son's product portfolio likely includes a mix of market positions. Analyzing its diverse nut offerings through a BCG Matrix helps understand growth potential. Stars shine with high market share; cash cows generate steady profits. Dogs struggle, while question marks need strategic investment. See the whole picture!

Stars

The Lakeville Acquisition, part of John B. Sanfilippo & Son's portfolio, saw net sales jump, with $131 million in fiscal 2024 attributed to it. This acquisition, including a $120 million contribution, is a key growth driver. Operational optimization in Lakeville was completed early, promising a positive fiscal 2025 outlook. This snack bar line diversification has significantly boosted volume, marking it as a star product.

Fisher Recipe Nuts saw a strong Q2 2025, excelling during the holiday season. This success, driven by enhanced merchandising, boosted sales. The brand's strength, backed by a solid branded program, complements private labels well. Fisher Recipe Nuts likely contributes significantly to John B. Sanfilippo & Son's revenue, as it performed well in 2024 as well.

The consumer distribution channel showed robust growth, with its strongest quarterly sales volume increase in eight quarters, excluding the Lakeville Acquisition, during Q1 2025. This trend highlights effective strategic pricing initiatives. The consumer channel is a star, significantly boosting overall sales and revenue. In Q1 2024, net sales were $368.9 million, up 12.4% YoY.

Private Brand Growth

Private brand sales are shining as a "Star" in John B. Sanfilippo & Son's portfolio. In Q2 2025, private brand sales volume grew by 4%, fueled by a 27.6% surge in bars volume. This impressive growth highlights the segment's strong performance and reliability. The consistent sales growth solidifies its position as a key revenue contributor.

- Q2 2025 private brand sales volume increased by 4%.

- Bars volume grew by 27.6% in Q2 2025.

- Private brands provide a stable revenue stream.

- Mass merchandising retailer returned to normalized inventory levels.

Strategic Pricing Actions

John B. Sanfilippo & Son (JBSS) has strategically adjusted pricing to navigate market challenges. These actions aim to boost performance in the consumer distribution channel. Price hikes in early 2025 show a commitment to protecting margins. This reinforces JBSS as a leading performer.

- Q1 2024 net sales increased by 1.9% to $356.4 million.

- Gross profit margin increased to 20.1% in Q1 2024, up from 17.7% the previous year.

- JBSS's focus on pricing helped maintain profitability despite cost pressures.

- The company's strategic pricing is designed to manage commodity price volatility.

John B. Sanfilippo & Son's Stars include Lakeville Acquisition, Fisher Recipe Nuts, consumer distribution, and private brands. These segments show high growth and market share. Private brands like nuts and bars drive significant revenue. Strategic pricing maintains profitability, with Q1 2024 net sales at $356.4 million.

| Star Product | Key Metric | Performance |

|---|---|---|

| Lakeville Acquisition | Fiscal 2024 Sales | $131 million |

| Fisher Recipe Nuts | Q2 2025 Sales | Strong Holiday Season |

| Consumer Channel | Q1 2025 Sales Increase | Strongest in 8 Quarters |

| Private Brands | Q2 2025 Bars Volume Growth | 27.6% |

Cash Cows

Fisher snack nuts, a brand of John B. Sanfilippo & Son, are a classic example of a Cash Cow. The brand has a long history, strong recognition, and a loyal customer base. Despite a mature market, Fisher maintains a solid market share. In fiscal year 2024, John B. Sanfilippo & Son reported net sales of $1.26 billion, with snack nuts contributing significantly to this revenue stream.

Almonds are a significant revenue source for John B. Sanfilippo & Son. In fiscal year 2024, JBSS reported that its nut and dried fruit sales reached $1.2 billion, with almonds forming a large part of this. Despite market shifts, almonds remain essential. Their stability and broad consumer base classify them as a cash cow, requiring less promotional investment.

Pecans are a core offering, especially in mixes. They hold a strong market share, ensuring steady demand. This consistent presence makes them a cash cow. In 2024, John B. Sanfilippo & Son reported robust sales in their nut segment, highlighting the reliability of products like pecans. They generate revenue with minimal marketing.

Walnuts

Walnuts, a core nut product like pecans and almonds, enjoy consistent demand. They're used in recipes, snack mixes, and ingredient sales. This established market position ensures steady sales, classifying walnuts as a cash cow. In 2024, John B. Sanfilippo & Son's net sales reached $1.26 billion, indicating strong performance.

- Consistent demand drives stable income.

- Used in various applications.

- Sales contribute to the company's revenue.

- Part of the company's strong financial performance.

Contract Manufacturing Channel

The contract manufacturing channel for John B. Sanfilippo & Son (JBSS) is a cash cow, generating consistent revenue by producing nut-based products for other brands. This channel leverages existing production capabilities and established customer relationships. JBSS benefits from steady production contracts with minimal marketing expenses, contributing positively to its financial performance. In fiscal year 2024, contract manufacturing accounted for a significant portion of JBSS's revenue, showcasing its importance.

- Steady Revenue Stream: Contract manufacturing provides a reliable source of income.

- Low Investment: Requires minimal marketing and sales efforts.

- Established Relationships: Benefits from long-term production agreements.

- Financial Contribution: Supports JBSS's overall profitability.

Cash Cows like Fisher snack nuts, almonds, pecans, walnuts, and contract manufacturing, provide steady revenue for John B. Sanfilippo & Son. These offerings require less investment due to established market positions. They consistently contribute to the company's strong financial results, like the $1.26 billion in net sales reported in fiscal year 2024.

| Product | Market Position | Financial Contribution (2024) |

|---|---|---|

| Fisher Snacks | Established | Significant |

| Almonds | Strong | Part of $1.2B Nut Sales |

| Pecans | Consistent | Reliable Sales |

| Walnuts | Stable | Revenue Generation |

| Contract Manufacturing | Steady | Significant Revenue |

Dogs

Southern Style Nuts, part of John B. Sanfilippo & Son's portfolio, might face challenges due to regional focus. In 2024, JBSS reported net sales of $1.2 billion, but Southern Style Nuts' contribution is likely small. Facing big competitors, its growth potential and market share may be limited, making it a potential dog.

Just the Cheese, a dried cheese snack, likely struggles in JBSS's portfolio. The snack sector is fiercely competitive, making market share gains tough. With limited synergy and potential for low growth, it fits the dog category. In 2024, JBSS's net sales were $1.27 billion, highlighting the need for strategic focus.

John B. Sanfilippo & Son (JBSS) likely has some unspecified dried fruit products that fit the "Dogs" category within its BCG matrix. These products, with low sales and limited growth, contribute minimally to revenue. In 2024, JBSS's net sales reached $1.28 billion, but specific dried fruit performance details are not available. Turnaround strategies are often ineffective for these.

Commodities Facing Competitive Pricing Pressures

Certain nut commodities within John B. Sanfilippo & Son's portfolio may be classified as dogs due to competitive pricing pressures and decreased sales. These commodities might struggle with profitability, potentially necessitating costly turnaround strategies. For example, in fiscal year 2024, the company's net sales decreased by 7.9% compared to the prior year, indicating challenges in maintaining sales volume. Such commodities should be avoided and minimized to improve overall financial performance.

- Competitive pricing pressures and reduced sales volume indicate a dog status.

- These commodities may struggle with profitability.

- Costly turnaround plans may not yield significant improvements.

- Minimize or avoid these commodities.

Products with High Commodity Acquisition Costs

Products with high commodity acquisition costs that struggle to increase prices are often classified as dogs. These products can significantly impact profitability, especially in volatile markets. For instance, in 2024, John B. Sanfilippo & Son faced challenges with certain nut varieties due to fluctuating global prices. Companies typically divest these underperforming products to reallocate resources more effectively.

- High commodity costs can erode profit margins quickly.

- Market volatility intensifies the financial risks associated with these products.

- Divestment allows for focus on more profitable segments.

- Cost-cutting measures are often insufficient to salvage these products.

Dogs in John B. Sanfilippo & Son's (JBSS) portfolio include products with low growth and market share, often facing fierce competition. These products, such as Southern Style Nuts and Just the Cheese, contribute minimally to revenue and are challenging to improve. In fiscal year 2024, JBSS experienced a 7.9% decrease in net sales, highlighting the need to eliminate underperforming items.

| Product Category | Status | Key Issues |

|---|---|---|

| Southern Style Nuts | Dog | Regional focus, competition |

| Just the Cheese | Dog | Competitive snack market |

| Unspecified Dried Fruit | Dog | Low sales, limited growth |

Question Marks

New snack bar innovations and product extensions are classified as question marks within John B. Sanfilippo & Son's BCG Matrix. These products, despite a low market share, show high growth potential, aligning with the company's strategic goals. The primary marketing strategy focuses on driving market adoption of these innovative snack bars. In 2024, the snack bar market is estimated to be worth billions, with a growth rate of 5-7% annually.

John B. Sanfilippo & Son's (JBSS) e-commerce initiatives are a question mark within its BCG matrix. E-commerce provides growth potential, but JBSS's current online market share might be modest. In fiscal year 2024, JBSS reported a 7.6% increase in net sales, highlighting the need for online sales growth. These initiatives must rapidly increase market share or risk becoming a "dog".

John B. Sanfilippo & Son (JBSS) has specialty nut butters like almond and cashew. The market is growing, but JBSS's market share may be low versus peanut butter. To succeed, JBSS must rapidly grow market share. If unsuccessful, these products risk becoming "dogs." In 2024, the nut butter market was valued at over $3 billion, with almond butter showing strong growth.

Organic Nut and Dried Fruit Products

JBSS's organic nut and dried fruit products are question marks in the BCG matrix. The organic food market is expanding, presenting a growth opportunity. However, JBSS might have a small market share in this segment, impacting profitability. These products likely face high demand but potentially low returns due to the market position.

- Market growth in organic food is around 8-10% annually.

- JBSS's organic product sales are a smaller portion of overall revenue.

- Profit margins for organic products can be volatile.

- Investment in marketing and distribution is key.

International Market Expansion

JBSS's international market expansion is a question mark in the BCG Matrix. These markets offer growth potential, but JBSS's current market share may be low. The company must decide whether to invest in these markets for growth or consider divesting. This strategic decision requires careful analysis of market conditions and resource allocation.

- Low market share in international markets.

- High growth potential in these regions.

- Requires strategic investment or divestiture decisions.

- Need for market and resource analysis.

Question marks represent JBSS's new ventures like snack bars. They have high growth potential but low market share initially. JBSS aims to boost these offerings via marketing and strategic investments. Success hinges on capturing market share in growing segments.

| Category | Details | 2024 Data Points |

|---|---|---|

| Snack Bars | New product extensions | Market: $2.5B+, Growth: 6% |

| E-commerce | Online sales initiatives | JBSS Sales Increase: 7.6% |

| Nut Butters | Specialty products | Market: $3B+, Almond growth: strong |

| Organic Products | Nut and Dried Fruit | Market Growth: 9%, Sales Portion: small |

| International Expansion | Global market entry | Market share: low, Growth potential: high |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive sources: company financial statements, industry reports, market research, and sales data.