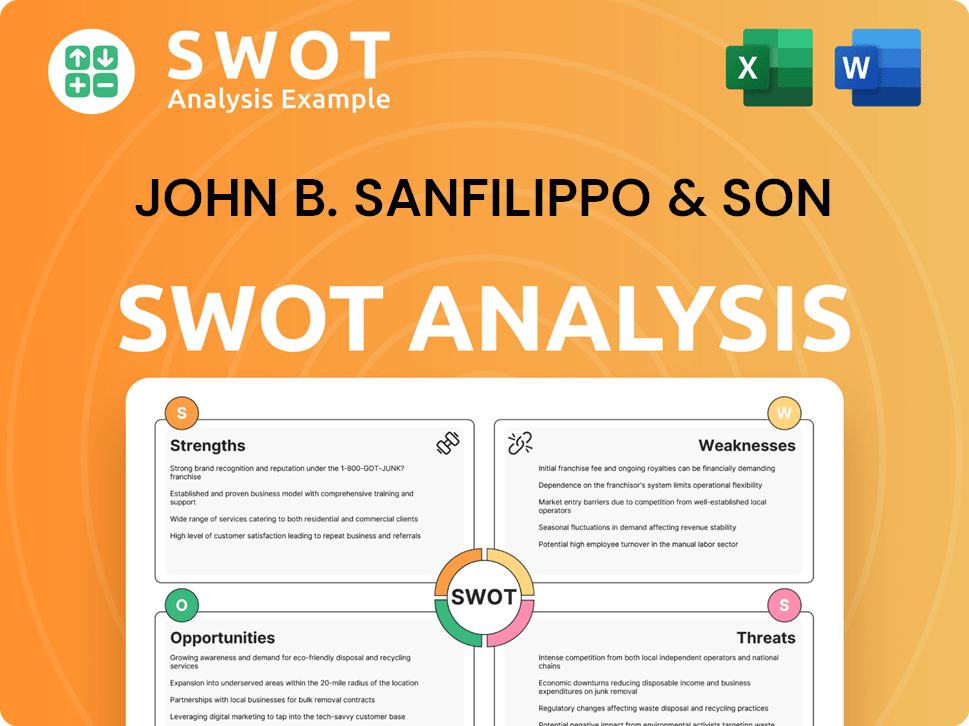

John B. Sanfilippo & Son SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

John B. Sanfilippo & Son Bundle

What is included in the product

Identifies key growth drivers and weaknesses for John B. Sanfilippo & Son

Simplifies complex SWOT analysis with a focused, accessible format.

Same Document Delivered

John B. Sanfilippo & Son SWOT Analysis

Take a look at this preview, it's the actual SWOT analysis document you'll get.

The full John B. Sanfilippo & Son report awaits! Purchase it to access all details.

No need to guess! The download delivers this exact, comprehensive SWOT report.

This detailed file is ready for you after completing your purchase.

SWOT Analysis Template

John B. Sanfilippo & Son faces unique challenges. We've examined its strengths, from brand recognition to diverse product lines. We've also identified weaknesses like supply chain vulnerabilities. Threats include volatile nut prices and intense competition. However, opportunities abound for expansion. Want the full story? Purchase the complete SWOT analysis. It offers in-depth insights.

Strengths

John B. Sanfilippo & Son (JBSS) holds a prominent position in the U.S. nut market, leveraging brands like Fisher. In 2024, JBSS reported net sales of approximately $1.2 billion. This market leadership provides a foundation for growth.

John B. Sanfilippo & Son (JBSS) boasts a diverse product portfolio. Beyond nuts, they offer snack bars and dried fruit. This diversification provides multiple revenue streams. In fiscal year 2024, net sales reached $1.22 billion, reflecting varied product contributions.

John B. Sanfilippo & Son's integrated operations, particularly for nuts such as pecans, peanuts, and walnuts, provide a significant strength. This vertical integration, encompassing procurement, shelling, processing, packaging, and marketing, allows for greater control over the value chain. In fiscal year 2024, net sales reached $1.1 billion, demonstrating the scale of their operations. This model contributes to cost efficiencies and ensures consistent product quality, key factors in maintaining a competitive edge.

Multiple Distribution Channels

John B. Sanfilippo & Son (JBSS) boasts multiple distribution channels, enhancing its market presence. This strength allows JBSS to reach diverse customer segments effectively. In fiscal year 2024, JBSS reported net sales of approximately $1.2 billion, demonstrating the success of its distribution strategy. Diversified channels help mitigate risks associated with reliance on a single outlet.

- Supermarkets, mass merchandisers, and club stores are key channels.

- JBSS also utilizes convenience stores, drug stores, and e-commerce.

- This multi-channel approach boosts market penetration.

- Broad distribution supports strong sales figures.

Focus on Private Brands

John B. Sanfilippo & Son's focus on private brands is a key strength, providing a solid foundation for revenue. This strategy allows the company to partner with retailers, meeting the growing demand for store-branded products. In 2024, private label sales accounted for a substantial percentage of their total revenue, showcasing its importance. This approach also offers diversification and shields the company from market fluctuations affecting specific branded products.

- Private label sales contribute significantly to overall revenue.

- Partnerships with retailers strengthen market presence.

- Diversification reduces risk from brand-specific issues.

- Stable revenue stream supports long-term financial health.

JBSS's strong brand recognition in the nut market, highlighted by the Fisher brand, supports robust sales. Their reported net sales in 2024 reached roughly $1.2 billion, demonstrating their market dominance.

JBSS offers a wide range of products including snacks. Diversification drives multiple revenue streams; in 2024, net sales hit $1.22 billion, showing varied contributions.

Vertical integration for nuts like pecans and peanuts improves cost controls and quality. This allows greater control over the value chain. Sales in 2024 reached $1.1 billion reflecting the impact.

JBSS employs various distribution channels. Multi-channel presence is strong, including supermarkets, convenience, and e-commerce. Approximately $1.2B in 2024 in net sales, illustrating the effectiveness.

Private brand focus is a major strength supporting income. Partnerships with retailers fuel their sales. Private label made a huge contribution, and revenue has shown stability.

| Strength | Details | 2024 Sales (Approx.) |

|---|---|---|

| Brand Recognition | Strong brand with market-leading presence. | $1.2 Billion |

| Product Diversification | Wide variety of products, including snacks. | $1.22 Billion |

| Vertical Integration | Control from sourcing to packaging, with costs. | $1.1 Billion |

| Distribution Channels | Multi-channel approach across various outlets. | $1.2 Billion |

| Private Brands | Retail partnerships for consistent revenue. | Significant % of total revenue |

Weaknesses

John B. Sanfilippo & Son faces a notable weakness: dependence on key customers. A considerable part of its sales is tied to a few major retailers. For instance, in fiscal year 2024, the top three customers accounted for over 40% of net sales. This concentration creates vulnerability.

John B. Sanfilippo & Son faces vulnerability because the cost of raw nuts and dried fruit fluctuates. Climate change and reliance on specific growing regions drive this volatility. For example, in Q1 2024, the company reported a decrease in gross profit margin, partly due to higher input costs. These fluctuations can significantly impact the company's cost of goods sold and overall profitability.

John B. Sanfilippo & Son faces a competitive nut and snack market. The industry includes many players, from local to global, some bigger and better-resourced. Competition is strong on pricing, brand awareness, and product innovation. In 2024, the snack food market was valued at approximately $480 billion globally.

Impact of Inflation on Consumer Demand

Inflation poses a significant challenge, potentially curbing consumer demand for John B. Sanfilippo & Son's products. Higher retail prices for food, including snacks, could prompt consumers to reduce purchases, opt for cheaper options, or switch to value-driven retailers. This shift could directly affect the company's sales volume and overall revenue. In 2024, food inflation rose, impacting consumer spending habits.

- Food prices rose 2.2% in April 2024.

- Consumers are increasingly price-sensitive.

- Value brands are gaining market share.

Potential Supply Chain Disruptions

John B. Sanfilippo & Son faces supply chain vulnerabilities. Disruptions, like those in 2022 and early 2023, can impact ingredient availability and raise costs. Shipping and packaging expenses are key concerns, as seen with rising inflation. Global instability further intensifies these risks.

- Shipping costs rose significantly in 2022, impacting margins.

- Ingredient shortages, particularly for certain nuts, have occurred.

- Packaging price increases added to operational expenses.

John B. Sanfilippo & Son is weakened by high customer concentration, with major retailers driving sales. This creates reliance and market sensitivity, as shown in 2024. Raw material cost volatility further impacts margins, demonstrated by fluctuations in 2024's Q1 gross profit.

| Weakness | Impact | Data (2024) |

|---|---|---|

| Customer Concentration | Vulnerability to Retailers | Top 3 customers = 40%+ sales |

| Raw Material Cost Volatility | Margin Pressure | Q1 Gross Margin Decline |

| Competition | Pricing and Innovation Pressure | Snack Food Market $480B |

Opportunities

The snacking market is booming, with projections estimating it to reach $834 billion by 2025. This growth is fueled by consumer demand for convenient and healthy options. John B. Sanfilippo & Son can capitalize on this, especially with plant-based protein products, as the plant-based food market is expected to hit $36.3 billion by 2029.

John B. Sanfilippo & Son expanded in the snack and nutrition bar market. The 2023 acquisition of snack bar assets from TreeHouse Foods helped diversify their offerings. This move aimed to boost net sales within this growing segment. For fiscal year 2024, the company reported $17.8 million in net sales from the snack bar business.

John B. Sanfilippo & Son (JBSS) plans major investments in domestic production by late fiscal 2026. This expansion aims to boost capacity and streamline operations. In Q1 2024, net sales rose to $271.9 million, showing growth potential. These investments should improve efficiency and support long-term market gains. This strategic move aligns with the company's growth objectives.

Innovation and New Product Development

John B. Sanfilippo & Son (JBSS) can capitalize on innovation and new product development to boost growth. Expanding product lines and exploring new channels, like online retail, can attract new customers. In fiscal year 2024, JBSS's net sales reached $1.28 billion, showing the importance of sales growth. New products and channels could further increase this figure.

- Product innovation can meet changing consumer preferences.

- Exploring e-commerce and other channels can increase sales.

- JBSS needs to invest in R&D for new product success.

Leveraging E-commerce Platforms

E-commerce platforms remain a key opportunity for John B. Sanfilippo & Son, even as growth normalizes. Online sales provide access to a broader consumer base. In 2024, e-commerce accounted for roughly 15% of the company's total revenue. This channel is essential for meeting evolving consumer shopping preferences.

- Online sales growth, though slowing, still offers expansion potential.

- E-commerce caters to the increasing number of online shoppers.

- Approximately 15% of revenue derived from online sales in 2024.

John B. Sanfilippo & Son (JBSS) has significant opportunities for growth in the thriving snacking market, projected to reach $834 billion by 2025. The expansion into the snack and nutrition bar market, coupled with the 2023 acquisition, presents diverse sales boosts. Innovation and e-commerce are key drivers.

| Area | Details | Data (2024) |

|---|---|---|

| Market Growth | Snacking Market | $834B by 2025 |

| E-commerce | % of Revenue | 15% |

| Snack Bar Sales | Net Sales | $17.8M |

Threats

John B. Sanfilippo & Son (JBSS) contends with formidable competition from larger food companies, potentially impacting market share. Retailers' private labels also pose a threat, squeezing profit margins and distribution. For instance, the snack food market is highly competitive, with major players like PepsiCo. In 2024, the private label market share grew to 20% in the US. This intensifies pricing pressures on JBSS's branded products.

Changing consumer tastes and economic shifts pose threats. Inflation and economic uncertainty may cut demand or push consumers to cheaper choices. This can lower sales and profits. For instance, in Q1 2024, consumer spending slowed, impacting discretionary food purchases. The company's Q1 2024 net sales were $336.3 million, a decrease compared to the prior year.

Import tariffs pose a threat by increasing costs for internationally sourced raw materials, impacting supply chain and retail prices. John B. Sanfilippo & Son's reliance on global sourcing makes it vulnerable. In 2024, tariffs on key ingredients could raise expenses by up to 5%. Proactive strategies are essential to counter these financial pressures.

Supply Chain and Transportation Challenges

John B. Sanfilippo & Son faces threats from supply chain and transportation issues. Ongoing disruptions, shortages, and rising costs for ingredients and transport negatively affect operations. In Q2 2024, increased freight costs and ingredient expenses squeezed margins. The company must navigate these challenges to maintain profitability.

- Rising costs for ingredients and transport can squeeze margins.

- Supply chain disruptions can impact operational efficiency.

- The company needs to mitigate these challenges to maintain profitability.

Dependency on a Few Significant Customers

John B. Sanfilippo & Son faces a significant threat due to its dependency on a few key customers. This concentration of sales means that the loss of even one major customer could severely impact revenue and profitability. For instance, in fiscal year 2024, a considerable portion of JBSS's sales came from a limited number of key retailers. This reliance increases the risk from shifts in customer strategies.

- In fiscal year 2024, 3 customers accounted for approximately 40% of net sales.

- This concentration makes JBSS vulnerable to changes in these customers' purchasing decisions.

- Loss of a major customer could lead to significant revenue decline.

JBSS struggles against strong rivals like PepsiCo, impacting its market share, especially with private labels capturing 20% of the U.S. market in 2024, squeezing profits.

Changes in consumer behavior and the economy cause concerns, with inflation potentially reducing demand and affecting sales figures, which were already down in Q1 2024.

Furthermore, rising costs from tariffs on international materials, which could raise expenses up to 5% in 2024, and ongoing supply chain disruptions and transportation issues, further challenge the company's operations.

| Threat | Impact | Data |

|---|---|---|

| Market Competition | Reduced market share, squeezed margins | PepsiCo, 20% private label share (2024) |

| Economic Shifts | Lower sales, reduced profitability | Q1 2024 sales decline |

| Tariffs & Supply Chain | Increased costs, operational inefficiencies | Tariffs: up to 5% expense increase (2024) |

SWOT Analysis Data Sources

The analysis utilizes financial statements, market reports, and expert assessments for a comprehensive view of John B. Sanfilippo & Son's strengths and weaknesses.