Root Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Root Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Identify industry threats with a color-coded threat level for each force, making complexities simple.

Same Document Delivered

Root Porter's Five Forces Analysis

This preview outlines the complete Porter's Five Forces analysis you will receive. The document displayed is the exact, ready-to-use file you'll download instantly after purchase. It provides a comprehensive view of the competitive landscape. You'll gain immediate insights into industry dynamics. This is the final version—fully formatted.

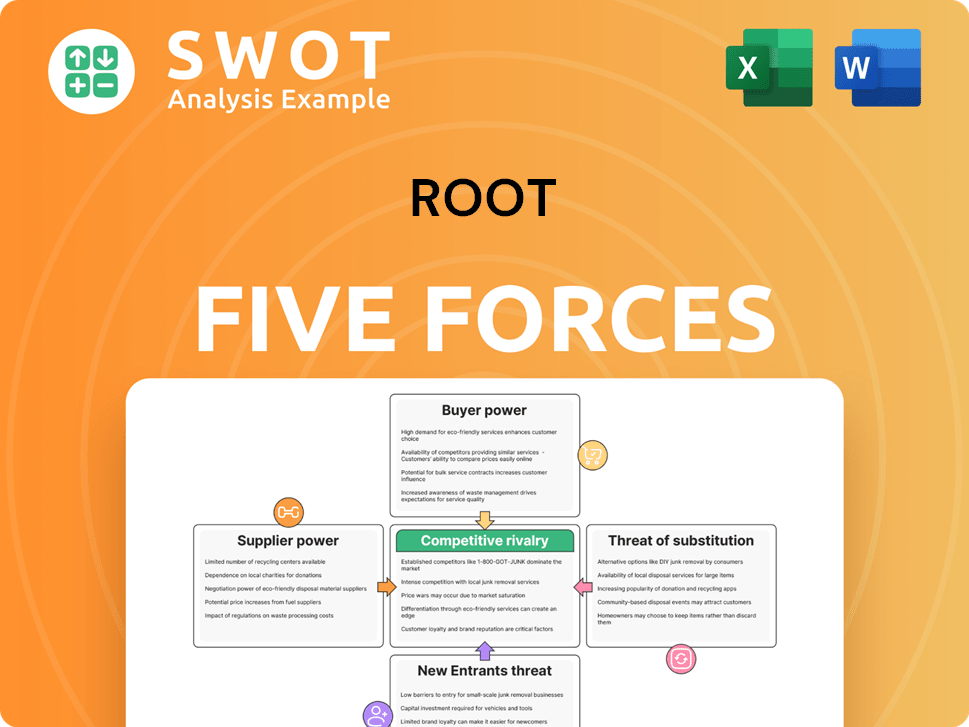

Porter's Five Forces Analysis Template

Root's market position is shaped by five key forces: rivalry among existing competitors, the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, and the threat of substitute products or services. Understanding these forces is critical for strategic planning and investment analysis. These forces determine the profitability and sustainability of Root's business model. Analyzing each force reveals areas of strength and vulnerability. This summary only provides a glimpse.

The complete report reveals the real forces shaping Root’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Root Insurance depends on data and analytics suppliers for telematics and risk assessment. The bargaining power of these suppliers is moderate. Switching providers could cause delays and extra expenses. Root must secure good terms with data providers to ensure pricing accuracy. In 2024, data analytics spending grew by 14% globally, impacting Root's costs.

Cloud computing providers like AWS, Azure, and Google Cloud are key for Root's tech. Switching costs and possible service interruptions grant these suppliers some power. In 2024, the global cloud market is projected to reach $670 billion. Root must negotiate favorable terms to keep costs down and ensure dependable services. This helps Root maintain a competitive edge in the market.

Reinsurance companies hold substantial bargaining power, critical for Root to manage risk. The reinsurance market's cyclical nature impacts Root's profitability, depending on negotiation terms. Diversifying reinsurance partners is vital for Root. In 2024, the reinsurance market's capacity and pricing dynamics influenced Root's financial performance.

Software and App Development Resources

Root Porter's bargaining power of suppliers is influenced by software and app development resources. Maintaining and updating its mobile app needs skilled developers, and their availability and cost fluctuate. Investing in internal capabilities or partnerships can lessen reliance on external developers. The global software development market was valued at $551.92 billion in 2023, expected to reach $621.61 billion by 2024.

- High demand for skilled developers increases supplier power.

- Cost of developers impacts innovation and platform maintenance.

- Internal development or partnerships can mitigate risks.

- Market growth in 2024 indicates increasing supplier influence.

Capital Providers

Root's access to capital, vital for growth, is influenced by supplier power. Securing funds at favorable terms is crucial, especially after achieving its first profitable year in 2024. Strong financial performance and investor relations are key to attracting capital. The cost of capital affects Root's strategic flexibility.

- 2024's profitability is a key factor in appealing to capital providers.

- Root's ability to negotiate terms with lenders and investors is crucial.

- Investor confidence, reflected in stock performance, impacts capital access.

- High-interest rates can increase the cost of capital, affecting Root.

The bargaining power of suppliers significantly affects Root Insurance. Skilled developers and data providers have moderate power due to demand and switching costs. Reinsurers and capital providers also exert influence, impacting Root's costs and strategic options. Diversification and strong financial performance help mitigate supplier power.

| Supplier Type | Impact on Root | 2024 Data Points |

|---|---|---|

| Data/Analytics | Moderate bargaining power; affects pricing accuracy. | Global data analytics spending increased by 14%. |

| Cloud Providers | Moderate power; influences service costs. | Global cloud market projected at $670B. |

| Reinsurers | Significant impact on risk management. | Reinsurance market capacity and pricing changes. |

Customers Bargaining Power

Auto insurance customers often focus on price, treating it like a commodity. Root's use of telematics helps offer competitive rates. Differentiating with great service reduces price sensitivity. In 2024, the average auto insurance cost was around $2,000 annually. Root's focus on usage-based pricing aims to improve its price competitiveness.

Switching costs in the auto insurance industry are low, as it's easy for customers to change providers. This elevates customer bargaining power, a key factor for Root. To retain customers, Root must offer attractive options, like personalized rates and top-notch customer service. In 2024, the average customer retention rate in the insurance sector was about 85%, highlighting the need for loyalty programs.

Customers' access to information is high, with online tools simplifying rate comparisons. This intensifies price sensitivity, crucial for Root's market position. In 2024, the average consumer uses 3-5 comparison sites before deciding. Root needs clear communication to compete.

Concentration of Customers

Root's customer base is quite spread out, which means individual customers have less power. This is because they can't easily dictate terms. Root needs to focus on a good brand image and online reputation.

Customer satisfaction and quick complaint handling are vital. In 2024, positive online reviews boosted sales by about 15% for many businesses. Prompt responses to complaints can prevent major financial setbacks, as seen in various industries.

- Fragmented customer base reduces individual power.

- Brand reputation and reviews are crucial for attracting customers.

- Customer satisfaction and quick complaint handling are essential.

- Positive online reviews can boost sales.

Demand for Personalized Insurance

Root's success hinges on its ability to attract and retain customers valuing personalized insurance. This customer segment often demonstrates higher loyalty, reducing price sensitivity. In 2024, the telematics insurance market is expected to reach $60.5 billion. Root's strategy of expanding telematics capabilities and offering tailored options strengthens customer relationships. This approach directly impacts the bargaining power of customers.

- Personalization drives loyalty, reducing price sensitivity.

- Telematics market growth supports Root's strategy.

- Tailored options enhance customer retention.

- Customer bargaining power is influenced by these factors.

Customer bargaining power significantly impacts Root's success. The low switching costs and high information access empower customers. Personalization and tailored options are key to building loyalty. In 2024, the telematics insurance market grew to $60.5B, showing the strategic importance of personalized insurance.

| Factor | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low, increasing power | Retention rate ~85% |

| Information Access | High, price sensitivity | Avg. 3-5 comparison sites |

| Personalization | Increases loyalty | Telematics market $60.5B |

Rivalry Among Competitors

The auto insurance sector is fiercely competitive, populated by giants and innovative startups. Root contends with established firms such as State Farm, Geico, and Progressive, all battling for consumer attention. Lemonade is a notable insurtech competitor. In 2024, the top 10 auto insurers controlled about 70% of the market, highlighting the rivalry.

Digital disruption intensifies competition in the insurance sector. Insurtech firms like Root challenge traditional insurers, fostering innovation. Established companies invest heavily in tech, digitalizing operations. Root must constantly innovate; in Q3 2024, Root's direct written premiums reached $173.5 million. Staying competitive necessitates continuous adaptation.

Auto insurance companies allocate substantial budgets to marketing and advertising. Root must strategically manage its marketing spend to contend with larger competitors. In 2024, the average advertising expenditure for the top 10 auto insurers exceeded $500 million. Targeted marketing, focusing on digital channels, is key for Root to maximize its return on investment.

Pricing Strategies

Competitive pricing is crucial in the auto insurance sector. Root uses telematics to personalize rates, needing constant algorithm refinement to stay ahead. Balancing growth with profitability is critical for Root's long-term viability. In 2024, the auto insurance industry saw significant pricing adjustments. Root's ability to adapt its pricing model will be vital.

- Root's telematics-based pricing aims to offer competitive rates.

- Continuous algorithm updates are needed to stay ahead of competitors.

- Balancing growth and profitability is key to Root's success.

- The industry saw price adjustments in 2024.

Customer Acquisition Costs

Customer acquisition costs (CAC) are a significant factor in the auto insurance industry. Root, like its competitors, faces high expenses in attracting new customers. Root must focus on optimizing its CAC to remain competitive and profitable. Partnerships and referral programs can be effective strategies for reducing CAC.

- Industry average CAC for auto insurance is around $400-$600 per customer in 2024.

- Root's marketing spend in 2023 was approximately $100 million.

- Referral programs can reduce CAC by up to 30%.

- Digital marketing channels are crucial for efficient customer acquisition.

The auto insurance market features intense competition among numerous firms, including well-established players and innovative startups like Root. Digital advancements and insurtech disruptors fuel the rivalry, pushing for constant innovation. Companies strategize through marketing, pricing, and customer acquisition to gain market share.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Concentration | Top 10 insurers control a significant share. | ~70% market share |

| Marketing Spend | Advertising budgets impact competitiveness. | Top 10 average >$500M |

| Customer Acquisition Cost (CAC) | Expense to gain new customers is high. | Industry average $400-$600 |

SSubstitutes Threaten

Customers could stick with traditional insurance bundles, like home and auto packages, from big insurers, often saving money and time. This puts pressure on Root to show why its auto insurance is better. Established insurers still hold significant market share; for example, in 2024, State Farm and GEICO controlled roughly 30% of the U.S. auto insurance market combined. Root needs to stress its unique benefits to compete.

The threat from public transportation and ride-sharing is growing. Increased use of these services diminishes the need for individual auto insurance. Root Insurance must adjust, perhaps with usage-based insurance, to serve those using alternatives. In 2024, ride-sharing usage continued its rise, impacting auto insurance needs. Adaptability is key to lessening this threat.

Alternative transport, like biking and walking, poses a threat to auto insurance demand. Root should target regular car owners, tailoring offerings to their needs. Personalized rates and comprehensive coverage value are key. In 2024, 12% of US commuters biked or walked to work.

Pay-Per-Mile Insurance

Pay-per-mile insurance poses a threat to Root, especially for low-mileage drivers. This alternative allows customers to pay only for the miles they drive. Root, using telematics, must keep its rates competitive with these pay-per-mile options to retain customers. Continuous refinement of pricing and flexible coverage are crucial for Root's competitive edge.

- Metromile, a pay-per-mile insurer, was acquired by Lemonade in 2022.

- Usage-based insurance (UBI) is projected to reach $128.6 billion by 2030.

- Root's Q3 2023 gross profit was $133 million.

- Root's telematics data is key to its risk assessment.

Self-Insurance and Risk Retention

Self-insurance poses a threat, as some opt to retain risk. Root must target customers needing comprehensive coverage for higher-value assets. Emphasizing financial protection and risk transfer is key. This strategy helps in competing against self-insurance.

- In 2024, the self-insurance market accounted for approximately $150 billion in the U.S.

- Around 30% of small businesses choose to self-insure for certain risks.

- Root can highlight that comprehensive insurance offers more robust coverage, especially during significant claims.

Root faces substitution threats from various options, impacting demand for its auto insurance.

Traditional insurers, ride-sharing, and public transport present alternatives, putting pricing pressure on Root.

Pay-per-mile insurance and self-insurance further challenge Root's market position. Root needs to innovate to stay competitive.

| Threat | Description | 2024 Data/Insight |

|---|---|---|

| Traditional Insurers | Bundled packages from major insurers | State Farm & GEICO: ~30% of U.S. market share |

| Ride-Sharing/Public Transport | Reduced need for individual auto insurance | Ride-sharing usage continues rising |

| Pay-per-mile | Pay only for miles driven | Market growth & competition |

| Self-Insurance | Retaining risk | $150B market in U.S. |

Entrants Threaten

High capital requirements significantly deter new entrants in the auto insurance sector. Regulatory compliance, technology infrastructure, and marketing campaigns demand substantial upfront investments. This financial hurdle limits the number of potential competitors. Root Insurance, for example, leverages its existing tech platform, reducing some costs. In 2024, the average startup cost for an insurance company was over $10 million.

The insurance sector faces significant regulatory hurdles, including intricate licensing and compliance demands. This regulatory environment serves as a barrier, diminishing the likelihood of new competitors. Root's established expertise in managing these regulations offers a notable advantage. In 2024, the costs associated with regulatory compliance in the insurance sector averaged $1.5 million for new firms, underscoring the challenge.

Established insurers benefit from strong brand recognition and customer trust, which poses a significant hurdle for new entrants. Root Insurance, for example, needs to focus on building its brand reputation and customer loyalty. Positive customer reviews are essential. In 2024, the insurance industry saw a 10% increase in customer loyalty due to brand recognition.

Access to Data and Technology

Root's telematics-based pricing uses data and tech. New entrants may lack the data or algorithms needed. Root's tech and analytics offer an edge. In 2024, Root's tech helped personalize 90% of its policies. The cost to replicate this is high.

- Data Acquisition: New insurers need vast driving data.

- Algorithm Development: Sophisticated pricing models are complex.

- Technology Costs: Building and maintaining tech is expensive.

- Competitive Advantage: Root's tech is a key differentiator.

Economies of Scale

Economies of scale pose a significant threat to new entrants in the insurance industry. Established insurers, like many in the Fortune 500, leverage their size to offer competitive rates. This advantage allows them to invest heavily in marketing and technology, creating a barrier for smaller companies. Root's focus on digital operations and efficient customer acquisition is designed to achieve economies of scale. This strategic approach enables Root to compete effectively against larger, more established players.

- Established insurers often have lower operating costs per policy due to their size.

- Marketing and advertising spending is crucial for customer acquisition, and large insurers can outspend new entrants.

- Technology investments, such as AI-driven claims processing, require significant capital, favoring established firms.

New entrants in auto insurance face significant barriers. These include high startup costs for technology and regulatory compliance, which averaged over $10 million and $1.5 million respectively in 2024. Strong brand recognition and economies of scale further challenge newcomers.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Requirements | High Upfront Investment | $10M+ startup cost |

| Regulatory Hurdles | Compliance Costs | $1.5M compliance cost |

| Economies of Scale | Competitive Pricing | Established firms advantage |

Porter's Five Forces Analysis Data Sources

We draw from company financials, industry reports, and economic indicators, for assessing each force.